Senior Actuarial Analyst Resume

Headline : Detail-oriented Actuarial Analyst with 7 years of experience in risk assessment, statistical modeling, and data analysis. Proven track record in optimizing reserve methodologies and enhancing financial decision-making processes.

Skills : Risk Assessment, Data Visualization, Data Management, Statistical Modeling

Description :

- Supported actuarial consultants in quarterly reserve analyses, applying actuarial methods to accurately predict client liabilities.

- Utilized Towers Watson's ResQ software to troubleshoot and enhance user experience for actuarial modeling.

- Conducted research on claims reserving methods using generalized linear modeling to add value to client analyses.

- Modeled client data with proprietary software, providing actionable recommendations to improve rating structures.

- Implemented efficient data processes, reallocating project budgets towards critical loss selection tasks.

- Acquired in-depth knowledge of client data management systems to facilitate data integration with ResQ.

- Collaborated with cross-functional teams to enhance actuarial methodologies and improve overall analysis quality.

Experience

5-7 Years

Level

Senior

Education

BSc AS

Actuarial Analyst II-III Resume

Summary : Results-driven Actuarial Analyst with 10 years of experience in risk assessment, data analysis, and financial modeling. Proven track record in developing innovative solutions to optimize insurance products and mitigate financial risks.

Skills : GGY AXIS Software, Advanced Excel Skills, Data Analysis Techniques, Data Validation Techniques, Data Visualization

Description :

- Provided actuarial solutions for life insurance products, enhancing profitability for Caribbean subsidiaries.

- Developed and validated cash flow projection models using GGY AXIS, ensuring compliance with IFRS 4 standards.

- Created analytical tests to validate data integrity, improving model accuracy and reliability.

- Conducted thorough analyses of policy contracts and financial data to inform modeling strategies.

- Reviewed client financial statements and statutory returns, identifying areas for model improvement.

- Prepared comprehensive valuation reports and statutory returns, ensuring regulatory compliance.

- Collaborated on bond valuation models to support interest rate vector assessments for solvency testing.

Experience

7-10 Years

Level

Consultant

Education

MSc Actuarial

Healthcare Actuarial Analyst II Resume

Summary : Detail-oriented Actuarial Analyst with 10 years of experience in financial modeling, risk assessment, and data analysis. Proven track record in optimizing actuarial processes and delivering actionable insights to enhance decision-making.

Skills : Data Analysis, Risk Assessment, Statistical Analysis, Predictive Modeling, Data Mining

Description :

- Conducted actuarial calculations to support provider negotiations, enhancing contract terms.

- Performed ad hoc analyses to inform strategic decisions and peer reviews for analysts.

- Produced analytical reports on reimbursement trends, improving client understanding of performance.

- Collaborated with healthcare systems to optimize provider support and operational efficiency.

- Analyzed data trends to prepare quarterly reports and annual reconciliations for contracts.

- Maintained documentation for standard reporting processes, ensuring compliance and accuracy.

- Developed a cost relativity model for health plans, improving pricing strategies.

Experience

7-10 Years

Level

Senior

Education

MSc Actuarial

Actuarial Analyst (Healthcare) Resume

Headline : Detail-oriented Actuarial Analyst with 7 years of experience in data analysis, risk assessment, and model development. Proven ability to leverage quantitative skills to drive business insights and optimize actuarial processes.

Skills : Matlab Expertise, Statistical Regression, ANOVA Analysis, Data Visualization, Risk Assessment

Description :

- Analyzed health insurance data to assess risk and develop pricing strategies.

- Conducted reform analyses and compliance testing for various actuarial projects.

- Utilized advanced statistical models to tailor actuarial assessments to specific client needs.

- Implemented actuarial models in Excel, serving as the office expert in VBA programming.

- Processed large datasets in SAS to calculate modified adjusted gross income (MAGI) for health plans.

- Assisted in modeling future costs for health insurance plans on new exchanges.

- Executed valuations to determine retiree benefit liabilities, ensuring compliance with GASB standards.

Experience

5-7 Years

Level

Senior

Education

MSc Actuarial

Actuarial Analyst I - Health Services Resume

Summary : Detail-oriented Actuarial Analyst with over 10 years of experience in data analysis, risk assessment, and model development. Proven track record in delivering actionable insights and optimizing client solutions in the insurance sector.

Skills : Advanced Excel Skills, SQL Data Analysis, Statistical Programming, Risk Assessment, Data Modeling

Description :

- Collected and analyzed Medicaid healthcare data, ensuring accuracy and compliance with regulations.

- Collaborated with cross-functional teams to produce client-ready deliverables, enhancing client satisfaction.

- Developed advanced pricing and valuation models, improving forecasting accuracy.

- Engaged with state client teams, providing insights through effective communication.

- Led project management initiatives, mentoring junior analysts to enhance team performance.

- Conducted efficiency analyses to optimize managed care products, achieving significant cost savings.

- Streamlined data transition processes, improving data accessibility and reporting efficiency.

Experience

10+ Years

Level

Management

Education

MSc Actuarial

Actuarial Analyst (Risk) Resume

Summary : Detail-oriented Actuarial Analyst with 10 years of experience in risk assessment, statistical modeling, and data analysis. Proven track record in developing predictive models and optimizing insurance processes to enhance profitability and reduce risk.

Skills : Excel Advanced, SQL Database Management, Predictive Analytics, Data Analysis

Description :

- Developed and refined risk adjustment factors for proprietary underwriting models, enhancing accuracy and functionality.

- Conducted comprehensive audits and cost-benefit analyses for senior management, driving strategic decision-making.

- Created detailed workflow diagrams to document key processes, significantly reducing operational risks.

- Performed quarterly testing and impact analysis of model assumptions, ensuring robust actuarial practices.

- Executed actuarial loss reserving and forecasting for self-insurance programs, improving financial stability.

- Designed and implemented tailored actuarial models to meet diverse client needs, enhancing service delivery.

- Calculated and reported unpaid claim reserves and premium deficiency reserves for year-end financial statements.

Experience

10+ Years

Level

Management

Education

MSc Actuarial

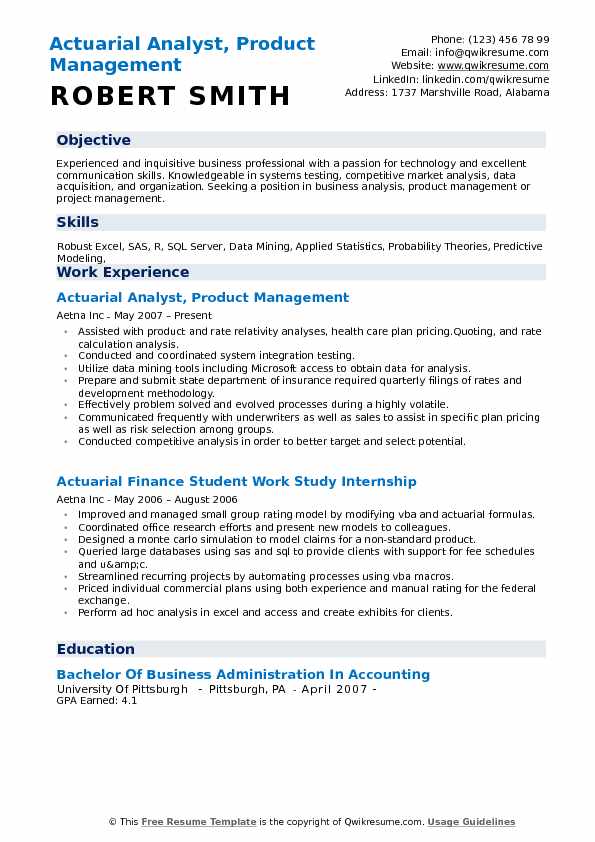

Actuarial Analyst, Product Management Resume

Summary : Detail-oriented Actuarial Analyst with 10 years of experience in risk assessment, data analysis, and predictive modeling. Proven track record in optimizing pricing strategies and enhancing data-driven decision-making processes.

Skills : Advanced Excel, Data Analysis, Statistical Analysis, Risk Assessment, Predictive Analytics

Description :

- Conducted comprehensive product and rate relativity analyses to optimize pricing strategies.

- Coordinated system integration testing to ensure data accuracy and reliability.

- Utilized advanced data mining tools to extract and analyze large datasets for actionable insights.

- Prepared and submitted quarterly filings to state insurance departments, ensuring compliance with regulations.

- Streamlined processes to enhance efficiency during periods of high volatility in the market.

- Collaborated with underwriters and sales teams to refine plan pricing and improve risk selection.

- Performed competitive analysis to identify market trends and inform strategic decisions.

Experience

10+ Years

Level

Management

Education

MSc Actuarial

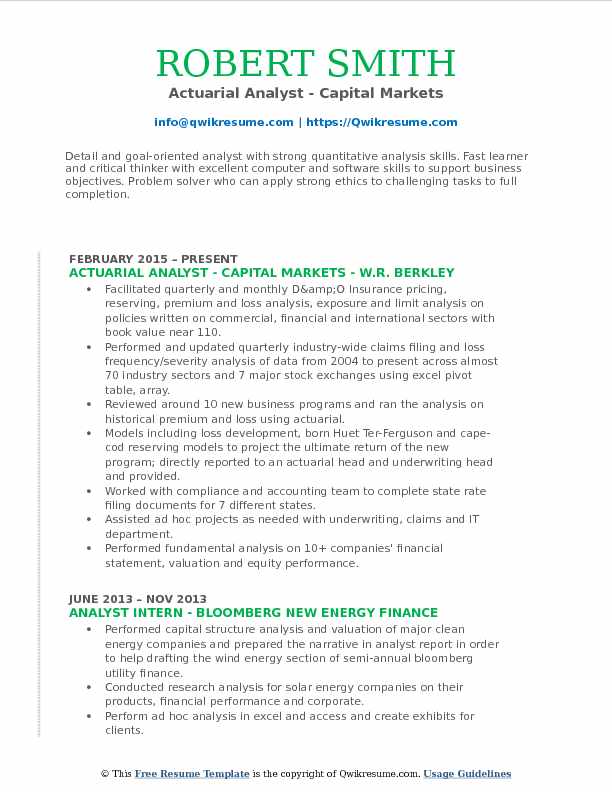

Actuarial Analyst - Capital Markets Resume

Objective : Results-driven Actuarial Analyst with 5 years of experience in quantitative analysis, risk assessment, and financial modeling. Proven ability to leverage data insights to inform strategic decisions and optimize insurance pricing.

Skills : Excel Modeling and Analysis, Database Management, Data Querying, Financial Data Analysis, Statistical Analysis

Description :

- Facilitated comprehensive insurance pricing and reserving analysis, enhancing decision-making for policies valued at $110M.

- Conducted quarterly claims analysis across 70 sectors, utilizing Excel for data manipulation and reporting.

- Reviewed and analyzed 10 new business programs, assessing historical premium and loss data for actuarial insights.

- Applied advanced reserving models to project ultimate returns, directly reporting findings to senior management.

- Collaborated with compliance teams to prepare state rate filing documents for 7 states, ensuring regulatory adherence.

- Supported cross-departmental projects, providing actuarial insights to underwriting and claims teams.

- Executed fundamental analysis on financial statements of 10 companies, informing investment strategies and performance evaluations.

Experience

2-5 Years

Level

Junior

Education

BSc Actuarial Science

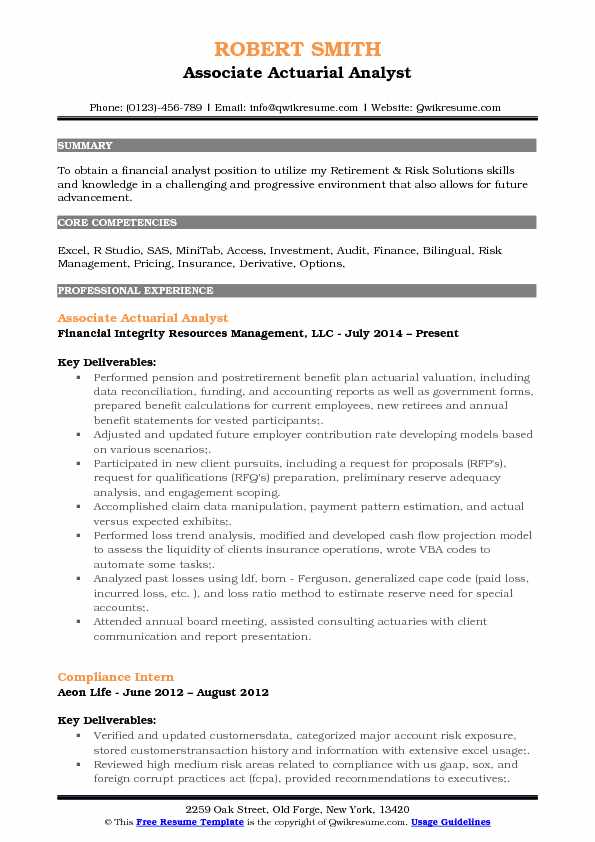

Associate Actuarial Analyst Resume

Objective : Detail-oriented Actuarial Analyst with 5 years of experience in pension valuation, risk assessment, and data analysis. Proven ability to develop models and provide insights that drive strategic decision-making.

Skills : Statistical Analysis, Data Visualization, Database Management, Risk Assessment, Data Analysis

Description :

- Conducted comprehensive actuarial valuations for pension and postretirement plans, ensuring compliance with regulatory standards.

- Developed predictive models to assess future employer contribution rates based on various financial scenarios.

- Engaged in client acquisition efforts, preparing RFPs and conducting preliminary reserve analyses to support new business initiatives.

- Executed detailed claim data analysis, estimating payment patterns and comparing actual versus expected outcomes.

- Performed loss trend analysis and created cash flow models to evaluate client liquidity, automating processes with VBA.

- Utilized various actuarial methods to estimate reserve needs, enhancing accuracy in financial reporting.

- Collaborated with consulting actuaries to present findings and recommendations during client meetings.

Experience

2-5 Years

Level

Junior

Education

BSc Actuarial

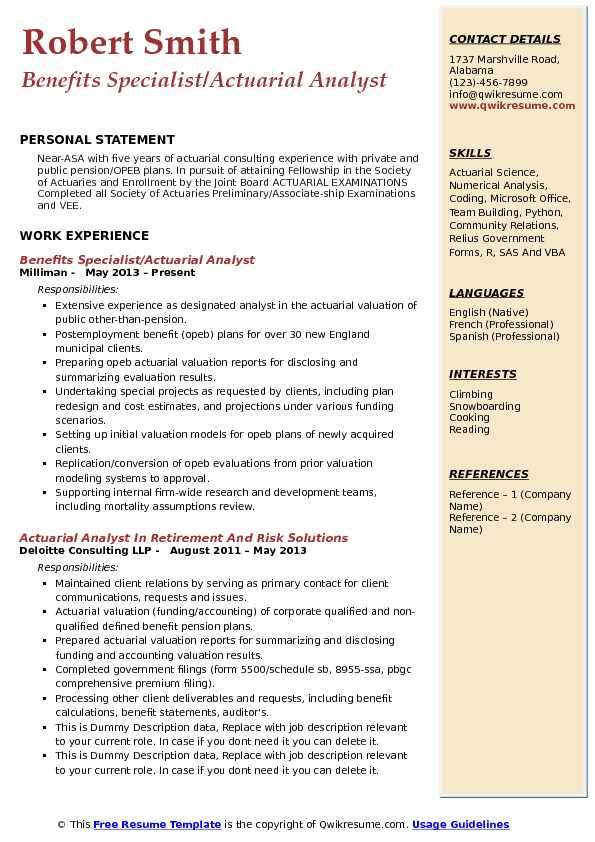

Benefits Specialist/Actuarial Analyst Resume

Objective : Detail-oriented Actuarial Analyst with 5 years of experience in pension and OPEB plan valuations. Proficient in data analysis, modeling, and reporting, with a strong commitment to achieving Fellowship in the Society of Actuaries.

Skills : Statistical Analysis, Data Analysis, Collaboration, Data Visualization

Description :

- Conducted actuarial valuations for OPEB plans, ensuring compliance with regulations.

- Developed valuation models for new clients, enhancing service delivery and accuracy.

- Prepared detailed actuarial reports summarizing valuation results for stakeholders.

- Collaborated with clients on special projects, including cost estimates and funding scenarios.

- Converted prior valuation data into new systems, improving data integrity.

- Supported research initiatives, reviewing mortality assumptions and trends.

- Performed studies on benefit adequacy and future liabilities, providing actionable insights.

Experience

2-5 Years

Level

Senior

Education

B.S. Actuarial Science

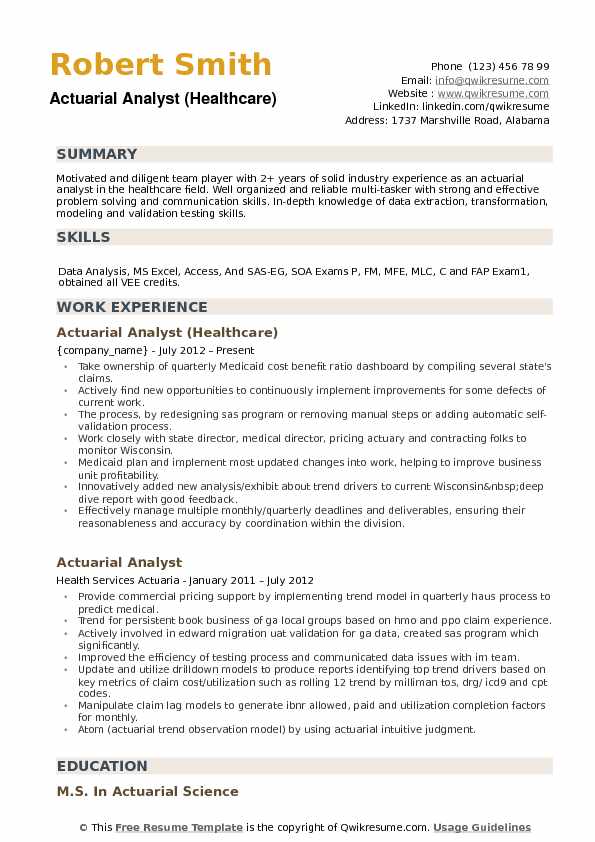

Actuarial Analyst (Healthcare) Resume

Headline : Detail-oriented Actuarial Analyst with 7 years of experience in data analysis, modeling, and risk assessment. Proven track record in enhancing operational efficiency and delivering actionable insights to drive business profitability.

Skills : Advanced Excel Skills, Database Management, SAS Programming, SOA Exam Preparation, Financial Mathematics

Description :

- Owned the development of Medicaid cost-benefit dashboards, enhancing data accuracy across multiple states.

- Identified and implemented process improvements, increasing operational efficiency by redesigning SAS programs.

- Collaborated with cross-functional teams to integrate updated Medicaid policies, boosting profitability.

- Created comprehensive analysis reports on trend drivers, receiving positive feedback from stakeholders.

- Managed multiple deadlines, ensuring timely and accurate deliverables through effective coordination.

- Utilized advanced statistical techniques to validate data integrity and support decision-making processes.

- Conducted in-depth analyses to identify key performance indicators, driving strategic initiatives.

Experience

5-7 Years

Level

Senior

Education

MSc Actuarial

Actuarial Analyst II - Pension & Insurance Resume

Objective : Detail-oriented Actuarial Analyst with 5 years of experience in financial mathematics and risk assessment. Proven track record in optimizing actuarial processes and delivering data-driven insights to support strategic business decisions.

Skills : Risk Assessment, Data Analysis, Statistical Modeling, Financial Reporting, Regulatory Compliance

Description :

- Conducted comprehensive cost and budget projections, enhancing financial forecasting accuracy.

- Facilitated communication between actuarial teams and stakeholders to clarify complex data insights.

- Led peer review processes for actuarial calculations, ensuring compliance and accuracy.

- Provided expert actuarial analysis to inform strategic business decisions and risk management.

- Played a pivotal role in implementing a new actuarial valuation system, improving efficiency.

- Reduced reliance on external consultants, saving $330K in projected costs through in-house capabilities.

- Utilized advanced actuarial software to perform complex financial mathematics and statistical analyses.

Experience

2-5 Years

Level

Junior

Education

BSc Actuarial