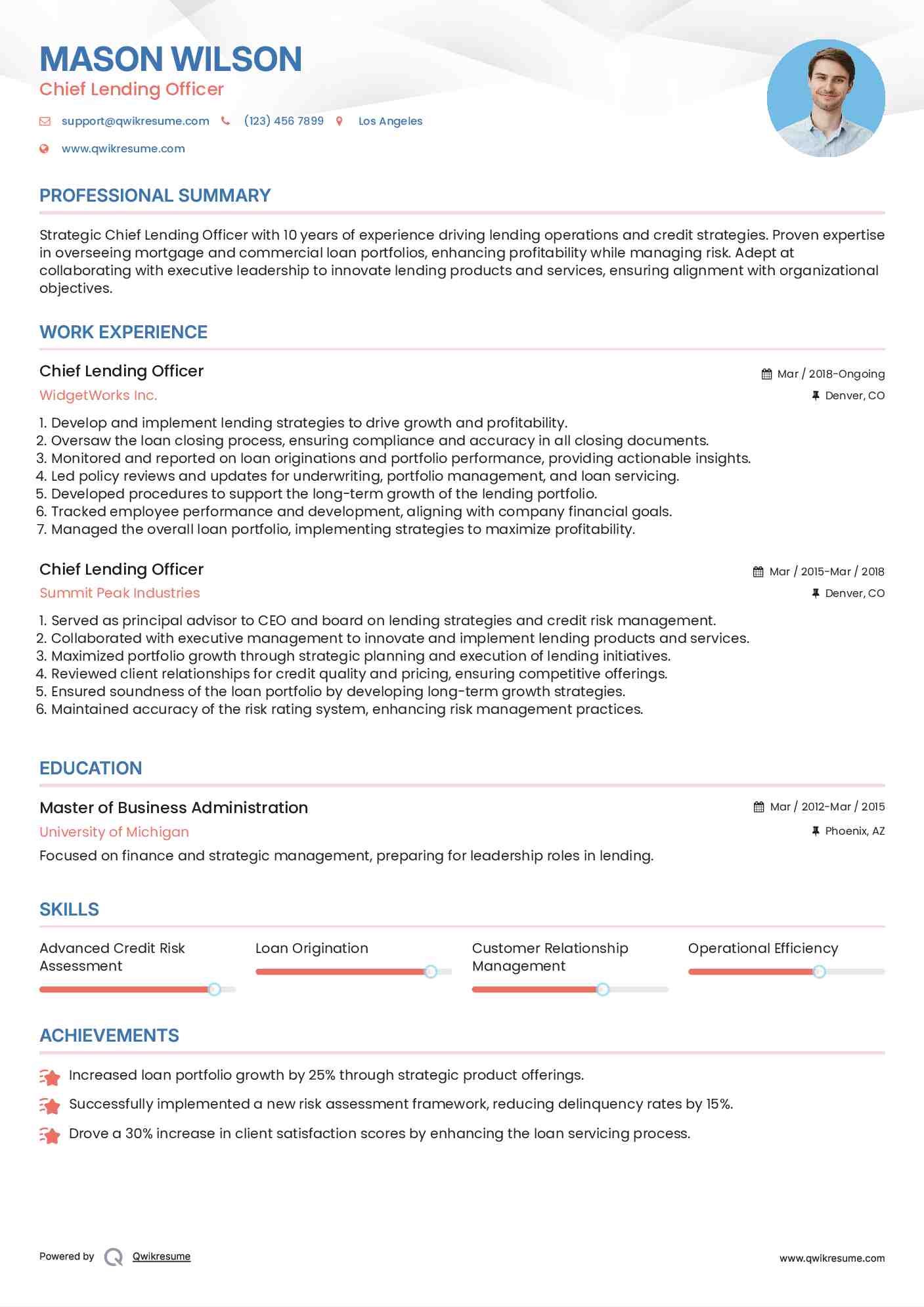

Chief Lending Officer Resume

Summary : Strategic Chief Lending Officer with 10 years of experience driving lending operations and credit strategies. Proven expertise in overseeing mortgage and commercial loan portfolios, enhancing profitability while managing risk. Adept at collaborating with executive leadership to innovate lending products and services, ensuring alignment with organizational objectives.

Skills : Advanced Credit Risk Assessment, Loan Origination, Customer Relationship Management, Operational Efficiency

Description :

- Develop and implement lending strategies to drive growth and profitability.

- Oversaw the loan closing process, ensuring compliance and accuracy in all closing documents.

- Monitored and reported on loan originations and portfolio performance, providing actionable insights.

- Led policy reviews and updates for underwriting, portfolio management, and loan servicing.

- Developed procedures to support the long-term growth of the lending portfolio.

- Tracked employee performance and development, aligning with company financial goals.

- Managed the overall loan portfolio, implementing strategies to maximize profitability.

Experience

10+ Years

Level

Executive

Education

MBA

Deputy Chief Lending Officer Resume

Headline : Dynamic Deputy Chief Lending Officer with 7 years of experience in driving lending initiatives and optimizing credit operations. Expert in managing diverse loan portfolios and enhancing profitability while mitigating risks. Skilled in collaborating with leadership to develop innovative lending strategies that align with corporate goals.

Skills : Risk Assessment, Decision Making, Stakeholder Engagement, Performance Metrics, Credit Policy Development

Description :

- Oversaw the management of the institution's lending portfolio, ensuring compliance with regulatory standards.

- Collaborated with executive teams to shape lending policies and enhance credit risk strategies.

- Identified and pursued new business opportunities to expand the financial institution's clientele.

- Implemented innovative financing solutions tailored to meet borrower needs and market demands.

- Designed comprehensive marketing strategies to promote loan products and services.

- Conducted regular performance reviews of the lending portfolio to assess risks and opportunities.

- Facilitated training sessions for staff on best practices in lending and compliance.

Experience

5-7 Years

Level

Management

Education

MBA

Chief Lending Officer Resume

Summary : Accomplished Chief Lending Officer with a decade of experience in enhancing lending strategies and driving operational excellence. Expertise in managing diverse loan portfolios, developing innovative financial products, and fostering strategic partnerships. Committed to optimizing profitability while ensuring compliance and risk management across lending operations.

Skills : Loan Portfolio Analysis, Attention To Detail, Networking Skills, Presentation Skills, Customer Service, Risk Management

Description :

- Directed the strategic lending program, focusing on business development and loan production.

- Collaborated with executive leadership to develop and implement innovative financial products.

- Managed loan policies and systems to enhance operational efficiency and compliance.

- Oversaw portfolio management, ensuring alignment with organizational objectives.

- Developed key partnerships to raise capital and expand lending capabilities.

- Conducted market analysis to identify growth opportunities and emerging trends.

- Supervised and mentored loan officers to enhance team performance and customer service.

Experience

10+ Years

Level

Executive

Education

MBA

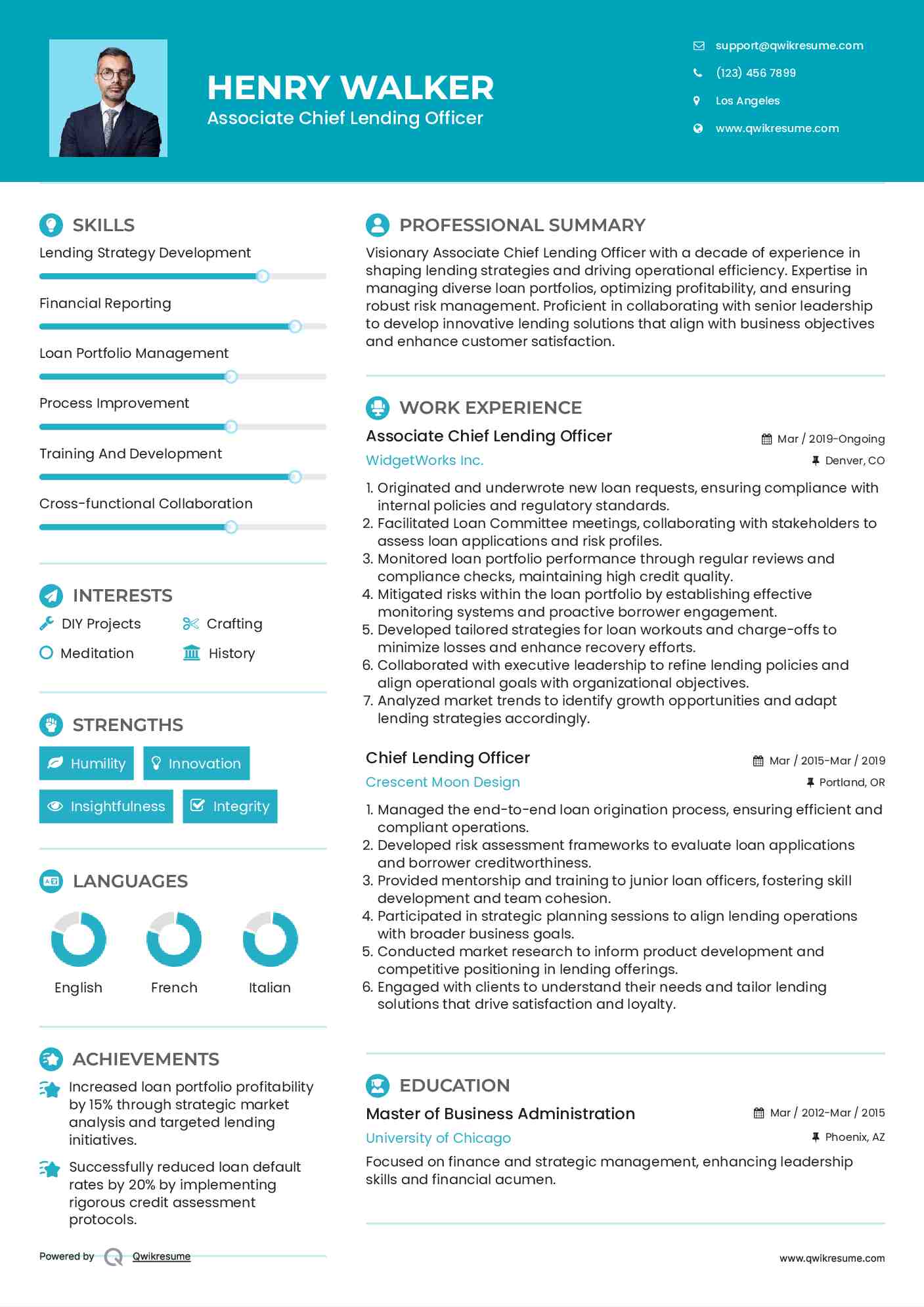

Associate Chief Lending Officer Resume

Summary : Visionary Associate Chief Lending Officer with a decade of experience in shaping lending strategies and driving operational efficiency. Expertise in managing diverse loan portfolios, optimizing profitability, and ensuring robust risk management. Proficient in collaborating with senior leadership to develop innovative lending solutions that align with business objectives and enhance customer satisfaction.

Skills : Lending Strategy Development, Financial Reporting, Loan Portfolio Management, Process Improvement, Training And Development, Cross-functional Collaboration

Description :

- Originated and underwrote new loan requests, ensuring compliance with internal policies and regulatory standards.

- Facilitated Loan Committee meetings, collaborating with stakeholders to assess loan applications and risk profiles.

- Monitored loan portfolio performance through regular reviews and compliance checks, maintaining high credit quality.

- Mitigated risks within the loan portfolio by establishing effective monitoring systems and proactive borrower engagement.

- Developed tailored strategies for loan workouts and charge-offs to minimize losses and enhance recovery efforts.

- Collaborated with executive leadership to refine lending policies and align operational goals with organizational objectives.

- Analyzed market trends to identify growth opportunities and adapt lending strategies accordingly.

Experience

10+ Years

Level

Executive

Education

MBA

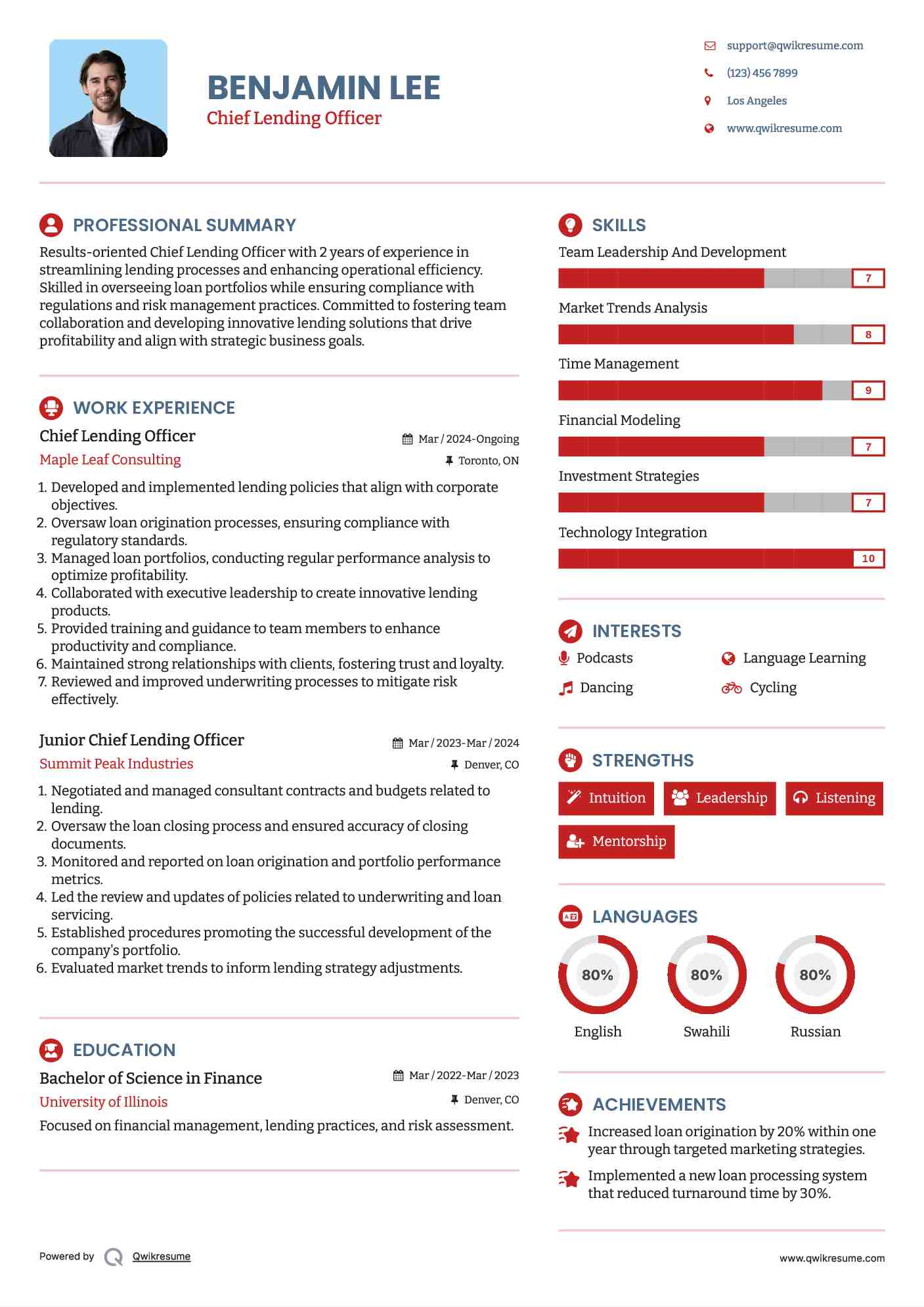

Chief Lending Officer Resume

Objective : Results-oriented Chief Lending Officer with 2 years of experience in streamlining lending processes and enhancing operational efficiency. Skilled in overseeing loan portfolios while ensuring compliance with regulations and risk management practices. Committed to fostering team collaboration and developing innovative lending solutions that drive profitability and align with strategic business goals.

Skills : Team Leadership And Development, Market Trends Analysis, Time Management, Financial Modeling, Investment Strategies, Technology Integration

Description :

- Developed and implemented lending policies that align with corporate objectives.

- Oversaw loan origination processes, ensuring compliance with regulatory standards.

- Managed loan portfolios, conducting regular performance analysis to optimize profitability.

- Collaborated with executive leadership to create innovative lending products.

- Provided training and guidance to team members to enhance productivity and compliance.

- Maintained strong relationships with clients, fostering trust and loyalty.

- Reviewed and improved underwriting processes to mitigate risk effectively.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

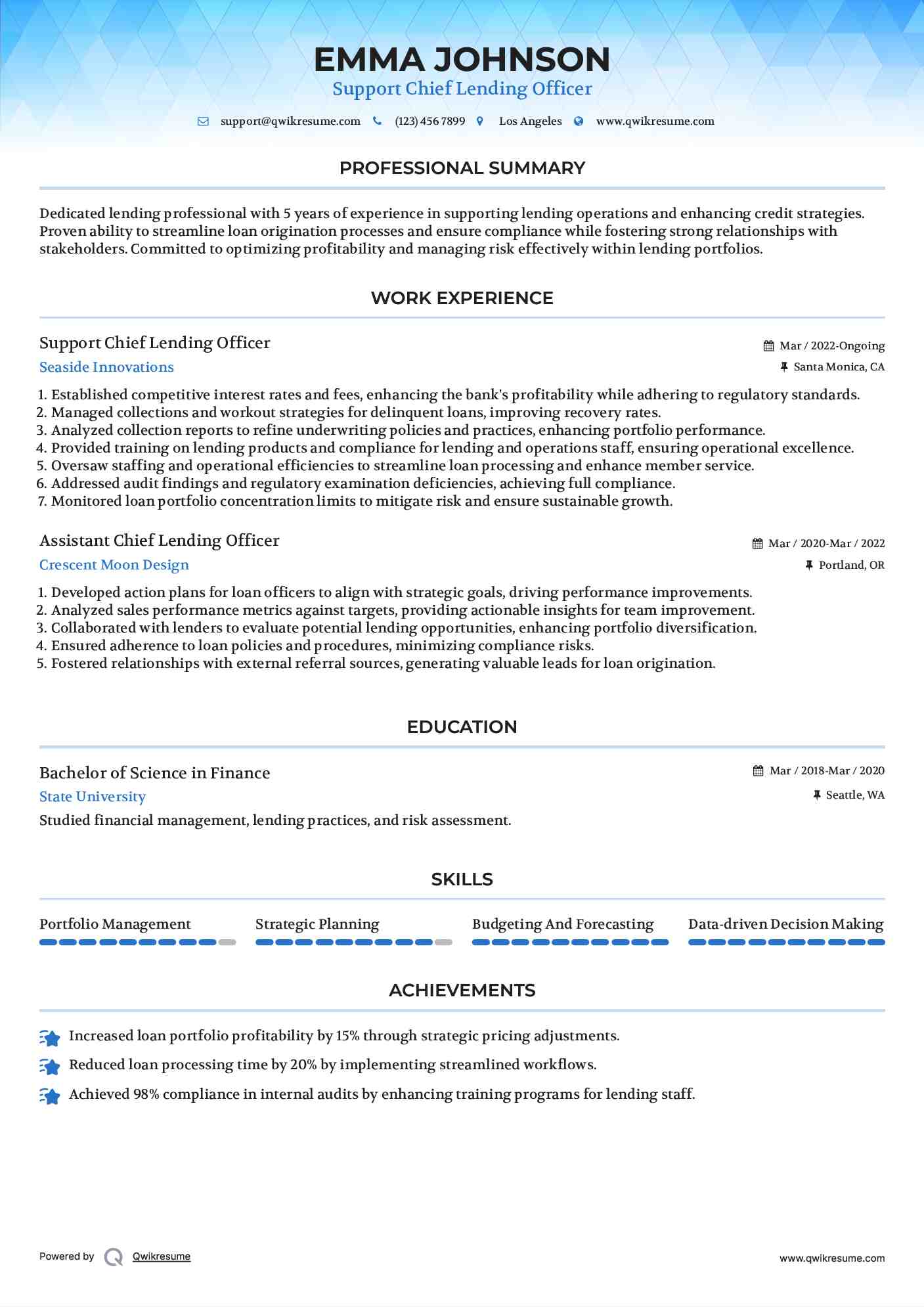

Support Chief Lending Officer Resume

Objective : Dedicated lending professional with 5 years of experience in supporting lending operations and enhancing credit strategies. Proven ability to streamline loan origination processes and ensure compliance while fostering strong relationships with stakeholders. Committed to optimizing profitability and managing risk effectively within lending portfolios.

Skills : Portfolio Management, Strategic Planning, Budgeting And Forecasting, Data-driven Decision Making

Description :

- Established competitive interest rates and fees, enhancing the bank's profitability while adhering to regulatory standards.

- Managed collections and workout strategies for delinquent loans, improving recovery rates.

- Analyzed collection reports to refine underwriting policies and practices, enhancing portfolio performance.

- Provided training on lending products and compliance for lending and operations staff, ensuring operational excellence.

- Oversaw staffing and operational efficiencies to streamline loan processing and enhance member service.

- Addressed audit findings and regulatory examination deficiencies, achieving full compliance.

- Monitored loan portfolio concentration limits to mitigate risk and ensure sustainable growth.

Experience

2-5 Years

Level

Management

Education

BSF

Chief Lending Officer Resume

Summary : Innovative Chief Lending Officer with a decade of extensive experience in transforming lending operations and driving strategic growth. Expertise in managing complex loan portfolios, optimizing risk management, and enhancing profitability. Committed to developing groundbreaking lending solutions that align with corporate objectives and elevate customer satisfaction.

Skills : Strategic Problem Solving, Capital Management, Client Retention Strategies, Compliance Auditing, Loan Documentation, Business Development

Description :

- Reviewed and approved or rejected loan applications, ensuring alignment with organizational risk management policies.

- Maintained comprehensive knowledge of loan products to effectively recommend tailored solutions for clients.

- Collaborated with cross-functional teams to enhance lending processes and improve customer experience.

- Developed and maintained accurate records of customer interactions, ensuring compliance with all regulatory requirements.

- Executed risk management strategies to safeguard company assets while maximizing profitability.

- Trained and mentored loan officers to achieve individual and team performance goals.

- Analyzed market trends to identify opportunities for new lending products and services.

Experience

10+ Years

Level

Executive

Education

MBA

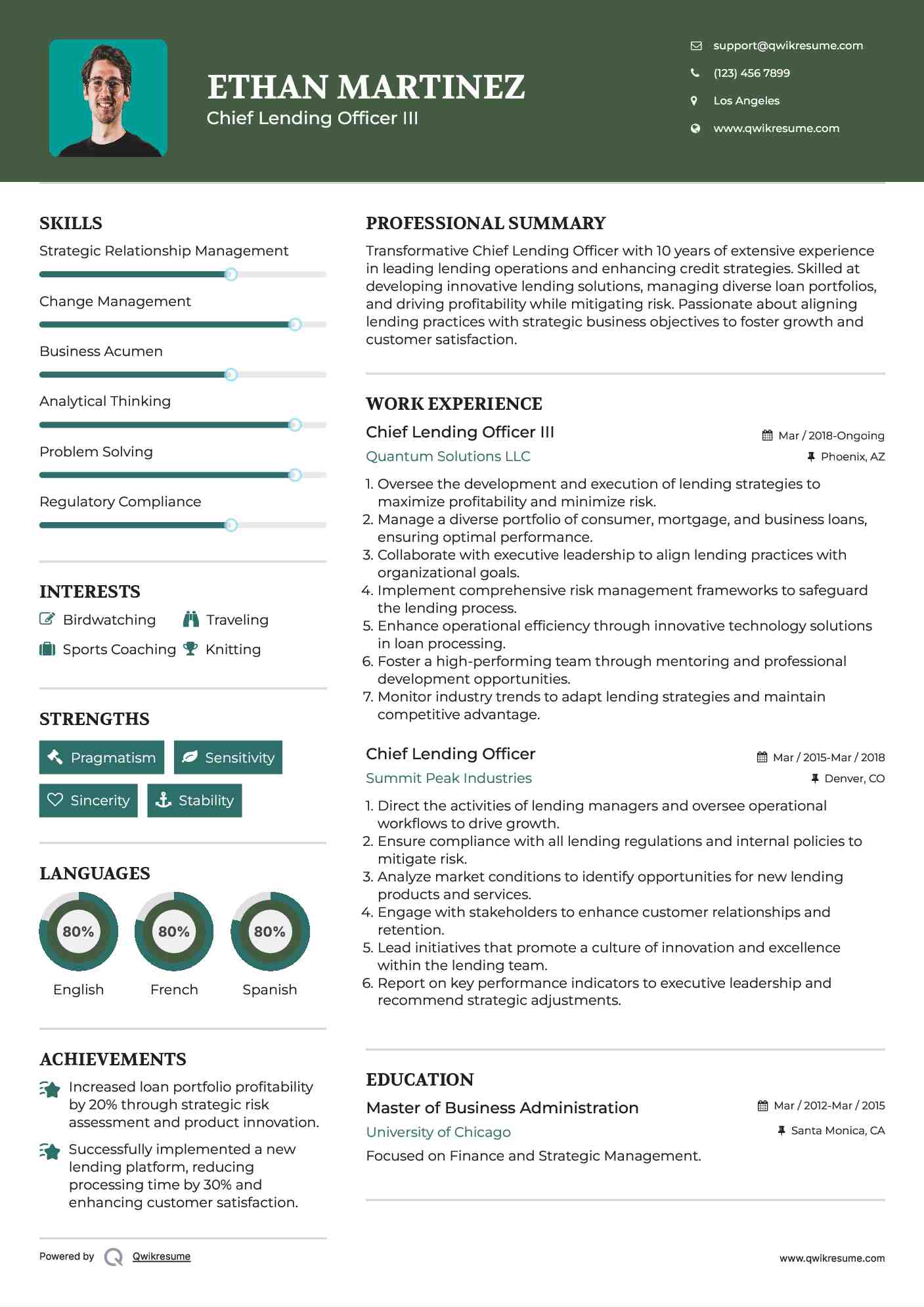

Chief Lending Officer III Resume

Summary : Transformative Chief Lending Officer with 10 years of extensive experience in leading lending operations and enhancing credit strategies. Skilled at developing innovative lending solutions, managing diverse loan portfolios, and driving profitability while mitigating risk. Passionate about aligning lending practices with strategic business objectives to foster growth and customer satisfaction.

Skills : Strategic Relationship Management, Change Management, Business Acumen, Analytical Thinking, Problem Solving, Regulatory Compliance

Description :

- Oversee the development and execution of lending strategies to maximize profitability and minimize risk.

- Manage a diverse portfolio of consumer, mortgage, and business loans, ensuring optimal performance.

- Collaborate with executive leadership to align lending practices with organizational goals.

- Implement comprehensive risk management frameworks to safeguard the lending process.

- Enhance operational efficiency through innovative technology solutions in loan processing.

- Foster a high-performing team through mentoring and professional development opportunities.

- Monitor industry trends to adapt lending strategies and maintain competitive advantage.

Experience

10+ Years

Level

Executive

Education

MBA

Chief Lending Officer Resume

Summary : Visionary Chief Lending Officer with 10 years of experience in steering comprehensive lending strategies and operational excellence. Expertise in managing diverse loan portfolios and fostering innovation in lending products to maximize profitability and minimize risk. Passionate about building strategic partnerships and aligning lending operations with organizational goals.

Skills : Financial Risk Assessment, Loan Underwriting, Policy Development, Sales Strategy, Market Analysis, Conflict Resolution

Description :

- Directed lending operations, ensuring compliance with regulatory standards and alignment with corporate strategy.

- Implemented innovative lending products, enhancing customer access to credit and driving portfolio growth.

- Conducted regular risk assessments to identify potential vulnerabilities within lending programs.

- Collaborated with executive leadership to establish organizational lending goals and strategies.

- Managed relationships with key stakeholders, including regulators and community partners, to foster a supportive lending environment.

- Analyzed market trends to inform lending strategies and adjust offerings accordingly.

- Developed training programs for lending staff to enhance skills and ensure high standards of service delivery.

Experience

10+ Years

Level

Executive

Education

MBA

Chief Lending Officer Resume

Summary : Results-focused Chief Lending Officer with a decade of experience in enhancing lending frameworks and driving sustainable growth. Expertise in managing comprehensive loan portfolios, innovating financial products, and optimizing risk management strategies. Committed to fostering collaboration with executive teams to align lending operations with corporate objectives and maximize profitability.

Skills : Strategic Team Leadership, Communication Skills, Project Management, Sales Forecasting, Relationship Building

Description :

- Directed lending operations, enhancing efficiency and profitability across consumer, mortgage, and commercial loans.

- Developed and implemented innovative lending policies aligned with compliance regulations and market trends.

- Managed a diverse team of lending professionals, fostering a culture of high performance and accountability.

- Analyzed lending data to inform strategic decisions, driving growth and mitigating risk across portfolios.

- Collaborated with senior leadership to align lending initiatives with overarching business goals and customer needs.

- Oversaw the compliance and risk management framework for lending operations, ensuring adherence to all regulatory standards.

- Enhanced customer experience through the development of streamlined lending processes and personalized service offerings.

Experience

10+ Years

Level

Executive

Education

MBA