Hedge Fund Manager Resume

Headline : Dynamic Hedge Fund Manager with over 7 years of experience in optimizing investment strategies and managing diverse portfolios. Proven expertise in conducting thorough due diligence, risk assessment, and performance analysis to drive superior returns. Adept at fostering client relationships and collaborating with cross-functional teams to enhance fund performance and compliance.

Skills : Investment Analysis And Financial Modeling, Quantitative Analysis, Risk Assessment, Financial Modeling

Description :

- Develop and implement investment strategies to maximize returns for clients.

- Facilitated strategic meetings and presentations with clients, significantly increasing assets under management.

- Conducted comprehensive research on diverse investment vehicles to ensure optimal asset selection for superior returns.

- Implemented risk mitigation strategies to safeguard investments and enhance client confidence.

- Regularly communicated research findings to portfolio managers and analysts to inform investment decisions.

- Collaborated with the portfolio management team to identify and recommend high-potential investment opportunities.

- Monitored and adjusted investment strategies based on market trends and fund performance metrics.

Experience

5-7 Years

Level

Management

Education

MBA

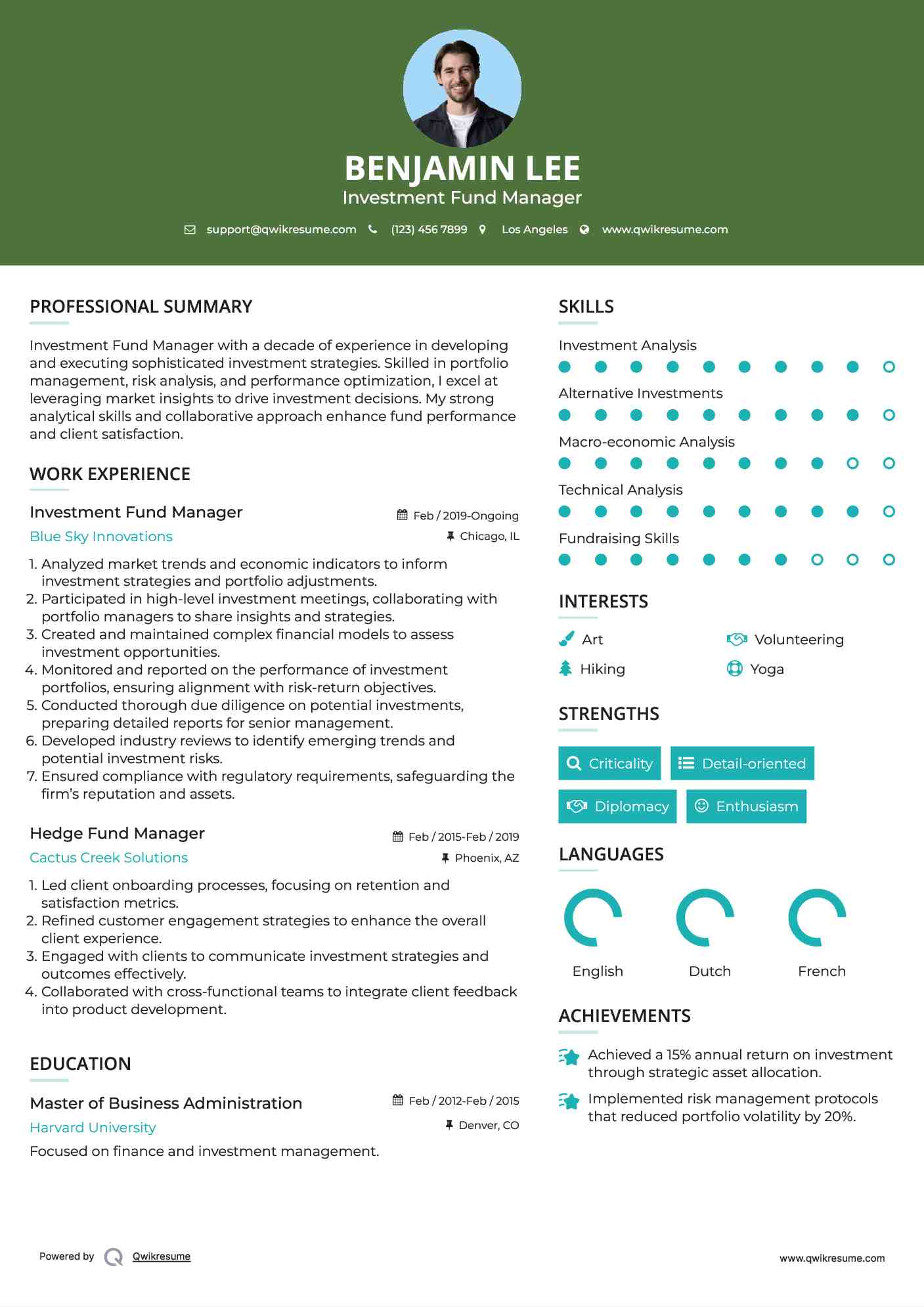

Investment Fund Manager Resume

Summary : Investment Fund Manager with a decade of experience in developing and executing sophisticated investment strategies. Skilled in portfolio management, risk analysis, and performance optimization, I excel at leveraging market insights to drive investment decisions. My strong analytical skills and collaborative approach enhance fund performance and client satisfaction.

Skills : Investment Analysis, Alternative Investments, Macro-economic Analysis, Technical Analysis, Fundraising Skills

Description :

- Analyzed market trends and economic indicators to inform investment strategies and portfolio adjustments.

- Participated in high-level investment meetings, collaborating with portfolio managers to share insights and strategies.

- Created and maintained complex financial models to assess investment opportunities.

- Monitored and reported on the performance of investment portfolios, ensuring alignment with risk-return objectives.

- Conducted thorough due diligence on potential investments, preparing detailed reports for senior management.

- Developed industry reviews to identify emerging trends and potential investment risks.

- Ensured compliance with regulatory requirements, safeguarding the firm’s reputation and assets.

Experience

10+ Years

Level

Executive

Education

MBA

Hedge Fund Manager Resume

Objective : Ambitious Hedge Fund Manager with 2 years of experience in developing strategic investment initiatives. Skilled in analyzing market trends and optimizing portfolio performance to achieve targeted returns. Proficient in risk management, regulatory compliance, and fostering key client relationships to drive growth and ensure fund success.

Skills : Client Communication, Relationship Building, Market Analysis, Investment Risk, Client Portfolio Management, Financial Regulations

Description :

- Collaborated with stakeholders to ensure compliance with regulatory obligations affecting investment strategies and trading operations.

- Monitored evolving regulatory landscapes and communicated implications to management and key stakeholders.

- Worked alongside legal teams to clarify regulatory requirements impacting trading activities.

- Contributed to the development and review of compliance policies to align with industry best practices.

- Provided advisory support to ensure adherence to compliance policies across all operational levels.

- Delivered ongoing training on compliance policies and regulatory requirements to enhance team awareness.

- Partnered with various departments to promote a strong culture of compliance within the organization.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

Hedge Fund Portfolio Manager Resume

Objective : Accomplished Hedge Fund Portfolio Manager with 5 years of experience in devising and implementing robust investment strategies. Expertise in quantitative analysis, risk management, and performance metrics, driving investment success. Proven ability to build strong client relationships and lead teams to optimize fund performance and compliance.

Skills : Negotiation Skills, Client Relationship Management, Strategic Planning, Asset Allocation, Performance Metrics, Equity Research

Description :

- Conducted in-depth financial analysis to evaluate investment opportunities and risks.

- Developed and executed investment strategies aligned with client objectives and market conditions.

- Monitored portfolio performance, adjusting strategies to optimize returns and minimize risks.

- Collaborated with analysts to assess market trends and economic indicators influencing investments.

- Prepared detailed reports for stakeholders on portfolio performance and strategic recommendations.

- Maintained compliance with regulatory requirements and internal policies.

- Led client presentations and meetings to communicate investment strategies and performance updates.

Experience

2-5 Years

Level

Junior

Education

MBA

Hedge Fund Manager Resume

Objective : Results-oriented Hedge Fund Manager with 2 years of experience driving investment performance through strategic analysis and portfolio optimization. Expert in market trend evaluation, risk management, and regulatory compliance. Proven ability to enhance client relations and collaborate across teams, ensuring fund success and sustainable growth.

Skills : Strategic Negotiation, Chartered Financial Analyst (cfa), Trading Strategies, Market Research, Behavioral Finance, Investment Research

Description :

- Ensured adherence to internal and regulatory credit policies, enhancing portfolio compliance.

- Contributed to risk management processes, proposing limit adjustments and addressing client inquiries promptly.

- Participated in strategic account planning sessions to align with customer business objectives.

- Conducted credit due diligence and prepared detailed reports on credit risk discussions.

- Collaborated with legal and financial teams to structure transactions effectively.

- Assisted in negotiating credit terms, preparing comprehensive Credit Term Sheets.

- Maintained strong relationships with key stakeholders to facilitate effective risk management.

Experience

0-2 Years

Level

Entry Level

Education

BFin

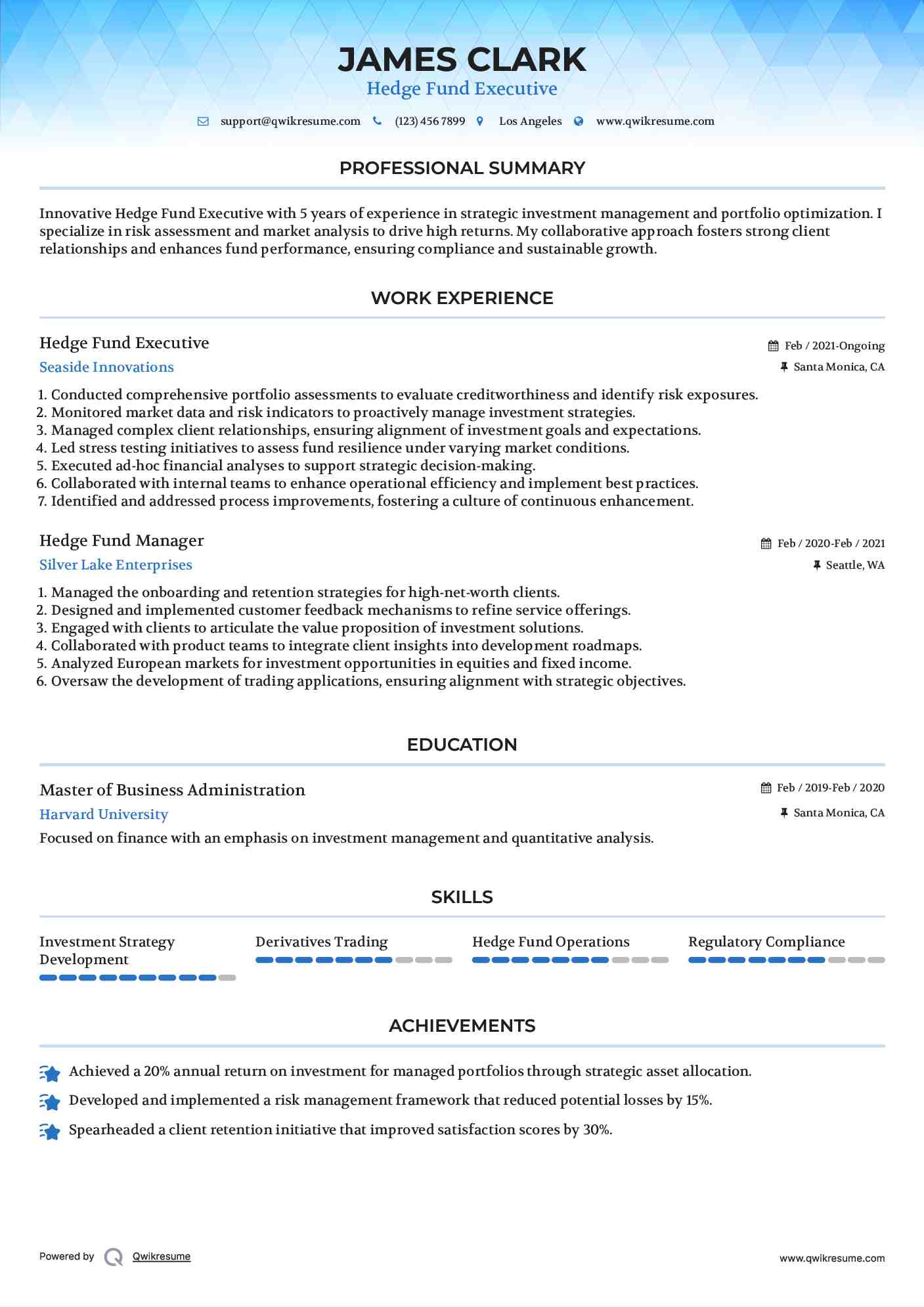

Hedge Fund Executive Resume

Objective : Innovative Hedge Fund Executive with 5 years of experience in strategic investment management and portfolio optimization. I specialize in risk assessment and market analysis to drive high returns. My collaborative approach fosters strong client relationships and enhances fund performance, ensuring compliance and sustainable growth.

Skills : Investment Strategy Development, Derivatives Trading, Hedge Fund Operations, Regulatory Compliance

Description :

- Conducted comprehensive portfolio assessments to evaluate creditworthiness and identify risk exposures.

- Monitored market data and risk indicators to proactively manage investment strategies.

- Managed complex client relationships, ensuring alignment of investment goals and expectations.

- Led stress testing initiatives to assess fund resilience under varying market conditions.

- Executed ad-hoc financial analyses to support strategic decision-making.

- Collaborated with internal teams to enhance operational efficiency and implement best practices.

- Identified and addressed process improvements, fostering a culture of continuous enhancement.

Experience

2-5 Years

Level

Executive

Education

MBA

Hedge Fund Manager Resume

Headline : Strategic Hedge Fund Manager with 7 years of experience in formulating and executing high-yield investment strategies. Expertise in portfolio management, risk mitigation, and quantitative analysis to maximize returns. Proven ability to cultivate investor relations and enhance fund performance through data-driven insights and collaborative teamwork.

Skills : Market Trends Analysis, Team Leadership, Data Analysis, Operational Efficiency, Quantitative Research, Due Diligence

Description :

- Prepare detailed reports and presentations for stakeholders and clients.

- Authored analytical papers summarizing insights from academic research and market trends.

- Led the development and testing of quantitative models to enhance investment strategies.

- Facilitated collaboration between research teams and IT for streamlined operations.

- Applied advanced programming skills in R and Python to build factor-based portfolio models.

- Managed trading activities utilizing SQL Server and financial risk models to optimize performance.

- Coordinated schedules and activities for senior management, ensuring efficient operations.

Experience

5-7 Years

Level

Management

Education

MBA

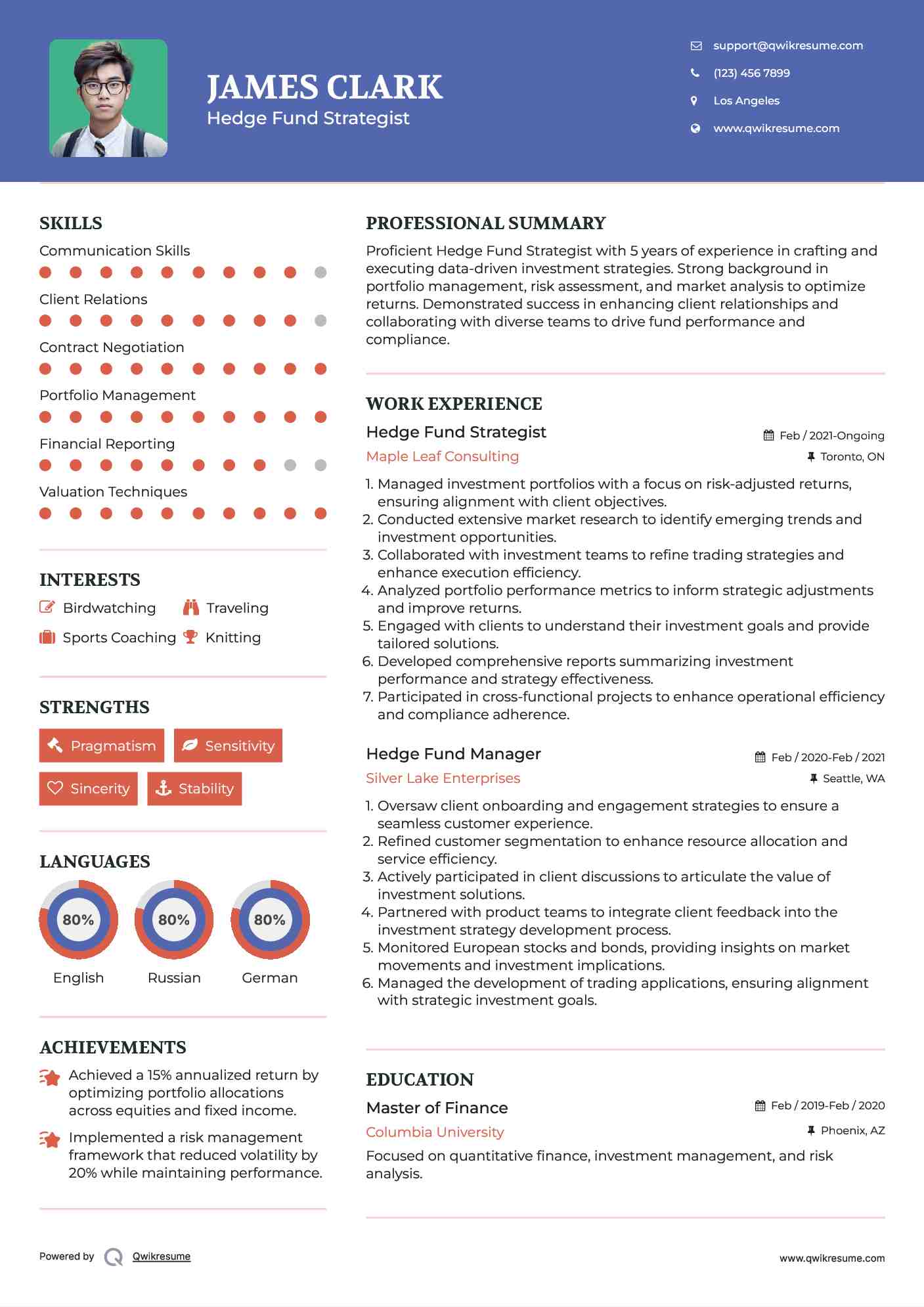

Hedge Fund Strategist Resume

Objective : Proficient Hedge Fund Strategist with 5 years of experience in crafting and executing data-driven investment strategies. Strong background in portfolio management, risk assessment, and market analysis to optimize returns. Demonstrated success in enhancing client relationships and collaborating with diverse teams to drive fund performance and compliance.

Skills : Communication Skills, Client Relations, Contract Negotiation, Portfolio Management, Financial Reporting, Valuation Techniques

Description :

- Managed investment portfolios with a focus on risk-adjusted returns, ensuring alignment with client objectives.

- Conducted extensive market research to identify emerging trends and investment opportunities.

- Collaborated with investment teams to refine trading strategies and enhance execution efficiency.

- Analyzed portfolio performance metrics to inform strategic adjustments and improve returns.

- Engaged with clients to understand their investment goals and provide tailored solutions.

- Developed comprehensive reports summarizing investment performance and strategy effectiveness.

- Participated in cross-functional projects to enhance operational efficiency and compliance adherence.

Experience

2-5 Years

Level

Consultant

Education

MFin

Hedge Fund Manager Resume

Summary : Accomplished Hedge Fund Manager with 10 years of experience in delivering high-performance investment strategies and managing complex portfolios. Expertise in quantitative analysis, risk management, and client engagement drives superior returns. Proven track record in optimizing fund operations and fostering strategic partnerships to achieve sustainable growth.

Skills : Asset Management, Investor Relations, Performance Analysis, Financial Advisory, Investment Due Diligence, Financial Strategy

Description :

- Oversaw compliance programs for multiple hedge funds, ensuring adherence to SEC regulations and best practices.

- Prepared and submitted regulatory filings, including Form ADV and Form PF, ensuring timely and accurate reporting.

- Collaborated with C-suite executives to enhance operational readiness for regulatory examinations.

- Conducted comprehensive mock audits and compliance reviews to identify and mitigate risks.

- Developed and revised governance policies to align with industry standards and regulatory requirements.

- Reviewed and approved marketing materials and investment documents to ensure compliance and accuracy.

- Trained staff on compliance protocols and investment strategies to enhance team performance.

Experience

10+ Years

Level

Executive

Education

MBA

Hedge Fund Manager Resume

Objective : Accomplished Hedge Fund Manager with 5 years of experience in developing strategic investment initiatives and optimizing portfolio performance. Expertise in risk analysis, compliance, and fostering robust client relationships to drive sustainable growth. Proven track record of leveraging market insights to enhance fund performance and achieve superior returns.

Skills : Capital Markets, Research Methodologies, Statistical Analysis, Financial Forecasting, Credit Analysis

Description :

- Conducted comprehensive compliance surveillance and testing to mitigate risks associated with personal trading and conflicts of interest.

- Educated and trained employees on firm policies and ethical standards to enhance compliance awareness.

- Monitored and managed relationships with third-party vendors to ensure alignment with investment strategies.

- Supervised and mentored junior analysts, fostering professional development and analytical skills.

- Managed Soft Dollar expenditures, optimizing cost efficiency in trading operations.

- Performed in-depth risk assessments to identify and address compliance vulnerabilities.

- Developed and implemented best practices for compliance and performance metrics, driving fund success.

Experience

2-5 Years

Level

Junior

Education

MBA