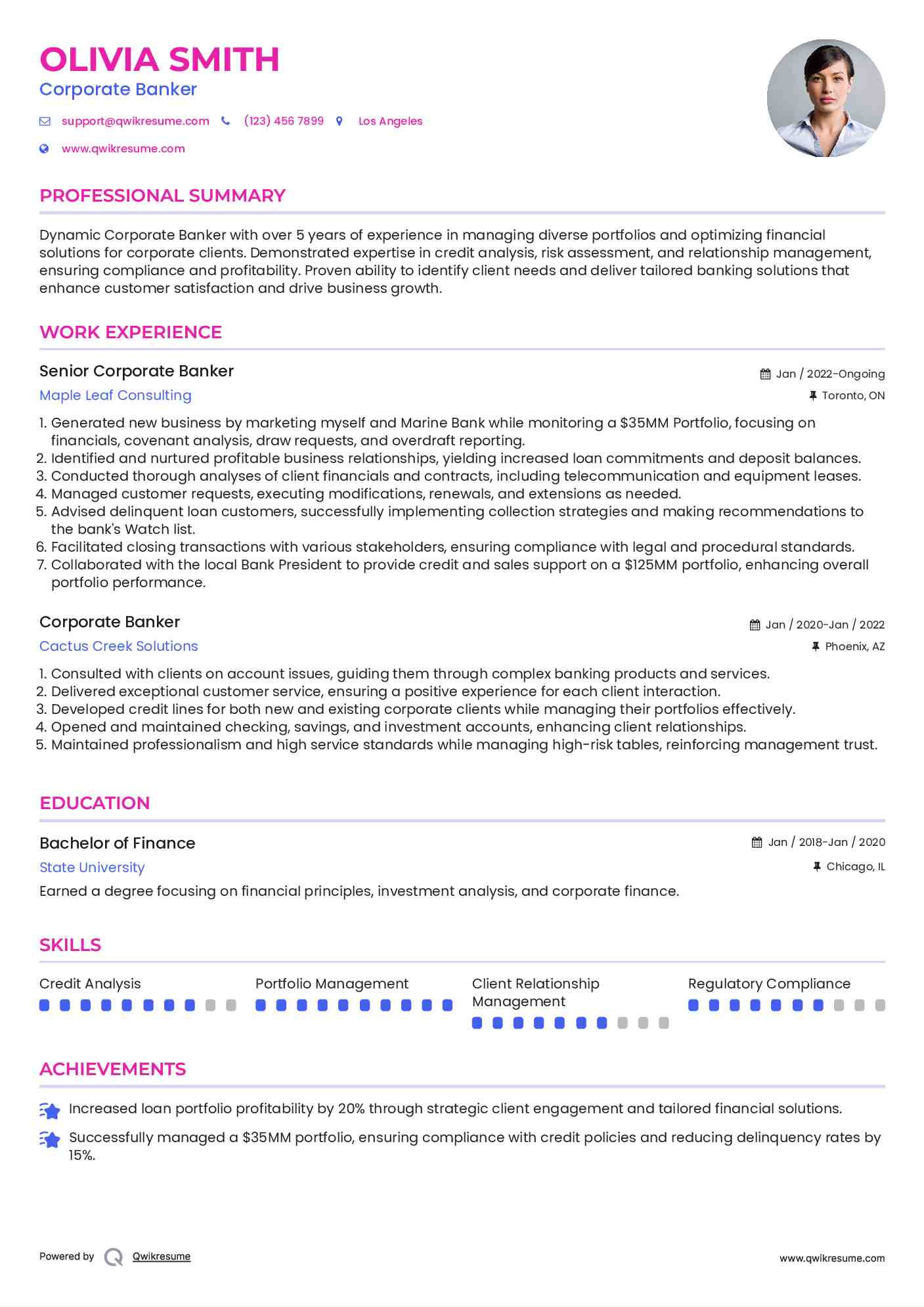

Senior Corporate Banker Resume

Objective : Dynamic Corporate Banker with over 5 years of experience in managing diverse portfolios and optimizing financial solutions for corporate clients. Demonstrated expertise in credit analysis, risk assessment, and relationship management, ensuring compliance and profitability. Proven ability to identify client needs and deliver tailored banking solutions that enhance customer satisfaction and drive business growth.

Skills : Credit Analysis, Portfolio Management, Client Relationship Management, Regulatory Compliance

Description :

- Generated new business by marketing myself and Marine Bank while monitoring a $35MM Portfolio, focusing on financials, covenant analysis, draw requests, and overdraft reporting.

- Identified and nurtured profitable business relationships, yielding increased loan commitments and deposit balances.

- Conducted thorough analyses of client financials and contracts, including telecommunication and equipment leases.

- Managed customer requests, executing modifications, renewals, and extensions as needed.

- Advised delinquent loan customers, successfully implementing collection strategies and making recommendations to the bank's Watch list.

- Facilitated closing transactions with various stakeholders, ensuring compliance with legal and procedural standards.

- Collaborated with the local Bank President to provide credit and sales support on a $125MM portfolio, enhancing overall portfolio performance.

Experience

2-5 Years

Level

Junior

Education

BFin

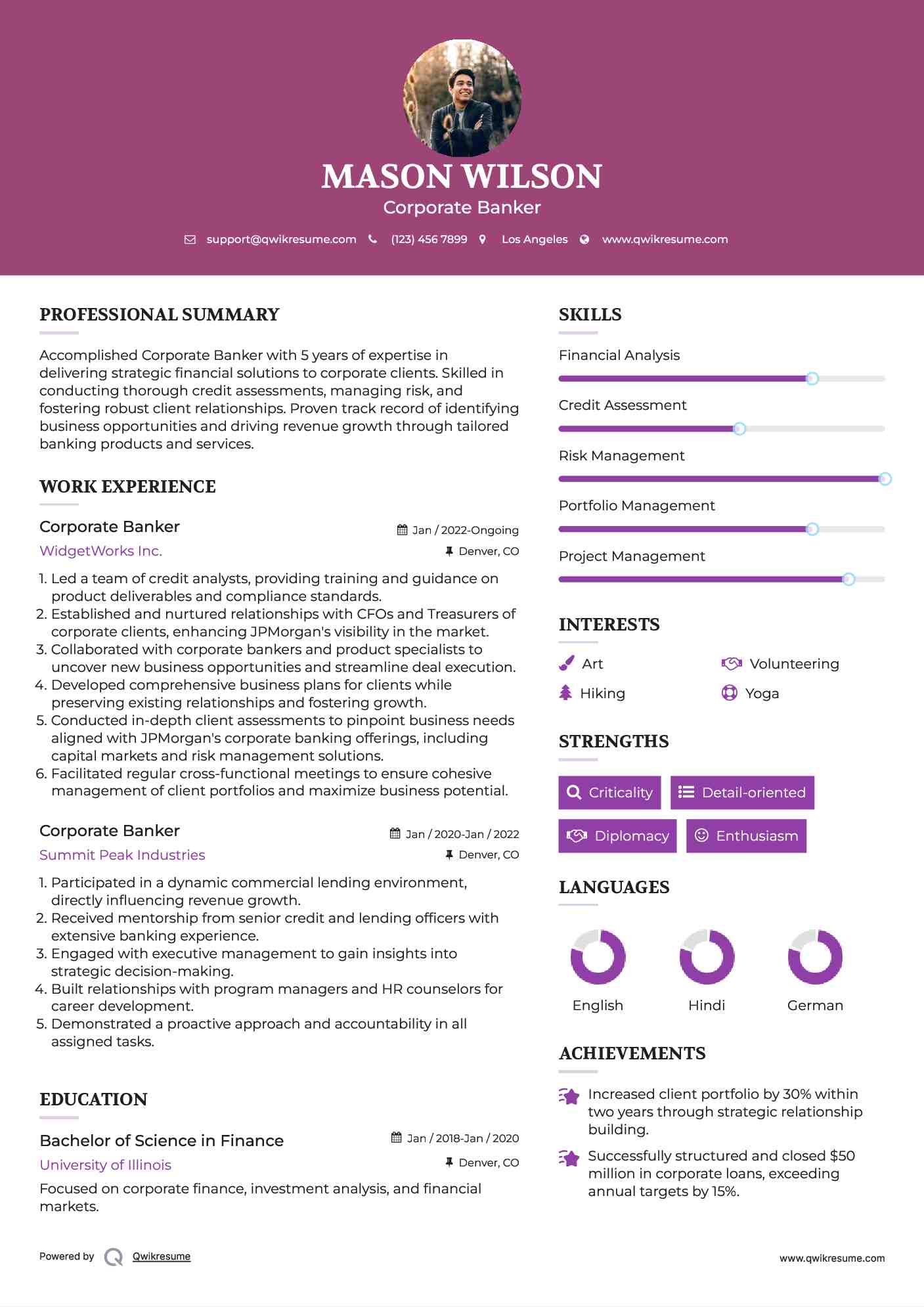

Corporate Banker Resume

Objective : Accomplished Corporate Banker with 5 years of expertise in delivering strategic financial solutions to corporate clients. Skilled in conducting thorough credit assessments, managing risk, and fostering robust client relationships. Proven track record of identifying business opportunities and driving revenue growth through tailored banking products and services.

Skills : Financial Analysis, Credit Assessment, Risk Management, Portfolio Management, Project Management

Description :

- Led a team of credit analysts, providing training and guidance on product deliverables and compliance standards.

- Established and nurtured relationships with CFOs and Treasurers of corporate clients, enhancing JPMorgan's visibility in the market.

- Collaborated with corporate bankers and product specialists to uncover new business opportunities and streamline deal execution.

- Developed comprehensive business plans for clients while preserving existing relationships and fostering growth.

- Conducted in-depth client assessments to pinpoint business needs aligned with JPMorgan's corporate banking offerings, including capital markets and risk management solutions.

- Facilitated regular cross-functional meetings to ensure cohesive management of client portfolios and maximize business potential.

Experience

2-5 Years

Level

Junior

Education

B.S. in Finance

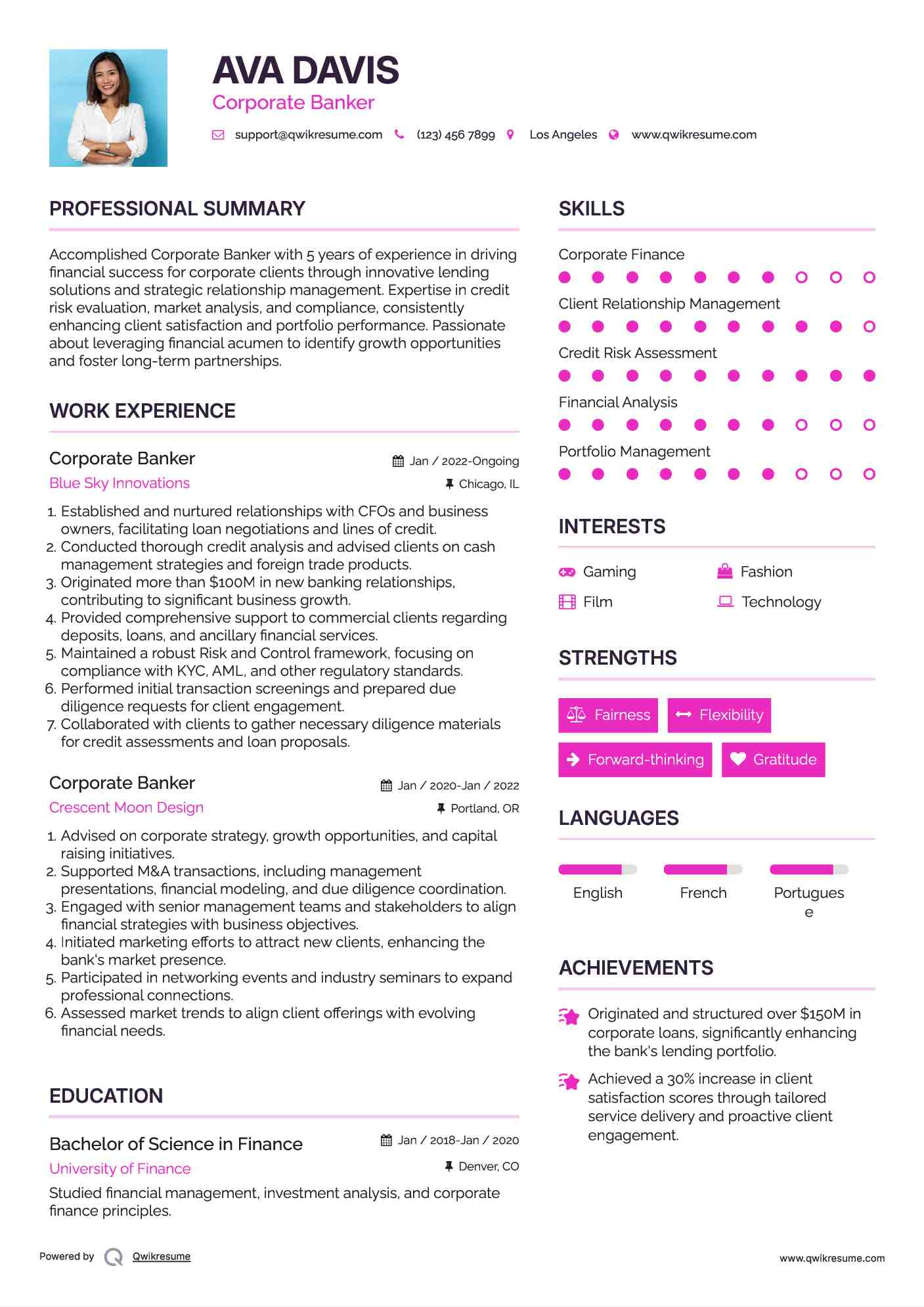

Corporate Banker Resume

Objective : Accomplished Corporate Banker with 5 years of experience in driving financial success for corporate clients through innovative lending solutions and strategic relationship management. Expertise in credit risk evaluation, market analysis, and compliance, consistently enhancing client satisfaction and portfolio performance. Passionate about leveraging financial acumen to identify growth opportunities and foster long-term partnerships.

Skills : Corporate Finance, Client Relationship Management, Credit Risk Assessment, Financial Analysis, Portfolio Management

Description :

- Established and nurtured relationships with CFOs and business owners, facilitating loan negotiations and lines of credit.

- Conducted thorough credit analysis and advised clients on cash management strategies and foreign trade products.

- Originated more than $100M in new banking relationships, contributing to significant business growth.

- Provided comprehensive support to commercial clients regarding deposits, loans, and ancillary financial services.

- Maintained a robust Risk and Control framework, focusing on compliance with KYC, AML, and other regulatory standards.

- Performed initial transaction screenings and prepared due diligence requests for client engagement.

- Collaborated with clients to gather necessary diligence materials for credit assessments and loan proposals.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Corporate Banker Resume

Summary : With a decade of experience as a Corporate Banker, I specialize in delivering comprehensive financial solutions tailored to corporate clients. My expertise encompasses credit risk analysis, strategic portfolio management, and fostering long-term client relationships. I excel in identifying market opportunities and driving profitability while ensuring compliance with regulatory standards. My commitment to excellence enables me to consistently enhance client satisfaction and contribute to the growth of the organization.

Skills : Client Relationship Management, Credit Risk Assessment, Portfolio Management, Financial Analysis, Regulatory Compliance

Description :

- Acted as the primary banking representative for corporate clients, ensuring their financial needs are met effectively.

- Managed and expanded a portfolio valued at $150-$250 million, consistently achieving annual growth objectives.

- Identified and cultivated new business opportunities, enhancing client relationships through cross-selling strategies.

- Conducted thorough credit quality assessments for commercial real estate loans, adhering to stringent standards.

- Engaged in community outreach to develop Centers of Influence, enhancing the bank's local presence.

- Provided timely sales performance reports to management, contributing to strategic decision-making.

- Regularly monitored and reviewed sales performance metrics, collaborating with supervisors to drive improvements.

Experience

7-10 Years

Level

Consultant

Education

B.S. Finance

Corporate Banker Resume

Summary : With a decade of experience in corporate banking, I excel in crafting and implementing innovative financial strategies for diverse corporate clients. My proficiency in credit risk analysis and portfolio management has consistently driven revenue growth and strengthened client relationships. I am dedicated to identifying opportunities that enhance operational efficiency, ensuring compliance, and delivering exceptional banking solutions that foster long-term partnerships.

Skills : Strategic Deal Structuring, Credit Risk Analysis, Portfolio Management, Client Relationship Management, Financial Product Development

Description :

- Executed comprehensive credit assessments and risk analyses to inform lending decisions for corporate clients.

- Collaborated with corporate banking specialists to address client needs and deliver customized financial solutions.

- Monitored borrower performance, providing timely insights to mitigate risks and enhance portfolio health.

- Maintained in-depth knowledge of corporate banking products to effectively communicate features and benefits to clients.

- Documented all client interactions, ensuring accurate record-keeping and compliance with banking regulations.

- Developed and implemented strategies for client engagement, resulting in improved satisfaction and retention.

- Actively participated in training junior staff on credit underwriting and risk evaluation techniques.

Experience

7-10 Years

Level

Consultant

Education

MBA

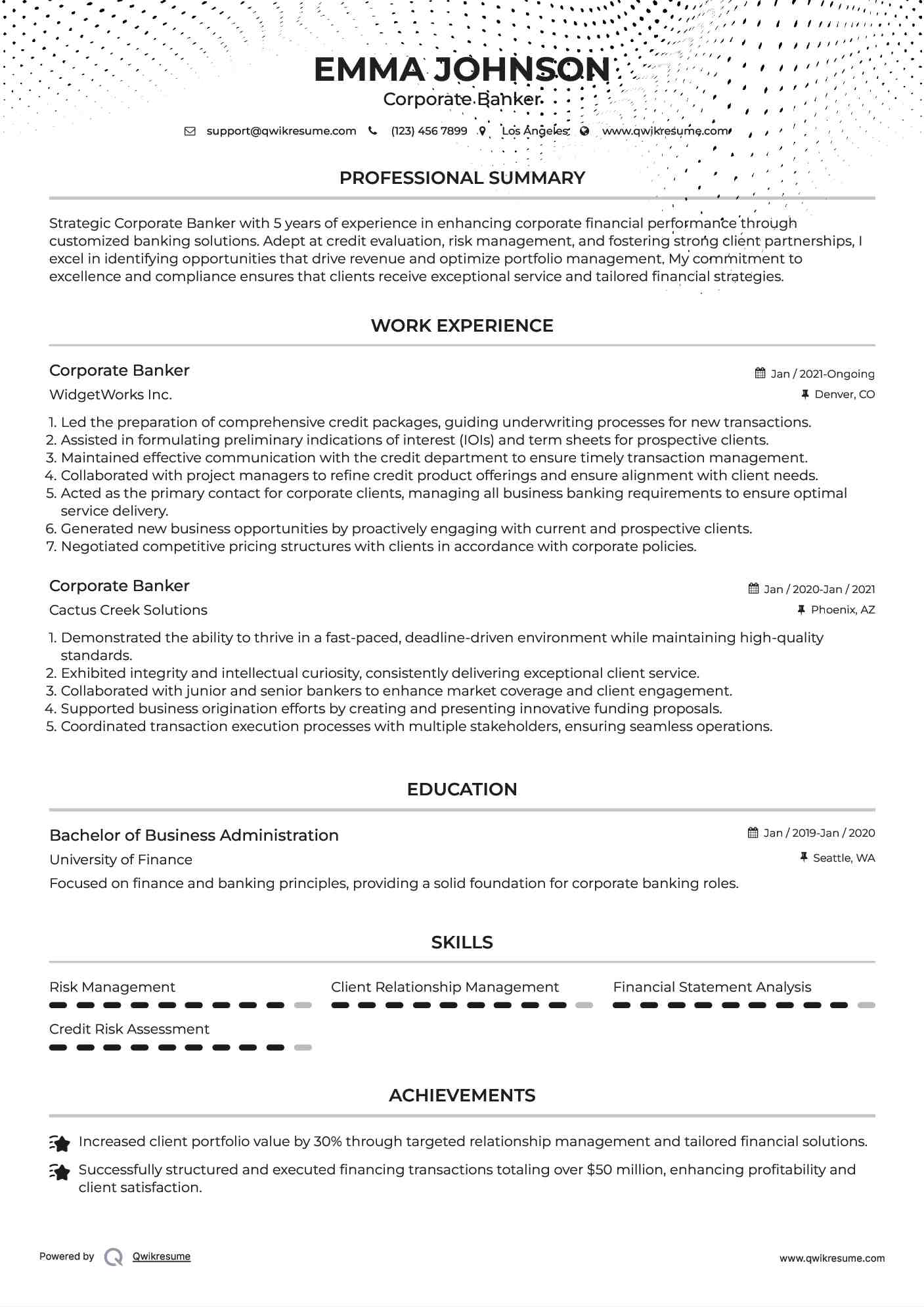

Corporate Banker Resume

Objective : Strategic Corporate Banker with 5 years of experience in enhancing corporate financial performance through customized banking solutions. Adept at credit evaluation, risk management, and fostering strong client partnerships, I excel in identifying opportunities that drive revenue and optimize portfolio management. My commitment to excellence and compliance ensures that clients receive exceptional service and tailored financial strategies.

Skills : Risk Management, Client Relationship Management, Financial Statement Analysis, Credit Risk Assessment

Description :

- Led the preparation of comprehensive credit packages, guiding underwriting processes for new transactions.

- Assisted in formulating preliminary indications of interest (IOIs) and term sheets for prospective clients.

- Maintained effective communication with the credit department to ensure timely transaction management.

- Collaborated with project managers to refine credit product offerings and ensure alignment with client needs.

- Acted as the primary contact for corporate clients, managing all business banking requirements to ensure optimal service delivery.

- Generated new business opportunities by proactively engaging with current and prospective clients.

- Negotiated competitive pricing structures with clients in accordance with corporate policies.

Experience

2-5 Years

Level

Executive

Education

BBA

Corporate Banker Resume

Objective : Strategic Corporate Banker with a strong background in relationship management and financial analysis. Recognized for developing innovative financing solutions that improved client cash flow and reduced costs by 20% across multiple sectors.

Skills : Corporate Banking Expertise, Credit Risk Analysis, Portfolio Management, Client Relationship Management, Financial Solutions Development

Description :

- Managed a diverse portfolio of corporate clients, minimizing risk while maximizing financial performance.

- Conducted comprehensive credit risk assessments, linking client capabilities with available securities and cash flow.

- Originated and structured profitable loan transactions, adhering to internal policies and financial objectives.

- Expanded the SBA 7a lending program, collaborating with management on outreach strategies for targeted markets.

- Evaluated small business loan opportunities for compliance with SBA requirements and financial viability.

- Developed strong referral networks with centers of influence, enhancing business growth opportunities.

- Maintained a thorough understanding of credit policies and ensured accurate loan application submissions.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

Corporate Banker Resume

Summary : With a decade of robust experience in corporate banking, I excel in devising and executing strategic financial solutions that drive growth and profitability for corporate clients. My extensive background in credit risk analysis, portfolio management, and relationship building empowers me to identify unique market opportunities while ensuring compliance with regulatory standards. I am dedicated to enhancing client satisfaction through innovative banking strategies and fostering long-term partnerships.

Skills : Strategic Planning, Investment Strategies, Financial Modeling, Loan Structuring, Sales Strategy

Description :

- Maintained comprehensive oversight of client portfolios, ensuring alignment with financial goals and compliance standards.

- Directed internal teams to efficiently manage loan transactions and operational requirements, enhancing service delivery.

- Developed and implemented a targeted business development strategy, resulting in a robust pipeline of commercial banking opportunities.

- Leveraged professional networks and industry events to attract new commercial banking prospects effectively.

- Proactively identified and pursued new business and referral opportunities through direct client engagement.

- Collaborated with product specialists to close deals across all product lines, meeting and exceeding individual revenue targets.

- Evaluated and sourced new credit opportunities, maximizing cross-selling potential for the bank's diverse product offerings.

Experience

7-10 Years

Level

Management

Education

B.S. Finance

Corporate Banker Resume

Objective : Seasoned Corporate Banker with 5 years of experience in crafting tailored financial solutions that drive operational success for corporate clients. Expertise in credit risk assessment, portfolio management, and strategic relationship building, ensuring compliance and enhancing profitability. Committed to leveraging analytical skills to identify market opportunities and deliver exceptional client-focused banking services.

Skills : Credit Risk Assessment, Portfolio Management, Financial Analysis, Client Relationship Management, Loan Structuring

Description :

- Pre-screened qualified loan opportunities, structuring deals to balance risk and rewards.

- Actively involved in pitching, structuring, negotiating, and closing new loan transactions.

- Oversaw and ensured sound underwriting practices for presentation to credit approvers.

- Acted as the primary point of contact for overall commercial banking relationships.

- Maintained expert knowledge of products, organizational practices, and applicable policies and procedures.

- Managed a diverse portfolio of up to 75 clients with credit outstanding up to $50MM, negotiating terms within established guidelines.

- Proactively solicited new and prospective loan and deposit relationships for the bank.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

Corporate Banker Resume

Objective : Innovative Corporate Banker with expertise in mergers and acquisitions financing. Played a key role in closing deals worth over $500 million, significantly enhancing the bank's reputation and client trust in the market.

Skills : Credit Analysis, Risk Management, Client Relationship Management, Financial Product Marketing, Portfolio Optimization

Description :

- Identified cross-sell opportunities for assigned relationships and marketed a broad range of financial products to clients and prospects.

- Collaborated with Product Management, Treasury Management, and Credit Underwriting teams to enhance banking relationships and meet customer objectives.

- Engaged in continuous learning from Senior Relationship Managers to gain insights into bank products, credit standards, and business development strategies.

- Partnered with Commercial Underwriters to assess customers' credit risk and structure fitting credit solutions within acceptable risk guidelines.

- Analyzed client needs and recommended appropriate banking products and services to optimize their financial performance.

- Developed new client relationships through referrals, networking, and community engagement, expanding the customer base.

- Maintained strong relationships with customers through proactive communication and support activities.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance