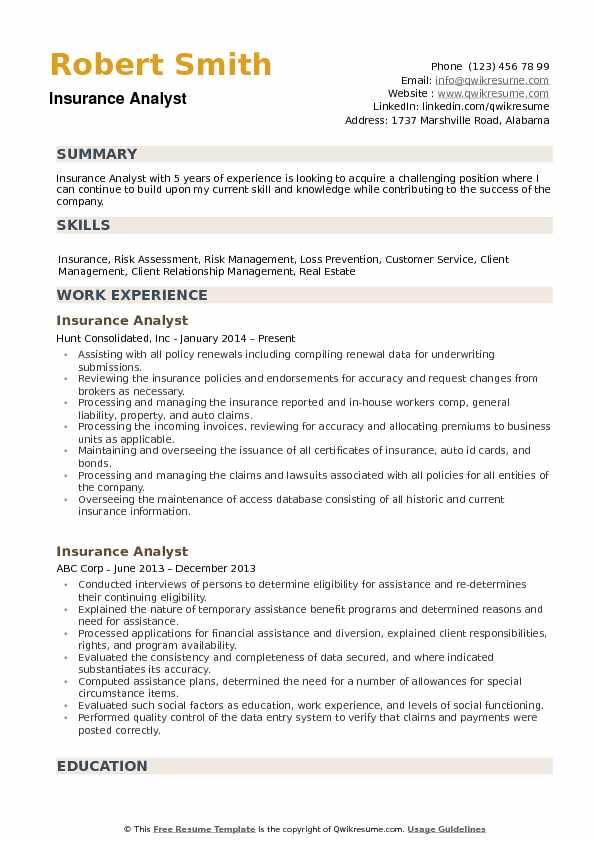

Insurance Analyst Resume

Headline : Dynamic Insurance Analyst with 7 years of experience specializing in policy analysis, risk assessment, and data-driven decision-making. Adept at collaborating with underwriting teams to enhance policy renewals and streamline processes. Eager to leverage analytical skills to drive efficiency and support strategic initiatives in the insurance sector.

Skills : Insurance Standards Optimization, Data Analysis And Reporting, Data Analysis, Statistical Analysis

Description :

- Conducted thorough analysis of insurance policies to support underwriting decisions and ensure compliance with industry regulations.

- Collaborated with cross-functional teams to allocate insurance expenses and optimize data for policy renewals.

- Utilized analytical models to assess risk exposures and allocate premiums accurately across cost centers.

- Gathered and synthesized company risk information for audits and policy renewal processes.

- Led research initiatives to enhance the effectiveness of the enterprise risk management program.

- Oversaw the origination and management of long-term debt and lease obligations, ensuring accurate forecasting and compliance.

- Negotiated favorable terms with financial institutions, resulting in significant cost savings for the company.

Experience

5-7 Years

Level

Senior

Education

BS Finance

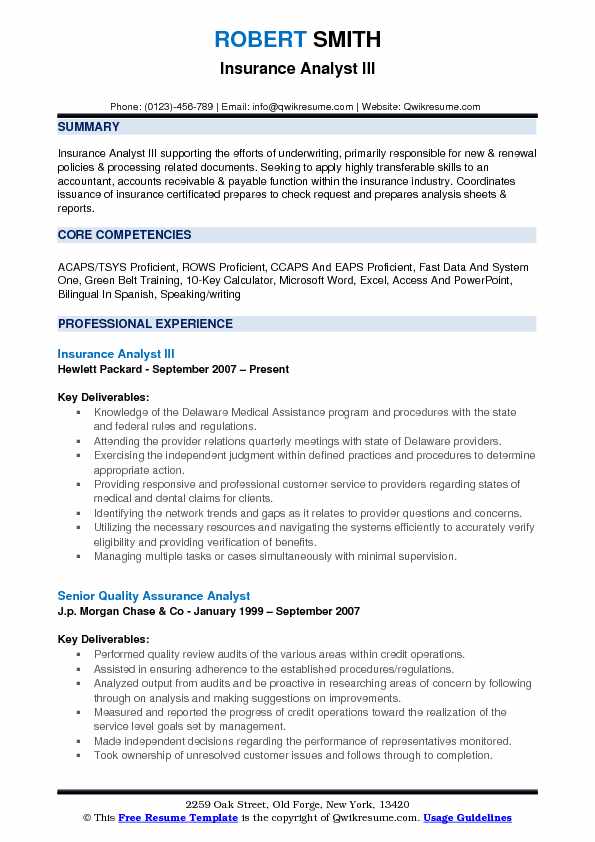

Senior Insurance Analyst Resume

Summary : Accomplished Senior Insurance Analyst with 10 years of extensive experience in risk management, data analysis, and policy optimization. Proven track record in enhancing operational efficiencies and driving strategic initiatives within the insurance sector. Committed to leveraging analytical expertise to deliver actionable insights and foster collaboration across teams.

Skills : Problem Solving, Attention To Detail, Communication Skills, Team Collaboration, Time Management

Description :

- Conduct thorough risk assessments to identify potential gaps in coverage and recommend solutions.

- Collaborate with underwriting teams to enhance policy issuance and renewal processes.

- Analyze complex data sets to inform decision-making and improve operational efficiency.

- Provide exceptional customer service to stakeholders, addressing inquiries related to medical and dental claims.

- Monitor industry trends to identify opportunities for improvement and innovation.

- Prepare detailed reports and presentations for management review, highlighting key findings and recommendations.

- Ensure compliance with HIPAA regulations while handling sensitive member information.

Experience

7-10 Years

Level

Senior

Education

B.S. in BA

Insurance Analyst Resume

Headline : Insightful Insurance Analyst with 7 years of experience in risk evaluation, policy analysis, and claims management. Proven ability to enhance operational efficiency through data analysis and strategic recommendations. Passionate about utilizing analytical expertise to support organizational goals and improve insurance processes.

Skills : Claims Processing, Insurance Market Analysis, Risk Assessment And Mitigation, Claims Management And Processing, Risk Mitigation, Client Relations

Description :

- Managed the allocation of insurance premiums based on the company’s budget, ensuring timely approval from directors.

- Ensured accurate invoicing and tracking of premium payments in collaboration with the accounting department.

- Utilized market analysis to leverage purchasing power for international insurance procurement.

- Evaluated coverage gaps and proposed consolidation strategies for local insurance lines, resulting in cost savings.

- Participated in strategic meetings with underwriters to assess market trends and address coverage issues.

- Contributed to the design and procurement of comprehensive commercial insurance programs.

- Analyzed trends to develop training programs that improved team performance in claims handling.

Experience

5-7 Years

Level

Senior

Education

B.S. in BA

Junior Insurance Analyst Resume

Summary : Results-oriented Junior Insurance Analyst with a decade of experience in policy evaluation, risk management, and data analysis. Skilled in collaborating across departments to enhance operational efficiency and ensure compliance with insurance standards. Ready to apply analytical expertise to support strategic initiatives and drive impactful solutions in the insurance industry.

Skills : Project Management, Insurance Regulations, Claims Analysis, Policy Review, Premium Calculation, Market Research

Description :

- Reviewed and validated insurance claims for accuracy and compliance with regulatory standards.

- Collaborated with cross-functional teams to establish and achieve regional sales goals.

- Managed billing and collections for insurance accounts, developing action plans for delinquent accounts.

- Educated sales teams on policy updates and compliance through presentations and workshops.

- Conducted detailed analysis of insurance renewals to ensure investor requirements were met.

- Provided ongoing support to clients regarding policy changes and claims inquiries.

- Generated monthly reports on claims performance and operational metrics for senior management.

Experience

10+ Years

Level

Junior

Education

B.S. in BA

Insurance Analyst Resume

Objective : Dedicated Insurance Analyst with 2 years of experience in risk assessment and policy analysis. Proficient in utilizing data analytics to enhance operational efficiencies and support compliance initiatives. Committed to delivering precise insights that drive informed decision-making and improve customer satisfaction in the insurance sector.

Skills : Data Analysis Software (as400), Stakeholder Communication, Process Optimization, Advanced Excel Skills, Data Management, Insurance Marketing Strategies

Description :

- Conducted thorough reviews of insurance agreements to ensure compliance with customer requirements.

- Monitored and updated insurance certificates, maintaining accuracy for vendor compliance.

- Designed tailored agreements based on customer-specific insurance criteria.

- Streamlined daily updates for insurance processes, improving clarity and follow-up.

- Assisted in developing and maintaining an insurance dashboard for reporting purposes.

- Reviewed end-of-month unit lists to ensure timely insurance requests.

- Tracked assets under investigation, providing weekly updates to management.

Experience

0-2 Years

Level

Entry Level

Education

B.S. in BA

Assistant Insurance Analyst Resume

Objective : Analytical professional with 5 years of experience in insurance data evaluation, reporting, and policy analysis. Skilled in collaborating with teams to optimize processes and enhance operational efficiency. Committed to delivering insightful analyses that drive informed decision-making and support organizational objectives in the insurance industry.

Skills : Proficient In Data Analysis Software, Proficient In Windows Operating System, Advanced Microsoft Word Skills, Advanced Excel For Data Analysis

Description :

- Conducted thorough evaluations of insurance claims to ensure compliance and accuracy.

- Collaborated with health insurance companies to resolve account discrepancies and expedite payments.

- Verified patient eligibility and insurance coverage, maintaining detailed records for reporting.

- Initiated communication with members and providers to gather necessary information for claims processing.

- Performed data analysis to identify trends in claims and enhance operational efficiencies.

- Assisted clients in reconciling accounts, ensuring timely closure of outstanding balances.

- Prepared detailed reports to support managerial decision-making regarding account management.

Experience

2-5 Years

Level

Executive

Education

B.S.B.A.

Insurance Analyst Resume

Objective : Analytical Insurance Analyst with 2 years of experience in policy review and risk assessment. Skilled in data analysis to ensure compliance and enhance operational efficiency. Passionate about utilizing insights to improve insurance processes and support strategic objectives.

Skills : Data Analysis Tools, Policy Evaluation, Presentation Development, Underwriting Support, Fraud Detection, Excel Proficiency

Description :

- Executed quality assurance reviews of insurance certificates and policies to ensure compliance with industry standards.

- Evaluated insurance documents to confirm coverage met regulatory requirements.

- Provided support to internal and external stakeholders regarding insurance coverage inquiries.

- Communicated effectively with clients and agents to resolve compliance issues.

- Recommended solutions to align insurance policies with investor guidelines.

- Maintained accurate tracking of compliance issues in internal systems.

- Updated quality control reports to monitor review progress and identify errors.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

Associate Insurance Analyst Resume

Objective : Insurance Analyst with 5 years of specialized experience in data analysis, policy evaluation, and risk management. Proven ability to streamline processes and enhance operational efficiency through detailed reporting and collaboration with cross-functional teams. Aiming to leverage analytical expertise to support strategic initiatives and drive impactful solutions within the insurance industry.

Skills : Critical Thinking, Data Evaluation, Loss Analysis, Policy Sales Strategies, Advanced Excel Proficiency, Insurance Software Proficiency

Description :

- Processed insurance forms from various vendors, conducting detailed analysis of applications and production records using specialized insurance software.

- Performed risk assessments to identify potential discrepancies and improve policy accuracy.

- Generated comprehensive reports that informed decision-making and streamlined workflow processes.

- Collaborated with underwriting teams to enhance policy evaluation procedures and ensure compliance with industry standards.

- Utilized data analytics tools to identify trends and support strategic initiatives within the organization.

- Trained and mentored new team members on insurance processing protocols and software usage.

- Maintained up-to-date knowledge of regulatory changes affecting the insurance industry.

Experience

2-5 Years

Level

Executive

Education

B.S.B.A.

Insurance Analyst Resume

Objective : Motivated Insurance Analyst with 2 years of experience in risk assessment and data analysis. Skilled in evaluating insurance policies and ensuring compliance with industry standards. Eager to utilize analytical capabilities to enhance operational efficiency and support data-driven decision-making within the insurance sector.

Skills : Cash Management, Database Management, Effective Communication Skills, Data Imaging Techniques, Microsoft Word Proficiency, Presentation Skills

Description :

- Main point of contact for insurance inquiries, coverage requirements, and investor guidelines.

- Analyzed insurance data to identify trends and assess risk factors for policy development.

- Reviewed investor insurance guidelines and loan documents to determine baseline requirements.

- Conducted annual reviews of insurance certificates and policies for compliance with investor standards.

- Gained insight into the insurance casualty provision and claims processes.

- Processed invoices and reimbursements for borrowers, ensuring accuracy and adherence to policies.

- Prepared and submitted all necessary claims documentation, including treatment plans and referrals.

Experience

0-2 Years

Level

Entry Level

Education

B.S. in B.A.

Insurance Analyst Resume

Objective : Proficient Insurance Analyst with 2 years of hands-on experience in policy evaluation and risk management. Demonstrated ability to analyze data for compliance and enhance operational efficiencies. Ready to apply analytical insights to streamline processes and support organizational objectives in the insurance industry.

Skills : Risk Analysis, Insurance Risk Management, Data Integrity, Insurance Software, Claims Management

Description :

- Assisted in policy renewals by compiling and analyzing renewal data for underwriting submissions.

- Reviewed insurance policies and endorsements for accuracy, coordinating necessary changes with brokers.

- Managed claims processes, including workers' compensation, general liability, and property claims.

- Processed incoming invoices, ensuring accurate allocation of premiums to relevant business units.

- Maintained issuance of certificates of insurance, auto ID cards, and bonds.

- Analyzed outstanding accounts receivable from processed and denied claims to identify trends.

- Provided backup support to the Risk Manager on all insurance-related matters.

Experience

0-2 Years

Level

Entry Level

Education

B.S. in BA