Credit Analyst II Resume

Summary : With a decade of comprehensive experience in credit analysis, I excel at evaluating financial statements and assessing creditworthiness. My expertise encompasses risk management, financial forecasting, and compliance with regulatory standards. I am committed to leveraging data-driven insights to enhance credit strategies and foster business growth.

Skills : Advanced Excel Analytics, Proficient in QuickBooks, Oracle Financial Services Knowledge, Credit Risk Assessment

Description :

- Streamlined credit analysis processes, leading to a reduction in receivable aging from $3 million to $160,000 within two months.

- Identified and resolved discrepancies in customer master files, enhancing data integrity.

- Enabled customer service representatives to effectively utilize compliance models under Sarbanes-Oxley regulations.

- Collaborated with sales and customers to minimize unapplied credits and misapplied checks.

- Key contributor to the Sarbanes-Oxley team, focusing on the implementation of taxation tables for accurate reporting.

- Regularly updated processes and procedures to align with Sarbanes-Oxley compliance requirements.

- Conducted thorough analyses of AR aging reports to address past due accounts and resolve customer issues.

Experience

7-10 Years

Level

Executive

Education

B.S. Finance

Credit Analyst II Resume

Summary : Bringing a decade of expertise in credit analysis, I specialize in assessing financial health and credit risks for diverse portfolios. My proficiency in regulatory compliance, risk assessment, and data-driven decision-making has consistently driven improved credit strategies.

Skills : Credit Risk Assessment, Financial Reporting, Financial Analysis, Debt Financing Strategies, Market Analysis

Description :

- Collaborated with credit bureaus and business partners to gather and analyze credit information.

- Conducted thorough evaluations of customer financial records, recommending tailored payment solutions.

- Reviewed and analyzed loan applications, ensuring compliance with underwriting standards.

- Monitored adherence to federal and state regulations, enhancing compliance frameworks.

- Utilized advanced accounting software to manage financial data and generate insightful reports.

- Executed accounting functions including accounts payable and receivable, ensuring accuracy in financial transactions.

- Streamlined payment processes by verifying documentation and coordinating disbursements efficiently.

Experience

7-10 Years

Level

Executive

Education

BSF

Accounts Receivable Credit Analyst Resume

Summary : Possessing a wealth of knowledge accumulated over a decade in credit analysis, I am adept at interpreting complex financial data to inform credit decisions and mitigate risk. My background in financial modeling, compliance adherence, and strategic forecasting has led to optimized credit processes that support organizational growth. I am eager to bring my analytical acumen and proactive approach to a dynamic team.

Skills : Risk Assessment, Financial Modeling, Data Analysis, Credit Risk Analysis, Regulatory Compliance

Description :

- Analyze financial statements and credit reports to evaluate the creditworthiness of individuals and businesses.

- Prepare detailed risk assessments for larger accounts, presenting findings to senior management for informed decision-making.

- Maintain confidentiality and ensure compliance with regulatory standards while communicating credit policies to stakeholders.

- Utilize credit review systems such as Dunn & Bradstreet and Experian for thorough evaluations.

- Process lease documents efficiently from origination through funding, ensuring accuracy and compliance.

- Verify applicant information and conduct credit condition checks to facilitate the leasing process.

- Conduct follow-up verification calls to ensure customer satisfaction post-lease approval.

Experience

7-10 Years

Level

Executive

Education

B.S. Finance

Senior Credit Analyst Resume

Objective : With over five years of dedicated experience in credit analysis, I possess a strong ability to assess financial documents and evaluate credit risk. My skills in financial modeling, risk assessment, and regulatory compliance have consistently contributed to the development of effective credit strategies. I am passionate about utilizing analytical insights to drive informed decision-making and enhance financial outcomes.

Skills : Financial Analysis Software, Credit Risk Assessment, Financial Reporting, Loan Underwriting, Credit Risk Modeling

Description :

- Analyzed credit and financial reports to assess the risk associated with loan applications and credit extensions.

- Evaluated financial data such as market trends, income growth, and management capabilities to determine loan viability.

- Conducted comparative analysis of liquidity, profitability, and credit histories of clients against industry benchmarks.

- Interpreted financial records, including earnings and payment histories, to recommend strategic financial actions.

- Managed documentation and compliance records, ensuring adherence to office procedures and regulatory standards.

- Compiled loan applications, performing credit analyses and presenting findings to loan committees for informed decisions.

- Reviewed customer accounts to identify delinquent payments and strategized collection efforts.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Accounts Receivable Credit Analyst Resume

Headline : An analytical professional with over 7 years of experience in credit analysis, I focus on evaluating financial documents and determining creditworthiness. My strong background in risk assessment, compliance, and financial forecasting enables me to develop and implement effective credit strategies. I am dedicated to utilizing data insights to drive informed financial decisions and enhance organizational performance.

Skills : Financial Statement Analysis, Credit Risk Assessment, Credit Policy Development, Financial Forecasting, Data Analysis

Description :

- Evaluate and analyze new account applications from various channels, ensuring accurate credit decisions.

- Process and review credit line increase requests, assessing financial stability and risk.

- Respond to complex inbound inquiries regarding credit products, utilizing extensive product knowledge.

- Assist in the development of credit policies and procedures to ensure compliance with regulatory standards.

- Support sales initiatives by providing insights on credit options and customer eligibility.

- Review and maintain account information, ensuring accuracy and up-to-date records.

- Educate customers on credit products and services, enhancing customer satisfaction and retention.

Experience

5-7 Years

Level

Junior

Education

B.S. Finance

Senior Credit Analyst Resume

Summary : Over the past ten years, I have honed my expertise in credit analysis, focusing on evaluating financial statements and determining credit risk for diverse portfolios. My strong analytical skills and proficiency in risk management, compliance, and financial forecasting enable me to develop robust credit strategies that drive business success. I am eager to leverage my insights to support organizational growth and enhance financial decision-making.

Skills : Microsoft Excel, QuickBooks Proficiency, Invoicing Management, Cash Flow Analysis

Description :

- Conducted thorough quantitative and qualitative analysis of credit applications to determine eligibility for credit lines.

- Evaluated collateral values and credit risk, preparing comprehensive credit-approval packages and denial notifications.

- Employed statistical methods to analyze customer data, enhancing risk assessment for new and existing clients.

- Utilized financial expertise to assess operational data, evaluating applicants' financial stability.

- Performed industry comparisons of liquidity, profitability, and credit history to identify potential risks.

- Analyzed income trends, management quality, and market share to inform credit decisions.

- Executed detailed cash flow and financial statement analyses, applying advanced accounting methodologies.

Experience

10+ Years

Level

Senior

Education

B.S. Finance

Senior Credit Analyst/Collections V Resume

Summary : With 10 years of extensive experience in credit analysis, I have developed a strong acumen for evaluating financial data and assessing credit risk. My skill set includes advanced risk management, regulatory compliance, and data analytics, all aimed at optimizing credit strategies.

Skills : Financial Analysis, Credit Research, Financial Software Proficiency, Adaptability to Market Changes, Excel Proficiency

Description :

- Managed a monthly credit volume exceeding $4.5 million while maintaining a delinquency rate of under 10%.

- Engaged with delinquent customers using effective collection techniques while ensuring high levels of customer satisfaction.

- Analyzed account terms and maintained updated credit limits, ensuring compliance with company policies.

- Developed and implemented payment plans for overdue accounts, improving cash flow.

- Conducted forensic accounting analysis to identify discrepancies and optimize collections.

- Collaborated with team leads to produce monthly reports that monitored departmental performance against budget.

- Performed comprehensive credit assessments for potential clients, ensuring alignment with lending criteria.

Experience

10+ Years

Level

Management

Education

B.S. Finance

Senior Credit Analyst Resume

Summary : Credit Analyst with 10 years of extensive experience in evaluating financial statements and determining credit risk across various sectors. Skilled in risk management, regulatory compliance, and financial forecasting, I utilize analytical insights to develop and implement effective credit strategies. My commitment to precision and data-driven decision-making has consistently driven enhanced financial outcomes and business growth.

Skills : Advanced Microsoft Office Suite, Consumer Credit Analysis, Credit Risk Assessment, Enterprise Risk Management, Financial Training and Development

Description :

- Evaluated financial statements and credit applications to determine creditworthiness and risk exposure.

- Conducted thorough analysis of financial data to support informed decision-making and mitigate potential risks.

- Collaborated with cross-functional teams to enhance credit strategies and improve portfolio performance.

- Developed reports and presentations that communicated credit analysis findings to stakeholders.

- Utilized advanced data analytics to identify trends and optimize credit processes.

- Trained junior analysts on best practices in credit assessment and risk management.

- Developed credit risk models that improved the accuracy of risk assessments by 25%, enhancing decision-making processes.

Experience

10+ Years

Level

Senior

Education

B.S. Finance

Credit Analyst II Resume

Summary : Results-driven Credit Analyst skilled in financial analysis and credit risk assessment. Successfully reduced default rates by 15% through comprehensive credit evaluations and strategic recommendations to management.

Skills : Credit Risk Analysis, Financial Negotiation, Risk Mitigation Strategies, Collaborative Problem Solving, Financial Statement Analysis

Description :

- Managed a diverse portfolio of 600 clients across various sectors, ensuring effective credit risk management and compliance.

- Developed comprehensive monthly reports on collections, profitability forecasts, and account reconciliations.

- Established strong relationships with clients through proactive communication and exceptional service, resulting in improved customer satisfaction.

- Identified key business needs and coordinated with internal teams to implement solutions that enhance service delivery.

- Analyzed accounts receivable penalty reports to uncover opportunities for process improvements, leading to significant cost savings.

- Streamlined employee performance measurement processes to enhance reliability and accuracy in evaluations.

- Mentored new hires on credit analysis and collections procedures, ensuring adherence to best practices.

Experience

7-10 Years

Level

Executive

Education

MBA

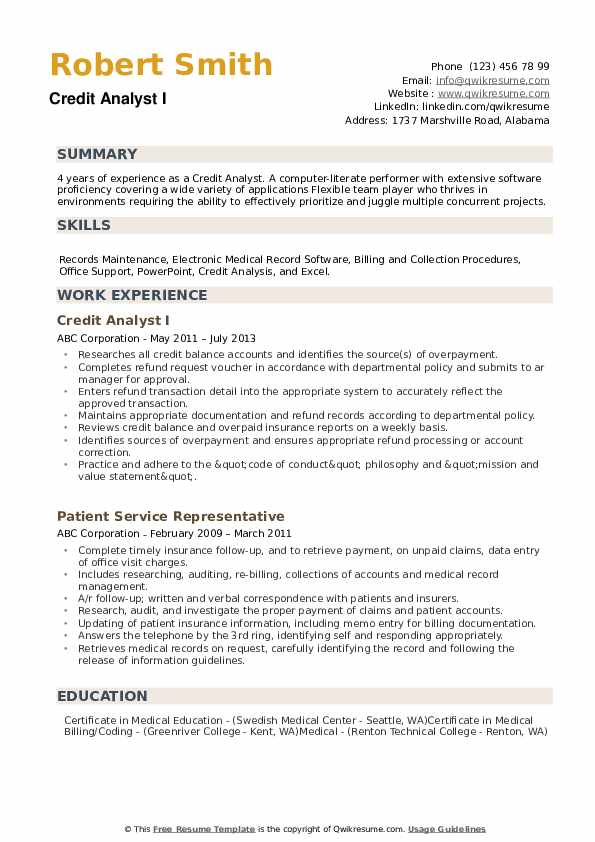

Credit Analyst I Resume

Objective : Bringing over five years of robust experience in credit analysis, I specialize in evaluating financial statements and determining credit risk for diverse portfolios. My expertise in risk assessment, regulatory compliance, and strategic forecasting has consistently led to the development of effective credit strategies. I am enthusiastic about applying data-driven insights to support informed decision-making and enhance organizational growth.

Skills : Credit Data Analysis, Financial Modeling Software, Risk Assessment Techniques, Regulatory Compliance Knowledge, Data Presentation Skills

Description :

- Conduct thorough analyses of credit data and financial information of applicants to evaluate risk profiles.

- Prepare detailed reports on creditworthiness and present findings to management for decision-making.

- Monitor and assess changes in financial conditions that may affect credit risk.

- Collaborate with cross-functional teams to implement effective credit policies.

- Utilize advanced financial modeling techniques to project future credit scenarios.

- Continuously improve credit assessment methodologies based on market trends and data analysis.

- Monitor and review credit portfolios, identifying trends and recommending adjustments to mitigate risks.

Experience

2-5 Years

Level

Junior

Education

BS Finance