KYC Analyst Resume

Headline : Results-oriented KYC Analyst with 7 years of experience specializing in AML compliance and customer due diligence. Proven ability to assess client risk profiles, execute enhanced due diligence, and ensure regulatory adherence. Adept at leveraging analytical skills to identify suspicious activities and contribute to effective risk management strategies.

Skills : Data Analysis, Financial Analytics, Email Management, Document Management

Description :

- Analyzed client sources of wealth and net worth for suitability to the firm, ensuring compliance with KYC regulations.

- Reviewed account documentation requirements for KYC, ensuring adherence to JPMorgan Chase standards.

- Conducted research on payment patterns and transaction histories to resolve discrepancies effectively.

- Serviced JPMC Commercial Bank's Global Wealth Management and Ultra High Net Worth portfolios, maintaining high compliance standards.

- Performed Enhanced Due Diligence (EDD) reviews for high-risk customers, identifying account purposes and confirming sources of wealth.

- Executed transactional reviews as part of periodic assessments to mitigate risk and ensure compliance.

- Collected comprehensive customer information to define normal and expected activity for high-risk clients.

Experience

5-7 Years

Level

Executive

Education

B.S. Finance

KYC Analyst Resume

Headline : Dedicated KYC Analyst with 7 years of expertise in anti-money laundering and customer due diligence. Skilled in evaluating client risk profiles, executing comprehensive investigations, and ensuring compliance with regulatory standards. Committed to enhancing risk management processes and identifying potential financial threats through meticulous analysis.

Skills : Data Analysis, Report Presentation, Database Management, Communication Management, Financial Software Proficiency

Description :

- Oversee daily transactions and KYC remediation efforts, ensuring accurate data collection and documentation for compliance.

- Act as the primary liaison for KYC inquiries, addressing concerns and facilitating communication among stakeholders.

- Provide expert guidance on AML and KYC policies to ensure adherence to regulatory requirements.

- Collaborate with compliance teams to discuss complex client issues and develop effective solutions.

- Conduct thorough investigations using internal and external data sources, including Actimize and World Check.

- Monitor client accounts for potential matches to sanctioned lists, escalating any risks as appropriate.

- Analyze KYC data to assess risk and determine the necessity for further investigation.

Experience

5-7 Years

Level

Executive

Education

B.S. Finance

KYC Analyst Resume

Objective : Strategic KYC Analyst with 5 years of comprehensive experience in anti-money laundering and customer risk assessment. Expertise in conducting thorough due diligence, analyzing complex client data, and ensuring compliance with regulatory standards. Passionate about utilizing analytical skills to enhance risk management frameworks and safeguard financial integrity.

Skills : Anti-Money Laundering Specialist, Fraud Detection and Prevention, Financial Crime Prevention, KYC Procedures, Document Verification

Description :

- Executed comprehensive due diligence reviews for personal and corporate accounts utilizing advanced research tools.

- Evaluated and documented customer wealth sources, ensuring thorough understanding of financial backgrounds.

- Performed risk assessments to accurately categorize clients based on potential financial crime exposure.

- Reviewed accounts of Special Category Customers, including PEPs, ensuring compliance with regulatory requirements.

- Conducted pre-account opening assessments to determine risk levels associated with potential clients.

- Analyzed client documentation to assess country-specific business risks and compliance issues.

- Collaborated with compliance teams to enhance KYC processes and policies.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

KYC Analyst Resume

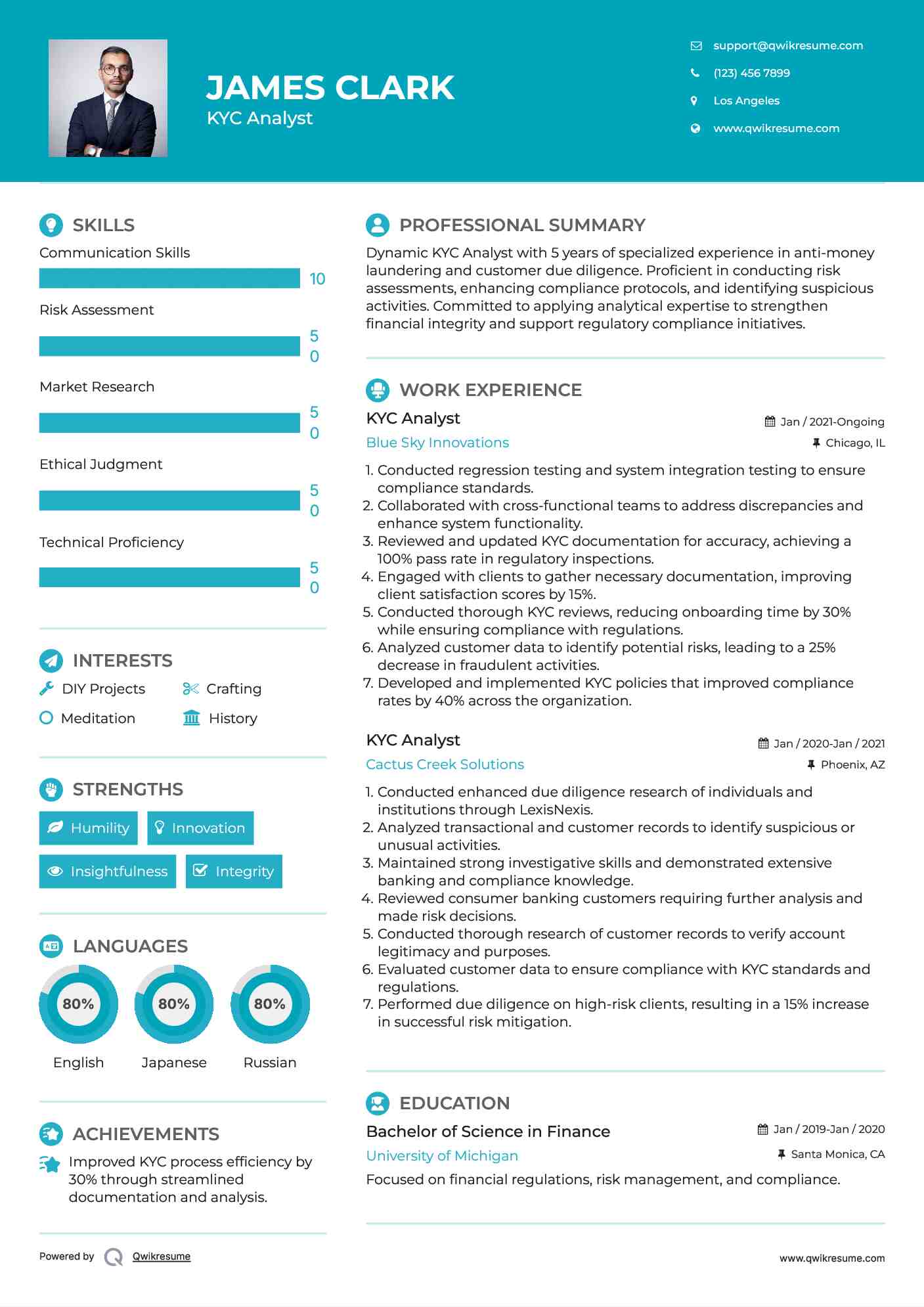

Objective : Dynamic KYC Analyst with 5 years of specialized experience in anti-money laundering and customer due diligence. Proficient in conducting risk assessments, enhancing compliance protocols, and identifying suspicious activities. Committed to applying analytical expertise to strengthen financial integrity and support regulatory compliance initiatives.

Skills : Communication Skills, Risk Assessment, Market Research, Ethical Judgment, Technical Proficiency

Description :

- Conducted regression testing and system integration testing to ensure compliance standards.

- Collaborated with cross-functional teams to address discrepancies and enhance system functionality.

- Reviewed and updated KYC documentation for accuracy, achieving a 100% pass rate in regulatory inspections.

- Engaged with clients to gather necessary documentation, improving client satisfaction scores by 15%.

- Conducted thorough KYC reviews, reducing onboarding time by 30% while ensuring compliance with regulations.

- Analyzed customer data to identify potential risks, leading to a 25% decrease in fraudulent activities.

- Developed and implemented KYC policies that improved compliance rates by 40% across the organization.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

KYC Analyst Resume

Summary : Accomplished KYC Analyst with a decade of experience in anti-money laundering compliance and customer due diligence. Expertise in conducting risk assessments, implementing robust due diligence processes, and ensuring adherence to regulatory standards. Committed to enhancing financial security through meticulous analysis and proactive identification of potential risks.

Skills : Advanced Microsoft Office Suite, LexisNexis and Public Records Research, Quality Assurance, Ethical Judgment, Technical Proficiency

Description :

- Conducted comprehensive risk assessments of business clients to identify and mitigate potential financial risks.

- Performed due diligence by verifying client identification and documentation, ensuring compliance with regulatory standards.

- Collaborated with the sales department to obtain necessary documentation while adhering to Customer Identification Program (CIP) requirements.

- Investigated negative news and potential criminal activity related to clients to assess reputational risk.

- Researched and verified the good standing of registered companies through public records.

- Analyzed ownership structures and business operations to identify potential risks and compliance issues.

- Maintained and updated client information in the AMC database to ensure accuracy and compliance.

Experience

7-10 Years

Level

Management

Education

B.S. Finance

KYC Analyst Resume

Objective : Skilled KYC Analyst with 5 years of experience specializing in AML compliance and risk assessment. Proficient in conducting thorough due diligence, analyzing customer profiles, and ensuring adherence to regulatory requirements. Committed to enhancing risk management strategies and identifying suspicious activities through meticulous research and analysis.

Skills : Microsoft Office Suite, Analytical Skills, Risk Assessment, Risk Mitigation

Description :

- Conducted comprehensive KYC investigations for business banking clients to ensure compliance with AML regulations.

- Analyzed client transactions to validate business legitimacy and identify potential risks.

- Assigned risk rankings based on detailed assessments of client profiles, transaction histories, and geographical factors.

- Documented due diligence findings and provided actionable recommendations to senior management.

- Collaborated with internal teams to gather necessary information for KYC evaluations.

- Monitored and updated KYC profiles to reflect changes in customer risk status.

- Escalated complex cases to management for further investigation and resolution.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

KYC Analyst Resume

Objective : With 5 years of dedicated experience as a KYC Analyst, I excel in conducting thorough due diligence and managing compliance with AML regulations. My analytical skills enable me to assess client risk effectively and enhance operational efficiencies. I am passionate about fostering a secure financial environment through meticulous attention to detail and proactive risk identification.

Skills : Data Analysis Software, Customer Due Diligence, Risk Assessment, AML Regulations, KYC Compliance

Description :

- Ensured compliance with KYC regulations by reviewing and verifying client onboarding documentation.

- Conducted thorough risk assessments for new clients, identifying potential compliance issues.

- Maintained accurate and detailed records of client interactions and KYC processes.

- Collaborated with compliance teams to develop enhanced due diligence protocols.

- Analyzed client data to identify trends and potential suspicious activities.

- Provided training and support to team members on KYC best practices and regulatory changes.

- Participated in audits and compliance reviews to ensure adherence to regulatory standards.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

KYC Analyst Resume

Objective : Proficient KYC Analyst with 5 years of experience in conducting thorough due diligence and compliance assessments. Skilled at identifying and mitigating risks related to anti-money laundering regulations. Committed to enhancing financial security through meticulous analysis of client data and effective risk management strategies.

Skills : KYC Analysis, Risk Mitigation, Customer Risk Assessment, AML Compliance Regulations, Financial Crime Prevention

Description :

- Applied knowledge of AML laws, including the Bank Secrecy Act and USA PATRIOT Act, to ensure compliance.

- Interpreted anti-money laundering regulations to recommend necessary compliance changes.

- Analyzed financial statements to identify unusual transaction patterns effectively.

- Investigated potentially suspicious activities from various sources, ensuring regulatory compliance.

- Performed due diligence related to suspicious activities through client background and transaction reviews.

- Conducted searches in third-party and internal databases for comprehensive due diligence.

- Implemented and maintained KYC and enhanced due diligence compliance standards across departments.

Experience

2-5 Years

Level

Junior

Education

BSc Finance

KYC Analyst Resume

Headline : Accomplished KYC Analyst with 7 years of extensive experience in anti-money laundering and customer due diligence. Expertise in conducting thorough risk assessments, executing enhanced due diligence, and ensuring compliance with regulatory frameworks. Passionate about leveraging analytical skills to identify suspicious activities and strengthen overall risk management strategies.

Skills : Data Visualization Tools, Regulatory Reporting Skills, Data Management, Investigative Research, Report Writing

Description :

- Conducted comprehensive investigations into diverse investment funds and vehicles, ensuring compliance with MIFID classifications.

- Gathered and analyzed documentation for complex ownership structures, ensuring adherence to due diligence procedures.

- Escalated adverse media and PEP matches to compliance, enhancing KYC framework integrity.

- Executed KYC procedures for high-net-worth individuals and corporate clients using advanced screening tools.

- Maintained accurate and accessible records of documentary evidence for compliance audits.

- Drafted and reviewed legal documents, ensuring compliance with regulatory standards.

- Conducted thorough reviews of low and medium-risk accounts to ensure compliance with KYC policies.

Experience

5-7 Years

Level

Executive

Education

B.S. Finance

KYC Analyst Resume

Objective : KYC Analyst with 2 years of experience in performing due diligence and compliance assessments. Skilled in identifying risk factors, analyzing client data, and ensuring adherence to AML regulations. Focused on enhancing the integrity of financial systems through thorough investigations and effective risk management strategies.

Skills : Data Analysis Tools, Client Risk Assessment, Database Management, Policy Development, Audit Support

Description :

- Executed KYC and AML due diligence for client onboarding and account monitoring.

- Verified client documents and ownership through various databases, ensuring accuracy.

- Identified high-risk accounts and escalated findings to senior compliance officers.

- Conducted investigations using tools like World Check and LexisNexis.

- Performed enhanced due diligence on high-risk clients, ensuring regulatory compliance.

- Maintained accurate records of findings and updates in internal databases.

- Collaborated with teams to streamline compliance processes and enhance efficiency.

Experience

0-2 Years

Level

Entry Level

Education

BS Finance