Investment Banking Summer Analyst Resume

Objective : Dynamic finance professional with two years of experience in investment banking, specializing in financial modeling and valuation analyses. Adept at conducting market research and executing M&A transactions, I bring strong analytical skills and a detailed approach to client engagements. Eager to leverage my expertise to support high-stakes financial projects and contribute effectively to a collaborative team environment.

Skills : Financial Modeling, Valuation Analysis, Excel Proficiency

Description :

- Created comprehensive financial models to forecast outcomes, assess corporate events, and analyze investment opportunities.

- Executed multiple M&A transactions from inception to completion, including building financial models and drafting presentations.

- Conducted thorough market research and coordinated due diligence processes to support investment decisions.

- Performed valuations of technology firms using DCF, LBO, and comparable company analyses.

- Analyzed capital markets data to recommend optimal financing structures to clients.

- Established training programs for new analysts, focusing on best practices and advanced Excel techniques.

- Led junior-level recruiting initiatives, successfully onboarding 9 interns and 7 full-time hires.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

Investment Banking Summer Analyst Resume

Objective : Accomplished finance professional with five years of investment banking experience, focusing on financial modeling, valuation, and M&A advisory. Proven ability to drive strategic initiatives and deliver analytical insights in high-pressure environments. Committed to enhancing client value through meticulous research and innovative financial solutions, eager to contribute to impactful projects.

Skills : Financial Analysis, Market Forecasting, Presentation Skills, Attention to Detail, Quantitative Skills

Description :

- Conducted comprehensive valuation analyses using DCF, LBO, and comparable company methodologies.

- Advised on strategic M&A opportunities, providing insights that shaped client acquisition strategies.

- Created detailed financial models to assess performance under diverse scenarios, aiding in capital structure decisions.

- Designed and presented PitchBook materials for client meetings, covering M&A strategies and market trends.

- Led valuation projects in the healthcare sector, successfully facilitating multiple buy-side and sell-side transactions.

- Supported due diligence efforts by analyzing target companies' financial and operational data to inform client decisions.

- Collaborated with senior bankers to streamline processes, enhancing team efficiency and client satisfaction.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Investment Banking Summer Analyst Resume

Objective : Summer Analyst is an entry-level investment banking position where the candidate will learn and develop skills in a variety of areas, including securities analysis, financial modeling, quantitative techniques, risk management and regulatory topics.

Skills : Problem Solving, Critical Thinking, Communication Skills, Client Interaction, Report Writing

Description :

Global Industrials Group Completed a ten-week internship in the Global Industrials Group, culminating in the extension of a full-time offer drafted.Conducted research on early-stage startups in various technology market segments.Constructed a model for industry-leading Maritime shipping and holding companies.Maintained a commitment to customer service while strategically turning calls into sales opportunities.Responded to inbound customer phone calls about our products and services.Conducted financial modeling and valuation analysis for M&A transactions, enhancing deal accuracy by 15%.Assisted in preparing pitch books and client presentations, contributing to a 20% increase in client engagement.

Experience

0-2 Years

Level

Entry Level

Education

BA in Economics

Investment Banking Summer Analyst Resume

Objective : Ambitious finance professional with two years of investment banking experience, focusing on financial analysis and strategic advisory. Proven expertise in conducting market assessments and supporting M&A initiatives, I excel in delivering data-driven insights and fostering client relationships. I aim to apply my analytical acumen and collaborative approach to contribute to impactful financial projects.

Skills : Project Coordination, Results-Oriented, Effective Communication, Rapid Assimilation of Concepts, Industry Knowledge

Description :

- Automated weekly status reports using Bloomberg and VBA, achieving 100% accuracy.

- Developed trade ideas for the equities team, driving strategic investment decisions.

- Provided strategic financial advice to clients in Commercial & Industrial and Transportation sectors.

- Created and maintained complex Excel financial models and monthly analytical reports.

- Conducted daily reconciliations for futures, options, and OTC derivatives.

- Utilized Bloomberg terminal for real-time securities analysis and data retrieval.

- Assisted in executing corporate finance transactions across diverse industries, ensuring compliance and efficiency.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

Investment Banking Summer Analyst Resume

Objective : Ambitious finance professional with two years in investment banking, excelling in financial modeling and market analysis. Proven ability to support M&A transactions and enhance client relationships through detailed research and strategic insights. Excited to apply my analytical skills and collaborative approach to drive value in high-stakes financial projects.

Skills : Financial Modeling, Market Analysis, Due Diligence, Client Engagement, Strategic Thinking

Description :

- Completed a ten-week training and internship program culminating in a full-time return offer.

- Compiled research and developed materials to assist in M&A presentations.

- Analyzed financial statements and built Pro-forma financial models for multiple clients.

- Coordinated and supported senior bankers in client interactions and project management.

- Played a key role in a $66 million IPO transaction as a member of the deal team.

- Performed comprehensive financial, legal, and business due diligence for the IPO prospectus.

- Documented financial conditions in daily reports, aiding in strategic decision-making.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

Investment Banking Summer Analyst Resume

Objective : Proficient finance professional with two years of investment banking experience, focusing on financial analysis and market dynamics. Skilled in conducting in-depth research, financial modeling, and valuation to support M&A transactions. Committed to delivering strategic insights and fostering strong client relationships to drive successful outcomes in high-pressure environments.

Skills : Financial Planning, Forecasting Techniques, Due Diligence, M&A Analysis

Description :

- Assist in presenting accurate and detailed information to clients, creating financial models, and preparing due diligence assignments.

- Deliver meaningful market and equity research for the managing director.

- Created comparable valuation analysis for the sale of a 590M company in the fertilizer industry.

- Researched competitive landscape to inform strategic decisions.

- Gained skills and experience including pitch book preparation, development of information memoranda, risk analysis, and matrix design.

- Independently created and delivered a buy-side pitch for a dairy company in the infant formula space to a senior panel.

- Worked in rotation across two industry coverage deal teams - Gaming, Lodging & Leisure, and Business & Tech Services.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

Investment Banking Summer Analyst Resume

Objective : Finance professional with two years in investment banking, skilled in financial analysis and modeling. Experienced in conducting detailed market research and supporting M&A transactions, I excel in delivering actionable insights and enhancing client engagement. Passionate about leveraging my analytical expertise to drive impactful financial solutions in a dynamic team setting.

Skills : Financial Reporting, Business Acumen, Analytical Skills, Technical Skills, Valuation Analysis

Description :

- Consistently ranked at the top of the analyst class in yearly reviews.

- Developed a detailed 3-year monthly forecast model tracking over 50 KPIs and operating metrics.

- Performed cohort analyses to determine member LTV and ROI on paid marketing spend.

- Conducted customer segmentation analyses to explore growth, conversion, and churn by group.

- Served as the sole advisor in the potential $100M sale of an online live video SaaS company.

- Created a subscription revenue forecast model utilizing a trial-to-subscription funnel for the consumer segment.

- Conducted independent research to guide forecast assumptions, leveraging limited historical data effectively.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

Investment Banking Summer Analyst Resume

Objective : Finance professional with five years of investment banking experience, adept at financial modeling, valuation, and M&A advisory. Proven track record in conducting thorough market analyses and supporting strategic initiatives under tight deadlines. Passionate about delivering innovative solutions that enhance client outcomes and drive organizational success in high-stakes environments.

Skills : Financial Modeling, Valuation Analysis, Market Research, M&A Advisory, Database Management

Description :

- Built a funds flow model to illustrate the allocation of proceeds, facilitating management negotiations.

- Led on-site diligence sessions, enhancing communication between executive teams and expediting decision-making.

- Served as book-runner in a $41M IPO and $84M follow-on offering for Applied Optoelectronics.

- Managed the sell-side M&A process, coordinating buyer outreach and tracking proposals efficiently.

- Prepared comparative analyses of bid proposals, enabling informed evaluations of potential buyers.

- Completed 20 training modules, enhancing expertise in valuation and financial analysis.

- Developed and maintained valuation models, including trading comps, to support investment decisions.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Investment Banking Summer Analyst Resume

Objective : Motivated finance professional with two years of experience in investment banking, focusing on financial analysis and client advisory. Skilled in developing financial models and conducting thorough market research to support M&A transactions. Eager to apply my expertise in a fast-paced environment to drive strategic initiatives and deliver exceptional value to clients.

Skills : Financial Analysis, Financial Modeling, Asset Valuation, Cash Flow Analysis, Investment Research

Description :

- Solicited, structured, and underwrote over $1 billion in general obligation, revenue, and lease revenue bonds.

- Created 50 presentations and pitch books for client executives and boards providing financial and strategic advice.

- Maintained precedent transactions and trading comparables databases to support valuation analyses.

- Performed due diligence, including industry and product research, and created memoranda for internal committees.

- Conducted analysis and participated in discussions during the LipoScience Nasdaq LPDX IPO.

- Drafted the investor-circulated Confidential Information Memorandum for a leading healthcare services company's LBO.

- Built complex financial models, including 3-statement merger, accretion/dilution, LBO, IPO, and DCF analyses.

Experience

0-2 Years

Level

Entry Level

Education

BS Finance

Investment Banking Summer Analyst Resume

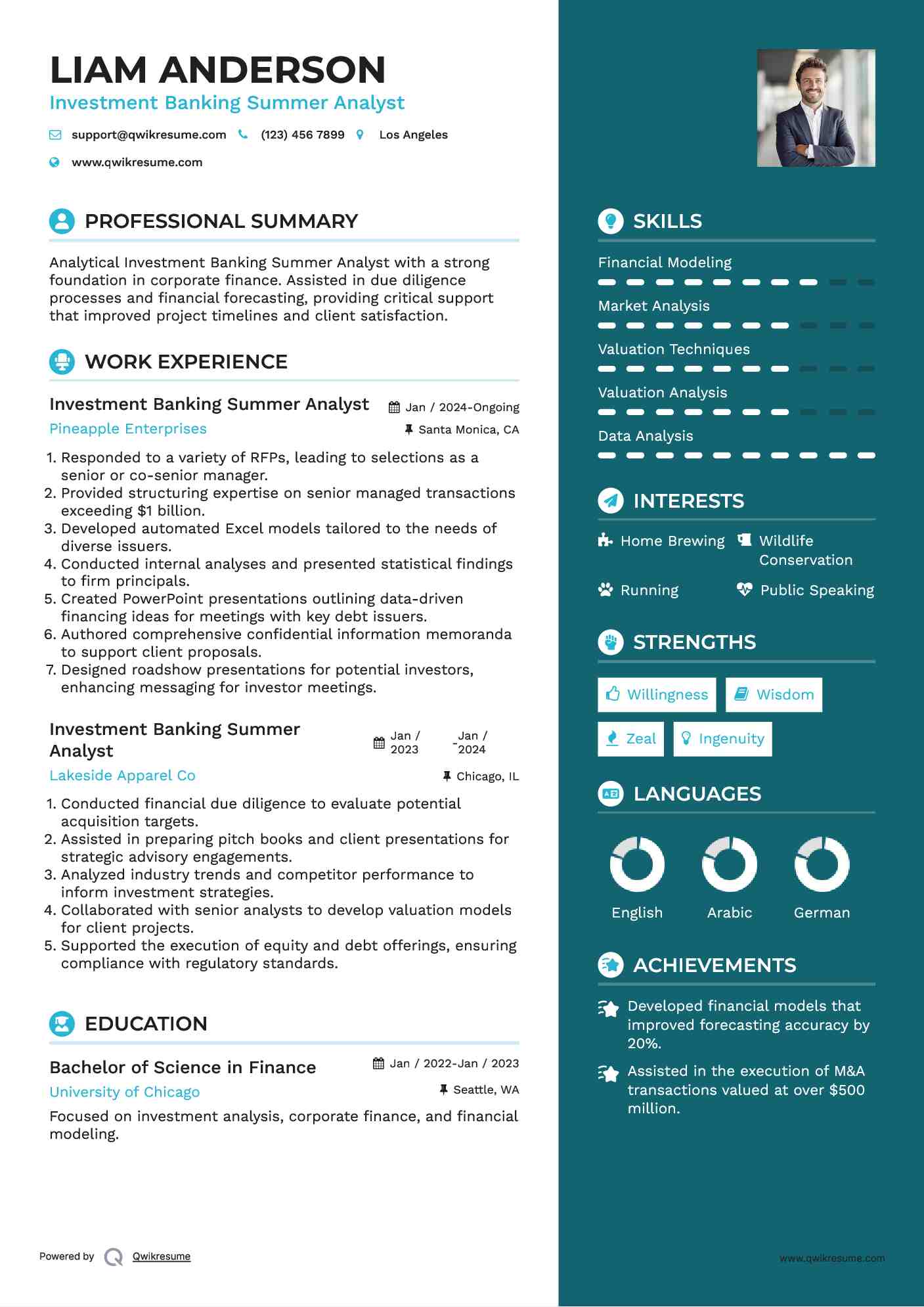

Objective : Analytical Investment Banking Summer Analyst with a strong foundation in corporate finance. Assisted in due diligence processes and financial forecasting, providing critical support that improved project timelines and client satisfaction.

Skills : Financial Modeling, Market Analysis, Valuation Techniques, Valuation Analysis, Data Analysis

Description :

- Responded to a variety of RFPs, leading to selections as a senior or co-senior manager.

- Provided structuring expertise on senior managed transactions exceeding $1 billion.

- Developed automated Excel models tailored to the needs of diverse issuers.

- Conducted internal analyses and presented statistical findings to firm principals.

- Created PowerPoint presentations outlining data-driven financing ideas for meetings with key debt issuers.

- Authored comprehensive confidential information memoranda to support client proposals.

- Designed roadshow presentations for potential investors, enhancing messaging for investor meetings.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance