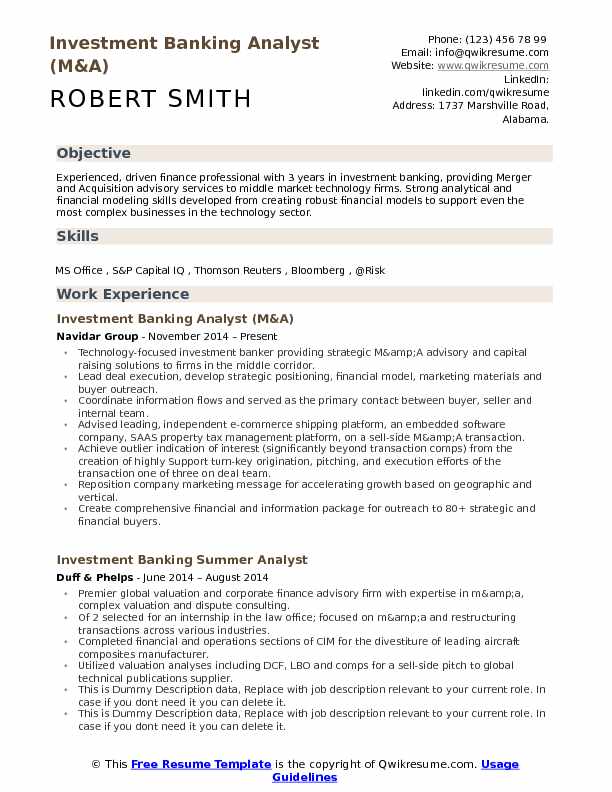

Investment Banking Analyst (M&A) Resume

Objective : Detail-oriented Investment Banking Analyst with 5 years of experience in M&A advisory and financial modeling. Proven track record in executing complex transactions and delivering strategic insights to clients in the technology sector.

Skills : Advanced Excel, Financial Analysis, Valuation Techniques, Financial Modeling

Description :

- Provided strategic M&A advisory and capital raising solutions to mid-market technology firms.

- Led deal execution, developing financial models, marketing materials, and buyer outreach strategies.

- Served as the primary liaison between buyers, sellers, and internal teams to ensure smooth transactions.

- Advised on sell-side M&A transactions for leading e-commerce and software companies.

- Generated significant interest from buyers, exceeding transaction comps through effective origination and pitching.

- Revised marketing strategies to accelerate growth based on market analysis and client needs.

- Created comprehensive financial packages for outreach to over 80 strategic and financial buyers.

Experience

2-5 Years

Level

Junior

Education

B.B.A

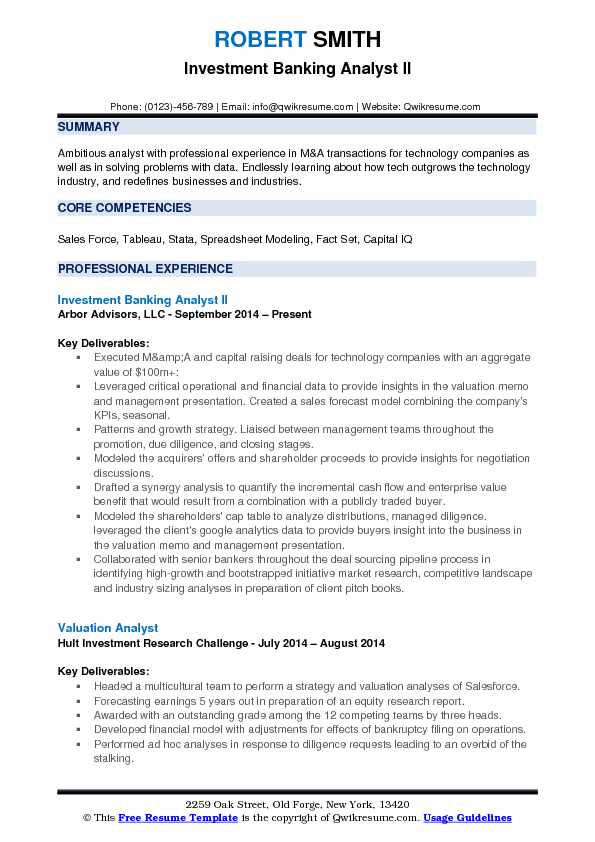

Investment Banking Analyst II Resume

Objective : Detail-oriented Investment Banking Analyst with 5 years of experience in M&A and capital raising. Proven track record in financial modeling, valuation analysis, and strategic advisory for technology firms.

Skills : Sales Analysis, Data Visualization, Statistical Analysis, Financial Modeling, Valuation Techniques

Description :

- Executed M&A and capital raising transactions for tech firms, totaling $100M.

- Utilized financial data to create valuation memos and management presentations.

- Collaborated with management teams during due diligence and closing phases.

- Analyzed acquirer offers and shareholder proceeds to support negotiation strategies.

- Drafted synergy analyses to quantify cash flow and enterprise value benefits.

- Managed shareholder cap tables and provided insights using Google Analytics data.

- Worked with senior bankers on market research and competitive landscape analyses.

Experience

2-5 Years

Level

Junior

Education

MBA

Investment Banking Analyst I Resume

Headline : Results-driven Investment Banking Analyst with 7 years of experience in financial modeling, valuation, and due diligence. Proven track record in delivering strategic insights and optimizing financial performance for clients.

Skills : Financial Modeling, Data Analysis, Valuation Techniques, Market Research, Due Diligence

Description :

- Analyzed and structured complex financial data for client presentations, enhancing decision-making.

- Collaborated with quantitative analysts to refine reporting frameworks for equity derivatives.

- Developed diverse financial models to accurately value client companies and support strategic initiatives.

- Coordinated with project managers and stakeholders to identify solutions that align with business objectives.

- Created detailed business cases outlining cost impacts and value drivers for proposed financial solutions.

- Designed systems for efficient retrieval of structured and unstructured financial data.

- Conducted thorough financial due diligence and valuations using DCF and comparable company analysis.

Experience

5-7 Years

Level

Junior

Education

M.B.A

Investment Banking Analyst - Mergers & Acquisitions Resume

Summary : Results-driven Investment Banking Analyst with 10 years of experience in M&A, financial modeling, and valuation. Proven track record in executing high-stakes transactions and delivering strategic insights to clients.

Skills : Financial Analysis, Financial Modeling, Valuation Techniques, M&A Transactions, Market Research

Description :

- Conducted comprehensive financial analyses, including DCF, WACC, and comparable company analyses, to support M&A transactions.

- Researched industry trends and contributed to the firm's marketing publications, enhancing client engagement.

- Performed quantitative and qualitative assessments of target companies, identifying synergies that drove high valuations.

- Analyzed tax implications and historical financial performance to optimize sale values for clients.

- Collaborated with lenders to restructure financing arrangements, improving revenue streams.

- Prepared detailed financial reports and valuation models, facilitating informed decision-making for clients.

- Managed due diligence processes, ensuring seamless information flow and compliance throughout transactions.

Experience

7-10 Years

Level

Junior

Education

MBA

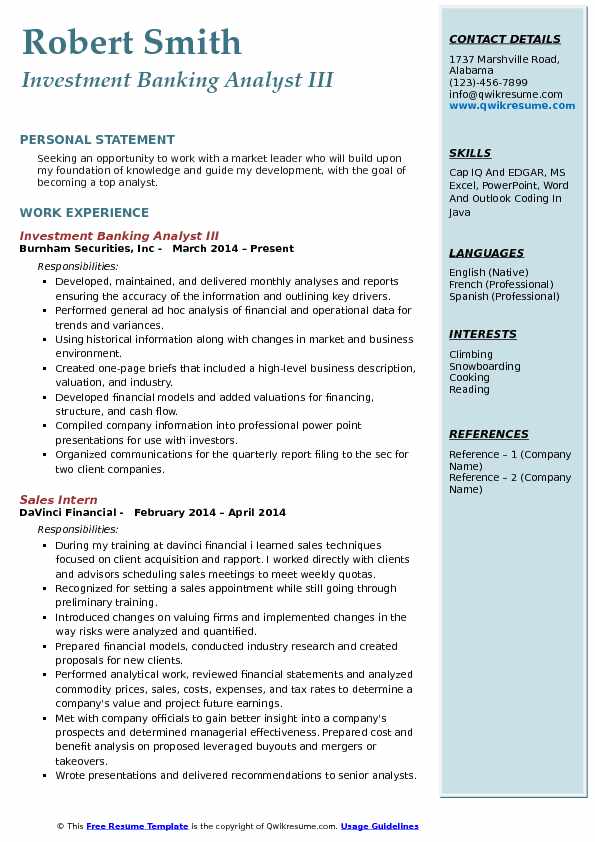

Investment Banking Analyst III Resume

Objective : Detail-oriented Investment Banking Analyst with 5 years of experience in financial modeling, valuation, and market analysis. Proven track record in delivering actionable insights and supporting strategic decision-making for clients.

Skills : CapIQ & EDGAR, Advanced Excel Skills, Financial Presentation Skills, Valuation Techniques, Market Research

Description :

- Developed and delivered comprehensive financial analyses and reports, ensuring accuracy and highlighting key performance drivers.

- Conducted in-depth ad hoc analysis of financial and operational data to identify trends and variances.

- Utilized historical data and market changes to inform strategic recommendations.

- Created concise one-page briefs summarizing business descriptions, valuations, and industry insights.

- Built complex financial models to assess financing structures and cash flow projections.

- Prepared professional PowerPoint presentations for investor meetings, effectively communicating key findings.

- Coordinated quarterly SEC report filings for multiple client companies, ensuring compliance and accuracy.

Experience

2-5 Years

Level

Junior

Education

BSc Finance

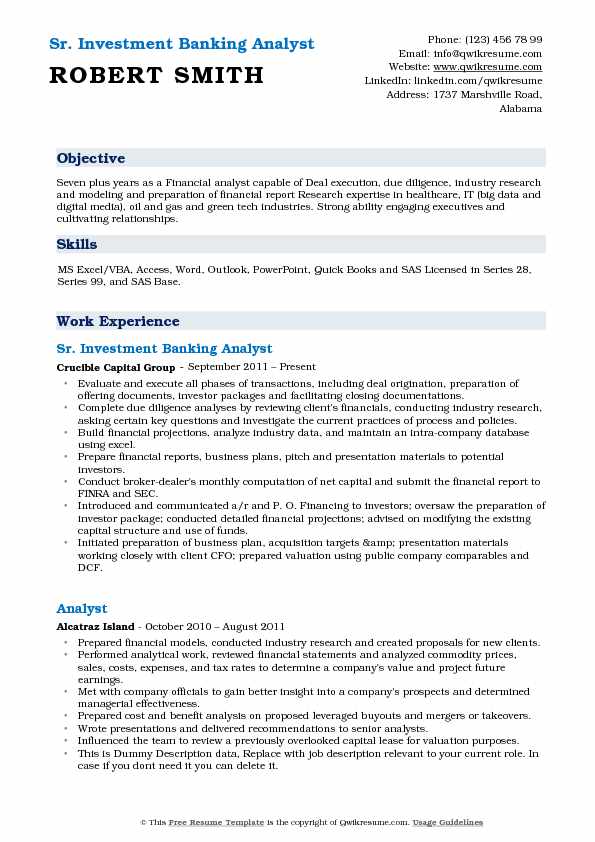

Sr. Investment Banking Analyst Resume

Summary : Results-driven Investment Banking Analyst with 10 years of experience in financial modeling, due diligence, and transaction execution. Proven track record in delivering strategic insights and fostering client relationships to drive successful outcomes.

Skills : Financial Modeling, Data Analysis, Report Writing, Client Communication

Description :

- Evaluate and execute all phases of transactions, including deal origination, offering documents, and closing documentation.

- Conduct comprehensive due diligence by analyzing financials, performing industry research, and assessing client practices.

- Develop detailed financial projections and maintain an intra-company database for accurate reporting.

- Prepare financial reports, business plans, and pitch materials for potential investors, enhancing engagement.

- Oversee monthly net capital computations for broker-dealers, ensuring compliance with FINRA and SEC regulations.

- Facilitate investor communications and prepare detailed financial projections to optimize capital structure.

- Collaborate with CFOs to prepare business plans and valuations using public comparables and DCF analysis.

Experience

7-10 Years

Level

Junior

Education

MBA

Global Investment Banking Analyst Resume

Objective : Detail-oriented Investment Banking Analyst with 5 years of experience in financial modeling, valuation, and transaction execution. Proven track record in managing complex deals and fostering client relationships in U.S. and China markets.

Skills : Investment Analysis, Advanced Financial Modeling, Financial Analysis, Private Equity Analysis, Market Research

Description :

- Independently sourced and analyzed investment opportunities in U.S. and China markets, enhancing deal flow.

- Managed transaction analysis and execution from pitch to close, reporting directly to senior management.

- Developed complex financial models and performed valuation analyses using DCF and comparable company multiples.

- Prepared bilingual marketing materials, including pitch books and investor presentations, to support client engagement.

- Conducted comprehensive company and industry research, maintaining insights into sector dynamics.

- Targeted institutional investors using Capital IQ, successfully marketing transactions to potential buyers.

- Built and maintained strong client relationships, focusing on identifying and meeting their needs.

Experience

2-5 Years

Level

Junior

Education

MBA

Investment Banking Analyst Resume

Objective : Detail-oriented Investment Banking Analyst with 2 years of experience in financial modeling, valuation, and market analysis. Proven ability to support transaction execution and enhance client relationships through effective communication.

Skills : Financial Modeling, Data Analysis, Report Writing, Database Management, Collaboration Tools

Description :

- Conducted comprehensive company and industry research to identify new transaction opportunities.

- Engaged with potential investors, facilitating actionable next steps for 11 live transactions across various sectors.

- Supported clients in understanding enterprise value by reviewing financial models and key metrics.

- Collaborated with senior management to develop impactful client pitch materials.

- Managed interns, providing mentorship and enhancing their practical experience.

- Performed analysis to support negotiations of long-term contracts with key stakeholders.

- Monitored restructuring opportunities and researched distressed investments to identify potential risks.

Experience

0-2 Years

Level

Junior

Education

BSc Finance

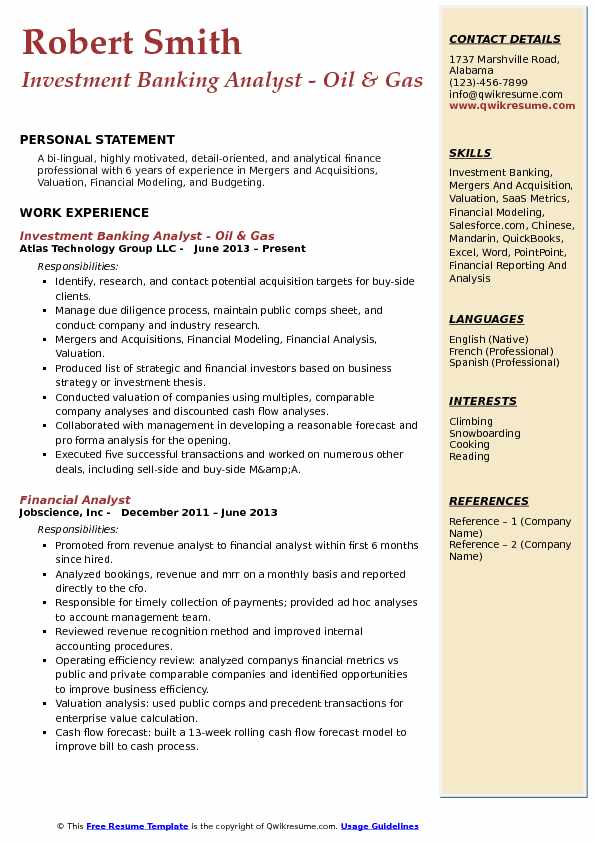

Investment Banking Analyst - Oil & Gas Resume

Headline : Results-driven Investment Banking Analyst with 7 years of experience in M&A, financial modeling, and valuation. Proven track record in executing complex transactions and delivering strategic insights to clients.

Skills : Investment Analysis, Financial Modeling, Valuation Techniques, Due Diligence, Market Research

Description :

- Identified and evaluated acquisition targets, enhancing client investment strategies.

- Managed comprehensive due diligence processes, ensuring compliance and accuracy.

- Developed detailed financial models to support valuation and investment decisions.

- Collaborated with cross-functional teams to create pro forma analyses for potential deals.

- Executed multiple successful transactions, including both buy-side and sell-side M&A.

- Conducted market research to inform strategic recommendations for clients.

- Prepared presentations for stakeholders, summarizing key findings and recommendations.

Experience

5-7 Years

Level

Junior

Education

MBA

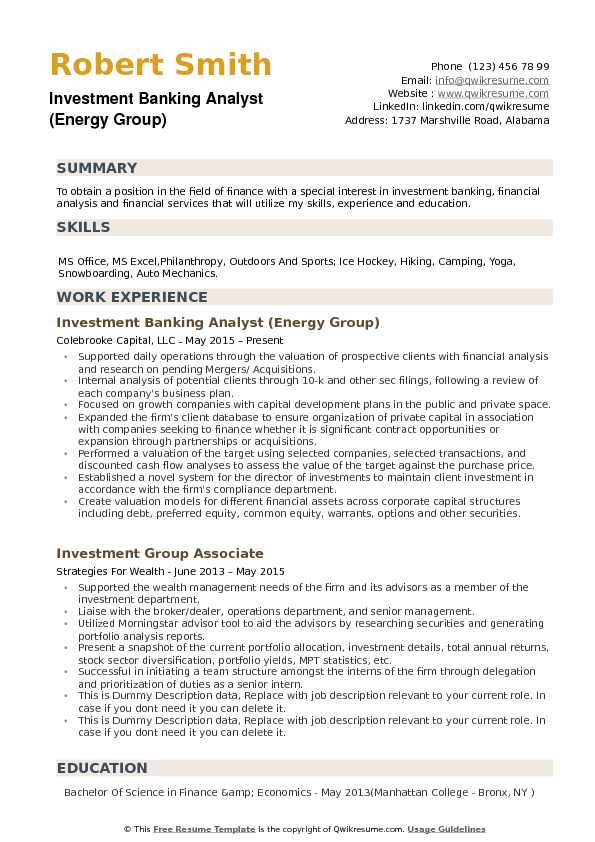

Investment Banking Analyst (Energy Group) Resume

Objective : Detail-oriented Investment Banking Analyst with 5 years of experience in financial modeling, valuation, and M&A analysis. Proven track record in supporting strategic financial decisions and enhancing client relationships.

Skills : Financial Modeling, Data Analysis, Valuation Techniques, M&A Analysis

Description :

- Conducted comprehensive financial analysis and valuation for M&A transactions, enhancing decision-making processes.

- Performed due diligence on potential clients, analyzing 10-K filings and business plans to assess viability.

- Focused on identifying growth opportunities in both public and private sectors, contributing to strategic planning.

- Expanded the client database, facilitating connections between private capital and companies seeking financing.

- Executed valuation models using comparable company analysis and discounted cash flow methods to determine fair value.

- Implemented a compliance tracking system for investment management, ensuring adherence to regulatory standards.

- Created detailed financial models for various asset classes, including equity and debt instruments, to support investment strategies.

Experience

2-5 Years

Level

Junior

Education

B.S (Finance)

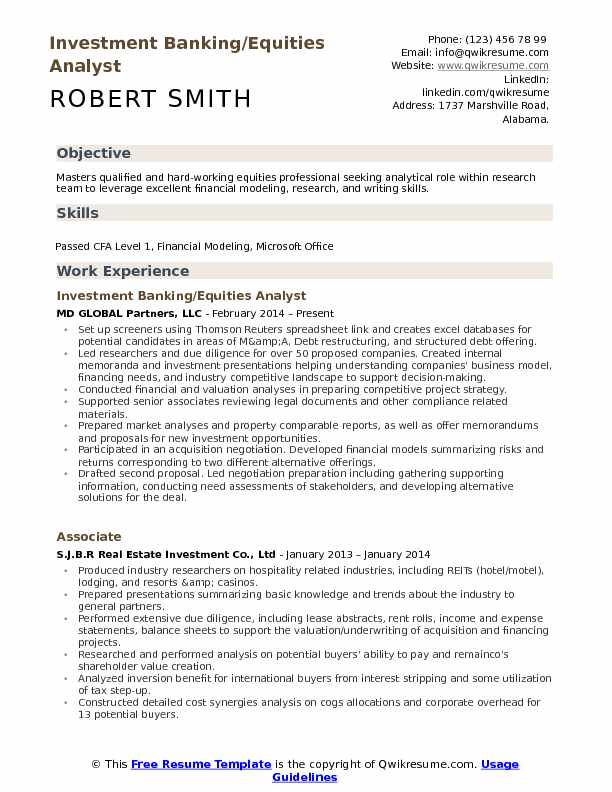

Investment Banking/Equities Analyst Resume

Objective : Detail-oriented Investment Banking Analyst with 5 years of experience in financial modeling, valuation, and market analysis. Proven track record in M&A transactions and investment presentations, driving strategic decision-making.

Skills : Completed CFA Level 1, Advanced Excel Skills, Financial Modeling, Valuation Analysis, Market Research

Description :

- Developed comprehensive financial models for M&A and restructuring projects, enhancing decision-making processes.

- Conducted due diligence for over 50 companies, creating investment presentations that clarified business models and financing needs.

- Performed detailed financial and valuation analyses to support competitive project strategies.

- Prepared market analyses and investment proposals, identifying new opportunities for growth.

- Participated in acquisition negotiations, developing models to summarize risks and returns for various offerings.

- Led negotiation preparations, gathering critical information and assessing stakeholder needs to develop alternative solutions.

- Created internal memoranda that streamlined communication and decision-making across teams.

Experience

2-5 Years

Level

Junior

Education

M.A(Finance)

Investment Banking Analyst Resume

Objective : Detail-oriented Investment Banking Analyst with 5 years of experience in financial modeling, market analysis, and strategic advisory. Proven track record in managing high-value transactions and delivering actionable insights to drive business growth.

Skills : Advanced Excel Skills, Financial Modeling, Market Analysis, Valuation Techniques, Data Interpretation

Description :

- Provided strategic advisory on capital structure and acquisition opportunities, preparing detailed presentations for stakeholders.

- Managed back office operations for six acquisition transactions, each valued over $100M, ensuring compliance and efficiency.

- Collaborated with CFOs to standardize and present company data in cohesive Excel dashboards, enhancing decision-making.

- Conducted in-depth market and company research focusing on IoT, SaaS, and e-commerce sectors, delivering actionable insights.

- Successfully managed multiple deals in fast-paced, deadline-driven environments, demonstrating strong organizational skills.

- Acted as a corporate finance generalist with a focus on restructuring transactions, providing critical analysis and recommendations.

- Built comprehensive financial projection models, including income statements, cash flow statements, and balance sheets.

Experience

2-5 Years

Level

Junior

Education

MBA

Investment Banking Analyst Internship Resume

Objective : Results-driven Investment Banking Analyst with 5 years of experience in M&A, financial modeling, and valuation analysis. Proven track record in executing complex transactions and delivering strategic insights to clients.

Skills : Financial Modeling, Financial Reporting, Statistical Analysis, Data Analysis, Market Research

Description :

- Developed DCF and LBO models for various mid-cap companies, enhancing investment strategies.

- Conducted thorough peer and transaction comparable analyses, focusing on TMT and consumer sectors.

- Created pitch books and presentations for senior bankers, effectively communicating investment opportunities.

- Collaborated with clients to execute strategic initiatives, improving client satisfaction and retention.

- Performed in-depth research on client backgrounds, market strategies, and financial health to assess risks.

- Executed tax analyses to optimize transaction structures, maximizing client benefits.

- Coordinated due diligence processes, ensuring comprehensive evaluations of potential investments.

Experience

2-5 Years

Level

Junior

Education

MSF

Investment Banking / Financial Analyst Resume

Objective : Detail-oriented Investment Banking Analyst with 5 years of experience in financial modeling, valuation, and strategic analysis. Proven track record in executing complex transactions and delivering actionable insights to clients.

Skills : Financial Analysis, Financial Modeling, Valuation Techniques, Market Research, Risk Assessment

Description :

- Identified acquisition and investment opportunities through comprehensive financial and strategic analyses, focusing on distressed debt transactions.

- Created detailed pitch books and presentations for internal stakeholders and investor meetings.

- Utilized advanced valuation models to assess companies' financial health and intrinsic value.

- Collaborated with managing directors to engage with clients' senior management, ensuring alignment on strategic goals.

- Conducted internal credit underwriting and prepared recommendations for credit approvals.

- Supported portfolio and risk management teams with ongoing financial analysis and reporting.

- Executed qualitative and quantitative analyses to evaluate capital raising opportunities and deal viability.

Experience

2-5 Years

Level

Junior

Education

BSc Finance

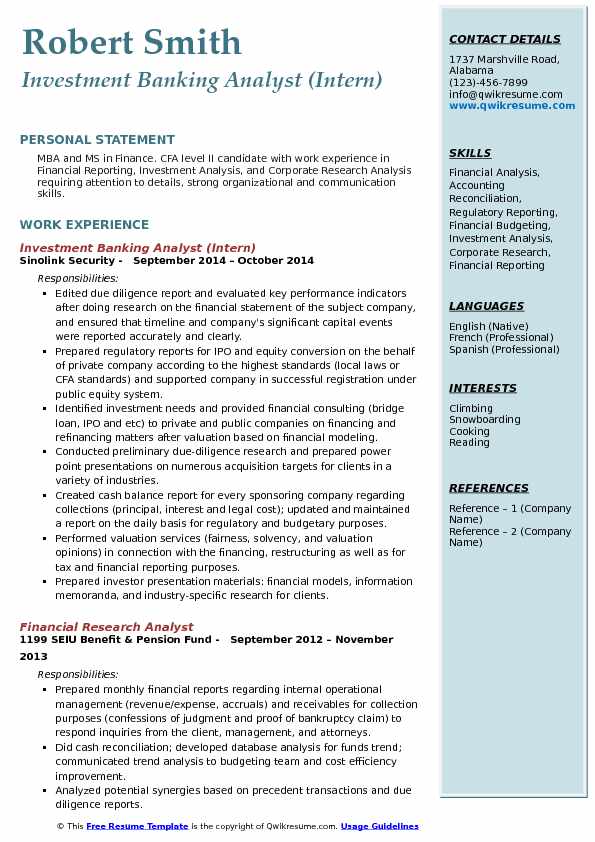

Investment Banking Analyst (Intern) Resume

Objective : Detail-oriented Investment Banking Analyst with 5 years of experience in financial modeling, valuation, and due diligence. Proven track record in delivering high-quality financial analysis and strategic insights to support investment decisions.

Skills : Financial Analysis, Compliance Reporting, Financial Forecasting, Equity Valuation, Financial Modeling

Description :

- Conducted in-depth financial analysis and due diligence for M&A transactions, ensuring accurate valuation and risk assessment.

- Prepared detailed financial models and presentations for investor meetings, enhancing communication of investment opportunities.

- Collaborated with cross-functional teams to develop strategic recommendations based on market trends and financial performance.

- Managed the preparation of regulatory filings and compliance reports, ensuring adherence to industry standards.

- Analyzed financial statements and key performance indicators to identify trends and inform investment strategies.

- Supported senior analysts in the execution of equity and debt offerings, contributing to successful capital raises.

- Maintained up-to-date knowledge of market conditions and industry developments to provide informed insights to clients.

Experience

2-5 Years

Level

Junior

Education

MBA