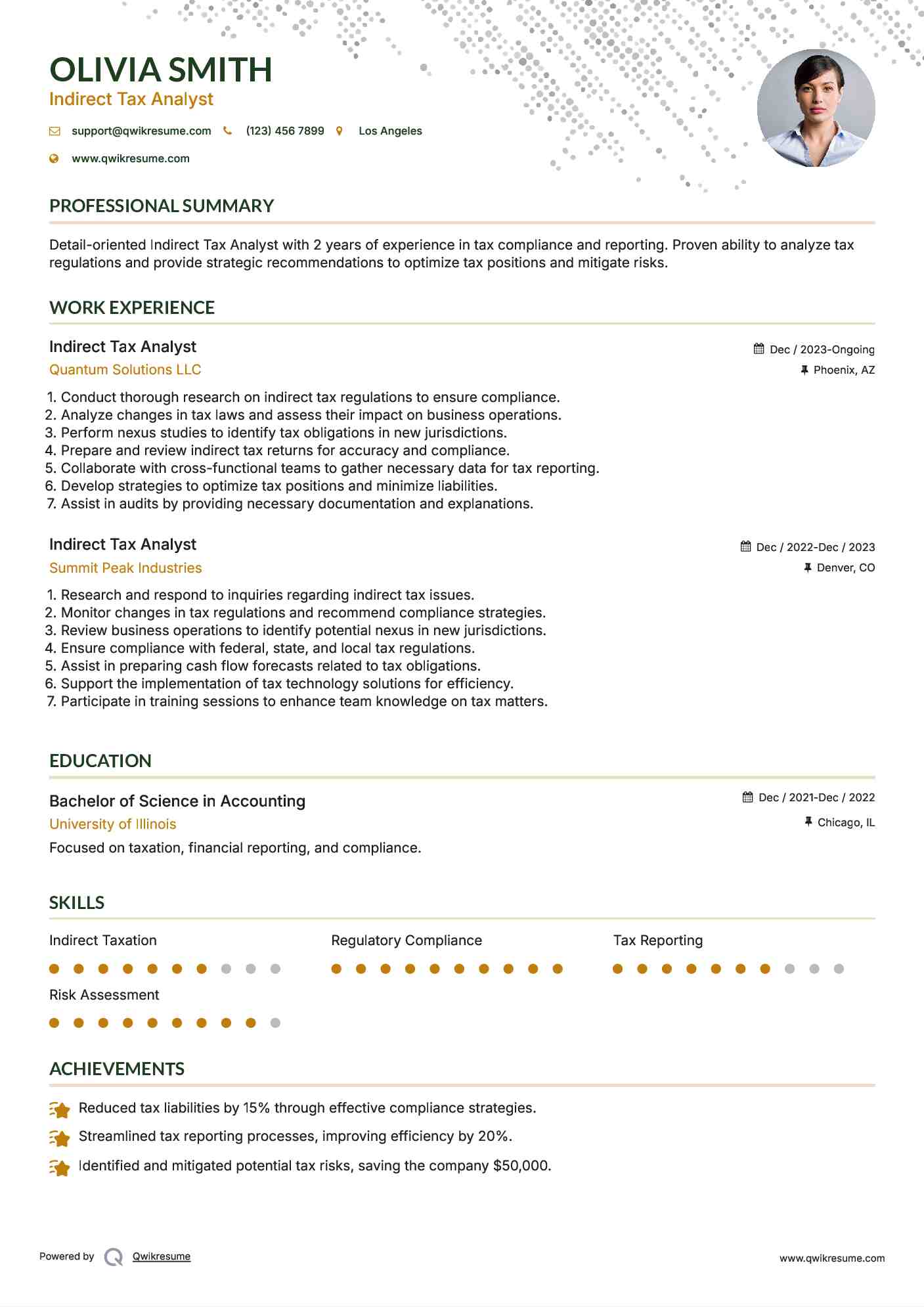

Indirect Tax Analyst Resume

Objective : Detail-oriented Indirect Tax Analyst with 2 years of experience in tax compliance and reporting. Proven ability to analyze tax regulations and provide strategic recommendations to optimize tax positions and mitigate risks.

Skills : Indirect Taxation, Regulatory Compliance, Tax Reporting, Risk Assessment

Description :

- Conduct thorough research on indirect tax regulations to ensure compliance.

- Analyze changes in tax laws and assess their impact on business operations.

- Perform nexus studies to identify tax obligations in new jurisdictions.

- Prepare and review indirect tax returns for accuracy and compliance.

- Collaborate with cross-functional teams to gather necessary data for tax reporting.

- Develop strategies to optimize tax positions and minimize liabilities.

- Assist in audits by providing necessary documentation and explanations.

Experience

0-2 Years

Level

Entry Level

Education

BSc Accounting

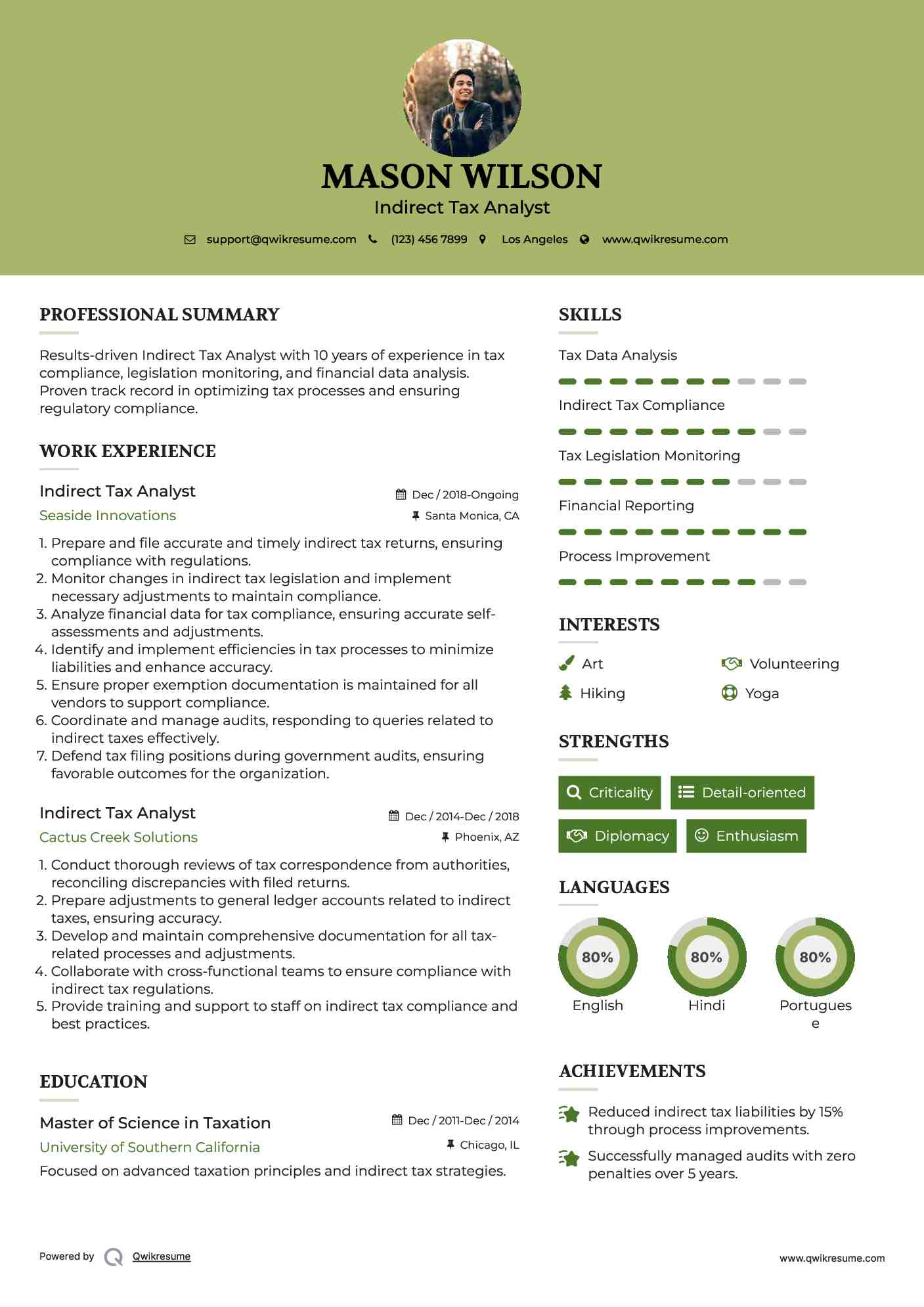

Indirect Tax Analyst Resume

Summary : Results-driven Indirect Tax Analyst with 10 years of experience in tax compliance, legislation monitoring, and financial data analysis. Proven track record in optimizing tax processes and ensuring regulatory compliance.

Skills : Tax Data Analysis, Indirect Tax Compliance, Tax Legislation Monitoring, Financial Reporting, Process Improvement

Description :

- Prepare and file accurate and timely indirect tax returns, ensuring compliance with regulations.

- Monitor changes in indirect tax legislation and implement necessary adjustments to maintain compliance.

- Analyze financial data for tax compliance, ensuring accurate self-assessments and adjustments.

- Identify and implement efficiencies in tax processes to minimize liabilities and enhance accuracy.

- Ensure proper exemption documentation is maintained for all vendors to support compliance.

- Coordinate and manage audits, responding to queries related to indirect taxes effectively.

- Defend tax filing positions during government audits, ensuring favorable outcomes for the organization.

Experience

10+ Years

Level

Senior

Education

MST

Indirect Tax Analyst Resume

Summary : Results-driven Indirect Tax Analyst with 10 years of experience in tax compliance, risk assessment, and regulatory changes. Proven ability to collaborate with cross-functional teams to optimize tax strategies and ensure compliance.

Skills : Tax Research Skills, Regulatory Compliance, Data Analysis, Tax Risk Management, Financial Reporting

Description :

- Conduct comprehensive tax research to ensure compliance with indirect tax regulations.

- Analyze intercompany transactions to determine withholding tax obligations.

- Review and assess vendor contracts for potential tax risks and liabilities.

- Collaborate on systems integration projects for newly acquired entities to ensure tax compliance.

- Provide expert guidance to internal stakeholders on indirect tax matters and compliance requirements.

- Prepare documentation to support tax positions and liaise with external tax advisors.

- Engage with tax authorities during audits and inquiries to resolve issues effectively.

Experience

7-10 Years

Level

Management

Education

MST

Indirect Tax Analyst Resume

Objective : Detail-oriented Indirect Tax Analyst with 5 years of experience in tax compliance, risk management, and cross-functional collaboration. Proven track record in optimizing tax processes and ensuring regulatory compliance.

Skills : Analytical Skills, Tax Compliance, Regulatory Analysis, Data Analysis, Risk Assessment

Description :

- Conduct comprehensive tax compliance reviews to ensure adherence to federal and state regulations.

- Collaborate with cross-functional teams to integrate tax considerations into business strategies.

- Prepare detailed analyses and memos on tax implications of business transactions.

- Manage relationships with tax authorities during audits and inquiries, ensuring timely responses.

- Research and interpret tax laws to provide guidance on compliance and planning strategies.

- Assist in the preparation of transfer pricing documentation and compliance reports.

- Support the implementation of tax risk management frameworks across the organization.

Experience

2-5 Years

Level

Executive

Education

Bachelor's Degree in Finance

Indirect Tax Analyst Resume

Objective : Detail-oriented Indirect Tax Analyst with 2 years of experience in VAT compliance, reconciliation, and reporting. Proven ability to enhance tax processes and ensure adherence to regulations while delivering accurate financial data.

Skills : Tax Software Proficiency, Data Analysis, Financial Reporting, Tax Reconciliation, Regulatory Research

Description :

- Conduct monthly reconciliations of indirect tax accounts to ensure accuracy and compliance.

- Prepare and review tax-related journal entries to maintain accurate financial records.

- Deliver comprehensive financial reports related to indirect tax for management review.

- Ensure compliance with indirect tax regulations and reporting obligations across jurisdictions.

- Enhance transactional compliance processes within the finance team to mitigate risks.

- Produce detailed balance sheet reconciliations with supporting documentation for audits.

- Identify and implement process improvements to enhance efficiency and control in tax operations.

Experience

0-2 Years

Level

Junior

Education

BSc Accounting

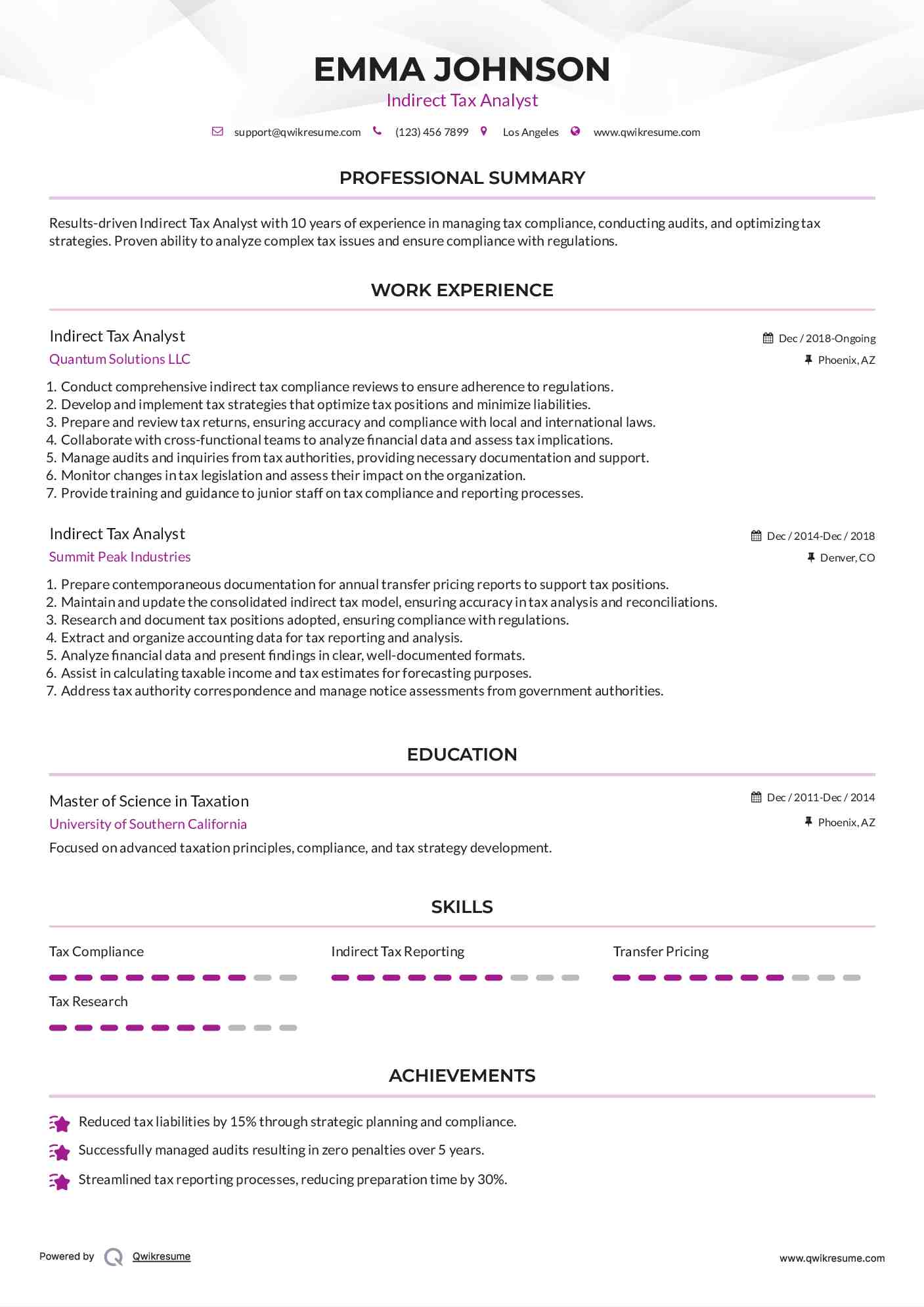

Indirect Tax Analyst Resume

Summary : Results-driven Indirect Tax Analyst with 10 years of experience in managing tax compliance, conducting audits, and optimizing tax strategies. Proven ability to analyze complex tax issues and ensure compliance with regulations.

Skills : Tax Compliance, Indirect Tax Reporting, Transfer Pricing, Tax Research

Description :

- Conduct comprehensive indirect tax compliance reviews to ensure adherence to regulations.

- Develop and implement tax strategies that optimize tax positions and minimize liabilities.

- Prepare and review tax returns, ensuring accuracy and compliance with local and international laws.

- Collaborate with cross-functional teams to analyze financial data and assess tax implications.

- Manage audits and inquiries from tax authorities, providing necessary documentation and support.

- Monitor changes in tax legislation and assess their impact on the organization.

- Provide training and guidance to junior staff on tax compliance and reporting processes.

Experience

7-10 Years

Level

Consultant

Education

MST

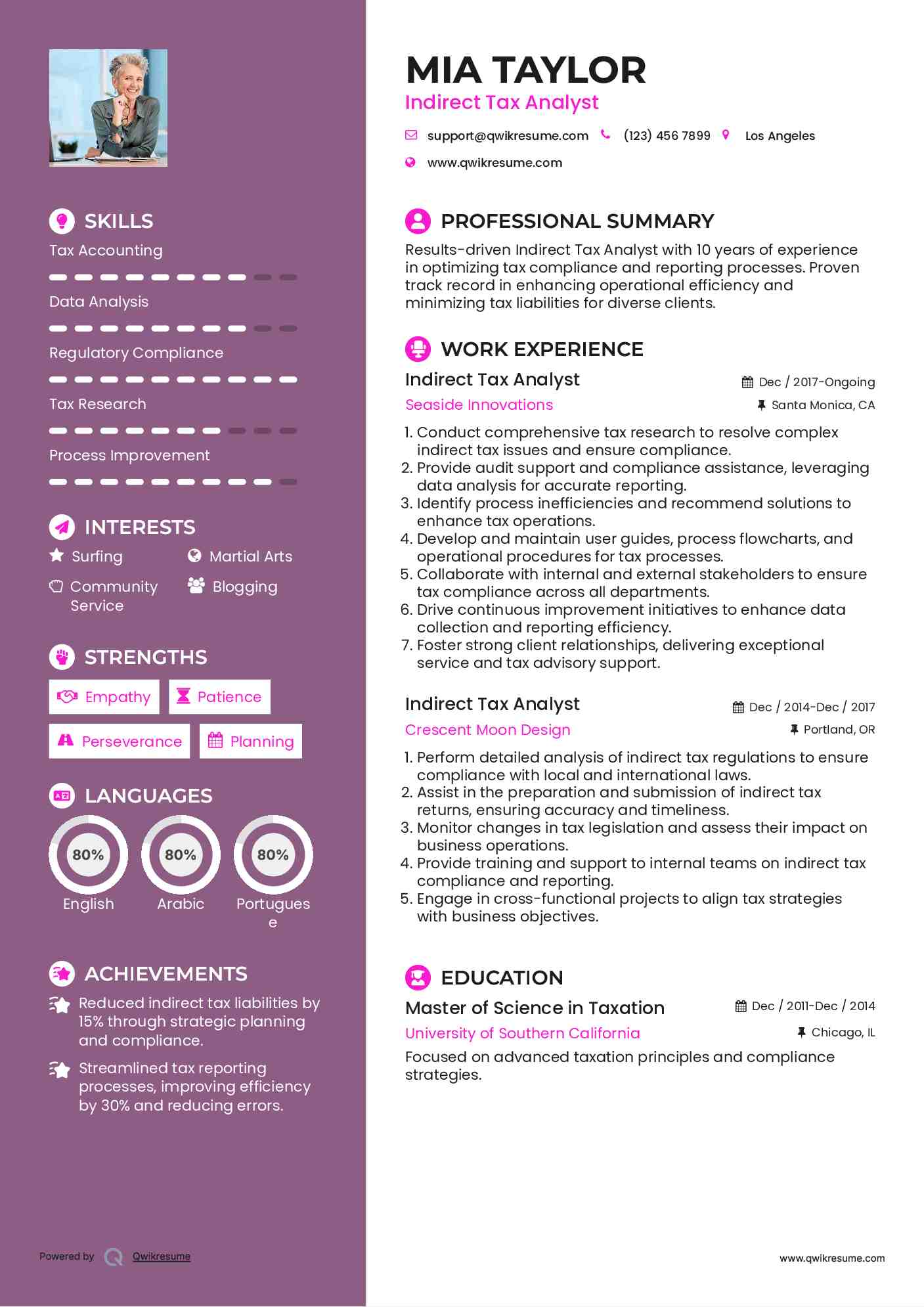

Indirect Tax Analyst Resume

Summary : Results-driven Indirect Tax Analyst with 10 years of experience in optimizing tax compliance and reporting processes. Proven track record in enhancing operational efficiency and minimizing tax liabilities for diverse clients.

Skills : Tax Accounting, Data Analysis, Regulatory Compliance, Tax Research, Process Improvement

Description :

- Conduct comprehensive tax research to resolve complex indirect tax issues and ensure compliance.

- Provide audit support and compliance assistance, leveraging data analysis for accurate reporting.

- Identify process inefficiencies and recommend solutions to enhance tax operations.

- Develop and maintain user guides, process flowcharts, and operational procedures for tax processes.

- Collaborate with internal and external stakeholders to ensure tax compliance across all departments.

- Drive continuous improvement initiatives to enhance data collection and reporting efficiency.

- Foster strong client relationships, delivering exceptional service and tax advisory support.

Experience

10+ Years

Level

Senior

Education

MST

Indirect Tax Analyst Resume

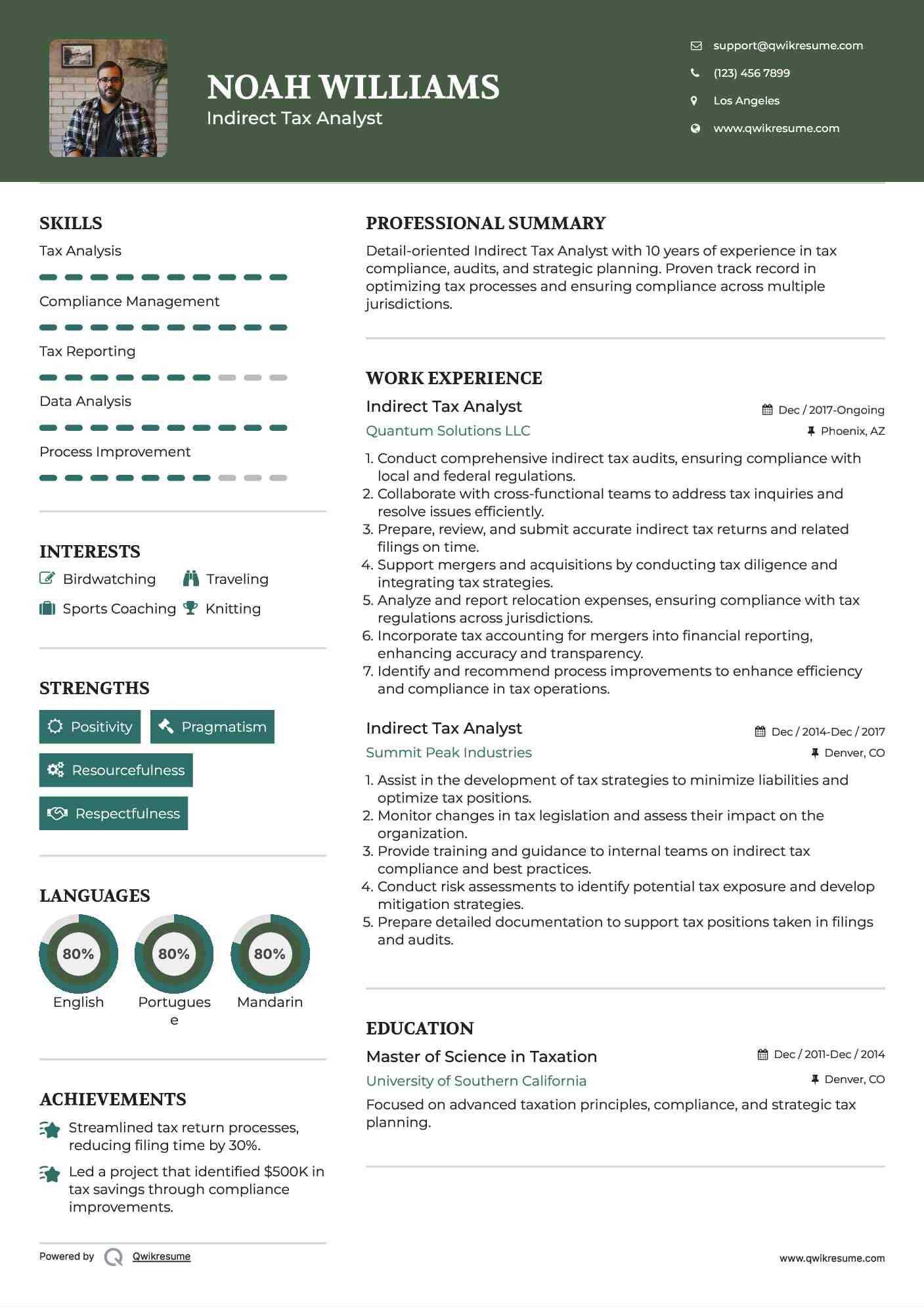

Summary : Detail-oriented Indirect Tax Analyst with 10 years of experience in tax compliance, audits, and strategic planning. Proven track record in optimizing tax processes and ensuring compliance across multiple jurisdictions.

Skills : Tax Analysis, Compliance Management, Tax Reporting, Data Analysis, Process Improvement

Description :

- Conduct comprehensive indirect tax audits, ensuring compliance with local and federal regulations.

- Collaborate with cross-functional teams to address tax inquiries and resolve issues efficiently.

- Prepare, review, and submit accurate indirect tax returns and related filings on time.

- Support mergers and acquisitions by conducting tax diligence and integrating tax strategies.

- Analyze and report relocation expenses, ensuring compliance with tax regulations across jurisdictions.

- Incorporate tax accounting for mergers into financial reporting, enhancing accuracy and transparency.

- Identify and recommend process improvements to enhance efficiency and compliance in tax operations.

Experience

7-10 Years

Level

Management

Education

MST

Indirect Tax Analyst Resume

Summary : Results-driven Indirect Tax Analyst with 10 years of experience in tax compliance, analysis, and reporting. Proven track record in optimizing tax processes and ensuring compliance with regulations to minimize liabilities.

Skills : Tax compliance expertise, Tax analysis, Regulatory compliance, Data interpretation, Process optimization

Description :

- Conduct comprehensive tax analysis to ensure compliance with indirect tax regulations.

- Prepare and review tax returns, ensuring accuracy and timely submission.

- Collaborate with cross-functional teams to resolve tax-related issues and enhance processes.

- Monitor changes in tax legislation and assess their impact on the organization.

- Develop and maintain documentation for tax processes and compliance procedures.

- Provide training and support to staff on indirect tax matters and compliance requirements.

- Engage with tax authorities to address inquiries and resolve disputes effectively.

Experience

10+ Years

Level

Senior

Education

MST

Indirect Tax Analyst Resume

Summary : Results-driven Indirect Tax Analyst with 10 years of experience in managing VAT compliance, optimizing tax processes, and ensuring regulatory adherence. Proven track record in delivering accurate tax returns and enhancing operational efficiency.

Skills : VAT compliance, Tax return preparation, Data analysis, Risk assessment, Financial reporting

Description :

- Develop and manage comprehensive VAT compliance strategies, ensuring timely and accurate submissions.

- Conduct thorough reviews of tax returns and documentation to ensure compliance with local and international regulations.

- Collaborate with cross-functional teams to identify tax-saving opportunities and mitigate risks.

- Analyze financial data to prepare detailed reports on tax liabilities and compliance status.

- Lead tax audits and liaise with tax authorities to resolve inquiries and disputes effectively.

- Provide training and guidance to junior staff on tax compliance and reporting processes.

- Continuously monitor changes in tax legislation to ensure ongoing compliance and strategic alignment.

Experience

7-10 Years

Level

Consultant

Education

MST