Credit Underwriter Resume

Objective : Detail-oriented Credit Underwriter with 5 years of experience in evaluating credit applications, assessing risk, and ensuring compliance with lending policies. Proven track record in enhancing credit decision processes and minimizing risk exposure.

Skills : Credit Analysis, Financial Acumen, Regulatory Compliance, Credit Risk Evaluation

Description :

- Evaluated and underwrote personal loans, lines of credit, and overdraft protection applications.

- Validated income through meticulous review of paystubs, tax returns, and financial documents.

- Conducted comprehensive risk analysis to identify deficiencies and recommend solutions.

- Analyzed credit bureau reports to assess applicant creditworthiness and identify trends.

- Recommended additional banking products based on thorough evaluation of customer records.

- Identified potential fraud indicators and conducted investigations to mitigate risks.

- Collaborated with Relationship Managers to structure credit solutions tailored to client needs.

Experience

2-5 Years

Level

Executive

Education

BSF

Credit Underwriter Resume

Objective : Detail-oriented Credit Underwriter with 5 years of experience in evaluating creditworthiness and risk assessment. Proven track record in making sound lending decisions and enhancing profitability while ensuring compliance with regulations.

Skills : Effective Communication, Risk Assessment, Financial Analysis, Decision Making, Regulatory Compliance

Description :

- Evaluated and analyzed small business loan requests up to $2 million, ensuring compliance with lending policies.

- Made informed credit decisions that align with profitability targets and risk management strategies.

- Reviewed existing loans for renewal or exit, assessing pricing and risk ratings effectively.

- Collaborated with loan officers to enhance relationships with creditworthy clients and mitigate risks.

- Developed and executed loan workout plans for distressed borrowers, improving recovery rates.

- Assessed credit and collateral positions on loans to support accurate risk ratings.

- Processed servicing requests for collateral releases and substitutions, ensuring compliance with regulations.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

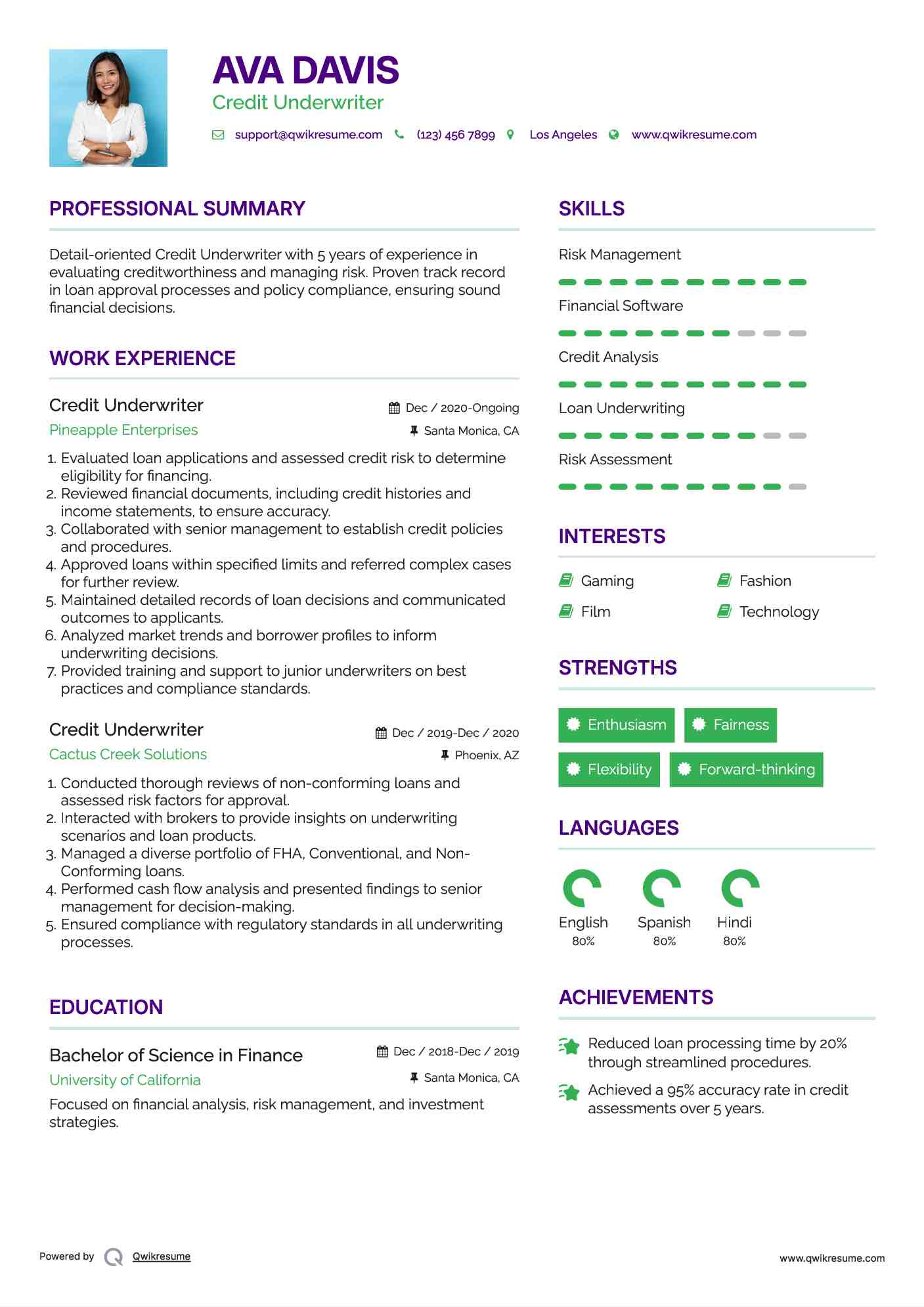

Credit Underwriter Resume

Objective : Detail-oriented Credit Underwriter with 5 years of experience in evaluating creditworthiness and managing risk. Proven track record in loan approval processes and policy compliance, ensuring sound financial decisions.

Skills : Risk Management, Financial Software, Credit Analysis, Loan Underwriting, Risk Assessment

Description :

- Evaluated loan applications and assessed credit risk to determine eligibility for financing.

- Reviewed financial documents, including credit histories and income statements, to ensure accuracy.

- Collaborated with senior management to establish credit policies and procedures.

- Approved loans within specified limits and referred complex cases for further review.

- Maintained detailed records of loan decisions and communicated outcomes to applicants.

- Analyzed market trends and borrower profiles to inform underwriting decisions.

- Provided training and support to junior underwriters on best practices and compliance standards.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

Credit Underwriter Resume

Objective : Detail-oriented Credit Underwriter with 5 years of experience in evaluating creditworthiness, analyzing financial data, and ensuring compliance with lending guidelines to support sound lending decisions.

Skills : Risk Assessment, Credit Analysis, Financial Reporting, Regulatory Compliance, Risk Management

Description :

- Balanced production goals while ensuring compliance and quality to minimize risk and maximize profitability.

- Conducted thorough risk assessments of applications through detailed document reviews.

- Maintained up-to-date knowledge of guidelines for FHA, FHLMC, FNMA, VA, and Conventional loans.

- Collaborated with supervisors to generate reports and summaries for upper management.

- Served as a resource for method and procedure clarifications within the team.

- Trained new underwriters both in-office and at off-site locations to ensure consistent quality.

- Managed reporting and file assignments to optimize team workflow.

Experience

2-5 Years

Level

Executive

Education

G.E.D

Credit Underwriter Resume

Headline : Detail-oriented Credit Underwriter with 7 years of experience in evaluating loan applications, analyzing credit reports, and ensuring compliance with lending regulations. Proven ability to communicate credit decisions effectively to stakeholders.

Skills : Credit Analysis, Risk Assessment, Financial Analysis, Loan Underwriting, Credit Risk Evaluation

Description :

- Ensured compliance with banking regulations while analyzing creditworthiness for consumer loans.

- Evaluated financial strength by calculating net income and analyzing Debt-to-Income ratios.

- Collaborated with processing teams to review conditions and adjust loan amounts efficiently.

- Mentored new underwriters and provided cross-training to enhance team capabilities.

- Made informed credit decisions for approvals and counteroffers, adhering to established guidelines.

- Maintained clear communication with borrowers and stakeholders regarding credit decisions.

- Verified that loan submissions met all eligibility requirements for internal and external standards.

Experience

5-7 Years

Level

Executive

Education

GED

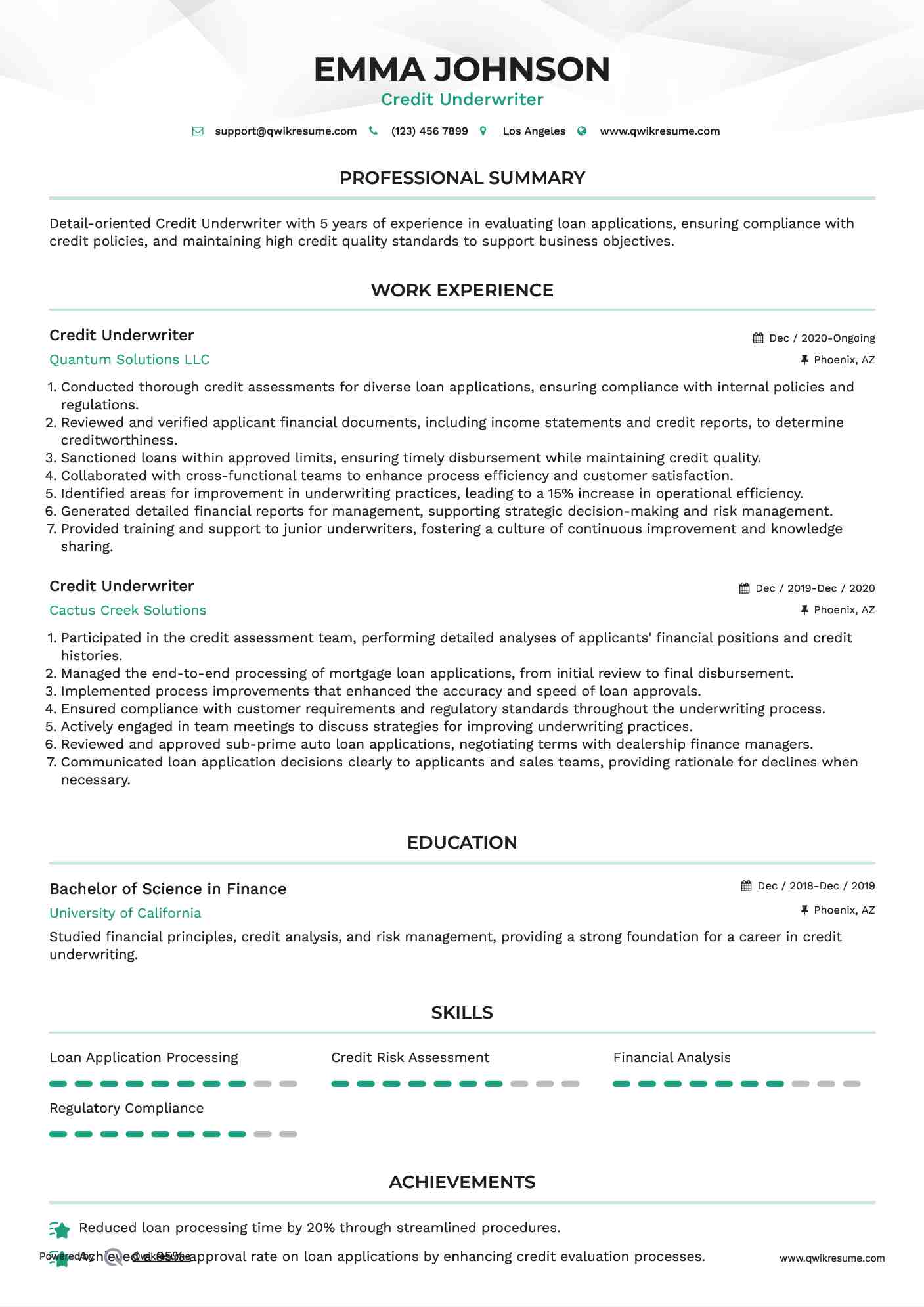

Credit Underwriter Resume

Objective : Detail-oriented Credit Underwriter with 5 years of experience in evaluating loan applications, ensuring compliance with credit policies, and maintaining high credit quality standards to support business objectives.

Skills : Loan Application Processing, Credit Risk Assessment, Financial Analysis, Regulatory Compliance

Description :

- Conducted thorough credit assessments for diverse loan applications, ensuring compliance with internal policies and regulations.

- Reviewed and verified applicant financial documents, including income statements and credit reports, to determine creditworthiness.

- Sanctioned loans within approved limits, ensuring timely disbursement while maintaining credit quality.

- Collaborated with cross-functional teams to enhance process efficiency and customer satisfaction.

- Identified areas for improvement in underwriting practices, leading to a 15% increase in operational efficiency.

- Generated detailed financial reports for management, supporting strategic decision-making and risk management.

- Provided training and support to junior underwriters, fostering a culture of continuous improvement and knowledge sharing.

Experience

2-5 Years

Level

Executive

Education

BS

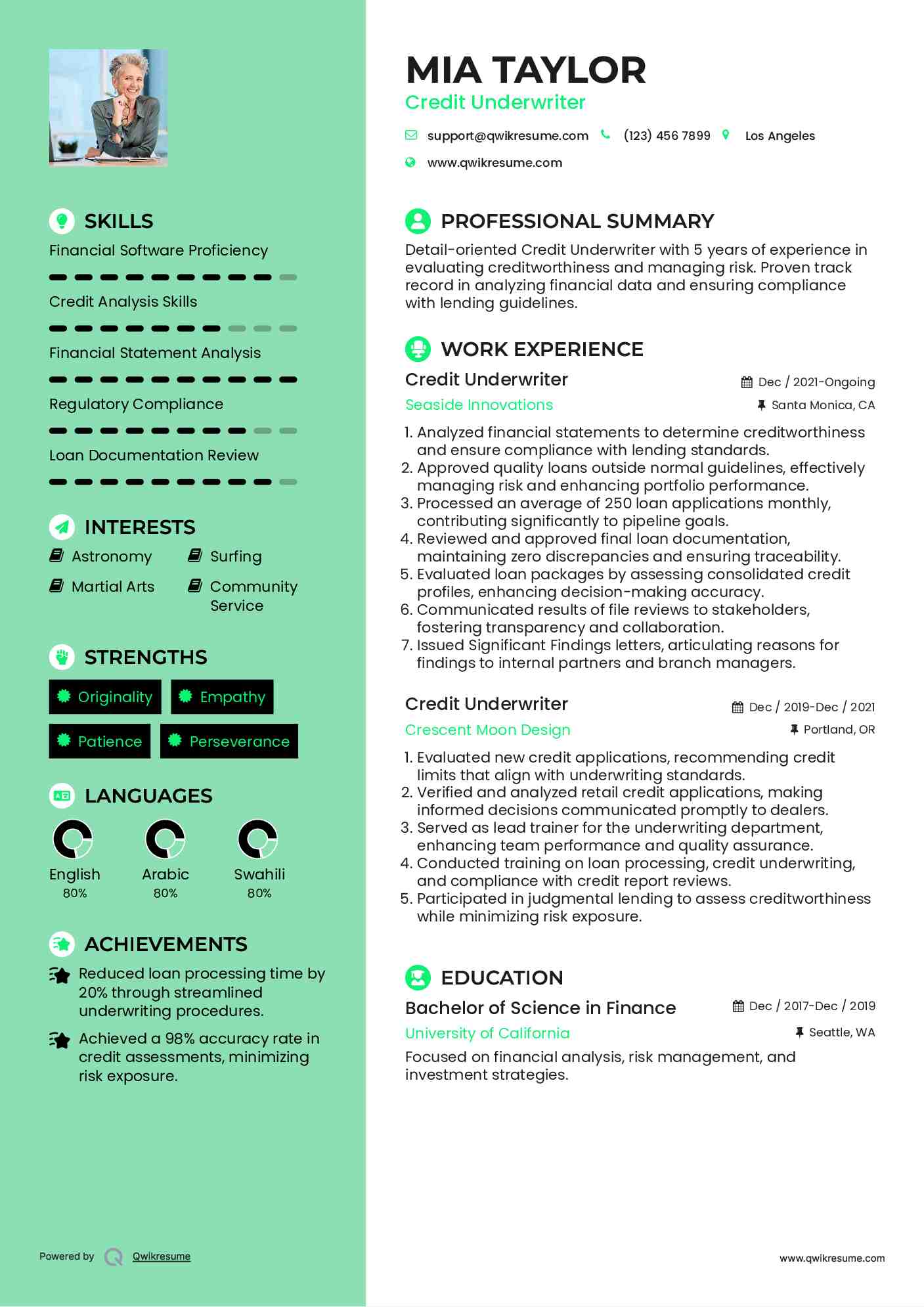

Credit Underwriter Resume

Objective : Detail-oriented Credit Underwriter with 5 years of experience in evaluating creditworthiness and managing risk. Proven track record in analyzing financial data and ensuring compliance with lending guidelines.

Skills : Financial Software Proficiency, Credit Analysis Skills, Financial Statement Analysis, Regulatory Compliance, Loan Documentation Review

Description :

- Analyzed financial statements to determine creditworthiness and ensure compliance with lending standards.

- Approved quality loans outside normal guidelines, effectively managing risk and enhancing portfolio performance.

- Processed an average of 250 loan applications monthly, contributing significantly to pipeline goals.

- Reviewed and approved final loan documentation, maintaining zero discrepancies and ensuring traceability.

- Evaluated loan packages by assessing consolidated credit profiles, enhancing decision-making accuracy.

- Communicated results of file reviews to stakeholders, fostering transparency and collaboration.

- Issued Significant Findings letters, articulating reasons for findings to internal partners and branch managers.

Experience

2-5 Years

Level

Executive

Education

MS

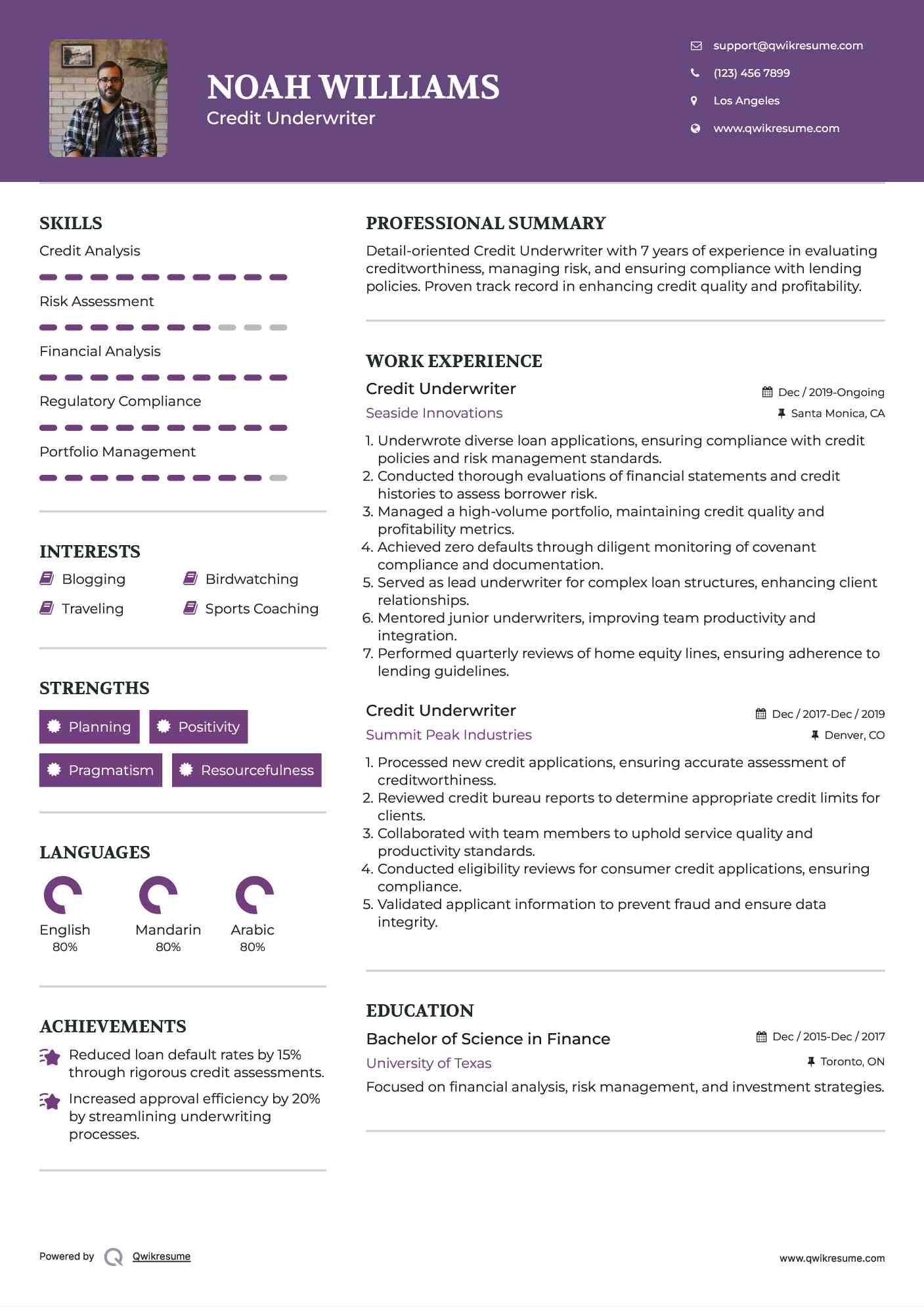

Credit Underwriter Resume

Headline : Detail-oriented Credit Underwriter with 7 years of experience in evaluating creditworthiness, managing risk, and ensuring compliance with lending policies. Proven track record in enhancing credit quality and profitability.

Skills : Credit Analysis, Risk Assessment, Financial Analysis, Regulatory Compliance, Portfolio Management

Description :

- Underwrote diverse loan applications, ensuring compliance with credit policies and risk management standards.

- Conducted thorough evaluations of financial statements and credit histories to assess borrower risk.

- Managed a high-volume portfolio, maintaining credit quality and profitability metrics.

- Achieved zero defaults through diligent monitoring of covenant compliance and documentation.

- Served as lead underwriter for complex loan structures, enhancing client relationships.

- Mentored junior underwriters, improving team productivity and integration.

- Performed quarterly reviews of home equity lines, ensuring adherence to lending guidelines.

Experience

5-7 Years

Level

Executive

Education

G.E.D

Credit Underwriter Resume

Headline : Detail-oriented Credit Underwriter with 7 years of experience in evaluating creditworthiness, analyzing financial data, and ensuring compliance with lending regulations to mitigate risk and enhance loan quality.

Skills : Credit Risk Assessment, Credit Risk Assessment, Financial Analysis, Regulatory Compliance, Loan Underwriting

Description :

- Conducted thorough credit evaluations to assess borrower risk and repayment capacity.

- Collaborated with loan officers to ensure compliance with lending policies and regulations.

- Developed and implemented underwriting guidelines to enhance decision-making processes.

- Analyzed financial statements and credit reports to determine creditworthiness.

- Maintained high production levels while ensuring quality standards were met.

- Provided training and support to junior underwriters on best practices and procedures.

- Utilized automated underwriting systems to streamline the loan approval process.

Experience

5-7 Years

Level

Executive

Education

High School Diploma

Credit Underwriter Resume

Headline : Detail-oriented Credit Underwriter with 7 years of experience in evaluating loan applications, assessing risk, and ensuring compliance with lending policies. Proven ability to manage multiple files efficiently while maintaining high accuracy.

Skills : Effective Communication, Risk Management, Credit Analysis, Loan Underwriting, Regulatory Compliance

Description :

- Reviewed and analyzed loan applications to assess creditworthiness and risk factors, ensuring compliance with company policies.

- Communicated underwriting decisions effectively to clients, maintaining positive relationships and providing alternative solutions when necessary.

- Conducted thorough reviews of loan conditions and resubmissions, ensuring timely processing and adherence to deadlines.

- Collaborated with internal teams to provide exceptional service and support throughout the loan process.

- Maintained high-quality standards in underwriting, achieving production goals consistently.

- Participated in special projects aimed at improving underwriting efficiency and customer satisfaction.

- Monitored and reviewed open loans for compliance and risk management during the initial 18 months post-approval.

Experience

5-7 Years

Level

Management

Education

B.S. Finance