Fraud Analyst Resume

Objective : Detail-oriented Fraud Analyst with 2 years of experience in identifying and mitigating fraudulent activities. Proven ability to analyze transaction patterns and implement effective fraud prevention strategies.

Skills : Fraud Detection, Data Analysis, Risk Assessment, Regulatory Compliance

Description :

- Monitor real-time transaction queues to identify and assess high-risk activities.

- Analyze customer transactions to detect and prevent fraudulent activities, minimizing revenue loss.

- Collaborate with banks and customers to validate transaction details and manage authorizations.

- Resolve customer inquiries and issues in accordance with established service level agreements.

- Maintain and enhance fraud analysis models to improve operational efficiency.

- Ensure confidentiality and integrity of sensitive information during investigations.

- Identify and report emerging fraud trends by analyzing transaction patterns and account behaviors.

Experience

0-2 Years

Level

Entry Level

Education

BSc Finance

Specialty Fraud Analyst Resume

Objective : Detail-oriented Fraud Analyst with 5 years of experience in detecting and preventing fraudulent activities. Proficient in data analysis, investigation techniques, and regulatory compliance, ensuring minimal financial loss and maintaining high decision quality.

Skills : Data Analysis Software, Fraud Detection Tools, Risk Assessment, Data Mining, Fraud Investigation

Description :

- Analyzed financial data to identify and mitigate fraudulent activities, ensuring compliance with regulations.

- Collaborated with consumers and merchants to investigate and resolve suspicious transactions.

- Conducted thorough investigations of fraudulent applications, leading to timely resolutions.

- Monitored daily ATM Network Settlement Reports to detect anomalies and prevent losses.

- Utilized in-house databases to research and resolve cardholder disputes effectively.

- Managed ATM case openings to ensure prompt crediting of non-dispensed funds to cardholders.

- Facilitated chargebacks to international partners, ensuring accurate fund transfers.

Experience

2-5 Years

Level

Executive

Education

BSc Finance

Fraud Analyst III Resume

Objective : Detail-oriented Fraud Analyst with over 5 years of experience in fraud detection and prevention. Proven track record in analyzing complex data, identifying fraudulent activities, and implementing effective risk management strategies.

Skills : Data analysis proficiency, Fraud detection techniques, Report writing and documentation, Analytical thinking, Data visualization tools

Description :

- Led the implementation of a new fraud management system, enhancing detection capabilities and reducing fraud incidents by 40%.

- Conducted in-depth analysis of roaming fraud, collaborating with major US telecom companies to mitigate risks.

- Resolved multiple rating discrepancies, ensuring accurate billing and customer satisfaction.

- Identified and apprehended a major fraudster, recovering $500K in losses through thorough investigation.

- Executed audits, including HLR and voucher audits, uncovering $200K in revenue discrepancies.

- Investigated internal fraud cases, conducting interviews that led to the dismissal of multiple employees for breaches of confidentiality.

- Analyzed various fraud scenarios, including phishing and international revenue share fraud, implementing preventive measures.

Experience

2-5 Years

Level

Junior

Education

BSCJ

Fraud Analyst II Resume

Objective : Detail-oriented Fraud Analyst with 5 years of experience in investigating financial crimes, analyzing transaction data, and preparing compliance reports. Proven track record in identifying fraud patterns and implementing effective controls.

Skills : Data Analysis, Fraud Detection, Risk Assessment, Data Mining, Report Writing

Description :

- Reviewed and analyzed transaction data to detect potential internal and external fraud schemes.

- Identified fraud trends and documented findings to enhance fraud prevention strategies.

- Conducted thorough investigations into suspicious activities, gathering relevant evidence.

- Prepared and submitted Suspicious Activity Reports (SARs) to the Financial Crimes Enforcement Network (FinCEN).

- Ensured compliance with FinCEN regulations and internal policies during investigations.

- Trained new employees on fraud detection techniques and compliance protocols.

- Developed and implemented SAR templates to streamline reporting processes.

Experience

2-5 Years

Level

Junior

Education

BSF

Risk & Fraud Analyst Resume

Objective : Detail-oriented Fraud Analyst with 2 years of experience in identifying and mitigating fraud risks. Proven ability to analyze data trends, investigate suspicious activities, and implement effective countermeasures to protect organizational assets.

Skills : Data Entry Proficiency, Data Analysis, Risk Assessment, Regulatory Compliance, Incident Reporting

Description :

- Received and processed customer inquiries, ensuring accurate data entry and adherence to call scripts.

- Analyzed and responded to emerging fraud trends, enhancing detection capabilities.

- Investigated and resolved irregular transactions, safeguarding customer accounts.

- Maintained detailed records of suspicious activities for compliance and reporting.

- Collaborated with cross-functional teams to escalate security threats and recommend solutions.

- Managed fraud risk rules within systems, optimizing adjudication processes.

- Provided training on fraud detection protocols to new team members, fostering a culture of vigilance.

Experience

0-2 Years

Level

Entry Level

Education

BSCJ

Fraud Analyst/Underwriter Resume

Headline : Detail-oriented Fraud Analyst with 7 years of experience in investigating financial discrepancies, analyzing data patterns, and implementing fraud prevention strategies to protect organizational assets and enhance compliance.

Skills : Financial Analysis, Financial Analysis, Data Entry Accuracy, Data Entry Accuracy

Description :

- Investigated and reported claims of financial abuse, ensuring compliance with regulations.

- Utilized analytical skills to assess banking products for potential fraud indicators.

- Prepared detailed reports for regulatory agencies, enhancing case resolution.

- Communicated effectively with stakeholders to clarify case details and findings.

- Prioritized cases to meet deadlines, improving overall efficiency.

- Processed Suspicious Activity Reports, contributing to fraud prevention efforts.

- Collaborated with law enforcement on complex fraud cases, ensuring thorough investigations.

Experience

5-7 Years

Level

Executive

Education

BSF

Lead Fraud Analyst Resume

Objective : Detail-oriented Fraud Analyst with 2 years of experience in detecting and preventing fraudulent activities. Proven ability to analyze data, implement effective countermeasures, and enhance fraud detection processes.

Skills : Data Mining, Regulatory Compliance, Transaction Monitoring, Report Generation, Investigative Techniques

Description :

- Monitored account activity to identify trends indicative of potential fraud.

- Conducted thorough analyses to detect front-end and back-end fraud, implementing effective countermeasures.

- Assisted in developing operational fraud processes to enhance program support.

- Evaluated existing fraud processes, recommending improvements to increase efficiency.

- Collaborated with cross-functional teams to make informed business decisions regarding fraud prevention.

- Collected and analyzed data from various sources to support fraud investigations.

- Drafted business requirements to address system issues and document processes.

Experience

0-2 Years

Level

Junior

Education

BSCJ

Jr. Fraud Analyst Resume

Objective : Detail-oriented Fraud Analyst with 5 years of experience in detecting and preventing fraudulent activities. Proficient in data analysis, risk assessment, and implementing effective fraud prevention strategies to protect organizational assets.

Skills : Data Analysis Tools, Fraud Detection Techniques, Risk Assessment, Data Interpretation, Fraud Investigation

Description :

- Conducted thorough reviews of customer accounts using advanced auditing tools to identify and flag fraudulent activities.

- Analyzed account data to determine discrepancies and issued refunds to affected customers.

- Collaborated with major shipping carriers to intercept and investigate fraudulent deliveries.

- Utilized data analysis to provide insights on cost, margin, and breakeven points for fraud-related cases.

- Performed trend analysis to recommend adjustments in fraud prevention strategies.

- Created a comprehensive Excel database to streamline access to critical fraud-related information.

- Provided actionable insights to management and sales teams to enhance fraud detection efforts.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Fraud Analyst Resume

Headline : Detail-oriented Fraud Analyst with 7 years of experience in detecting and preventing fraudulent activities. Proven track record in analyzing data, managing investigations, and implementing effective fraud prevention strategies.

Skills : Data Analysis, Fraud Detection, Risk Assessment, Data Mining, Regulatory Compliance

Description :

- Monitored credit card accounts for fraudulent activity, addressing fraud concerns from cardholders and internal teams.

- Conducted thorough reviews of automated fraud alerts from TSYS and FDR systems.

- Analyzed flagged accounts, contacted customers, and made informed decisions to block or allow transactions.

- Managed fraud claims investigations using Pega, ensuring timely resolution.

- Created and maintained an Excel spreadsheet to track monthly fraud detection metrics.

- Reported suspicious activities to supervisors for Suspicious Activity Reports (SARs) completion.

- Recommended improvements to internal controls based on fraud queue analysis.

Experience

5-7 Years

Level

Executive

Education

BSCJ

Fraud Analyst/Associate Trainer Resume

Objective : Detail-oriented Fraud Analyst with 5 years of experience in detecting and preventing fraudulent activities. Proficient in data analysis, risk assessment, and implementing effective fraud prevention strategies to safeguard assets.

Skills : Analytical skills, Risk assessment, Fraud detection techniques, Data analysis

Description :

- Analyzed account activities using advanced fraud detection tools to minimize risk and prevent losses.

- Implemented effective loss prevention strategies, safeguarding bank assets and reducing operational losses.

- Provided exceptional service to clients and partners by utilizing fraud filters and research tools efficiently.

- Collaborated with business partners to process operational charge-off losses, ensuring compliance with regulations.

- Responded to inquiries from branches and internal departments, resolving card-related issues with vendors.

- Executed tasks with precision, including card maintenance, fraud claims, and ATM dispute resolutions.

- Managed compromised card alerts, reducing exposure for members and the credit union.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Risk Fraud Analyst Resume

Headline : Detail-oriented Fraud Analyst with 7 years of experience in detecting and preventing fraudulent activities. Proven track record in analyzing financial data, implementing fraud prevention strategies, and collaborating with law enforcement.

Skills : Fraud Detection, Data Analysis, Risk Assessment, Regulatory Compliance, Investigation Techniques

Description :

- Conducted thorough investigations into potential fraud cases, analyzing financial records and transaction patterns to identify suspicious activities.

- Implemented quality control measures to ensure compliance with regulatory standards and internal policies, enhancing fraud detection processes.

- Collaborated with cross-functional teams to develop and refine fraud prevention strategies, resulting in a significant reduction in fraudulent activities.

- Utilized advanced data analytics tools to monitor transactions in real-time, identifying anomalies and mitigating risks effectively.

- Prepared detailed reports on fraud investigations, presenting findings to management and recommending actionable solutions.

- Trained and mentored junior analysts on fraud detection techniques and best practices, fostering a culture of vigilance within the team.

- Maintained up-to-date knowledge of emerging fraud trends and technologies, adapting strategies to counteract new threats.

Experience

5-7 Years

Level

Consultant

Education

B.S. Finance

Fraud Analyst I Resume

Headline : Detail-oriented Fraud Analyst with 7 years of experience in detecting and preventing fraudulent activities. Proven track record in analyzing transactions, implementing fraud prevention strategies, and collaborating with cross-functional teams to mitigate risks.

Skills : Fraud Detection, Risk Assessment, Data Analysis, Chargeback Management, Regulatory Compliance

Description :

- Investigated and resolved debit and credit card claims, ensuring compliance with Visa, MasterCard, and Discover regulations.

- Collaborated with internal teams to identify and mitigate risks associated with customer disputes.

- Authored and updated departmental procedures, enhancing operational efficiency and cross-training initiatives.

- Led process improvement projects, transitioning manual processes to electronic systems, saving $3,000 annually.

- Facilitated successful offshoring initiatives that reduced operational costs.

- Developed tools to identify transaction anomalies, increasing productivity and accuracy.

- Conducted training sessions for staff on fraud detection techniques and regulatory compliance.

Experience

5-7 Years

Level

Executive

Education

B.S. Finance

Fraud Analyst Associate Resume

Objective : Detail-oriented Fraud Analyst with 5 years of experience in detecting and investigating fraudulent activities. Proven ability to analyze data, mitigate risks, and enhance security measures to protect financial assets.

Skills : Data Analysis, Report Writing, Fraud Detection, Risk Assessment, Data Management

Description :

- Identified and investigated bankcard fraud cases using proprietary tools and customer reports.

- Analyzed raw data and utilized data mining tools to detect suspicious fraud activities.

- Organized and assessed data for case development using analytical and tracking tools.

- Collaborated with senior staff to analyze points of compromise and notify customers of risks.

- Executed tasks related to fraud detection using proprietary software and in-house tools.

- Maintained knowledge of card industry trends, focusing on counterfeit and routing fraud.

- Adhered to standard fraud investigation practices to ensure thorough case handling.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Fraud Analyst Resume

Headline : Detail-oriented Fraud Analyst with 7 years of experience in detecting and preventing fraudulent activities. Proven track record in data analysis, risk assessment, and implementing effective fraud prevention strategies.

Skills : Bilingual (Spanish), Fraud Detection, Data Analysis, Risk Assessment, Regulatory Compliance

Description :

- Conducted in-depth fraud analysis across multiple business lines to identify and mitigate risks.

- Reviewed transactions to detect fraudulent activities, leading to a 30% reduction in losses.

- Utilized advanced verification tools to enhance fraud detection and prevention efforts.

- Identified emerging fraud trends, resulting in the implementation of improved data-mining tools.

- Provided exceptional customer service by addressing inquiries related to fraud and dispute claims.

- Consistently flagged 15 fraudulent online orders monthly, saving the company over $500,000.

- Achieved and exceeded productivity metrics, ensuring high-quality performance in all tasks.

Experience

5-7 Years

Level

Executive

Education

BSCJ

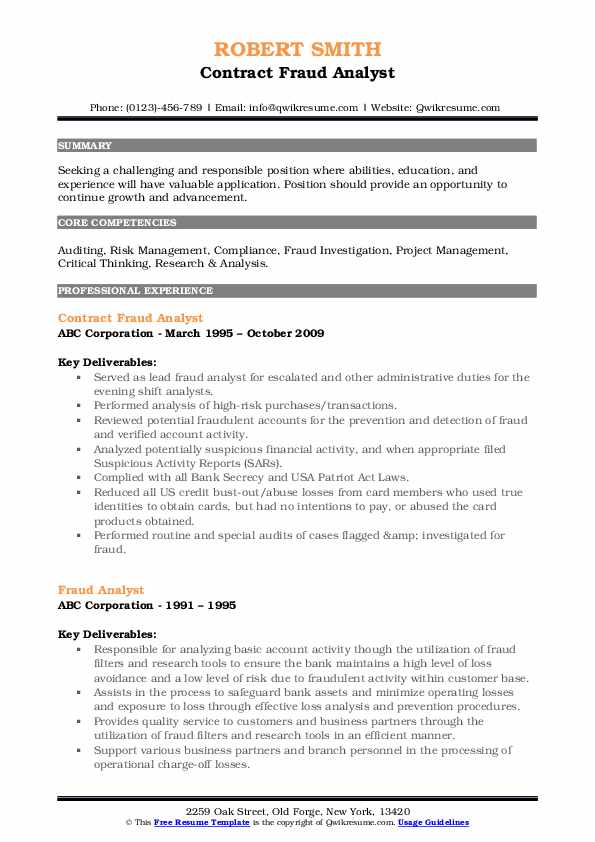

Contract Fraud Analyst Resume

Summary : Detail-oriented Fraud Analyst with 10 years of experience in detecting and preventing fraudulent activities. Proven track record in analyzing transactions, conducting audits, and ensuring compliance with regulations to safeguard assets.

Skills : Fraud Detection, Data Analysis, Regulatory Compliance, Risk Assessment, Transaction Monitoring

Description :

- Led fraud analysis initiatives, managing escalated cases and guiding evening shift analysts.

- Conducted thorough analysis of high-risk transactions to identify potential fraud.

- Reviewed and verified account activities to prevent and detect fraudulent actions.

- Filed Suspicious Activity Reports (SARs) for identified suspicious financial activities.

- Ensured compliance with Bank Secrecy and USA Patriot Act regulations.

- Executed routine audits on flagged cases, enhancing fraud investigation processes.

- Recommended improvements for fraud case documentation accuracy and efficiency.

Experience

10+ Years

Level

Senior

Education

BSc Finance