Credit Risk Analyst Resume

Objective : Dedicated Credit Risk Analyst with 2 years of experience in evaluating creditworthiness and managing risk portfolios. Skilled in financial modeling, risk assessment, and covenant compliance, with a strong ability to analyze complex financial data. Eager to leverage analytical expertise to enhance risk management strategies in a dynamic financial environment.

Skills : Credit Portfolio Management, Portfolio Management, Credit Scoring, Financial Modeling

Description :

- Applied financial principles to assess creditworthiness and manage risk portfolios effectively.

- Utilized advanced software tools to monitor compliance with loan covenants and financial agreements.

- Supported credit risk managers by analyzing personal and business financial statements.

- Developed cash flow projections and performed stress testing to evaluate borrower risk.

- Assessed guarantor support and market conditions to inform lending decisions.

- Performed collateral analysis and prepared detailed reports for credit authorities.

- Collaborated with stakeholders to identify and mitigate potential risks in credit proposals.

Experience

0-2 Years

Level

Entry Level

Education

BSF

Junior Credit Risk Analyst Resume

Objective : Enthusiastic Junior Credit Risk Analyst with 5 years of comprehensive experience in credit evaluation and risk assessment. Proficient in financial analysis, data interpretation, and credit portfolio management. Committed to enhancing risk strategies through meticulous analysis and collaborative teamwork in fast-paced financial settings.

Skills : Credit Policy Development, Stress Testing, Predictive Analytics, Loan Underwriting, Financial Forecasting

Description :

- Coordinated with the special situations group, delivering monthly credit reports to teams in the U.S., U.K., and Asia.

- Conducted thorough credit reviews, collaborating with cross-functional teams for accurate data collection.

- Assessed creditworthiness of companies across various sectors, including technology and healthcare.

- Analyzed financial data to evaluate companies' debt repayment capabilities and overall stability.

- Utilized historical trends to enhance understanding of debt repayment likelihood.

- Presented risk models to federal regulators, ensuring compliance and transparency.

- Managed monthly audits with senior management to ensure adherence to credit policies.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Credit Risk Analyst Resume

Headline : Accomplished Credit Risk Analyst with 7 years of experience in evaluating credit portfolios and implementing risk management strategies. Proficient in predictive modeling, financial analysis, and risk assessment, with a proven record of enhancing creditworthiness evaluations. Passionate about utilizing data-driven insights to optimize lending practices and drive organizational success.

Skills : R Programming, Matlab For Financial Analysis, Sas For Risk Analysis, Sas And Spss Analytics, Tableau For Data Visualization, Jump Statistical Software

Description :

- Developed and executed comprehensive credit stress tests to assess portfolio risk on a regular basis.

- Analyzed management requests to evaluate credit risk, producing detailed reports to support lending decisions.

- Created advanced credit models to optimize profitability and minimize credit losses.

- Identified emerging credit risk trends through scenario analysis of assigned portfolios.

- Maintained and enhanced credit risk models, ensuring their efficacy and compliance.

- Conducted market analysis to align credit strategies with business objectives.

- Performed advanced analytics using SQL, Tableau, SAS, R, and Excel to support data-driven decision-making.

Experience

5-7 Years

Level

Senior

Education

MSF

Senior Credit Risk Analyst Resume

Summary : Seasoned Credit Risk Analyst with 10 years of extensive experience in evaluating credit portfolios and mitigating financial risks. Adept in predictive analytics, financial modeling, and compliance assessment. Committed to driving sustainable growth through data-driven insights and strategic risk management in dynamic financial environments.

Skills : Regulatory Compliance, Risk Mitigation, Financial Reporting, Quantitative Analysis, Statistical Analysis, Market Research

Description :

- Conducted in-depth credit risk analysis focusing on key metrics such as probability of default and risk-weighted assets.

- Partnered with cross-functional teams to facilitate the underwriting of a $110 million loan, optimizing risk parameters.

- Performed comprehensive risk assessments for commercial loans averaging $2 million, ensuring robust creditworthiness evaluations.

- Reviewed and analyzed loan applications, underwriting decisions based on financial performance and market conditions.

- Monitored and ensured compliance with loan agreements, proactively addressing any discrepancies with stakeholders.

- Prepared detailed presentations for credit committee approvals, collaborating with senior management to safeguard capital.

- Analyzed individual loans to identify risk factors, implementing strategies to mitigate servicing issues and prevent losses.

Experience

7-10 Years

Level

Management

Education

MSE

Credit Risk Analyst Resume

Summary : Analytical Credit Risk Analyst with 10 years of expertise in evaluating credit portfolios and mitigating risks. Proficient in financial modeling, risk assessment, and compliance analysis, with a strong track record of improving risk management strategies. Passionate about leveraging data analytics to drive informed decision-making and support organizational growth.

Skills : Credit Risk Policies, Risk Reporting, Risk Assessment Training, Financial Presentations, Advanced Excel For Financial Modeling, Analytical Thinking

Description :

- Developed a comprehensive dashboard for risk assessment, leading to a 30% increase in efficiency across departments.

- Executed loss forecasting models that reduced unexpected losses by 15% year-over-year.

- Standardized reporting processes across teams, improving accuracy in risk evaluations by 25%.

- Collaborated with cross-functional teams to enhance credit portfolio management strategies.

- Utilized predictive analytics to assess and optimize lending practices, increasing profitability.

- Led training sessions on risk assessment methodologies to enhance team capability.

- Analyzed complex financial data to inform strategic decisions and mitigate risks.

Experience

10+ Years

Level

Executive

Education

MBA

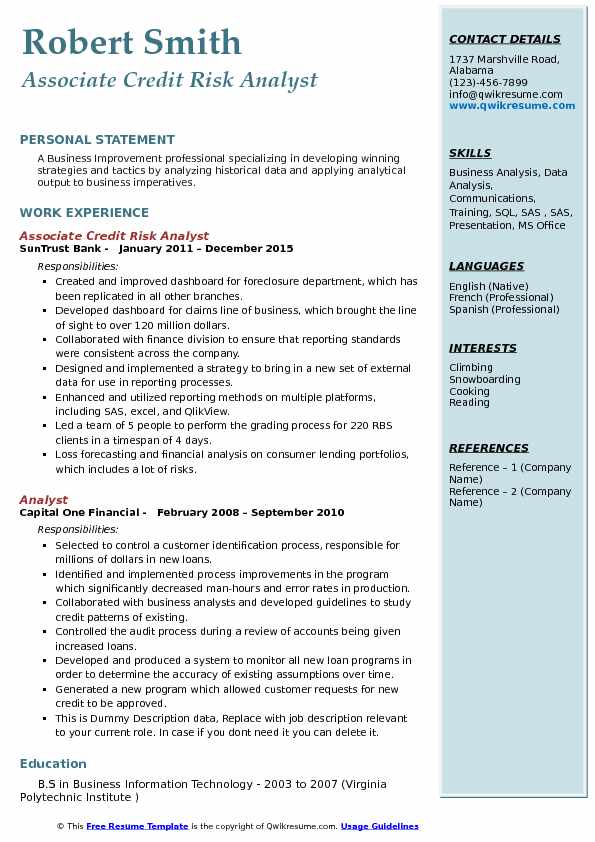

Associate Credit Risk Analyst Resume

Objective : Results-oriented Associate Credit Risk Analyst with 2 years of experience in credit evaluation and risk assessment. Proficient in analyzing financial data to assess creditworthiness and manage risk portfolios. Dedicated to implementing effective risk management strategies to support organizational objectives in a competitive financial landscape.

Skills : Financial Analysis Software, Risk Management Systems, Credit Risk Assessment, Regulatory Knowledge

Description :

- Managed the credit risk portfolio for B2B accounts, ensuring compliance with company policies.

- Conducted thorough credit analysis using business and consumer credit reports to evaluate risk.

- Established account types based on credit analysis, optimizing customer credit limits.

- Analyzed credit reports to identify and mitigate high usage risks effectively.

- Set credit limits in alignment with Automotive LLC guidelines, enhancing financial safety.

- Executed collection responsibilities for accounts exceeding credit limits, ensuring compliance.

- Collaborated with stakeholders to develop risk management strategies that protected company assets.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

Credit Risk Analyst Resume

Headline : Dynamic Credit Risk Analyst with 7 years of extensive experience in evaluating credit portfolios and developing robust risk management frameworks. Expert in financial modeling, risk assessment, and compliance analysis, with a strong focus on leveraging data analytics to enhance credit evaluation processes. Committed to driving strategic decision-making and optimizing lending outcomes in competitive financial environments.

Skills : Cash Flow Analysis, Loan-to-value Ratio Analysis, Debt-to-income Ratio Assessment, Debt Analysis, Data Visualization, Problem Solving

Description :

- Evaluate credit exposures across merchant portfolios, managing risks totaling up to $2 million annually.

- Conduct comprehensive financial analyses on merchant accounts with risk exposure up to $300,000.

- Utilize scenario-based risk models to monitor and assess trends in merchant account performance.

- Analyze financial statements to assess operational strength, providing recommendations for credit approvals or declines.

- Establish appropriate credit control limits to mitigate ongoing risk exposures for merchants.

- Underwrite merchant accounts and adjust collateral requirements to safeguard against potential risks.

- Investigate processing trends and bank statements to identify and mitigate fraud risks effectively.

Experience

5-7 Years

Level

Senior

Education

B.S. Finance

Senior Credit Risk Analyst Resume

Summary : Strategic Senior Credit Risk Analyst with a decade of experience in assessing credit portfolios and managing financial risk. Expertise in advanced financial modeling, risk assessment methodologies, and compliance analytics. Committed to leveraging data-driven insights to enhance credit strategies and support organizational growth in competitive markets.

Skills : Regulatory Reporting, Predictive Financial Modeling, Risk Mitigation Strategies, Team Collaboration, Decision Making, Time Management

Description :

- Oversee annual reviews of domestic and international accounts, conducting thorough financial assessments to evaluate risk and determine credit limits.

- Negotiate contracts with credit agencies and trade insurance companies to optimize risk coverage and minimize exposure.

- Enhance sales potential by securing favorable terms and mitigating risks associated with high-risk accounts.

- Monitor financial performance of high-risk accounts, delivering quarterly reviews to senior management.

- Provide detailed contribution margin analyses to inform strategic decision-making for major accounts and regional managers.

- Calculate and report on financial ratios for bank covenant compliance, ensuring adherence to financial agreements.

- Collaborate with collections teams to resolve credit issues, adjusting credit lines and releasing orders as necessary.

Experience

7-10 Years

Level

Management

Education

M.S. Finance

Credit Risk Analyst Resume

Objective : Analytical Credit Risk Analyst with 2 years of specialized experience in assessing creditworthiness and managing risk portfolios. Adept at utilizing statistical tools to analyze financial data and develop risk mitigation strategies. Committed to enhancing credit evaluation processes and improving risk management frameworks within fast-paced financial environments.

Skills : Advanced Vba Programming, Data Visualization In Powerpoint, Bloomberg Terminal Analysis, Statistical Analysis With Matlab, Spss Data Analysis, Excel Proficiency

Description :

- Monitored credit portfolio positions and executed daily risk management tasks.

- Analyzed extensive financial datasets using SAS and Excel to formulate acquisition risk strategies for installment loans.

- Managed ongoing credit risks by evaluating clients' operational performance and financial statements to determine creditworthiness and leverage capabilities.

- Utilized SAS for validating and enhancing credit rating scorecard models across two types of installment loans.

- Established a risk reporting framework and generated regular reports to monitor key risk metrics in the loan portfolio.

- Conducted risk assessments, research, and liquidity analyses of customer financial performance.

- Provided analytical support across the credit risk lifecycle, including origination, portfolio management, and recovery strategies.

Experience

0-2 Years

Level

Fresher

Education

BSc Finance

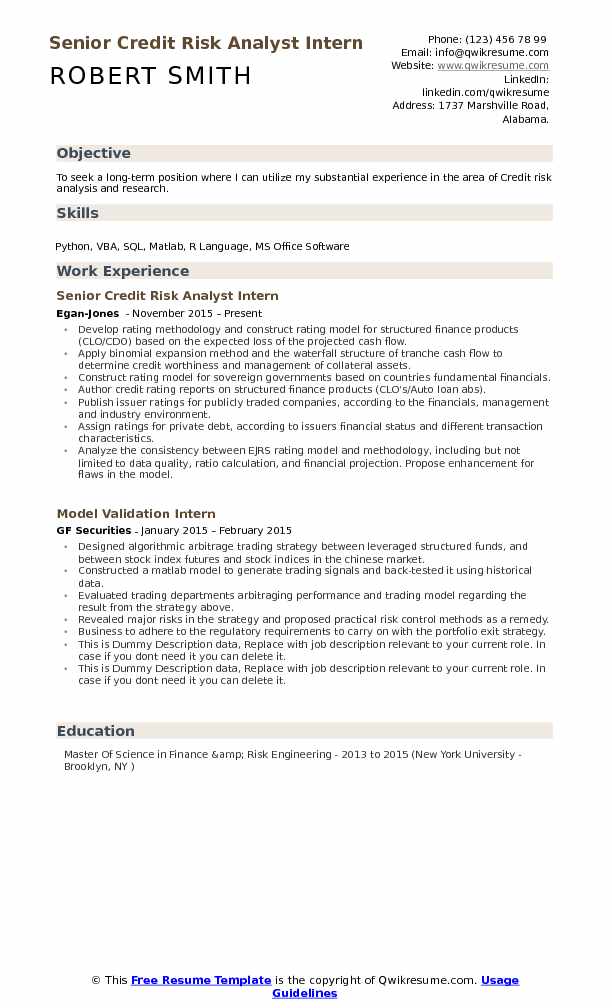

Lead Credit Risk Analyst Resume

Headline : Strategic Lead Credit Risk Analyst with 7 years of experience in assessing credit portfolios and developing risk management frameworks across diverse markets. Expert in predictive modeling, risk assessment, and regulatory compliance. Proven ability to leverage data analytics to enhance credit evaluation processes and drive informed lending decisions, fostering organizational growth.

Skills : Advanced Financial Modeling, Risk Assessment Techniques, Presentation Skills, Negotiation Skills

Description :

- Independently managed high-risk counterparty issues, collaborating with senior management to mitigate risks.

- Monitored and analyzed risk exposure in trading portfolios, ensuring compliance with internal standards.

- Identified and remediated unacceptable risk levels in collaboration with banking teams.

- Assigned internal credit ratings for counterparties, adhering to established methodologies.

- Conducted industry analyses to support credit evaluations of counterparties.

- Analyzed credit data and financial statements to assess risk and creditworthiness.

- Reviewed credit counterparties regularly to ensure ongoing risk assessment and management.

Experience

5-7 Years

Level

Senior

Education

MBA

Credit Risk Analyst Resume

Objective : Results-focused Credit Risk Analyst with 2 years of experience in credit evaluation and risk portfolio management. Proficient in financial modeling and risk assessment, with a proven ability to analyze complex datasets. Seeking to apply analytical skills to strengthen risk management frameworks and drive informed decision-making in a challenging financial landscape.

Skills : Data Analysis With Python, Financial Modeling With Vba, Quantitative Analysis With Matlab, Statistical Analysis With R, Advanced Excel And Reporting

Description :

- Developed a robust rating methodology and constructed models for structured finance products based on projected cash flows.

- Applied advanced financial techniques to assess creditworthiness and manage collateral assets effectively.

- Generated credit rating reports for structured finance products, enhancing transparency for stakeholders.

- Published issuer ratings for publicly traded companies, focusing on financial health and market conditions.

- Assigned ratings for private debt, considering issuer financials and transaction characteristics.

- Conducted thorough analysis of existing rating models to ensure data integrity and compliance.

- Proposed enhancements to rating methodologies to address identified weaknesses in risk assessment processes.

Experience

0-2 Years

Level

Fresher

Education

B.S. Finance

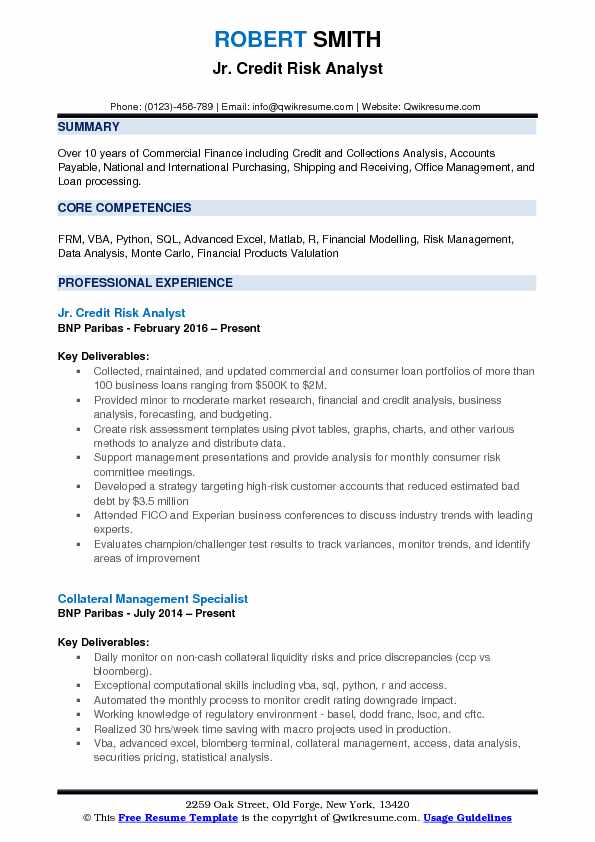

Junior Credit Risk Analyst Resume

Objective : Motivated Junior Credit Risk Analyst with 5 years of extensive experience in credit evaluation and risk management. Adept at conducting in-depth financial analyses and developing risk mitigation strategies. Keen to utilize analytical skills to enhance credit assessment processes and support informed decision-making within a dynamic financial environment.

Skills : Financial Risk Management, Visual Basic For Applications, Matlab Programming, Sql Skills, Monte Carlo Simulations, Attention To Detail

Description :

- Managed and updated a diverse portfolio of over 100 commercial and consumer loans, ensuring compliance with risk standards.

- Conducted thorough market research and financial analysis to support credit evaluations and risk assessments.

- Created risk assessment templates utilizing pivot tables and data visualization tools for effective data analysis.

- Provided analytical support for management presentations and consumer risk committee meetings.

- Developed strategies for high-risk accounts, resulting in a reduction of estimated bad debt by $3.5 million.

- Participated in industry conferences to stay updated on credit risk trends and best practices.

- Evaluated test results to identify trends, monitor performance, and suggest areas for improvement.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Credit Risk Analyst Resume

Objective : Accomplished Credit Risk Analyst with 5 years of experience in assessing creditworthiness and managing risk portfolios. Expertise in financial modeling, risk assessment, and data analysis to optimize credit strategies. Driven to enhance organizational performance through rigorous risk management and data-driven insights.

Skills : Risk Assessment Tools, Scenario Analysis, Credit Risk Framework, Business Acumen, Customer Relationship Management, Industry Knowledge

Description :

- Analyze and determine if obligors or facilities are classified as defaulted accounts under specific criteria (e.g., classification codes, performance codes).

- Confirm and modify data related to defaulted obligors and facilities within Citirisk.

- Evaluate obligors and facilities against Basel II regulations to establish default status.

- Communicate completion status and key findings to risk senior management, ensuring transparency and alignment.

- Generate detailed reports on credit risk assessments, contributing to strategic risk management initiatives.

- Collaborate with teams to enhance data integrity and support robust risk evaluation processes.

- Utilize advanced analytical tools to identify trends and inform credit risk strategies.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

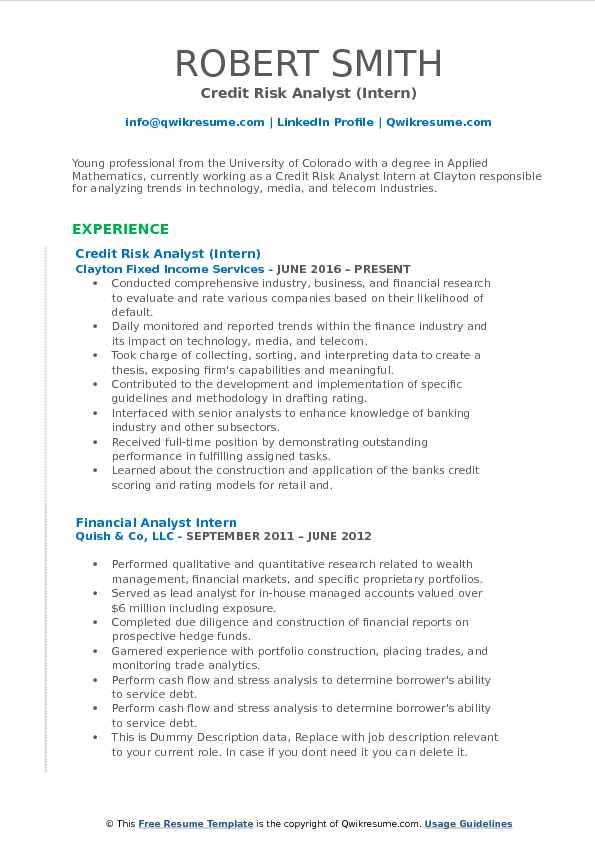

Assistant Credit Risk Analyst Resume

Objective : Results-driven analyst with 2 years of experience in credit risk assessment and financial analysis. Proven ability to evaluate creditworthiness and manage risk portfolios effectively. Seeking to apply strong analytical skills and industry knowledge to enhance risk management practices and support informed decision-making in a fast-paced financial environment.

Skills : Financial Analysis, Risk Management, Data Interpretation, Credit Modeling, Credit Analysis, Forecasting

Description :

- Conducted in-depth research on industry trends to evaluate the creditworthiness of various companies.

- Monitored financial market trends daily, analyzing their impact on credit risk assessments.

- Collected and interpreted financial data to support credit evaluation processes.

- Assisted in developing guidelines and methodologies for credit rating assignments.

- Collaborated with senior analysts to deepen understanding of the banking sector and enhance analytical skills.

- Recognized with a full-time offer due to exemplary performance in internship tasks.

- Gained insights into the construction and application of credit scoring models for retail banking.

Experience

0-2 Years

Level

Fresher

Education

B.S. in Applied Math

Credit Risk Analyst Resume

Objective : Proficient Credit Risk Analyst with 2 years of hands-on experience in assessing creditworthiness and managing diverse risk portfolios. Adept at financial analysis, risk modeling, and compliance review, with a strong focus on data-driven decision-making. Passionate about utilizing analytical skills to enhance risk management processes and contribute to organizational success.

Skills : Sensitivity Analysis, Client Relationship Management, Technical Writing, Trend Analysis, Project Management

Description :

- Conducted thorough analysis and due diligence for a portfolio of approximately 700 accounts, including various investment vehicles.

- Granted approval authority for credit limits up to $10 million, managing client credit limits that reached $300 million.

- Performed annual reviews and due diligence for non-banking counterparties to ensure compliance and risk mitigation.

- Monitored credit risk exposure and prepared detailed risk reports to address limit breaches proactively.

- Collaborated with documentation teams to establish credit terms for legal agreements, including MSFTAs and ISDAs.

- Facilitated onboarding processes for new clients, ensuring accurate data management in systems.

- Maintained and updated client records, rectifying inaccuracies to improve data integrity.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance