Credit Risk Manager Resume

Headline : Dynamic Credit Risk Manager with 7 years of experience in assessing credit exposures and implementing risk mitigation strategies. Proven track record in enhancing reporting processes and collaborating with cross-functional teams to support business objectives. Adept at analyzing financial data to inform strategic decisions and ensure compliance with corporate policies. Committed to fostering strong stakeholder relationships and driving organizational success.

Skills : Data Analysis, Credit Analysis, Credit Scoring, Financial Modeling

Description :

- Conducted thorough credit assessments on strategic accounts, aligning with corporate policies to minimize risk exposure.

- Maintained and nurtured relationships with key stakeholders to optimize collection strategies and enhance credit management.

- Produced and managed credit reports for senior leadership, consolidating metrics for informed decision-making.

- Collaborated with sales teams to provide financial insights and support business growth initiatives.

- Facilitated communication across departments to develop and implement effective risk mitigation strategies.

- Ensured adherence to corporate credit policies while overseeing compliance audits and risk evaluations.

- Led initiatives to improve accounts receivable processes, resulting in streamlined workflows and increased efficiency.

Experience

5-7 Years

Level

Management

Education

MBA

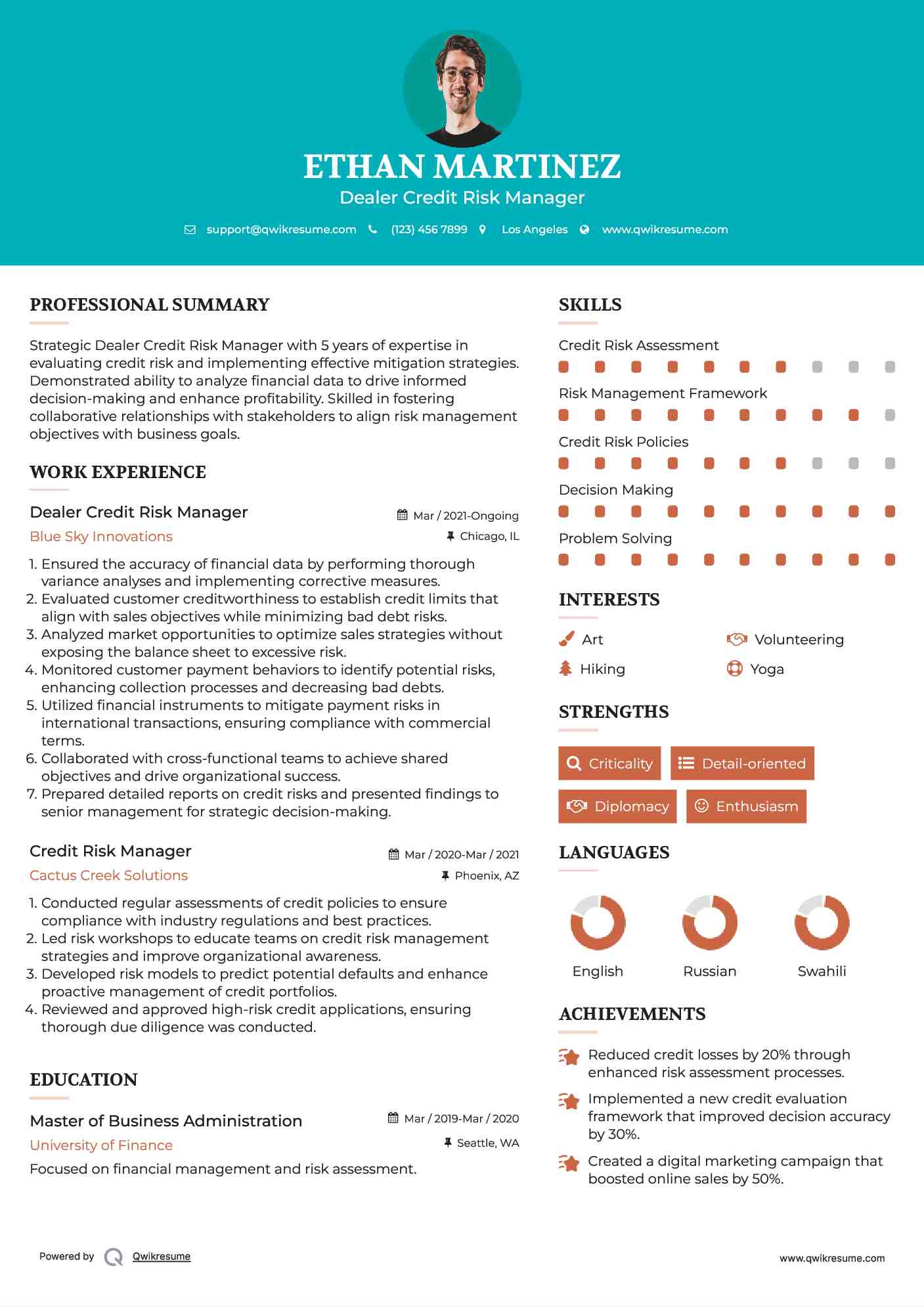

Dealer Credit Risk Manager Resume

Objective : Strategic Dealer Credit Risk Manager with 5 years of expertise in evaluating credit risk and implementing effective mitigation strategies. Demonstrated ability to analyze financial data to drive informed decision-making and enhance profitability. Skilled in fostering collaborative relationships with stakeholders to align risk management objectives with business goals.

Skills : Credit Risk Assessment, Risk Management Framework, Credit Risk Policies, Decision Making, Problem Solving

Description :

- Ensured the accuracy of financial data by performing thorough variance analyses and implementing corrective measures.

- Evaluated customer creditworthiness to establish credit limits that align with sales objectives while minimizing bad debt risks.

- Analyzed market opportunities to optimize sales strategies without exposing the balance sheet to excessive risk.

- Monitored customer payment behaviors to identify potential risks, enhancing collection processes and decreasing bad debts.

- Utilized financial instruments to mitigate payment risks in international transactions, ensuring compliance with commercial terms.

- Collaborated with cross-functional teams to achieve shared objectives and drive organizational success.

- Prepared detailed reports on credit risks and presented findings to senior management for strategic decision-making.

Experience

2-5 Years

Level

Consultant

Education

MBA

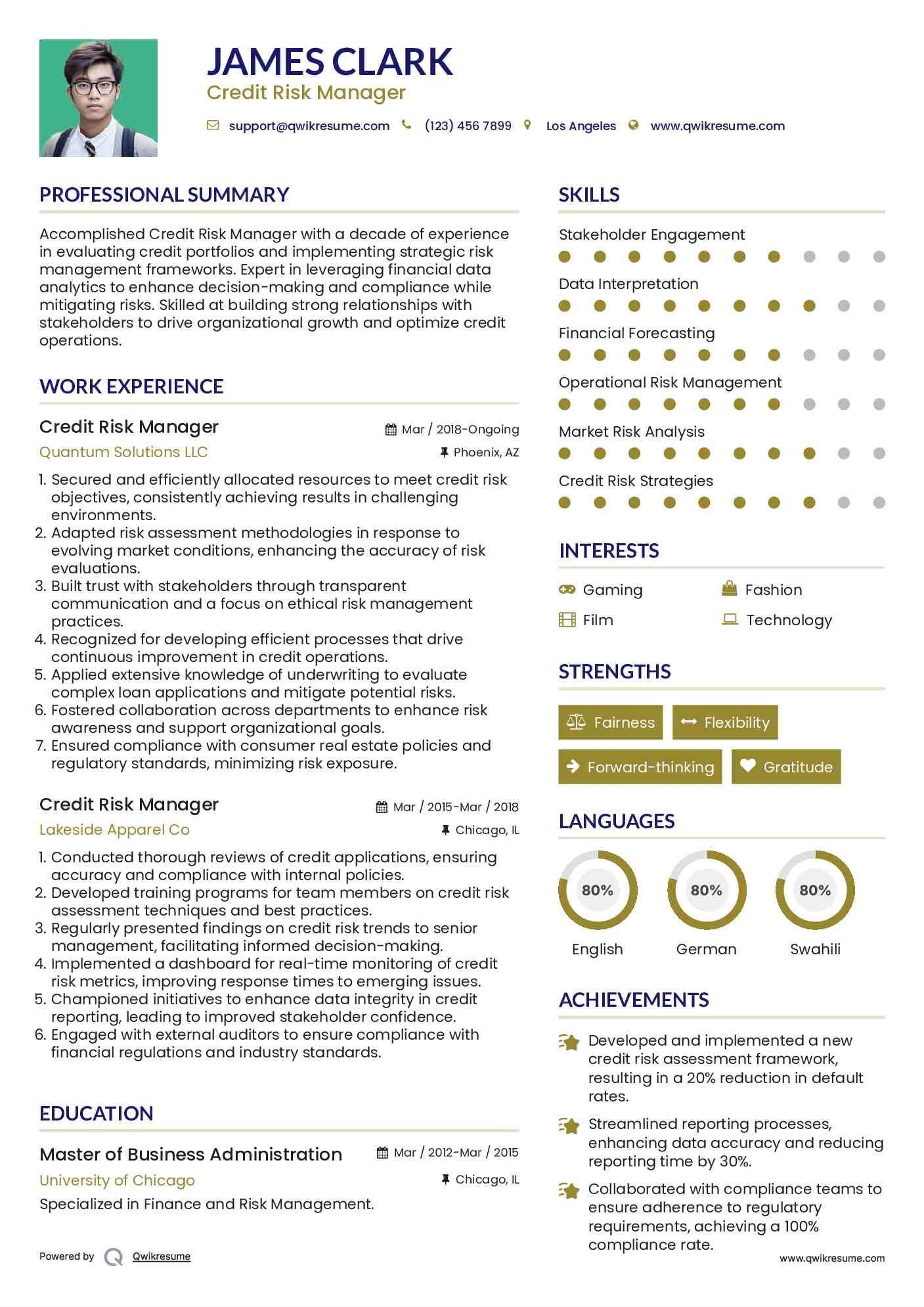

Credit Risk Manager Resume

Summary : Accomplished Credit Risk Manager with a decade of experience in evaluating credit portfolios and implementing strategic risk management frameworks. Expert in leveraging financial data analytics to enhance decision-making and compliance while mitigating risks. Skilled at building strong relationships with stakeholders to drive organizational growth and optimize credit operations.

Skills : Stakeholder Engagement, Data Interpretation, Financial Forecasting, Operational Risk Management, Market Risk Analysis, Credit Risk Strategies

Description :

- Secured and efficiently allocated resources to meet credit risk objectives, consistently achieving results in challenging environments.

- Adapted risk assessment methodologies in response to evolving market conditions, enhancing the accuracy of risk evaluations.

- Built trust with stakeholders through transparent communication and a focus on ethical risk management practices.

- Recognized for developing efficient processes that drive continuous improvement in credit operations.

- Applied extensive knowledge of underwriting to evaluate complex loan applications and mitigate potential risks.

- Fostered collaboration across departments to enhance risk awareness and support organizational goals.

- Ensured compliance with consumer real estate policies and regulatory standards, minimizing risk exposure.

Experience

10+ Years

Level

Senior

Education

MBA

Junior Credit Risk Manager Resume

Objective : Analytical Junior Credit Risk Manager with 5 years of experience in credit assessment and risk evaluation. Skilled in conducting thorough financial analyses and crafting risk mitigation strategies that align with business objectives. Proven ability to collaborate with teams to enhance decision-making processes and ensure compliance. Eager to leverage expertise in fostering relationships to support organizational growth.

Skills : Communication Skills, Team Leadership, Negotiation Skills, Risk Mitigation, Market Analysis, Statistical Analysis

Description :

- Provided actionable recommendations to credit approvers while monitoring portfolio risk exposure.

- Conducted independent credit analysis, focusing on project financing transactions to assess viability.

- Evaluated and critiqued credit proposals, delivering thorough written recommendations to management.

- Identified potential risks and suggested structural enhancements for prospective transactions.

- Maintained open communication with origination teams to balance business opportunities with risk management.

- Collaborated with credit units to gather necessary data for informed credit decision-making.

- Reviewed credit assessments prepared by portfolio management for existing project finance exposures.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Credit Risk Manager Resume

Summary : With a decade of experience in credit risk management, I specialize in developing robust risk assessment frameworks and strategic mitigation strategies. My expertise in financial data analysis drives informed decision-making and ensures regulatory compliance. I excel at cultivating stakeholder relationships to enhance operational efficiency and support sustainable growth.

Skills : Financial Statement Analysis, Risk Quantification, Analytical Thinking, Strategic Planning, Credit Risk Tools, Performance Metrics

Description :

- Facilitated the sharing of critical account information among stakeholders to enhance decision-making.

- Participated in special projects focused on new product launches and policy enhancements.

- Monitored compliance with regulatory frameworks and internal policies to mitigate risk exposure.

- Provided strategic advice to organizations on identifying and addressing potential financial threats.

- Oversaw comprehensive risk management processes, including audits and insurance procurement.

- Directed risk analytics initiatives, producing detailed reports and forecasts for business units.

- Developed predictive models to assess risks and collaborated with partners to implement effective strategies.

Experience

7-10 Years

Level

Senior

Education

MBA

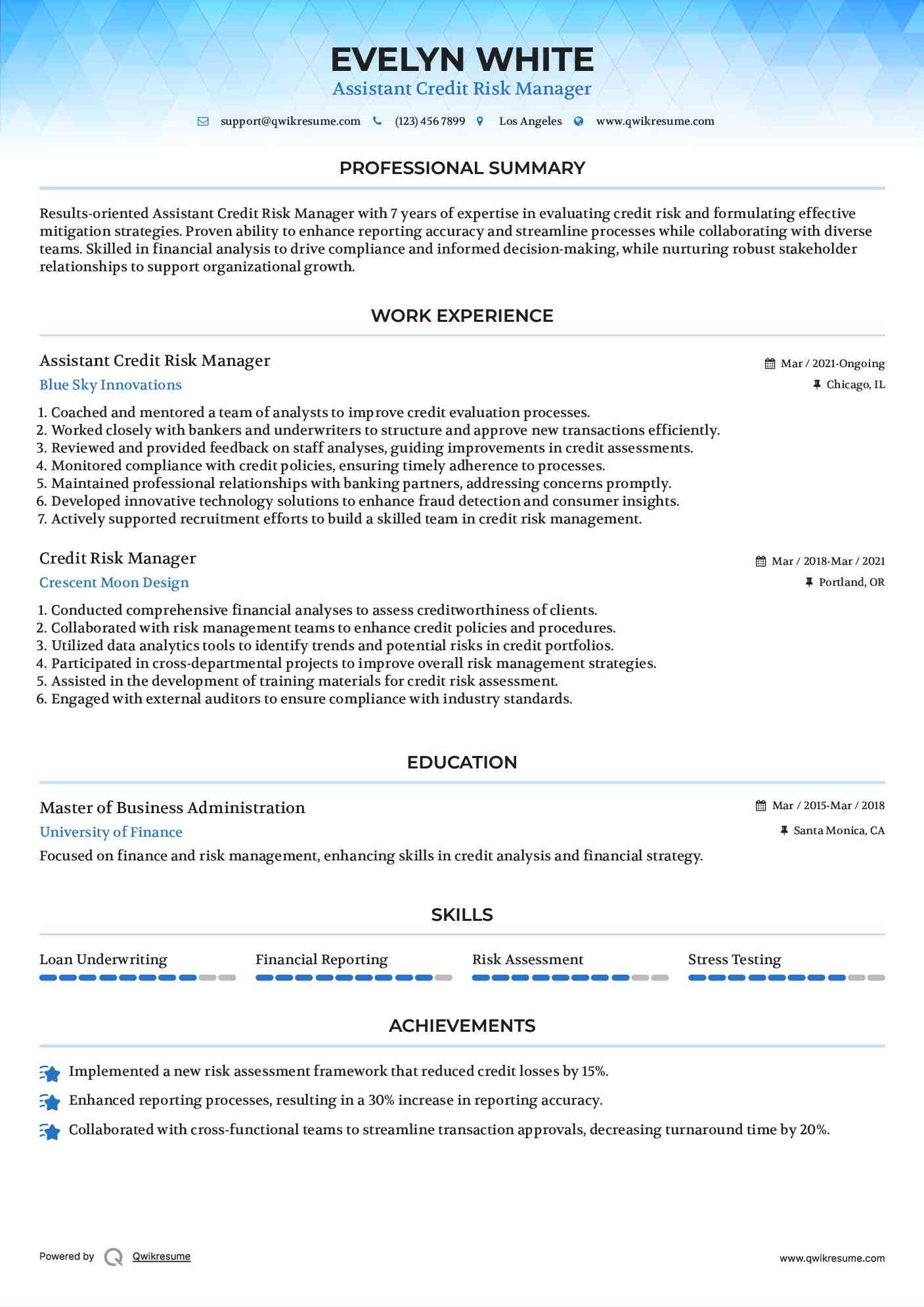

Assistant Credit Risk Manager Resume

Headline : Results-oriented Assistant Credit Risk Manager with 7 years of expertise in evaluating credit risk and formulating effective mitigation strategies. Proven ability to enhance reporting accuracy and streamline processes while collaborating with diverse teams. Skilled in financial analysis to drive compliance and informed decision-making, while nurturing robust stakeholder relationships to support organizational growth.

Skills : Loan Underwriting, Financial Reporting, Risk Assessment, Stress Testing

Description :

- Coached and mentored a team of analysts to improve credit evaluation processes.

- Worked closely with bankers and underwriters to structure and approve new transactions efficiently.

- Reviewed and provided feedback on staff analyses, guiding improvements in credit assessments.

- Monitored compliance with credit policies, ensuring timely adherence to processes.

- Maintained professional relationships with banking partners, addressing concerns promptly.

- Developed innovative technology solutions to enhance fraud detection and consumer insights.

- Actively supported recruitment efforts to build a skilled team in credit risk management.

Experience

5-7 Years

Level

Executive

Education

MBA

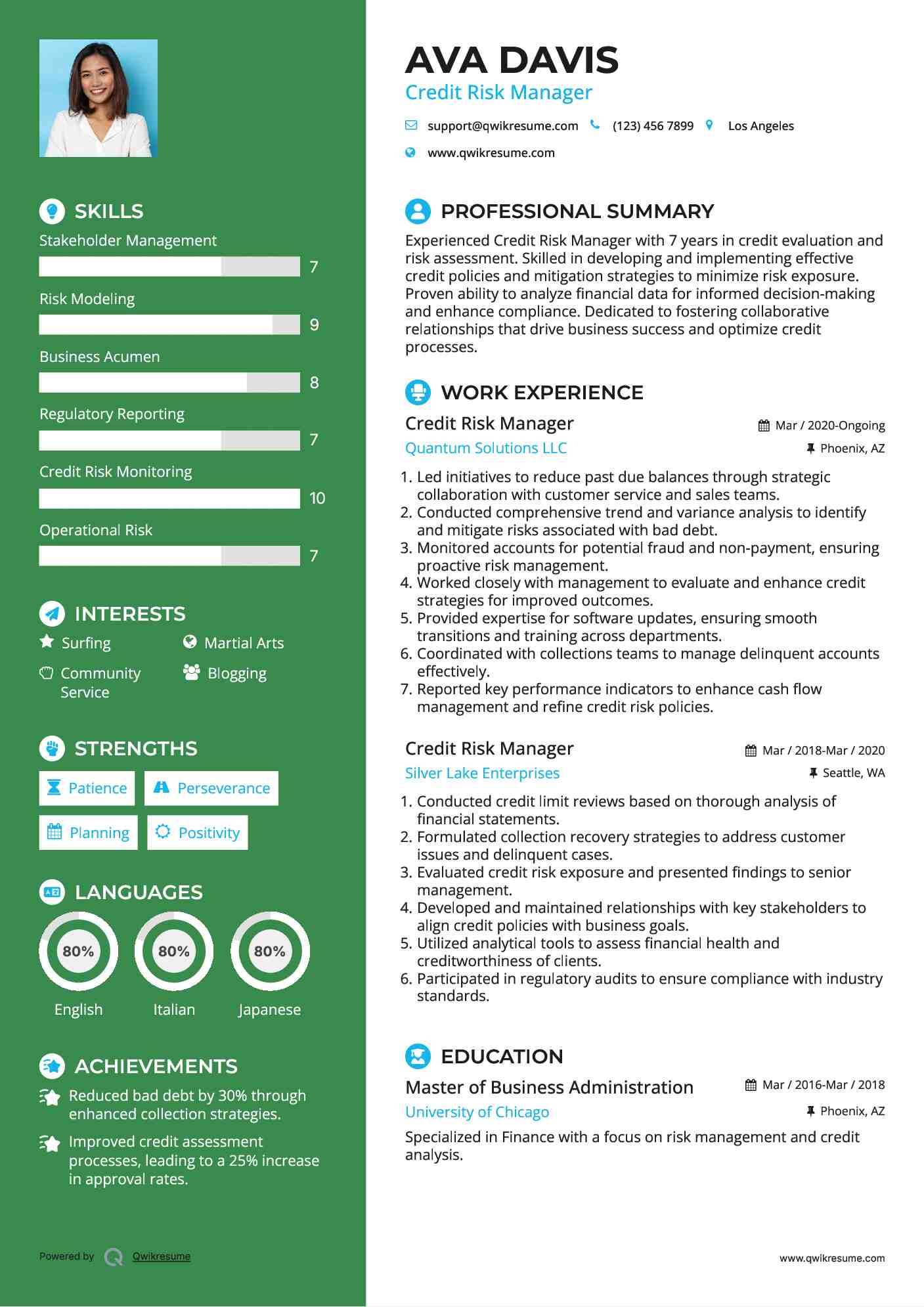

Credit Risk Manager Resume

Headline : Experienced Credit Risk Manager with 7 years in credit evaluation and risk assessment. Skilled in developing and implementing effective credit policies and mitigation strategies to minimize risk exposure. Proven ability to analyze financial data for informed decision-making and enhance compliance. Dedicated to fostering collaborative relationships that drive business success and optimize credit processes.

Skills : Stakeholder Management, Risk Modeling, Business Acumen, Regulatory Reporting, Credit Risk Monitoring, Operational Risk

Description :

- Led initiatives to reduce past due balances through strategic collaboration with customer service and sales teams.

- Conducted comprehensive trend and variance analysis to identify and mitigate risks associated with bad debt.

- Monitored accounts for potential fraud and non-payment, ensuring proactive risk management.

- Worked closely with management to evaluate and enhance credit strategies for improved outcomes.

- Provided expertise for software updates, ensuring smooth transitions and training across departments.

- Coordinated with collections teams to manage delinquent accounts effectively.

- Reported key performance indicators to enhance cash flow management and refine credit risk policies.

Experience

5-7 Years

Level

Management

Education

MBA

Senior Credit Risk Manager Resume

Headline : Accomplished Senior Credit Risk Manager with 7 years of experience in evaluating credit risk exposure and implementing comprehensive mitigation strategies. Expertise in financial data analysis to guide strategic business decisions while ensuring compliance with regulatory standards. Dedicated to optimizing credit processes and enhancing stakeholder engagement to drive organizational growth.

Skills : Quantitative Analysis, Credit Policy Development, Risk Assessment Tools, Credit Risk Modeling, Portfolio Management, Regulatory Compliance

Description :

- Negotiated settlements and payment terms with customers to optimize cash flow.

- Streamlined processes for early identification of potential credit risks and issues.

- Attended ongoing professional training to enhance credit management practices.

- Developed strategies to expedite payments and resolve customer disputes efficiently.

- Provided mentorship to junior colleagues, improving overall team performance.

- Analyzed financial statuses and property evaluations to assess loan feasibility.

- Optimized credit approval and collection processes, enhancing operational efficiencies by over 20%.

Experience

5-7 Years

Level

Senior

Education

MBA

Credit Risk Manager Resume

Summary : Accomplished Credit Risk Manager with 10 years of experience in developing and executing comprehensive credit risk frameworks. Expertise in analyzing financial data to enhance decision-making processes and ensure compliance with regulatory standards. Proven ability to build strong stakeholder relationships and drive organizational growth through effective risk management strategies.

Skills : Data Visualization, Time Management, Project Management, Financial Risk Management, Economic Analysis, Risk Reporting

Description :

- Oversee all reporting, documentation, and recordkeeping requirements for the credit risk department.

- Investigate and evaluate customers for creditworthiness and potential risk factors using advanced analytics.

- Maintain up-to-date knowledge of the regulatory environment and proactively adjust policies to meet changing requirements.

- Write and implement standard operating procedures to achieve consistency in credit operations.

- Develop and implement credit risk policies and procedures to mitigate potential losses.

- Review and verify income, credit reports, and employment histories for each borrower to assess risk.

- Collaborate with credit and front office teams to review credit reports and enhance decision-making processes.

Experience

10+ Years

Level

Senior

Education

MBA

Credit Risk Manager Resume

Headline : Results-driven Credit Risk Manager with 7 years of experience in evaluating creditworthiness and developing risk mitigation strategies. Expertise in analyzing complex financial data to inform strategic decisions and enhance compliance. Proven ability to lead cross-functional teams in optimizing credit processes and fostering robust stakeholder relationships to drive business success.

Skills : Credit Risk Analysis, Attention To Detail, Risk Appetite Framework, Scenario Analysis, Client Relationship Management

Description :

- Conducted comprehensive credit analysis for high-risk accounts, ensuring sound underwriting decisions.

- Prepared detailed risk assessment reports for management review, enhancing decision transparency.

- Led negotiations with clients, fostering relationships that improved credit terms and reduced defaults.

- Reviewed and approved credit risk analyses completed by team members, ensuring adherence to guidelines.

- Monitored daily MIS reports for compliance with productivity standards, identifying areas for improvement.

- Trained and supervised Credit and Risk Officers, driving system enhancements and process improvements.

- Executed vintage loss forecasting for pricing strategies, effectively managing performance against targets.

Experience

5-7 Years

Level

Management

Education

MBA