Execution Trader Resume

Objective : Motivated Execution Trader with two years of experience in analyzing market trends and executing trades across various asset classes. Adept at leveraging trading systems to optimize performance and reduce costs, while ensuring compliance with risk management protocols. Committed to enhancing trading strategies through detailed post-trade analysis and collaboration with cross-functional teams.

Skills : Technical Analysis, Financial Modeling, Trade Execution, Portfolio Management

Description :

- Developed and maintained relationships with counterparties to facilitate efficient trade execution.

- Analyzed execution processes and generated detailed performance reports to identify improvement opportunities.

- Collected market data through diverse communication channels to inform trading decisions.

- Designed and presented spreadsheets for morning meetings to review trade activities.

- Participated in administrative tasks to streamline execution processes.

- Executed foreign exchange transactions across multiple currencies with precision.

- Collaborated with traders and developers to enhance automated trading systems.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

Junior Execution Trader Resume

Objective : Dynamic Junior Execution Trader with five years of experience in executing trades and managing risk across diverse asset classes. Proficient in leveraging advanced trading systems to enhance efficiency and optimize execution. Committed to continuous improvement through in-depth analysis and collaboration with cross-functional teams to drive trading success.

Skills : Statistical Analysis, Liquidity Management, Trade Reconciliation, P&l Analysis, Execution Speed

Description :

- Set and monitored risk limits for trading positions, ensuring strict adherence to risk management policies.

- Executed trades accurately using advanced trading platforms and order management systems.

- Ensured timely and precise completion of orders across asset classes, including equities and derivatives.

- Executed trades efficiently in fast-paced environments to maximize profitability.

- Monitored market trends and news to inform trading strategies and decisions.

- Evaluated trading venues to optimize cost-effectiveness in executing orders.

- Adapted trading strategies in real-time based on market fluctuations, ensuring minimal risk exposure.

Experience

2-5 Years

Level

Junior

Education

BSc Finance

Execution Trader Resume

Headline : Accomplished Execution Trader with 7 years of experience in executing high-volume trades and managing risk across multiple asset classes. Expert in market analysis and leveraging advanced trading technologies to optimize execution and minimize costs. Proven track record in enhancing trading strategies and ensuring compliance with risk management protocols.

Skills : Market Analysis, Order Types, Market Making, Volatility Analysis, Event-driven Trading, Backtesting Strategies

Description :

- Executed high-volume trades across diverse asset classes while adhering to risk management protocols.

- Analyzed market data and economic indicators to identify trading opportunities and inform decision-making.

- Collaborated with research analysts and portfolio managers to develop and refine trading strategies.

- Monitored financial markets and provided timely insights to senior management regarding market trends.

- Maintained robust relationships with brokers and liquidity providers to enhance execution efficiency.

- Utilized advanced trading systems to optimize performance and reduce transaction costs.

- Conducted comprehensive post-trade analysis to evaluate trade effectiveness and identify improvement areas.

Experience

5-7 Years

Level

Senior

Education

BSc Finance

Senior Execution Trader Resume

Summary : Strategic Senior Execution Trader with over 10 years of experience in executing high-stakes trades and optimizing performance across diverse asset classes. Proficient in advanced trading technologies and market analytics, leading to improved execution efficiency and risk management. Dedicated to fostering collaboration within trading teams to drive innovative strategies and enhance overall trading outcomes.

Skills : Market Trends, Transaction Cost Analysis, Hedge Strategies, Order Management, Financial Instruments, Data Analysis

Description :

- Executed trades across a broad spectrum of financial instruments, ensuring optimal execution and risk management.

- Conducted in-depth market analysis to inform trading decisions and strategy adjustments.

- Collaborated with portfolio managers and analysts to align trading strategies with investment goals.

- Monitored economic indicators and market trends, adapting strategies to changing conditions.

- Managed and optimized trade execution platforms, ensuring seamless integration with market exchanges.

- Analyzed historical data to identify trading opportunities and patterns.

- Trained junior traders on market strategies and risk management best practices.

Experience

7-10 Years

Level

Senior

Education

BSc Finance

Execution Trader Resume

Summary : Seasoned Execution Trader with a decade of experience in executing complex trades and managing risk across diverse asset classes. Expert in utilizing advanced trading technologies and analytics to enhance execution efficiency and drive profitability. Focused on continuous improvement through strategic analysis and collaborative efforts to refine trading methodologies.

Skills : Time Management, Options Trading, Futures Trading, Forex Trading, Market Microstructure, Trade Optimization

Description :

- Executed high-volume trades while ensuring adherence to regulatory requirements and internal policies.

- Analyzed market trends and economic indicators to inform trading decisions and optimize strategies.

- Collaborated with cross-functional teams to enhance trading systems and tools, driving efficiency.

- Adapted trading strategies in real-time based on market fluctuations and emerging opportunities.

- Communicated effectively with clients and stakeholders regarding trade performance and strategic insights.

- Resolved trading-related issues promptly to maintain operational integrity and client satisfaction.

- Monitored and reported on key market developments and their potential impact on trading activities.

Experience

7-10 Years

Level

Management

Education

B.S. Finance

Management Execution Trader Resume

Summary : Seasoned Management Execution Trader with a decade of experience in executing high-volume trades and optimizing strategies across diverse asset classes. Proven ability to leverage advanced trading systems and analytics, driving efficiency and minimizing costs. Committed to enhancing performance through data-driven insights and collaboration with trading teams to achieve superior market outcomes.

Skills : Performance Metrics, Regulatory Compliance, Risk Management, Quantitative Analysis

Description :

- Developed and executed comprehensive pre and post-trade analytics to enhance trade performance.

- Conducted in-depth research on securities, assessing liquidity, trading volumes, and execution risks to inform trading decisions.

- Evaluated and monitored counterparty performance against firm benchmarks to optimize execution outcomes.

- Managed order routing and execution management system (EMS) activities to improve trade efficiency.

- Automated reconciliation processes, driving efficiency and accuracy in post-trade operations.

- Built and maintained strong relationships with external counterparties to facilitate effective trading activities.

- Served as a primary contact for trading-related inquiries, providing timely and informed responses.

Experience

7-10 Years

Level

Management

Education

B.S. Finance

Execution Trader Resume

Summary : Accomplished Execution Trader with 10 years of extensive experience in executing high-volume trades and managing risk across multiple asset classes. Proficient in utilizing advanced trading technologies and market analytics to optimize execution and drive profitability. Focused on enhancing trading strategies through continuous analysis and collaboration to achieve superior market outcomes.

Skills : Algorithmic Execution, Client Relationship Management, Price Discovery, Communication Skills, Attention To Detail, Problem Solving

Description :

- Implemented stop-loss orders to mitigate potential losses.

- Monitored market activity and adjusted trading strategies based on news and market conditions.

- Conducted post-trade analysis to assess execution quality and outcomes.

- Communicated with trading teams to ensure orders were executed accurately.

- Adapted trading strategies based on changing market conditions.

- Executed trades on behalf of clients, ensuring compliance with their instructions.

- Coordinated with brokers to facilitate efficient trading activity.

Experience

10+ Years

Level

Executive

Education

B.Sc. Finance

Lead Execution Trader Resume

Summary : Accomplished Lead Execution Trader with a decade of experience in executing and optimizing high-stakes trades across diverse asset classes. Skilled in advanced market analysis and leveraging cutting-edge trading technologies to enhance execution efficiency. Eager to drive innovative trading strategies through collaborative efforts and data-driven insights.

Skills : Strategic Adaptability, Decision Making, Algorithmic Trading, Negotiation Skills, Technical Proficiency, Excel Proficiency

Description :

- Calculated profit and loss on securities trades to inform strategic decisions.

- Established and nurtured relationships with key clients, driving trading volume and activity.

- Analyzed client objectives to ensure optimal trade execution aligned with their goals.

- Monitored market conditions continuously to capitalize on opportunities and mitigate risk.

- Conducted in-depth analysis of trade data, identifying trends to refine execution strategies.

- Engaged in continuous learning to stay updated on market developments.

- Executed approved trades promptly while ensuring adherence to risk management protocols.

Experience

7-10 Years

Level

Management

Education

B.S. Finance

Execution Trader Resume

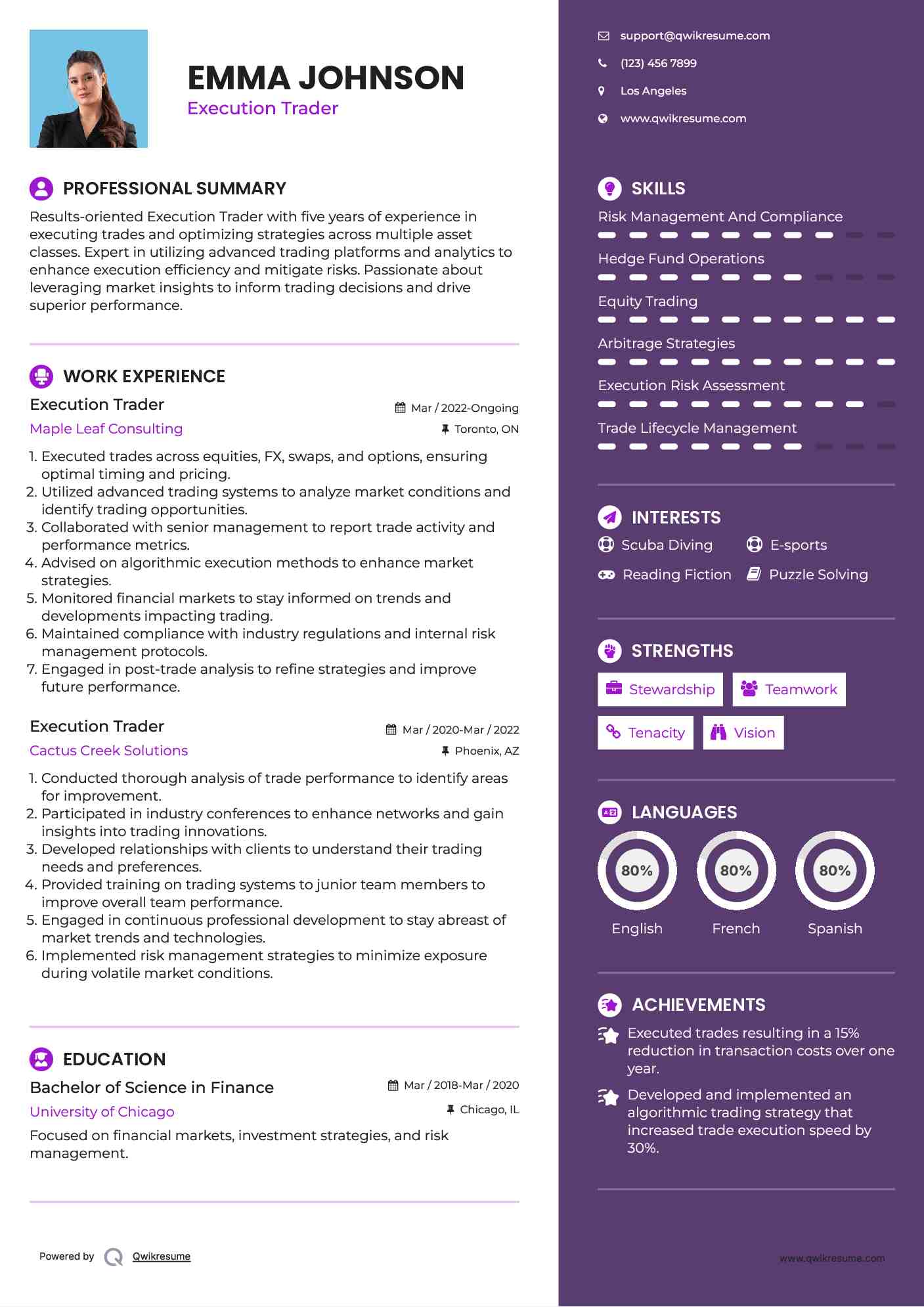

Objective : Results-oriented Execution Trader with five years of experience in executing trades and optimizing strategies across multiple asset classes. Expert in utilizing advanced trading platforms and analytics to enhance execution efficiency and mitigate risks. Passionate about leveraging market insights to inform trading decisions and drive superior performance.

Skills : Risk Management And Compliance, Hedge Fund Operations, Equity Trading, Arbitrage Strategies, Execution Risk Assessment, Trade Lifecycle Management

Description :

- Executed trades across equities, FX, swaps, and options, ensuring optimal timing and pricing.

- Utilized advanced trading systems to analyze market conditions and identify trading opportunities.

- Collaborated with senior management to report trade activity and performance metrics.

- Advised on algorithmic execution methods to enhance market strategies.

- Monitored financial markets to stay informed on trends and developments impacting trading.

- Maintained compliance with industry regulations and internal risk management protocols.

- Engaged in post-trade analysis to refine strategies and improve future performance.

Experience

2-5 Years

Level

Consultant

Education

B.S. Finance

Execution Trader Resume

Objective : Versatile Execution Trader with 5 years of experience in executing trades and managing risk across multiple asset classes. Skilled in utilizing advanced trading platforms to enhance execution efficiency and reduce transaction costs. Eager to leverage analytical insights and strategic collaboration to drive performance and optimize trading outcomes.

Skills : Market Research, Execution Strategies, Trading Platforms, Execution Algorithms, Asset Allocation

Description :

- Executed large volume trades with minimal market impact, ensuring optimal pricing for clients.

- Utilized advanced trading systems to efficiently implement trading decisions, reducing transaction costs.

- Conducted real-time market analysis to inform trading strategies and enhance decision-making.

- Collaborated with cross-functional teams to refine trading methodologies and improve performance.

- Prepared and submitted regulatory reports, maintaining compliance with all requirements.

- Identified and resolved market data issues to ensure accurate trading operations.

- Developed improvements to trading systems based on feedback and performance metrics.

Experience

2-5 Years

Level

Freelancer

Education

BS Finance