Aml Analyst Resume

Headline : Detail-oriented AML Analyst with 7 years of experience in detecting and preventing money laundering and fraud. Proven track record in compliance, risk assessment, and collaboration with law enforcement agencies.

Skills : Data Analysis Tools, Risk Assessment, Fraud Detection, Regulatory Compliance

Description :

- Implemented AML monitoring systems, optimizing threshold settings to enhance detection capabilities.

- Established partnerships with law enforcement to streamline investigations and improve case outcomes.

- Conducted comprehensive file reviews, ensuring thorough analysis of customer activities across all products.

- Oversaw Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) processes to mitigate risks effectively.

- Compiled and maintained documentation in compliance with BSA/AML regulations, ensuring audit readiness.

- Analyzed large datasets to identify trends and emerging risks, establishing metrics for ongoing risk assessment.

- Recommended and implemented controls to address rising risk exposures, fostering a culture of continuous improvement.

Experience

5-7 Years

Level

Executive

Education

BSc Finance

Jr. AML Analyst Resume

Objective : Detail-oriented AML Analyst with 5 years of experience in compliance, risk assessment, and regulatory reporting. Proven track record in identifying and mitigating money laundering risks while ensuring adherence to AML regulations.

Skills : Data Analysis Tools, Risk Assessment, Regulatory Reporting, Transaction Monitoring, Data Analysis

Description :

- Led AML compliance initiatives, ensuring adherence to regulatory standards and internal policies.

- Utilized advanced AML systems to analyze customer data for suspicious activity detection.

- Collaborated with cross-functional teams to enhance transaction monitoring processes.

- Conducted thorough investigations of high-risk transactions, documenting findings for compliance reporting.

- Implemented training programs for staff on AML regulations and best practices.

- Managed UAT for AML software, ensuring effective functionality and user experience.

- Monitored and reported on key AML metrics to senior management for strategic decision-making.

Experience

2-5 Years

Level

Junior

Education

BSc Finance

Sr. AML Analyst Resume

Summary : Detail-oriented AML Analyst with 10 years of experience in detecting and preventing money laundering activities. Proven track record in compliance, risk assessment, and regulatory reporting to ensure adherence to AML laws and regulations.

Skills : Financial Analysis, Risk Assessment, Regulatory Compliance, Transaction Monitoring, KYC Procedures

Description :

- Executed triage and intake controls to ensure timely assignment and logging of alerts.

- Investigated consumer accounts to detect potentially suspicious activities.

- Documented branch referrals, prior investigations, PEP, KYC, and SAR histories.

- Analyzed data using pivot tables to determine escalation needs for alerts.

- Consistently exceeded daily production goals while maintaining high-quality standards.

- Collaborated with team members and investigators to resolve alerts efficiently.

- Supported investigators with suspicious transaction documentation for law enforcement referrals.

Experience

10+ Years

Level

Senior

Education

BSc Finance

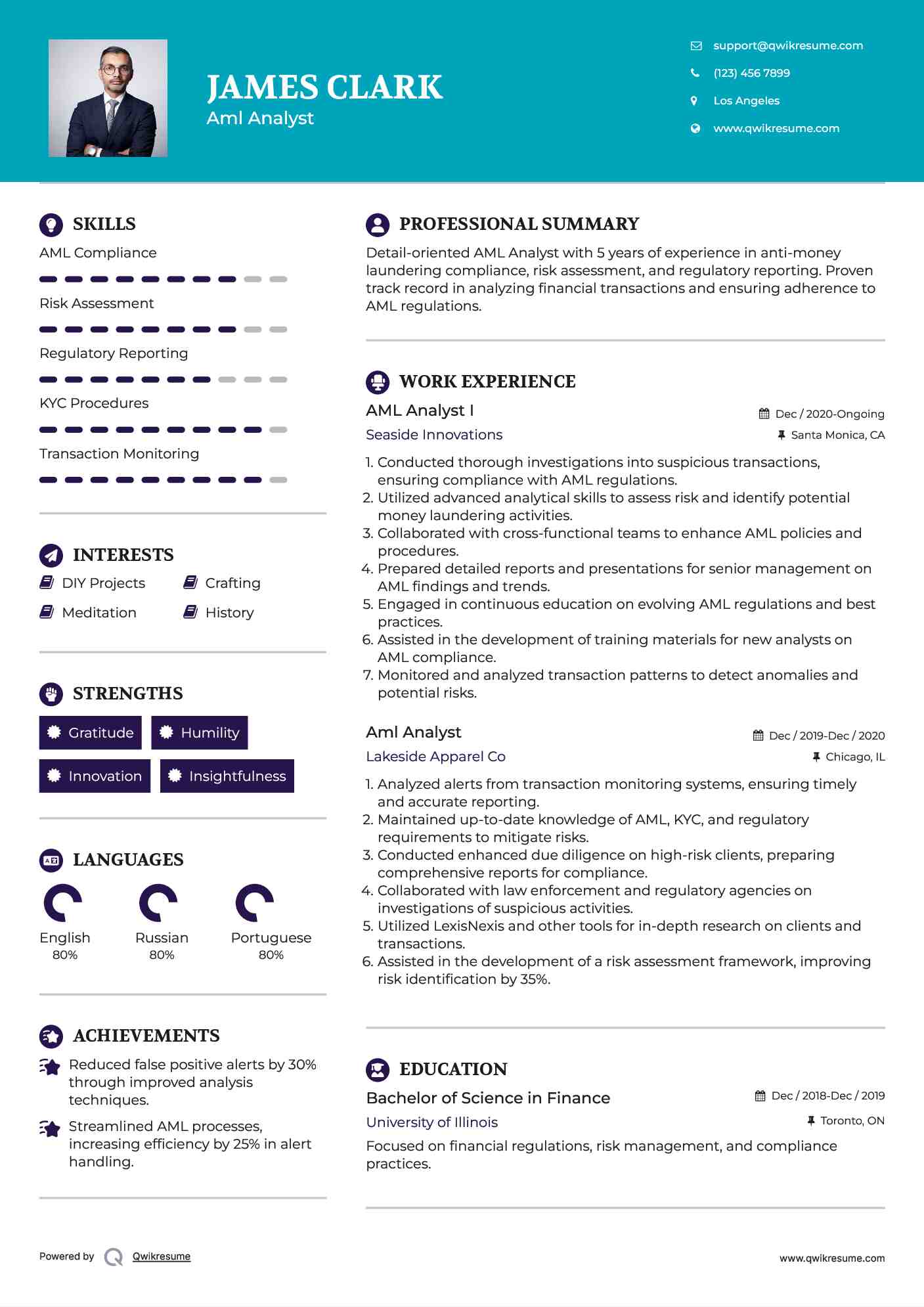

AML Analyst I Resume

Objective : Detail-oriented AML Analyst with 5 years of experience in anti-money laundering compliance, risk assessment, and regulatory reporting. Proven track record in analyzing financial transactions and ensuring adherence to AML regulations.

Skills : AML Compliance, Risk Assessment, Regulatory Reporting, KYC Procedures, Transaction Monitoring

Description :

- Conducted thorough investigations into suspicious transactions, ensuring compliance with AML regulations.

- Utilized advanced analytical skills to assess risk and identify potential money laundering activities.

- Collaborated with cross-functional teams to enhance AML policies and procedures.

- Prepared detailed reports and presentations for senior management on AML findings and trends.

- Engaged in continuous education on evolving AML regulations and best practices.

- Assisted in the development of training materials for new analysts on AML compliance.

- Monitored and analyzed transaction patterns to detect anomalies and potential risks.

Experience

2-5 Years

Level

Junior

Education

BSc Finance

AML Analyst II Resume

Headline : Detail-oriented AML Analyst with 7 years of experience in financial services, specializing in detecting and reporting suspicious activities. Committed to regulatory compliance and enhancing organizational integrity.

Skills : Data Analysis Tools, Risk Assessment, Fraud Detection, Data Mining, Regulatory Reporting

Description :

- Identified and reported suspicious activities, enhancing compliance with AML regulations.

- Managed investigations from detection to resolution, ensuring thorough documentation.

- Conducted timely reviews of reports to identify potential money laundering activities.

- Recommended actions for suspicious findings, reporting to regulatory authorities as needed.

- Evaluated cases for closure or escalation, filing Suspicious Activity Reports when necessary.

- Created detailed reports and presentations to support complex AML investigations.

- Performed data analysis and quality control to support the Investigation Unit's responses.

Experience

5-7 Years

Level

Executive

Education

BSc Finance

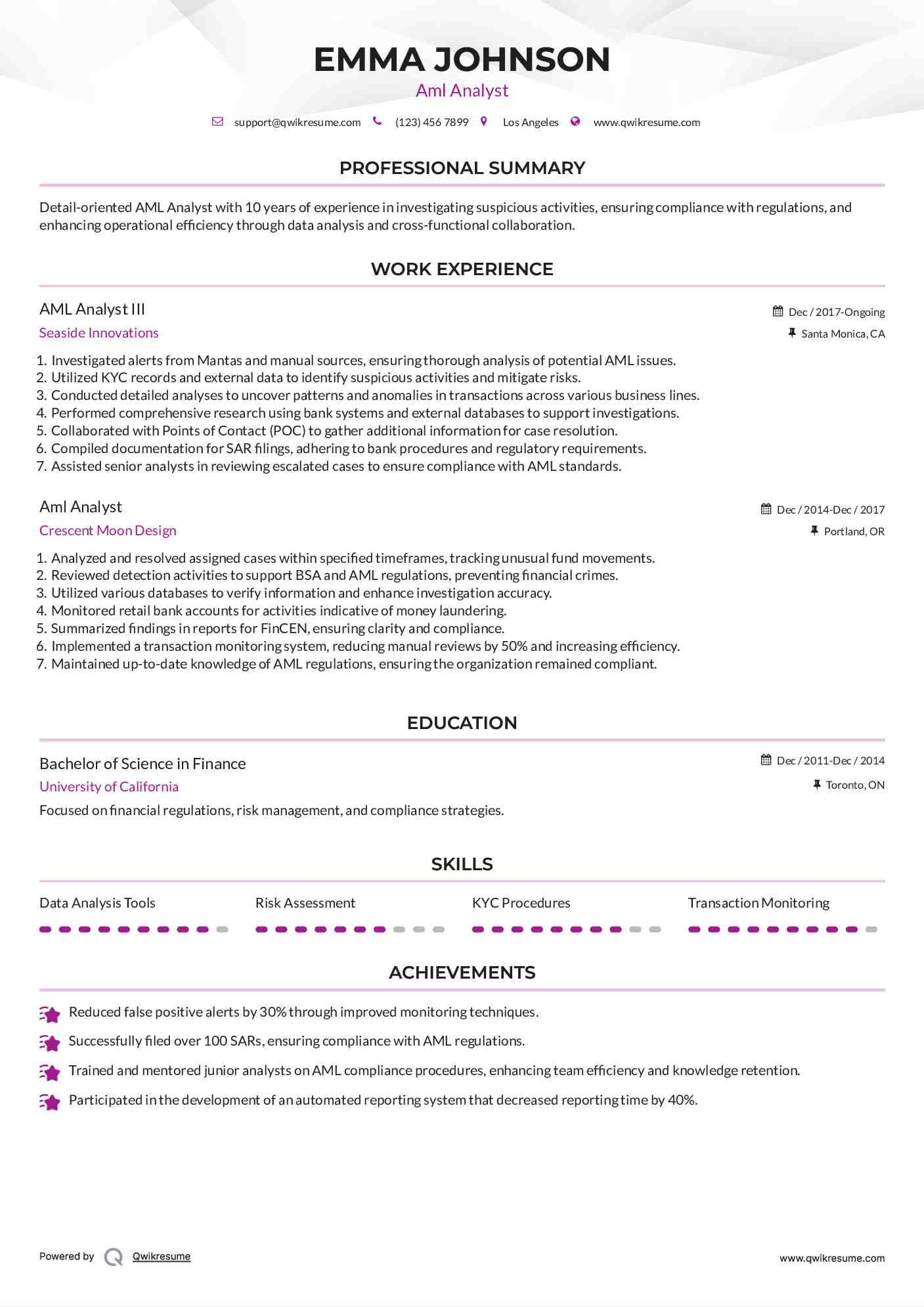

AML Analyst III Resume

Summary : Detail-oriented AML Analyst with 10 years of experience in investigating suspicious activities, ensuring compliance with regulations, and enhancing operational efficiency through data analysis and cross-functional collaboration.

Skills : Data Analysis Tools, Risk Assessment, KYC Procedures, Transaction Monitoring

Description :

- Investigated alerts from Mantas and manual sources, ensuring thorough analysis of potential AML issues.

- Utilized KYC records and external data to identify suspicious activities and mitigate risks.

- Conducted detailed analyses to uncover patterns and anomalies in transactions across various business lines.

- Performed comprehensive research using bank systems and external databases to support investigations.

- Collaborated with Points of Contact (POC) to gather additional information for case resolution.

- Compiled documentation for SAR filings, adhering to bank procedures and regulatory requirements.

- Assisted senior analysts in reviewing escalated cases to ensure compliance with AML standards.

Experience

7-10 Years

Level

Management

Education

BSc Finance

Assist. AML Analyst Resume

Objective : Detail-oriented AML Analyst with 5 years of experience in conducting thorough investigations, analyzing financial transactions, and ensuring compliance with regulatory requirements to mitigate money laundering risks.

Skills : Risk Assessment, Transaction Monitoring, Data Analysis, Fraud Detection, KYC Procedures

Description :

- Conducted comprehensive analysis to identify and mitigate money laundering risks using sound judgment.

- Reported suspicious activities to the Financial Intelligence Unit (FIU) in compliance with regulations.

- Ensured adherence to AML guidelines, OFAC requirements, and Suspicious Activity Reporting standards.

- Utilized web-based research tools to investigate accounts and transactions flagged as high-risk.

- Prepared detailed Suspicious Activity Reports (SARs) for potential money laundering cases.

- Led a team to verify documentation and licensing for Foreign Money Service Businesses (MSBs).

- Collaborated with cross-functional teams to enhance AML compliance processes and reporting accuracy.

Experience

2-5 Years

Level

Junior

Education

BSc Finance

Associate AML Analyst Resume

Headline : Detail-oriented AML Analyst with 7 years of experience in transaction monitoring, risk assessment, and regulatory compliance. Proven track record in identifying suspicious activities and enhancing AML programs to mitigate risks.

Skills : Data Analysis Tools, Risk Assessment, Transaction Monitoring, Regulatory Compliance, Data Mining

Description :

- Conducted thorough reviews of client transactions to identify and escalate suspicious activities for further investigation.

- Utilized public domain and database search services to research entities and individuals linked to flagged transactions.

- Collaborated with branch personnel to gather essential information regarding customer accounts and activities.

- Assisted in the design and development of monitoring reports, enhancing the effectiveness of the AML program.

- Supported senior staff in responding to regulatory inquiries and compliance audits.

- Provided accurate and timely information to management to facilitate decision-making and address program gaps.

- Ensured compliance with AML policies by implementing and monitoring internal controls to mitigate risks.

Experience

5-7 Years

Level

Executive

Education

BSc Finance

Lead AML Analyst Resume

Summary : Results-driven AML Analyst with 10 years of experience in financial compliance, risk assessment, and regulatory reporting. Proven track record in identifying suspicious activities and enhancing compliance programs to mitigate risks.

Skills : Data Analysis Tools, Risk Assessment, Regulatory Reporting, Transaction Monitoring, KYC Procedures

Description :

- Conducted thorough reviews of KYC processes for Corporate and Investment Banking, ensuring compliance with regulations.

- Analyzed customer transactions for suspicious activities, providing insights to senior management for AML investigations.

- Developed and delivered AML compliance training programs for international offices, enhancing global compliance standards.

- Mentored and supervised AML interns, fostering a culture of compliance and risk awareness.

- Collaborated with the Head of International Financial Institutions on US AML Framework compliance, including BSA and OFAC.

- Streamlined international KYC processes, improving efficiency and compliance adherence.

- Utilized advanced data analysis techniques to identify trends and anomalies in customer behavior.

Experience

10+ Years

Level

Senior

Education

MSc Finance

AML Analyst Resume

Headline : Detail-oriented AML Analyst with 7 years of experience in risk management, compliance, and transaction monitoring. Proven track record in identifying suspicious activities and enhancing procedural efficiencies to mitigate financial crime risks.

Skills : Data Analysis Tools, Data Visualization, Report Writing, Financial Crime Prevention, Regulatory Reporting

Description :

- Analyzed alerts and investigated customers against OFAC, Red Flag, and Negative Media lists during account openings.

- Conducted thorough searches, gathering data from internal systems and external databases to support investigations.

- Adhered to AML procedures and compliance regulations to ensure risk mitigation.

- Consistently met or exceeded productivity and quality benchmarks in investigations.

- Developed procedural improvements to enhance operational effectiveness and compliance.

- Provided training and mentorship to junior analysts on AML regulations and investigation techniques.

- Collaborated with compliance teams to ensure alignment with regulatory requirements and best practices.

Experience

5-7 Years

Level

Executive

Education

BSc Finance