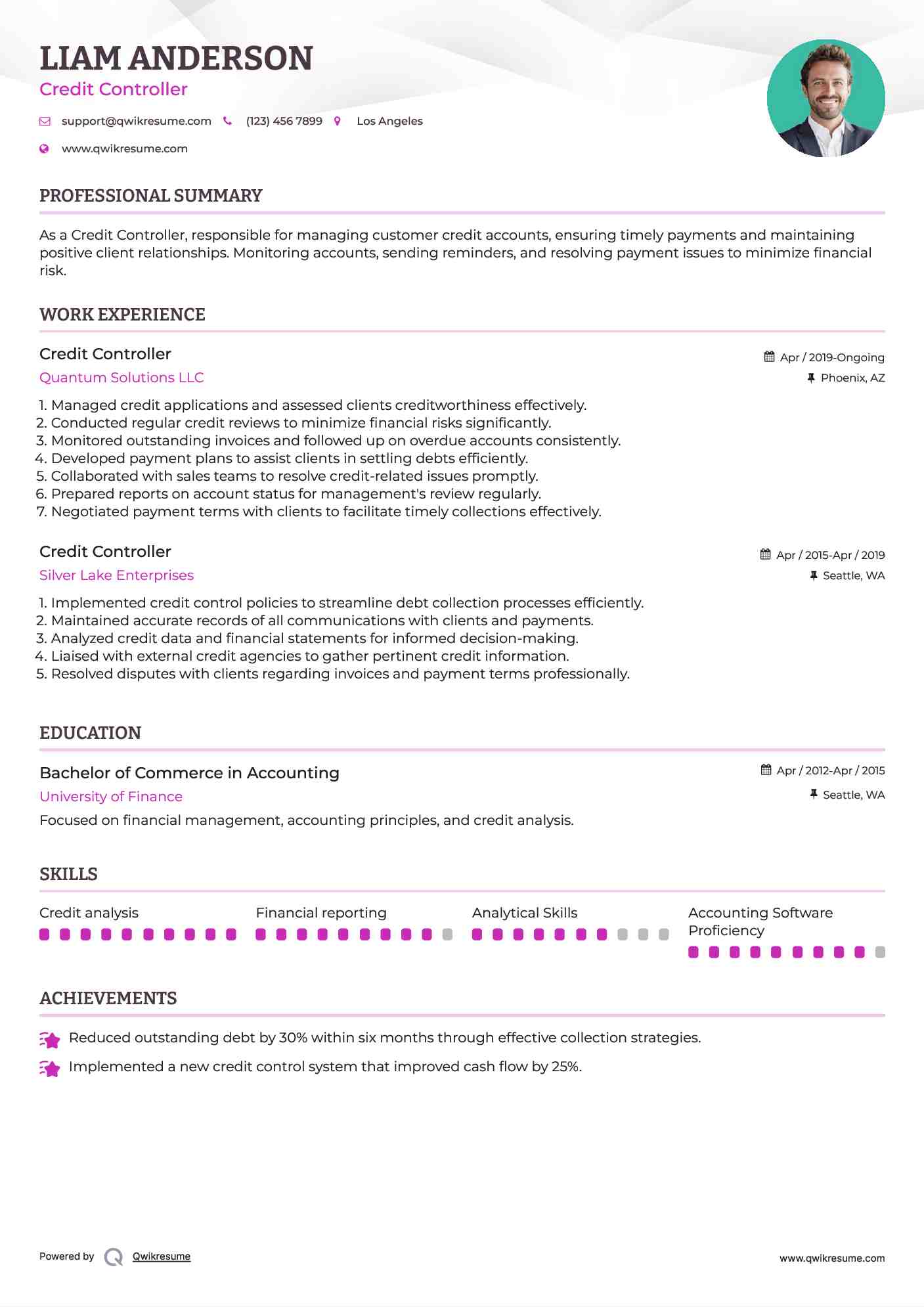

Credit Controller Resume

Summary : As a Credit Controller, responsible for managing customer credit accounts, ensuring timely payments and maintaining positive client relationships. Monitoring accounts, sending reminders, and resolving payment issues to minimize financial risk.

Skills : Credit analysis, Financial reporting, Analytical Skills, Accounting Software Proficiency

Description :

- Managed credit applications and assessed clients creditworthiness effectively.

- Conducted regular credit reviews to minimize financial risks significantly.

- Monitored outstanding invoices and followed up on overdue accounts consistently.

- Developed payment plans to assist clients in settling debts efficiently.

- Collaborated with sales teams to resolve credit-related issues promptly.

- Prepared reports on account status for management's review regularly.

- Negotiated payment terms with clients to facilitate timely collections effectively.

Experience

10+ Years

Level

Senior

Education

B.Com

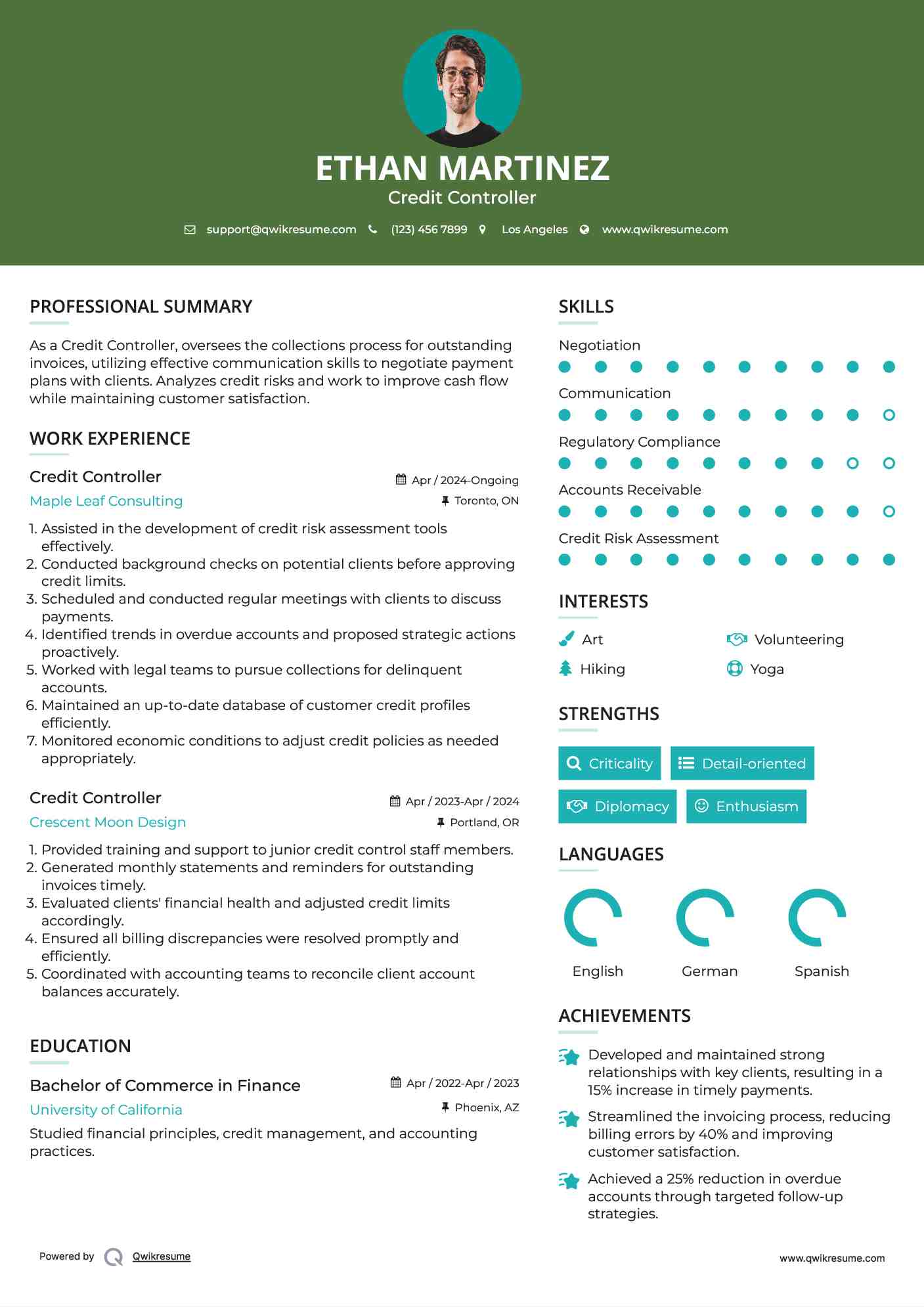

Credit Controller Resume

Objective : As a Credit Controller, oversees the collections process for outstanding invoices, utilizing effective communication skills to negotiate payment plans with clients. Analyzes credit risks and work to improve cash flow while maintaining customer satisfaction.

Skills : Negotiation, Communication, Regulatory Compliance

Description :

- Assisted in the development of credit risk assessment tools effectively.

- Conducted background checks on potential clients before approving credit limits.

- Scheduled and conducted regular meetings with clients to discuss payments.

- Identified trends in overdue accounts and proposed strategic actions proactively.

- Worked with legal teams to pursue collections for delinquent accounts.

- Maintained an up-to-date database of customer credit profiles efficiently.

- Monitored economic conditions to adjust credit policies as needed appropriately.

Experience

0-2 Years

Level

Entry Level

Education

MBA

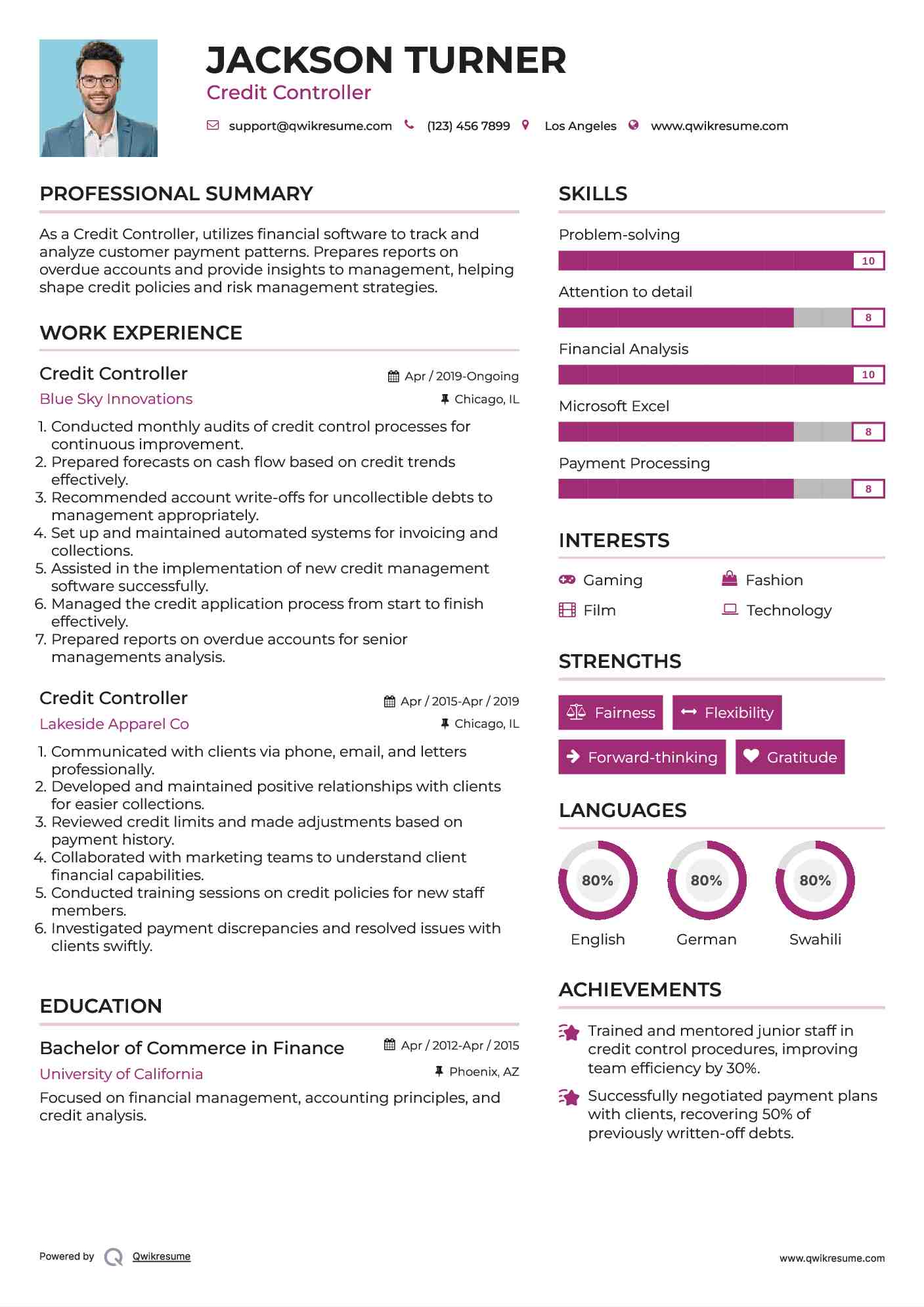

Credit Controller Resume

Summary : As a Credit Controller, utilizes financial software to track and analyze customer payment patterns. Prepares reports on overdue accounts and provide insights to management, helping shape credit policies and risk management strategies.

Skills : Problem-solving, Attention to detail, Financial Analysis, Microsoft Excel

Description :

- Conducted monthly audits of credit control processes for continuous improvement.

- Prepared forecasts on cash flow based on credit trends effectively.

- Recommended account write-offs for uncollectible debts to management appropriately.

- Set up and maintained automated systems for invoicing and collections.

- Assisted in the implementation of new credit management software successfully.

- Managed the credit application process from start to finish effectively.

- Prepared reports on overdue accounts for senior managements analysis.

Experience

7-10 Years

Level

Management

Education

BBA

Credit Controller Resume

Objective : As a Credit Controller, collaborates with sales and customer service departments to address client concerns related to credit accounts. Contributes to maintaining strong relationships while ensuring compliance with company credit policies.

Skills : Time management, Customer service, Financial Reporting, Attention to Detail

Description :

- Utilized accounting software to track payments, generate reports, and monitor account statuses, ensuring accurate records of all transactions.

- Documented all correspondence with clients regarding credit and payments accurately.

- Ensured prompt processing of credit applications and approvals efficiently.

- Assisted in the recovery of overdue debts through negotiation.

- Established credit limits based on thorough analysis and research conducted.

- Reviewed client's payment histories to assess risk levels systematically.

- Conducted regular credit assessments of clients to determine creditworthiness, utilizing financial statements and credit reports to make informed decisions.

Experience

2-5 Years

Level

Executive

Education

B.Sc. Finance

Credit Controller Resume

Objective : As a Credit Controller, assesses the creditworthiness of potential and existing customers, determining credit limits and monitoring risk levels. Develops strategies to mitigate financial exposure while supporting business growth.

Skills : Data analysis, Risk assessment, Customer Relationship Management, Invoice Processing

Description :

- Developed and implemented strategies to reduce overall debt levels successfully.

- Assisted in implementing effective credit control training for all staff.

- Monitored cash flow to ensure timely collections and payments received.

- Evaluated existing clients' credit profiles and updated them as necessary.

- Ensured compliance with industry standards and legal requirements diligently.

- Developed credit reports for specific clients to assess risks effectively.

- Conducted thorough investigations of potential fraud cases when necessary.

Experience

0-2 Years

Level

Junior

Education

B.A. Economics

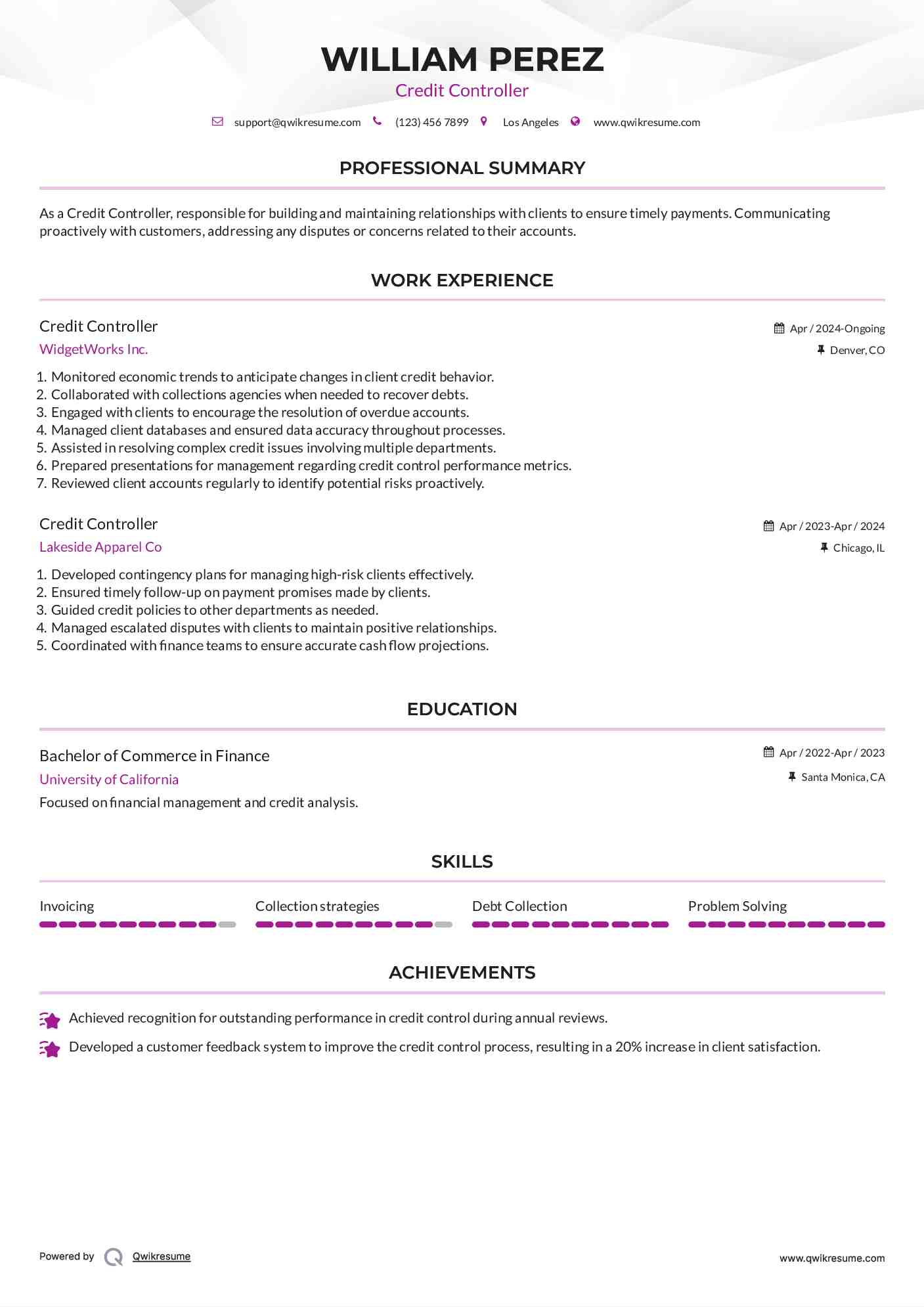

Credit Controller Resume

Objective : As a Credit Controller, responsible for building and maintaining relationships with clients to ensure timely payments. Communicating proactively with customers, addressing any disputes or concerns related to their accounts.

Skills : Invoicing, Collection strategies, Debt Collection, Problem Solving

Description :

- Monitored economic trends to anticipate changes in client credit behavior.

- Collaborated with collections agencies when needed to recover debts.

- Engaged with clients to encourage the resolution of overdue accounts.

- Managed client databases and ensured data accuracy throughout processes.

- Assisted in resolving complex credit issues involving multiple departments.

- Prepared presentations for management regarding credit control performance metrics.

- Reviewed client accounts regularly to identify potential risks proactively.

Experience

0-2 Years

Level

Fresher

Education

M.Sc. Accounting

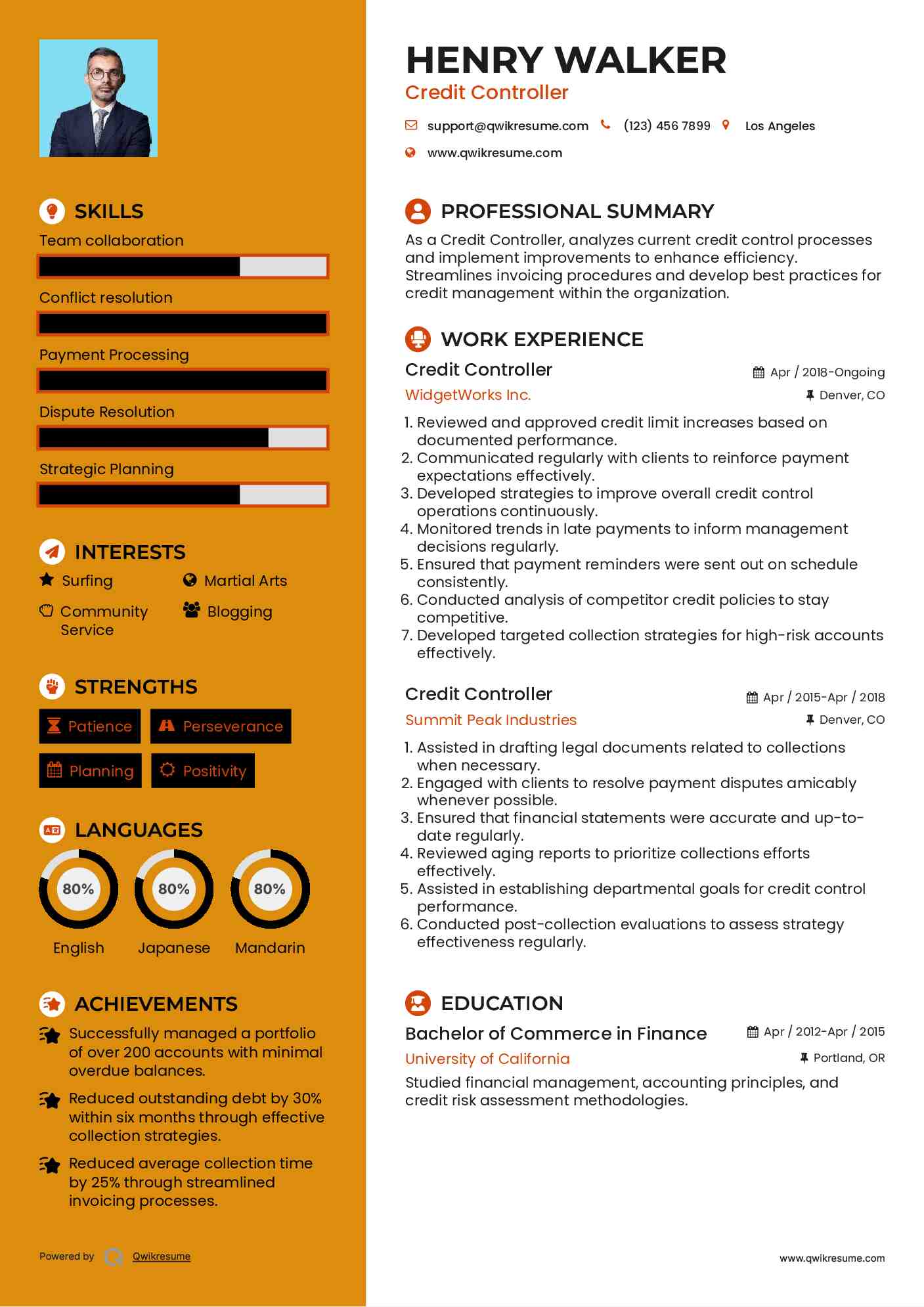

Credit Controller Resume

Summary : As a Credit Controller, analyzes current credit control processes and implement improvements to enhance efficiency. Streamlines invoicing procedures and develop best practices for credit management within the organization.

Skills : Team collaboration, Conflict resolution, Payment Processing, Dispute Resolution

Description :

- Reviewed and approved credit limit increases based on documented performance.

- Communicated regularly with clients to reinforce payment expectations effectively.

- Developed strategies to improve overall credit control operations continuously.

- Monitored trends in late payments to inform management decisions regularly.

- Ensured that payment reminders were sent out on schedule consistently.

- Conducted analysis of competitor credit policies to stay competitive.

- Developed targeted collection strategies for high-risk accounts effectively.

Experience

7-10 Years

Level

Consultant

Education

Dip. Fin. Mgmt.

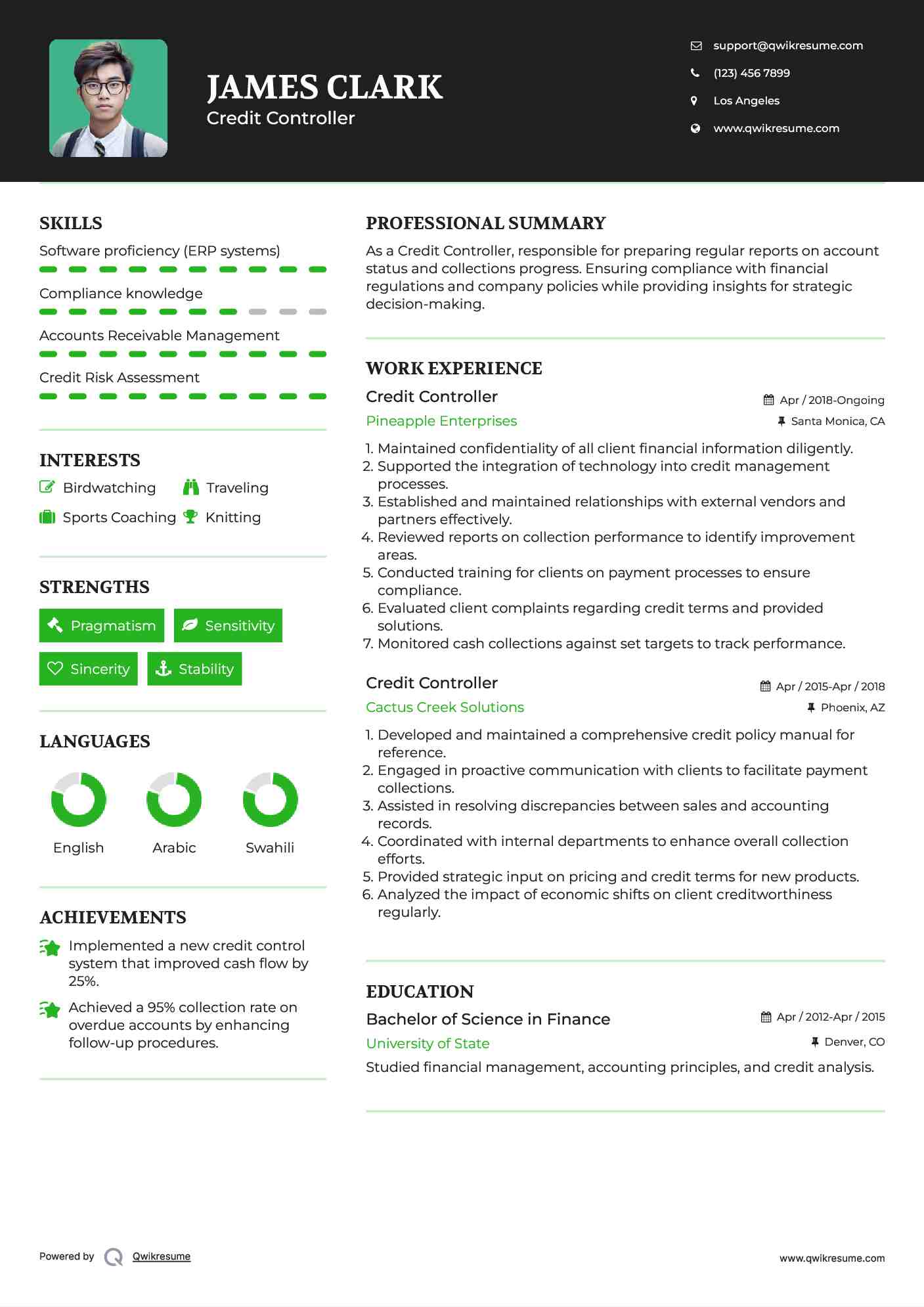

Credit Controller Resume

Summary : As a Credit Controller, responsible for preparing regular reports on account status and collections progress. Ensuring compliance with financial regulations and company policies while providing insights for strategic decision-making.

Skills : Software proficiency (ERP systems), Compliance knowledge, Accounts Receivable Management, Credit Risk Assessment

Description :

- Maintained confidentiality of all client financial information diligently.

- Supported the integration of technology into credit management processes.

- Established and maintained relationships with external vendors and partners effectively.

- Reviewed reports on collection performance to identify improvement areas.

- Conducted training for clients on payment processes to ensure compliance.

- Evaluated client complaints regarding credit terms and provided solutions.

- Monitored cash collections against set targets to track performance.

Experience

7-10 Years

Level

Management

Education

Cert. Bus. Fin.

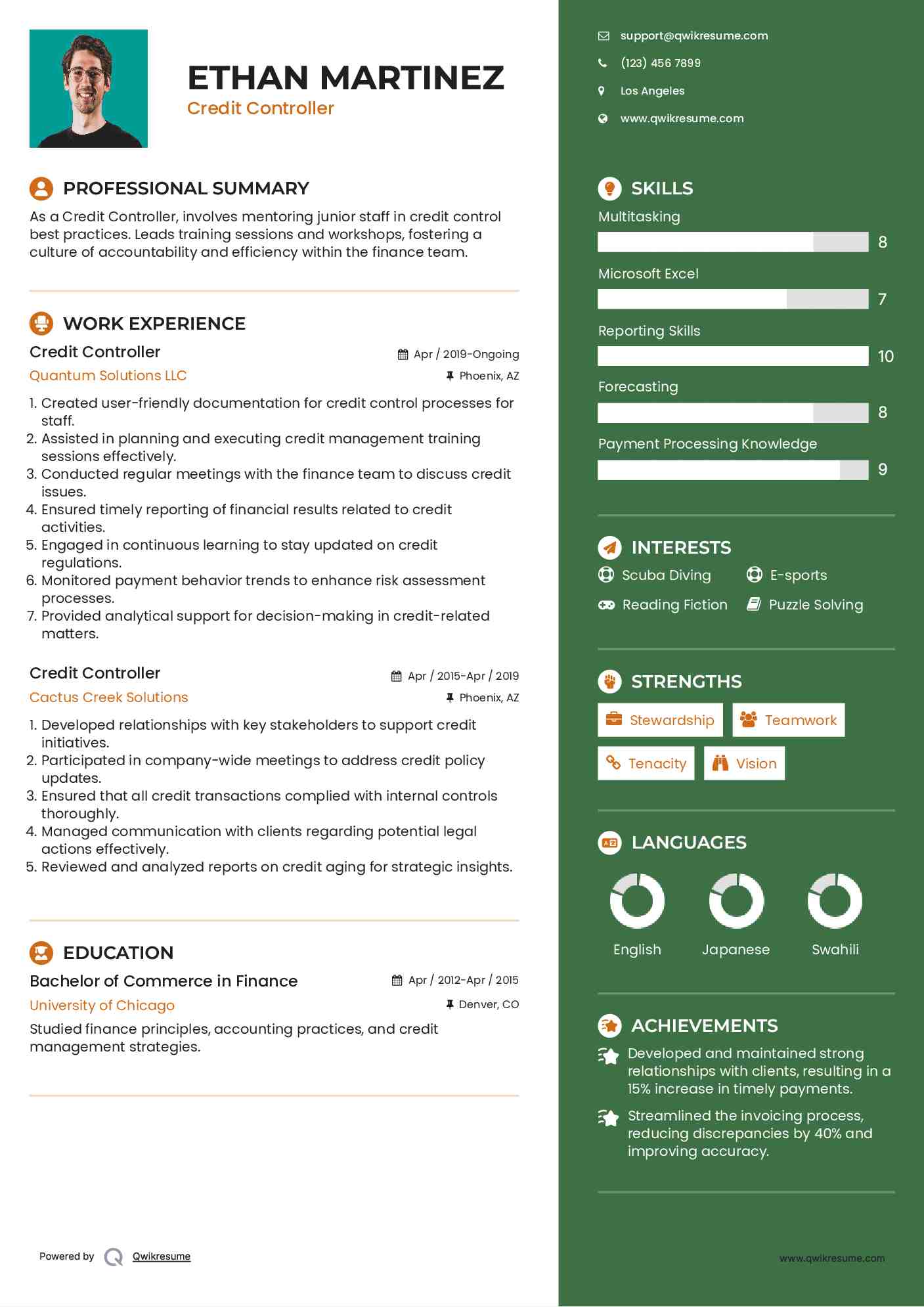

Credit Controller Resume

Summary : As a Credit Controller, involves mentoring junior staff in credit control best practices. Leads training sessions and workshops, fostering a culture of accountability and efficiency within the finance team.

Skills : Multitasking, Microsoft Excel, Reporting Skills, Forecasting

Description :

- Created user-friendly documentation for credit control processes for staff.

- Assisted in planning and executing credit management training sessions effectively.

- Conducted regular meetings with the finance team to discuss credit issues.

- Ensured timely reporting of financial results related to credit activities.

- Engaged in continuous learning to stay updated on credit regulations.

- Monitored payment behavior trends to enhance risk assessment processes.

- Provided analytical support for decision-making in credit-related matters.

Experience

7-10 Years

Level

Consultant

Education

B.Com

Credit Controller Resume

Objective : As a Credit Controller, improves credit control processes, utilizing automated systems for invoicing and collections. Works closely with IT to implement new tools that enhance data accuracy and reporting capabilities.

Skills : Financial forecasting, Organizational, Process Improvement, Cash Flow Management

Description :

- Evaluated the effectiveness of current credit control strategies regularly.

- Ensured that all correspondence adhered to company branding guidelines consistently.

- Monitored the credit approval process to ensure timely decisions made.

- Assisted in preparing year-end reports related to credit management performance.

- Engaged in negotiations with clients to settle outstanding debts amicably.

- Developed metrics for measuring success in credit control efforts effectively.

- Provided support for client onboarding to ensure smooth credit assessments.

Experience

2-5 Years

Level

Executive

Education

Cert. Credit Mgmt.