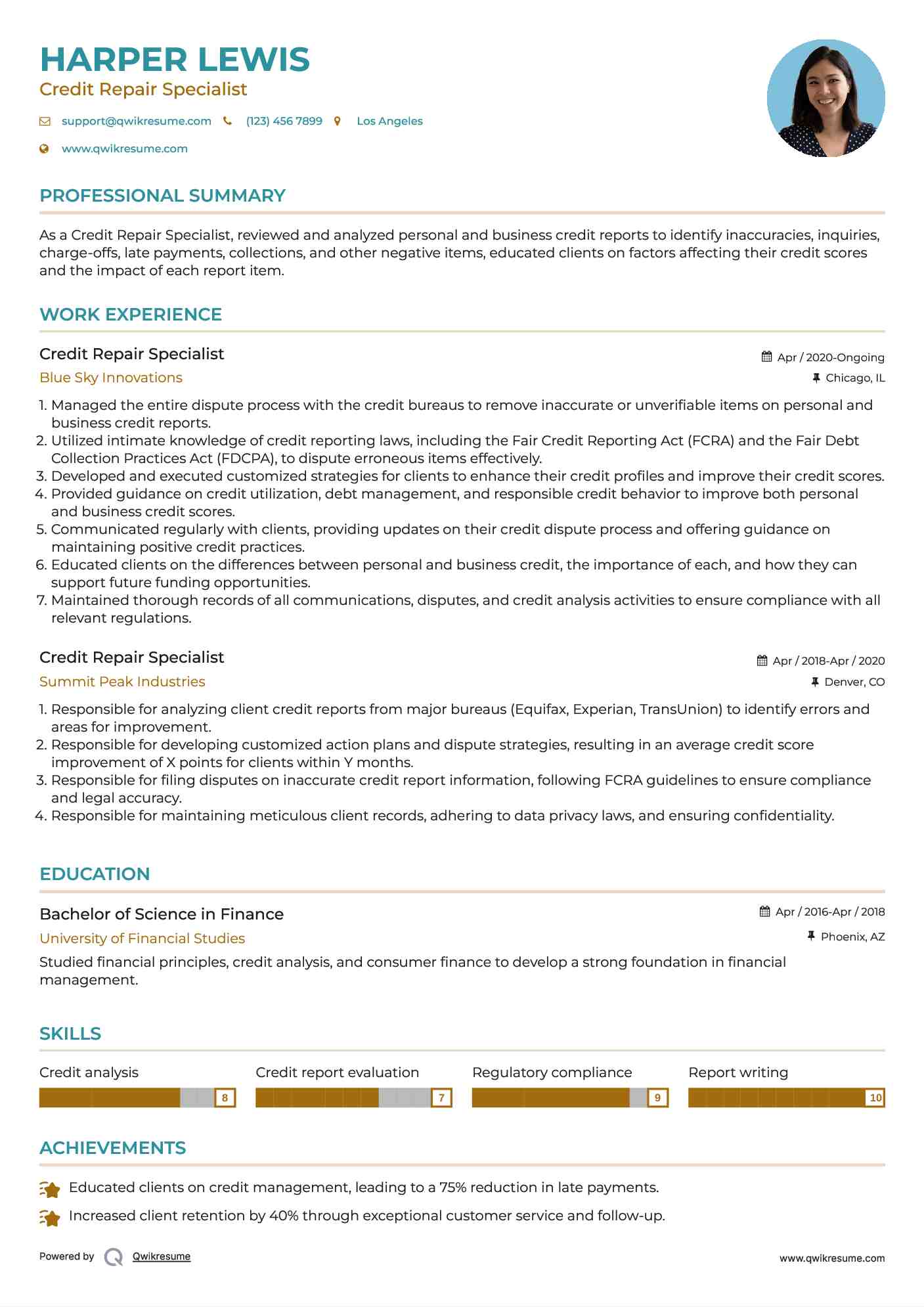

Credit Repair Specialist Resume

Headline : As a Credit Repair Specialist, reviewed and analyzed personal and business credit reports to identify inaccuracies, inquiries, charge-offs, late payments, collections, and other negative items, educated clients on factors affecting their credit scores and the impact of each report item.

Skills : Credit analysis, Credit report evaluation, Regulatory compliance, Report writing, Adaptability

Description :

- Managed the entire dispute process with the credit bureaus to remove inaccurate or unverifiable items on personal and business credit reports.

- Utilized intimate knowledge of credit reporting laws, including the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA), to dispute erroneous items effectively.

- Developed and executed customized strategies for clients to enhance their credit profiles and improve their credit scores.

- Provided guidance on credit utilization, debt management, and responsible credit behavior to improve both personal and business credit scores.

- Communicated regularly with clients, providing updates on their credit dispute process and offering guidance on maintaining positive credit practices.

- Educated clients on the differences between personal and business credit, the importance of each, and how they can support future funding opportunities.

- Maintained thorough records of all communications, disputes, and credit analysis activities to ensure compliance with all relevant regulations.

Experience

5-7 Years

Level

Senior

Education

AAS in Spa Management

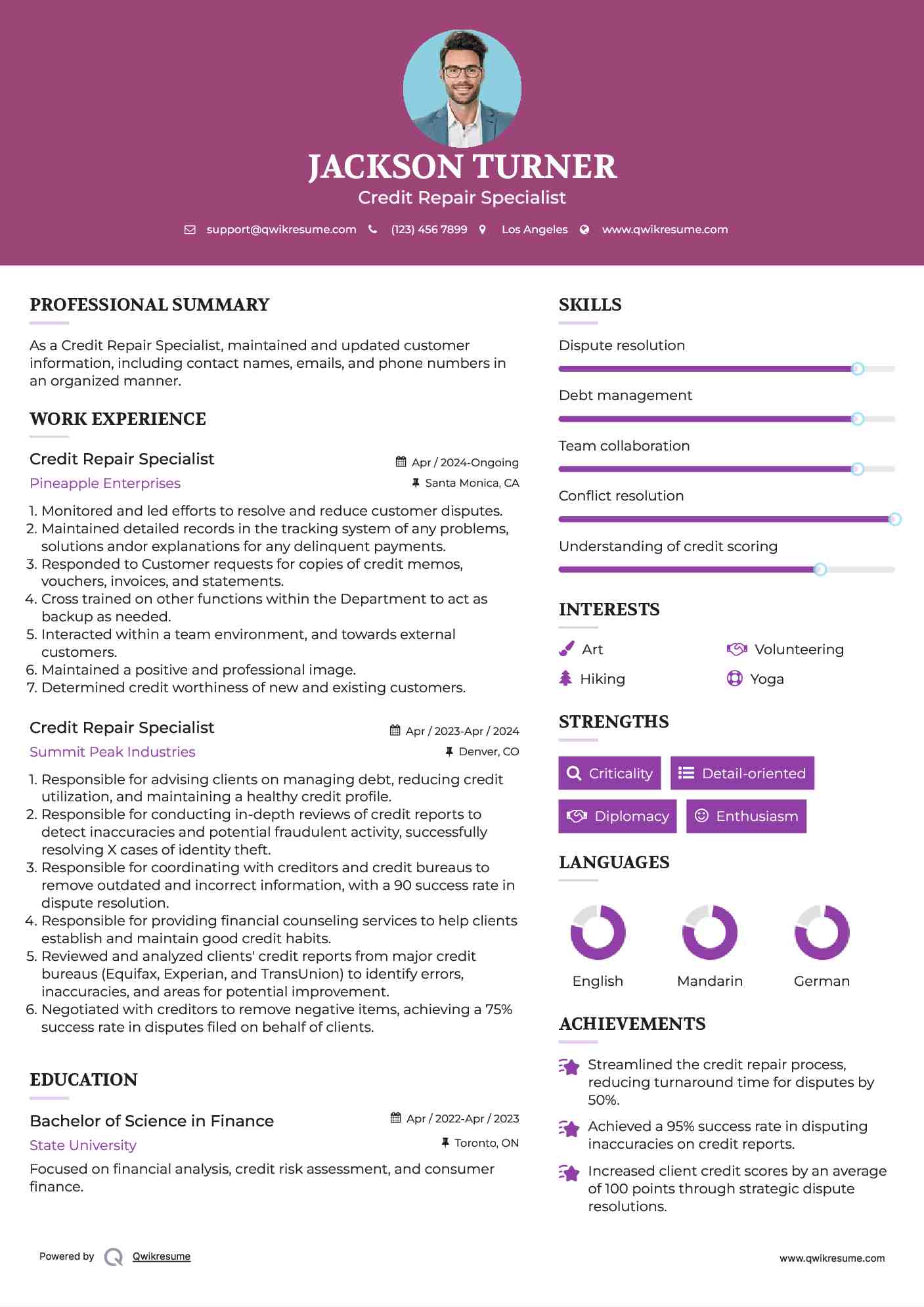

Credit Repair Specialist Resume

Objective : As a Credit Repair Specialist, maintained and updated customer information, including contact names, emails, and phone numbers in an organized manner.

Skills : Dispute resolution, Debt management, Team collaboration, Conflict resolution, Understanding of credit scoring

Description :

- Monitored and led efforts to resolve and reduce customer disputes.

- Maintained detailed records in the tracking system of any problems, solutions andor explanations for any delinquent payments.

- Responded to Customer requests for copies of credit memos, vouchers, invoices, and statements.

- Cross trained on other functions within the Department to act as backup as needed.

- Interacted within a team environment, and towards external customers.

- Maintained a positive and professional image.

- Determined credit worthiness of new and existing customers.

Experience

0-2 Years

Level

Junior

Education

BBA in Finance

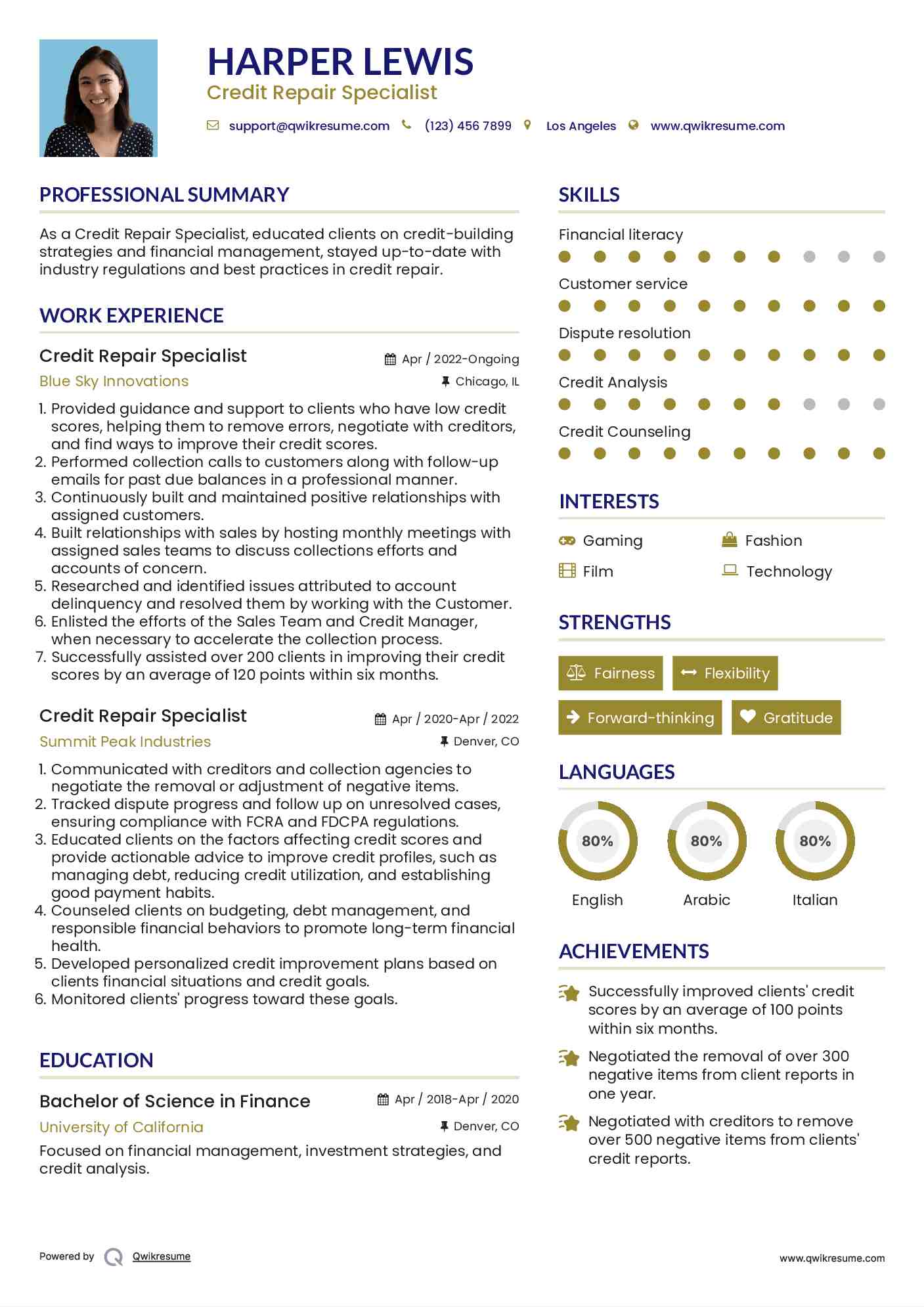

Credit Repair Specialist Resume

Objective : As a Credit Repair Specialist, educated clients on credit-building strategies and financial management, stayed up-to-date with industry regulations and best practices in credit repair.

Skills : Financial literacy, Credit analysis, Customer service, Dispute resolution

Description :

- Provided guidance and support to clients who have low credit scores, helping them to remove errors, negotiate with creditors, and find ways to improve their credit scores.

- Performed collection calls to customers along with follow-up emails for past due balances in a professional manner.

- Continuously built and maintained positive relationships with assigned customers.

- Built relationships with sales by hosting monthly meetings with assigned sales teams to discuss collections efforts and accounts of concern.

- Researched and identified issues attributed to account delinquency and resolved them by working with the Customer.

- Enlisted the efforts of the Sales Team and Credit Manager, when necessary to accelerate the collection process.

- Successfully assisted over 200 clients in improving their credit scores by an average of 120 points within six months.

Experience

2-5 Years

Level

Junior

Education

BA in Marketing

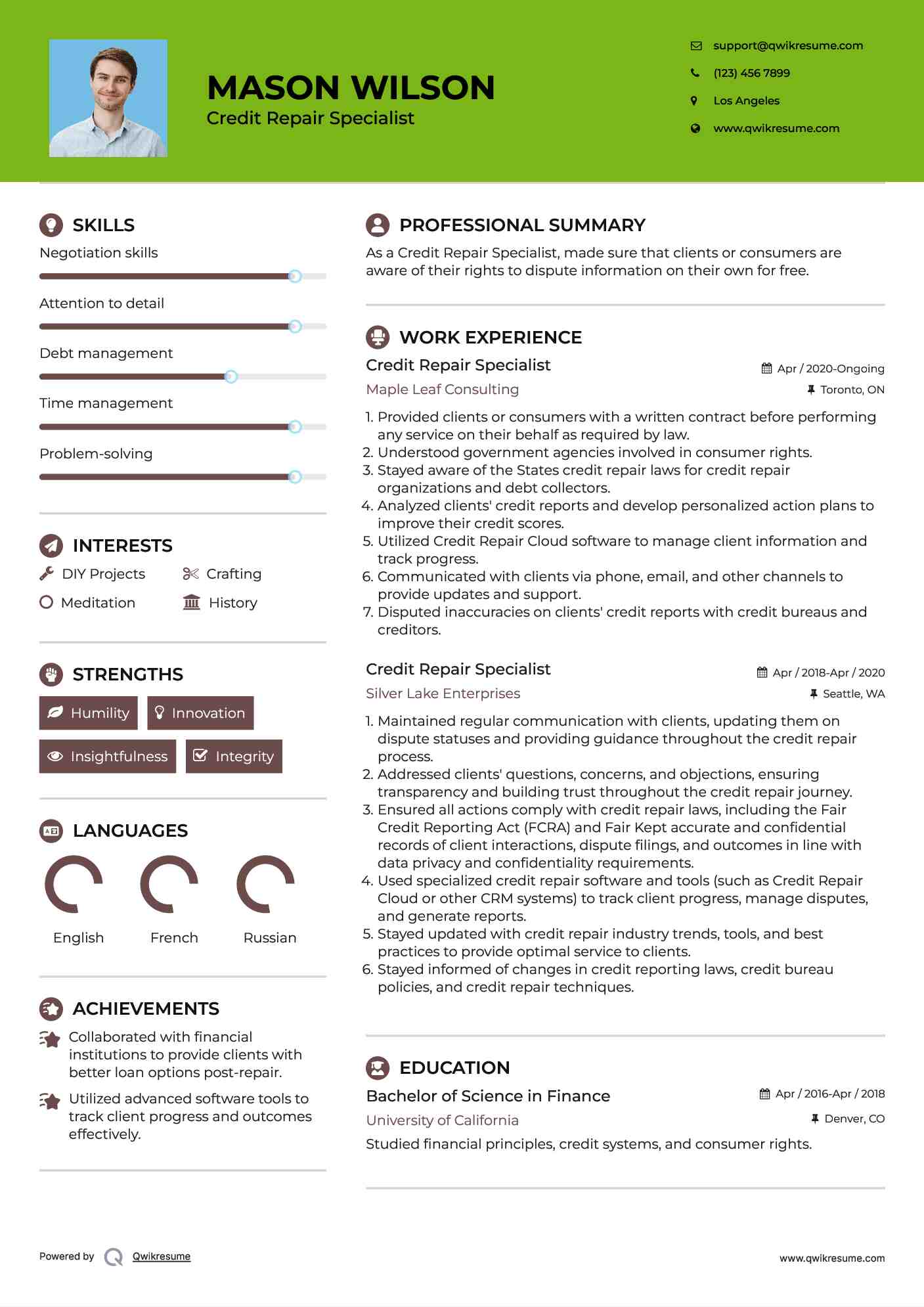

Credit Repair Specialist Resume

Headline : As a Credit Repair Specialist, made sure that clients or consumers are aware of their rights to dispute information on their own for free.

Skills : Negotiation skills, Attention to detail, Debt management, Time management, Problem-solving

Description :

- Provided clients or consumers with a written contract before performing any service on their behalf as required by law.

- Understood government agencies involved in consumer rights.

- Stayed aware of the States credit repair laws for credit repair organizations and debt collectors.

- Analyzed clients' credit reports and develop personalized action plans to improve their credit scores.

- Utilized Credit Repair Cloud software to manage client information and track progress.

- Communicated with clients via phone, email, and other channels to provide updates and support.

- Disputed inaccuracies on clients' credit reports with credit bureaus and creditors.

Experience

5-7 Years

Level

Executive

Education

MBA in Finance

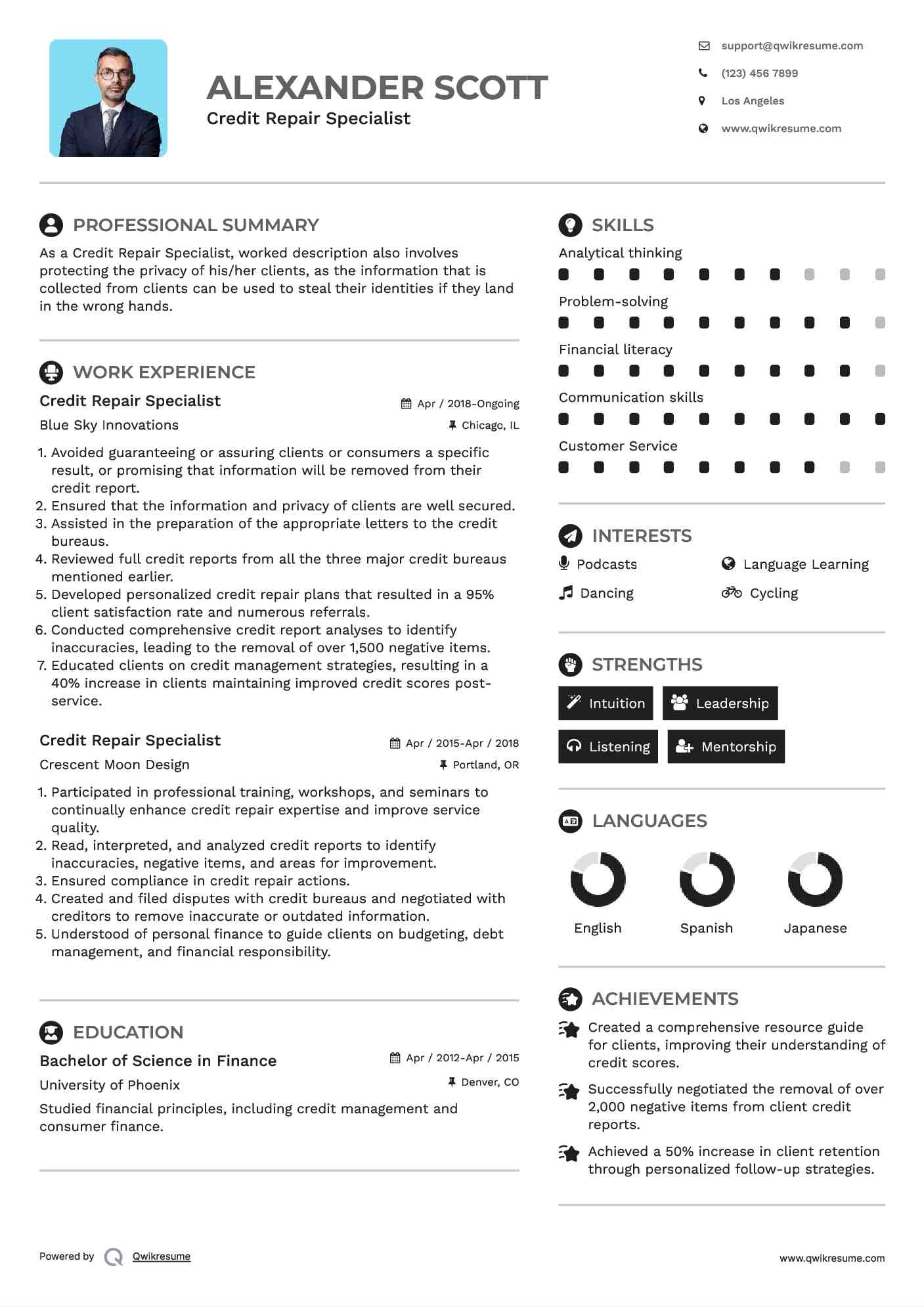

Credit Repair Specialist Resume

Summary : As a Credit Repair Specialist, worked description also involves protecting the privacy of his/her clients, as the information that is collected from clients can be used to steal their identities if they land in the wrong hands.

Skills : Analytical thinking, Problem-solving, Financial literacy, Communication skills

Description :

- Avoided guaranteeing or assuring clients or consumers a specific result, or promising that information will be removed from their credit report.

- Ensured that the information and privacy of clients are well secured.

- Assisted in the preparation of the appropriate letters to the credit bureaus.

- Reviewed full credit reports from all the three major credit bureaus mentioned earlier.

- Developed personalized credit repair plans that resulted in a 95% client satisfaction rate and numerous referrals.

- Conducted comprehensive credit report analyses to identify inaccuracies, leading to the removal of over 1,500 negative items.

- Educated clients on credit management strategies, resulting in a 40% increase in clients maintaining improved credit scores post-service.

Experience

7-10 Years

Level

Management

Education

BSc in Accounting

Credit Repair Specialist Resume

Summary : As a Credit Repair Specialist, gathered financial information, verifies truthfulness, and exercises judgment on customers credit worthiness based on said information.

Skills : Knowledge of credit laws, Communication skills, Social media marketing, Data entry, Sales skills, Conflict resolution

Description :

- Reviewed the credit reports of consumers, customers, or clients from all three credit bureaus.

- Gathered and maintained customer credit information, they then resell it to other businesses in the form of a consumers credit report.

- Conflicted letters that may be ignored by the credit bureaus. Heshe then mails the letter on behalf of the customer, client, or consumer.

- Provided or recommended various options for how to handle negative items on consumers credit reports, and also helped to decide the best way to proceed based on their circumstance and their long-term credit and financial goals.

- Disputed, played off, negotiated removal, and settled or waited out the credit reporting time limit.

- Made sure that clients or consumers are aware of their rights to dispute information on their own for free.

- Performed various functions in helping their clients resolve their credit issues.

Experience

10+ Years

Level

Senior

Education

Cert in Credit Counseling

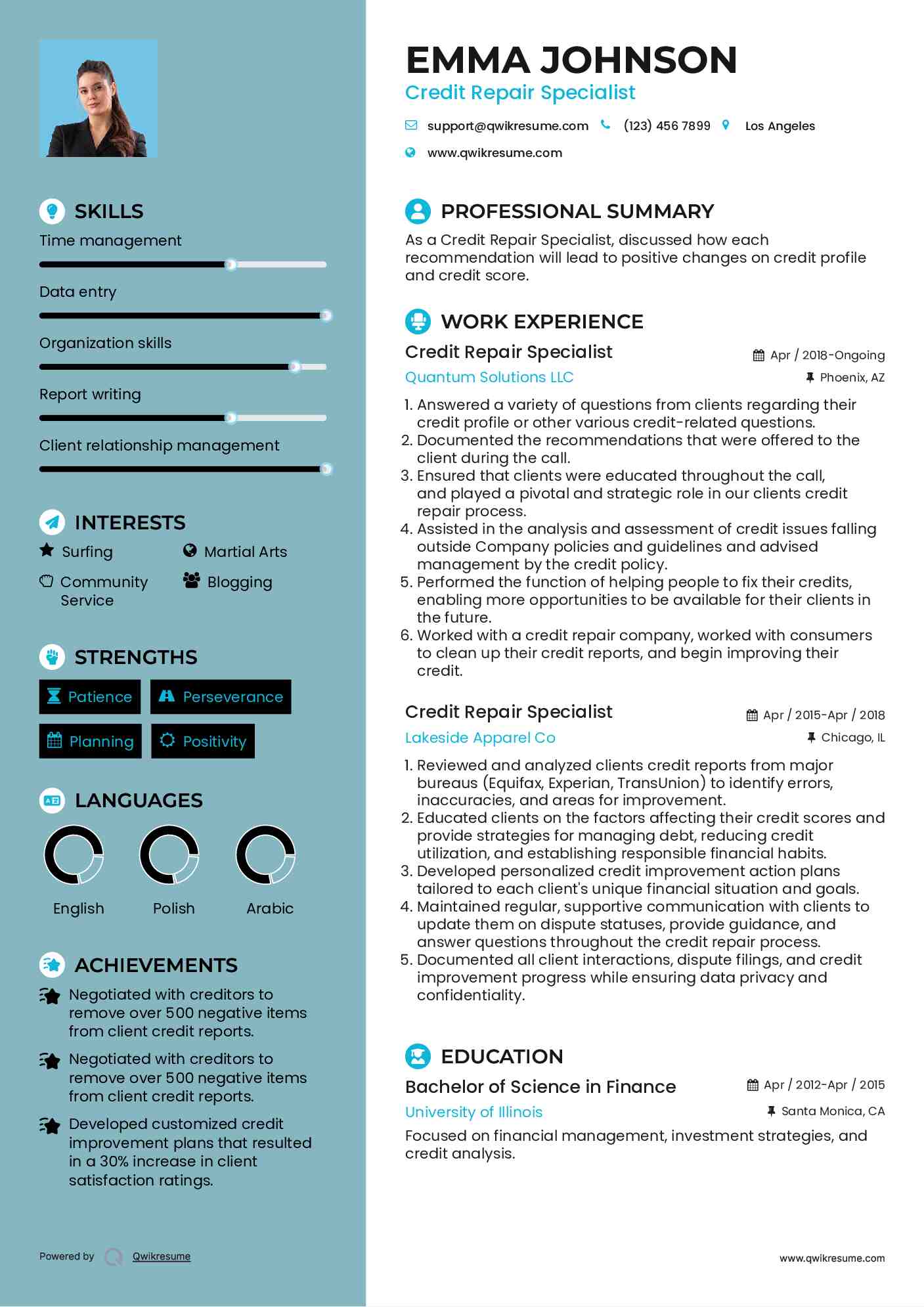

Credit Repair Specialist Resume

Summary : As a Credit Repair Specialist, discussed how each recommendation will lead to positive changes on credit profile and credit score.

Skills : Time management, Data entry, Organization skills, Report writing, Client relationship management, Research skills

Description :

- Answered a variety of questions from clients regarding their credit profile or other various credit-related questions.

- Documented the recommendations that were offered to the client during the call.

- Ensured that clients were educated throughout the call, and played a pivotal and strategic role in our clients credit repair process.

- Analyzed all three credit bureaus (Experian, Equifax, and TransUnion), providing recommendations on impacting credit factors, and discussing tactics on how the client can remedy their credit situation.

- Assisted in the analysis and assessment of credit issues falling outside Company policies and guidelines and advised management by the credit policy.

- Performed the function of helping people to fix their credits, enabling more opportunities to be available for their clients in the future.

- Worked with a credit repair company, worked with consumers to clean up their credit reports, and begin improving their credit.

Experience

10+ Years

Level

Senior

Education

BSc in Economics

Credit Repair Specialist Resume

Objective : As a Credit Repair Specialist, collaborated with the finance team to ensure proper revenue cycle management practices, engaged in telemarketing efforts to communicate with clients regarding their accounts and payment options.

Skills : Research skills, Organization skills, Empathy, Marketing skills

Description :

- Applied knowledge of medical terminology when dealing with healthcare-related accounts.

- Executed account reconciliation processes to ensure accuracy in financial reporting.

- Analyzed Experian, Equifax, and Transunion to create custom credit plans for clients.

- Identified negative factors that need to be addressed which will lead to improvement of credit profile.

- Recommended accounts that will be advantageous for positive credit reporting and an increase in score.

- Identified the key contributors to the clients current score.

- Collaborated with financial institutions to negotiate settlements on behalf of clients, saving them an average of $5,000 each.

Experience

0-2 Years

Level

Junior

Education

Diploma in Fin Lit

Credit Repair Specialist Resume

Objective : As a Credit Repair Specialist, kept up-to-date with credit industry trends, policy changes, and regulatory requirements to enhance the effectiveness of our credit optimization strategies, sought a detail-oriented and analytical Credit Specialist to join our team.

Skills : Sales skills, Marketing strategies, Report writing, Financial planning, Team collaboration, Understanding of credit scoring

Description :

- Managed credit accounts, performing credit analysis, and ensuring timely collections.

- Understood financial concepts and excellent communication skills to effectively interact with clients and internal teams.

- Plaid a crucial role in maintaining the financial health of the organization by managing accounts receivable and supporting revenue cycle management.

- Conducted thorough account analysis to assess the creditworthiness and risk levels of clients.

- Performed credit analysis to determine appropriate credit limits and terms for customers.

- Managed medical collections by following up on outstanding invoices and resolving payment issues.

- Utilized accounting software to maintain accurate records of transactions and account statuses.

Experience

2-5 Years

Level

Junior

Education

BA in Consumer Psych

Credit Repair Specialist Resume

Summary : As a Credit Repair Specialist, reviewed full credit reports from all the three major credit bureaus mentioned earlier.

Skills : Client relationship management, Financial planning, Team collaboration, Technical proficiency, Regulatory compliance, Negotiation skills

Description :

- Assessed clients' credit reports and identify errors, discrepancies, or negative items.

- Analyzed creditworthiness based on credit scores, payment history, and debt-to-income ratio.

- Assisted clients in disputing errors with credit bureaus or creditors.

- Provided strategies for improving credit scores, such as paying down debts or establishing credit lines.

- Educated clients on credit management, budgeting, and financial planning.

- Implemented a tracking system for client progress, enhancing follow-up efficiency and increasing client retention by 30%.

- Provided expert guidance on debt management, helping clients reduce their overall debt by an average of 25% within a year.

Experience

7-10 Years

Level

Management

Education

MSc in Finance