Loan Officer Resume

Objective : Detail-oriented Loan Officer with over 5 years of experience in mortgage lending and customer service. Proven track record in assessing client needs, providing tailored loan solutions, and ensuring compliance with regulations.

Skills : Loan Documentation, Financial Analysis, Risk Assessment

Description :

- Educate clients on various loan products and credit options, ensuring they understand terms and conditions.

- Collaborate with clients to identify financial goals and develop strategies to achieve them, while liaising with underwriters to resolve application issues.

- Negotiate payment plans with clients facing delinquency, promoting suitable bank products to meet their needs.

- Conduct thorough financial assessments to determine client eligibility for loans, ensuring compliance with lending regulations.

- Maintain accurate records of client interactions and loan applications, enhancing the efficiency of the loan processing workflow.

- Provide exceptional customer service, addressing inquiries and resolving issues promptly to foster client loyalty.

- Stay updated on industry trends and regulatory changes to provide informed advice to clients and ensure compliance.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

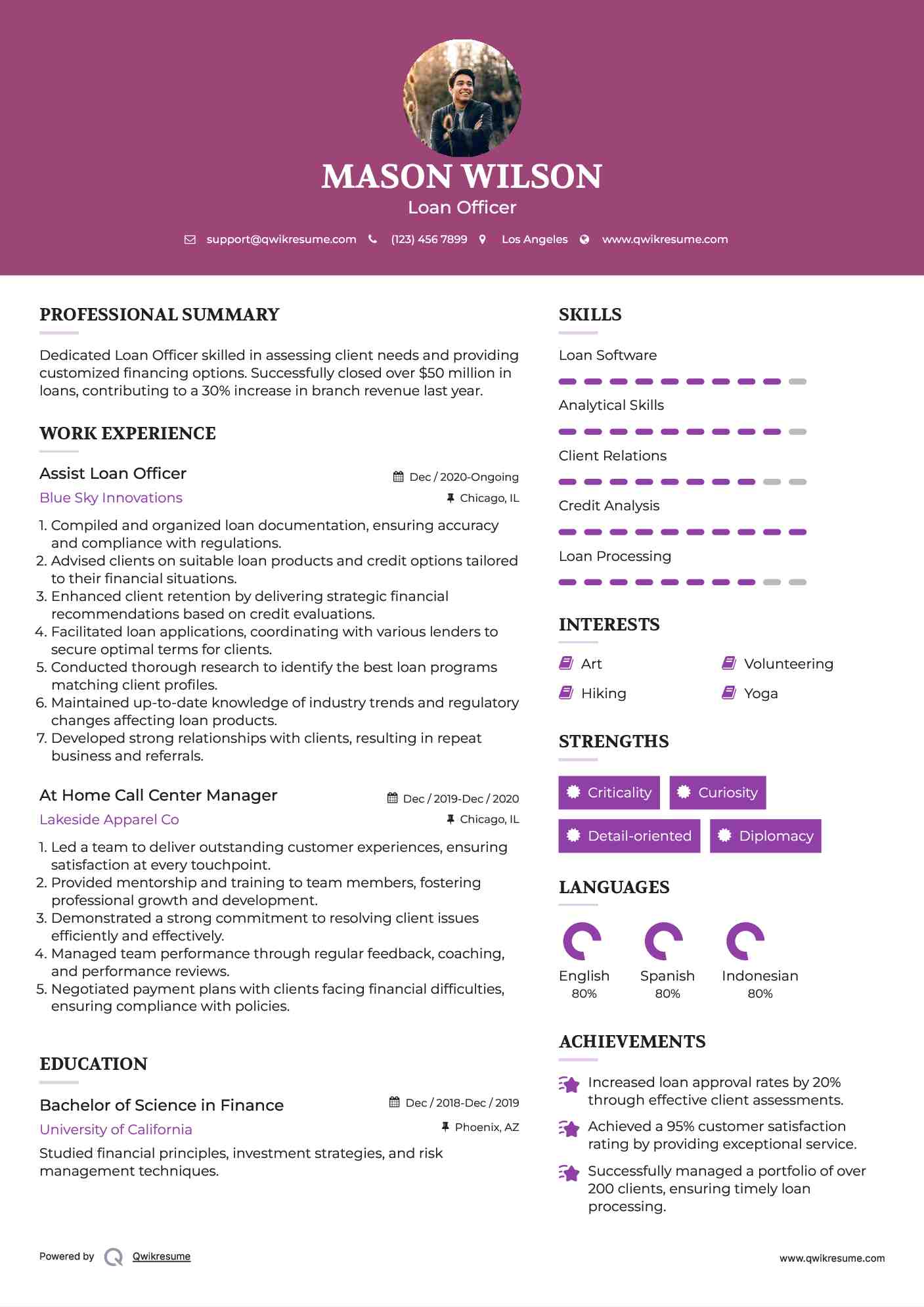

Assist Loan Officer Resume

Objective : Dedicated Loan Officer skilled in assessing client needs and providing customized financing options. Successfully closed over $50 million in loans, contributing to a 30% increase in branch revenue last year.

Skills : Loan Software, Analytical Skills, Client Relations, Credit Analysis, Loan Processing

Description :

- Compiled and organized loan documentation, ensuring accuracy and compliance with regulations.

- Advised clients on suitable loan products and credit options tailored to their financial situations.

- Enhanced client retention by delivering strategic financial recommendations based on credit evaluations.

- Facilitated loan applications, coordinating with various lenders to secure optimal terms for clients.

- Conducted thorough research to identify the best loan programs matching client profiles.

- Maintained up-to-date knowledge of industry trends and regulatory changes affecting loan products.

- Developed strong relationships with clients, resulting in repeat business and referrals.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

Mortgage Loan Officer Resume

Objective : Results-driven Loan Officer with 5 years of experience in mortgage lending, client relations, and financial analysis. Proven track record of exceeding sales targets and building strong client relationships to drive business growth.

Skills : Data Analysis, Documentation Skills, Customer Service, Financial Analysis, Credit Assessment, Loan Processing

Description :

- Trained bank partners on effective referral strategies and sales techniques, enhancing client engagement.

- Collaborated with realtors and financial institutions to identify and secure mortgage opportunities.

- Developed marketing initiatives to attract new clients and strengthen existing relationships.

- Established and maintained partnerships with realtors, title agents, and attorneys to expand referral networks.

- Certified as a wealth management mortgage loan officer, enhancing service offerings to high-net-worth clients.

- Consistently exceeded production goals, achieving top performance metrics in the first year.

- Participated in industry events to promote mortgage services and foster relationships with banking partners.

Experience

2-5 Years

Level

Executive

Education

BSF

Senior Loan Officer Resume

Objective : Experienced Loan Officer with a strong background in residential and commercial lending. Expert in building relationships and guiding clients through the loan process, resulting in a 95% client retention rate.

Skills : Financial Analysis, Data Analysis, Financial Modeling, Documentation Skills, Presentation Skills

Description :

- Conduct thorough assessments of loan applications to determine eligibility and risk factors.

- Collaborate with clients to gather necessary documentation and provide guidance throughout the loan process.

- Approve loans within established limits and escalate complex cases to senior management.

- Negotiate repayment plans with clients facing financial difficulties to minimize defaults.

- Prepare detailed reports on loan performance and client interactions for management review.

- Ensure compliance with all regulatory requirements and internal policies during the loan process.

- Originate and close over $5 million in loans annually, exceeding sales targets by 20%.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

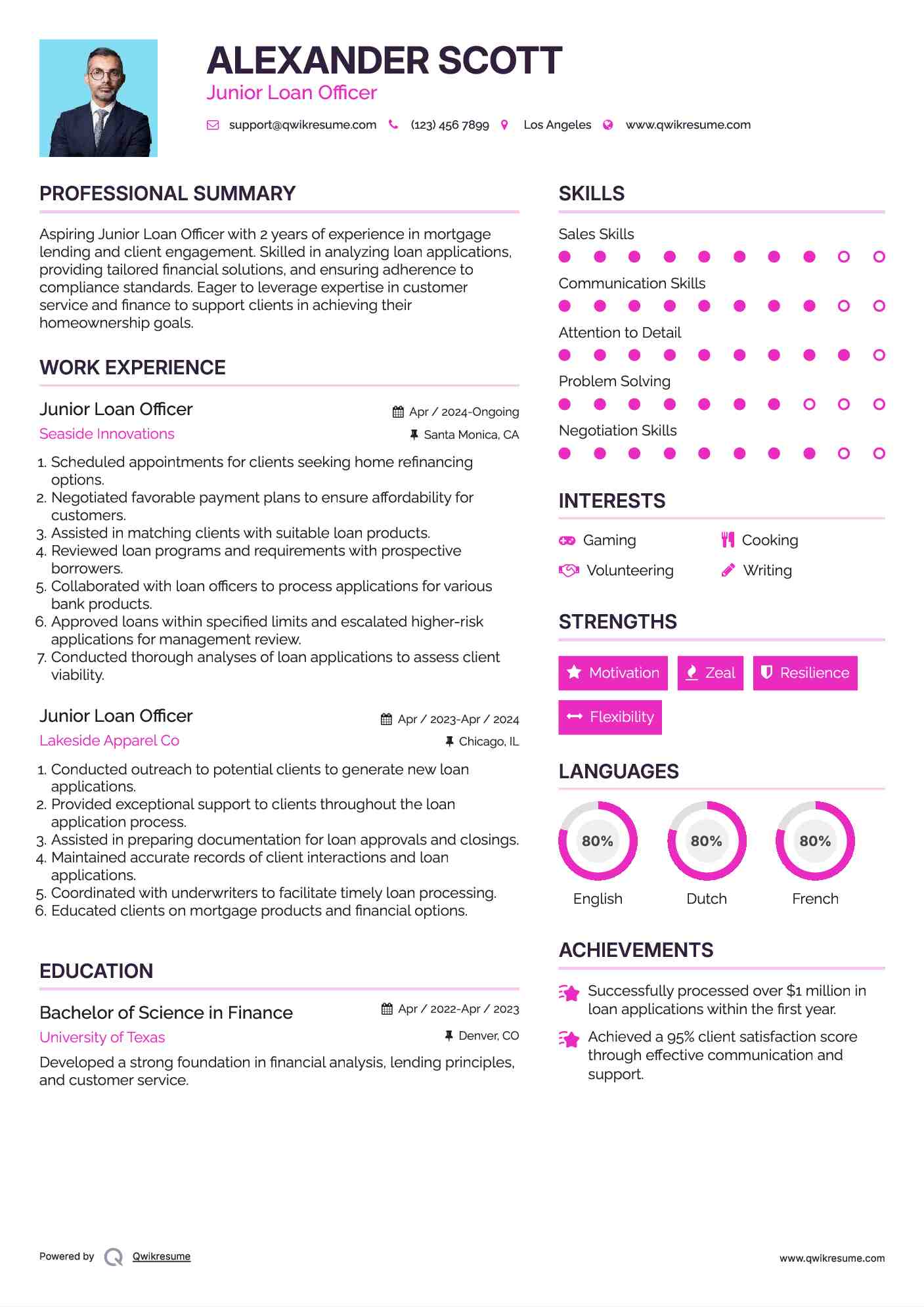

Junior Loan Officer Resume

Objective : Results-driven Loan Officer with 2 years of experience in evaluating loan applications and providing tailored financial solutions. Proven ability to build strong client relationships and exceed sales targets while ensuring compliance with lending regulations.

Skills : Loan Documentation, Client Engagement, Credit Assessment, Risk Assessment, Loan Processing

Description :

- Evaluated loan applications and prepared detailed submissions for underwriter review.

- Identified and resolved credit issues, ensuring accurate information for loan processing.

- Communicated with denied applicants, providing clear explanations and alternative options.

- Assessed clients' financial needs to recommend suitable loan products and services.

- Explained loan terms, interest rates, and documentation requirements to clients effectively.

- Developed a referral network and cross-sold financial products to meet sales goals.

- Maintained accurate records of loan applications and disbursements using banking software.

Experience

0-2 Years

Level

Junior

Education

B.S. Finance

Loan Officer/Processor Resume

Headline : Results-driven Loan Officer with 7 years of experience in evaluating financial data, guiding clients through the loan process, and ensuring compliance with regulations. Proven track record of closing loans efficiently and enhancing customer satisfaction.

Skills : Loan Process Management, Financial Analysis, Customer Relationship Management, Regulatory Compliance

Description :

- Conducted comprehensive interviews with loan applicants to gather personal and financial information for loan processing.

- Provided timely updates to borrowers regarding loan status and escalated issues to appropriate departments.

- Managed the entire loan pipeline, ensuring accuracy and efficiency from application to closing.

- Performed detailed financial analyses to recommend suitable loan products tailored to client needs.

- Processed customer payments and negotiated repayment plans for delinquent accounts effectively.

- Engaged in all aspects of lending, including consumer and commercial loans, ensuring compliance with regulations.

- Conducted thorough financial assessments to ensure loan eligibility, reducing default rates by 15%.

Experience

5-7 Years

Level

Consultant

Education

BSF

Loan Officer I Resume

Objective : Detail-oriented Loan Officer with 2 years of experience in evaluating loan applications, analyzing financial data, and providing exceptional customer service. Proven track record in managing the loan process from application to closing.

Skills : Microsoft Office, Client Assessment, Loan Structuring, Credit Analysis, Risk Assessment

Description :

- Reviewed and verified loan agreements for accuracy and compliance with policies.

- Analyzed applicants' financial status and credit history to assess loan eligibility.

- Maintained a comprehensive database of loan applicants' financial information.

- Recommended loan approvals or denials based on detailed application reviews.

- Ensured confidentiality of sensitive bank records and client data.

- Coordinated with underwriters to facilitate loan application verification.

- Managed the loan process from client prospecting to closing, fostering strong client relationships.

Experience

0-2 Years

Level

Entry Level

Education

BSF

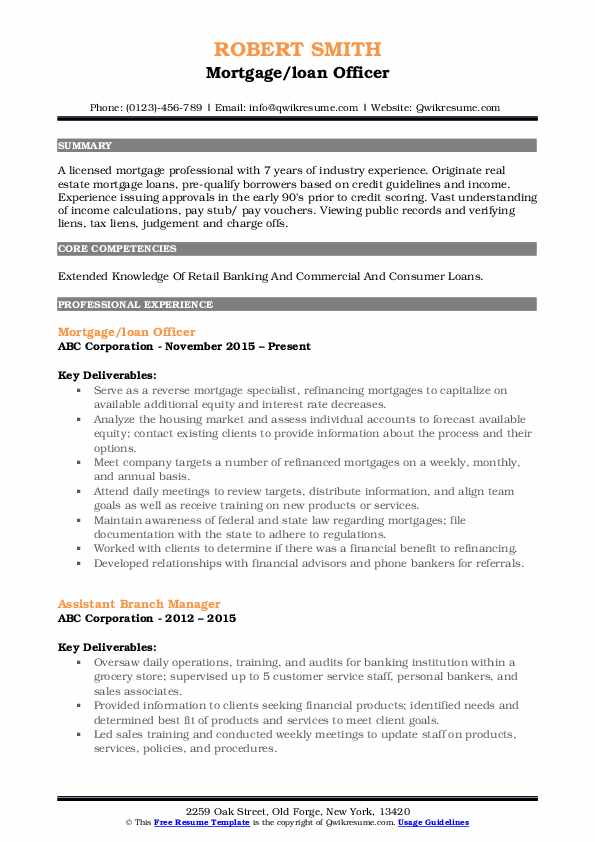

Mortgage/loan Officer Resume

Headline : Dynamic Loan Officer with a passion for helping clients achieve their financial goals. Recognized for outstanding performance, having consistently ranked in the top 10% of loan officers in the region for three consecutive years.

Skills : Expertise in Mortgage Underwriting, Loan Origination, Client Relationship Management, Regulatory Compliance, Credit Analysis

Description :

- Specialized in mortgage origination, guiding clients through refinancing options to maximize equity.

- Conducted thorough market analysis to evaluate client accounts and forecast equity availability.

- Consistently met and exceeded company targets for loan refinances on a weekly and monthly basis.

- Participated in daily strategy meetings to align team objectives and enhance product knowledge.

- Ensured compliance with federal and state mortgage regulations by maintaining accurate documentation.

- Collaborated with clients to assess financial benefits of refinancing options.

- Established strong referral networks with financial advisors to drive new business opportunities.

Experience

5-7 Years

Level

Consultant

Education

BSF

Licensed Mortgage Loan Officer Resume

Summary : Detail-oriented Loan Officer with expertise in credit analysis and risk assessment. Successfully streamlined the loan approval process, reducing turnaround time by 20% while maintaining compliance with regulations.

Skills : Proficient in Loan Processing Software, Document Management, Data Analysis, Presentation Skills, Client Communication

Description :

- Managed the end-to-end loan application process, ensuring compliance with underwriting guidelines.

- Evaluated borrower creditworthiness by analyzing financial documents and credit reports.

- Achieved the highest loan approval rate in the branch, resulting in recognition as Employee of the Month.

- Educated clients on loan products and guided them through the application process.

- Developed strong referral networks with real estate agents and financial advisors to drive business growth.

- Coordinated with underwriters and processors to expedite loan approvals and closings.

- Streamlined loan processing procedures, decreasing turnaround time by 25% and enhancing customer satisfaction.

Experience

10+ Years

Level

Senior

Education

BSF

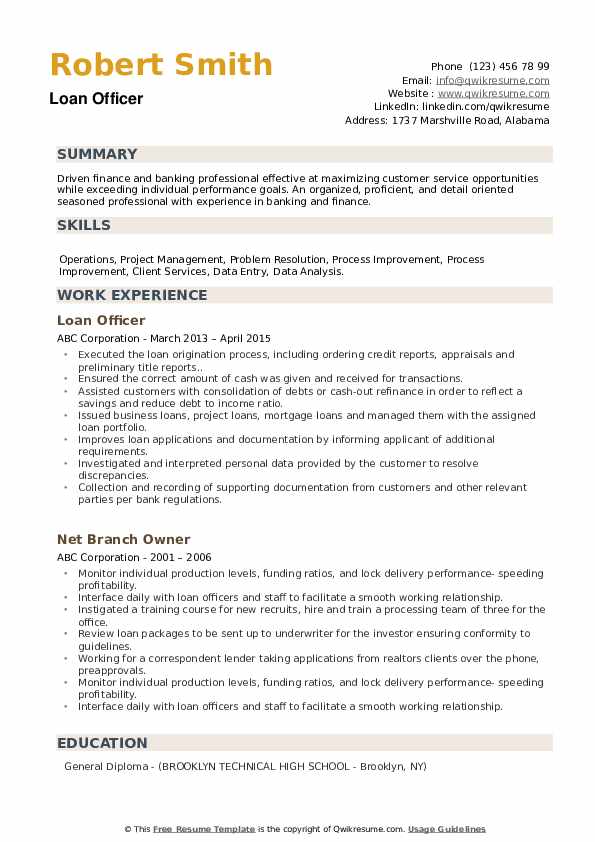

Loan Officer Resume

Summary : Proficient Loan Officer with a deep understanding of mortgage products and market trends. Developed innovative marketing strategies that increased lead generation by 40%, driving significant growth in loan applications.

Skills : Loan Operations, Loan Project Management, Loan Problem Resolution, Loan Process Improvement

Description :

- Executed the loan origination process, including credit report orders, appraisals, and title reports.

- Ensured accurate cash handling for all transactions, maintaining compliance with banking regulations.

- Guided clients through debt consolidation and refinancing options to enhance savings and reduce debt-to-income ratios.

- Managed a diverse portfolio of business, project, and mortgage loans, ensuring timely processing and compliance.

- Enhanced loan applications by advising applicants on additional documentation requirements.

- Analyzed customer data to identify discrepancies and resolve issues effectively.

- Collected and documented supporting materials from clients in accordance with bank policies.

Experience

10+ Years

Level

Senior

Education

B.S. Finance

Senior Loan Officer/Processor Resume

Summary : Self-motivated individual with over 25 years of professional experience. To obtain a position which utilizes my years of solid experience and challenges technical, administrative and management skills.

Skills : <div>Confidentiality, Analyzing information, Decision making.</div>

Description :

- Expedited mortgage loan processes through high-level expertise in preparing mortgage application packages, interviewing potential mortgage applicants and finalizing all required documentation.

- Analyzed customer's financial status, credit, and other prudent financial information to identify appropriate mortgage programs.

- Key Achievements: Employed strong planning and organizational skills while reviewing 40 to 50 mortgage applications each month and processing 10 of 40 applications for management approval or disapproval.

- Processed mortgage loan application up to $500k.

- Communicated with approved applicants regarding payment schedules and payments distribution to principle, interest, and taxes.

- Effectively communicated with mortgage applicants to ensure accuracy of loan applications and maintain a positive rapport with applicants at all times.

- Developed monthly reports regarding potential risk or compliance issues for distribution to managers.

- Promptly resolved mortgage application issues or questions in collaboration with underwriters.

Experience

10+ Years

Level

Senior

Education

Banking

Senior Loan Officer Assistant Resume

Objective : Ability to structure deals Strong Commercial Real Estate Finance skills Experience working with large institutions; Private Equity and Hedge Funds Experience securing financing from the US Small Business Administration (SBA) Experience with EB-5 Investor program for foreign nationals investing in the Experience dealing with an international network of clientele.

Skills : Microsoft Excel, Microsoft Office Suite, Financial Modeling, Accounting.

Description :

- Established solid partnerships with realtors, builders, financial organizations, and other sources to facilitate the development of top-notch residential loans.

- Ensured loans met strict lending guidelines.

- Maintained detailed industry knowledge as well as intricacies of company products, policies, procedures, and VA/FHA underwriting standards.

- Use expertise to educate clients on portfolio of services, regulations, and procedures in addition to mentoring new loan officers.

- Obtained customer applications, quote points and rates, and follow up with registration lock-in.

- Demonstrated proficiency with Microsoft Office Word, Excel, PowerPoint, and Outlook.

- Key Achievements: Mastered the complexities of procedures, policies, and underwriting guidelines; Led to promotion as Senior Loan Officer and the responsibility of training new loan officers.

- Leveraged in-depth program and underwriting knowledge into a mutually profitable joint venture marketing deal with the Re/Max First Baton Rouge office.

Experience

2-5 Years

Level

Junior

Education

Diploma

Senior Loan Officer III Resume

Summary : Over fifteen years of intensive professional, managerial, organizational and supervisory knowledge and experience with specialization in the insurance industry. Self-motivated, able to prioritize tasks, set short and long term goals and meet functional deadlines. Able to work individually and in groups, an expert in providing motivation to ensure smooth work flow and efficient working deadlines.

Skills : Microsoft, CRM, Credit Analysis, Financial Statements, Business Development, Talent Management, Business Management, Performance Management, Sales Training.

Description :

- Interviewed loan applicants, obtained all of the necessary documentation to make the loan decision, properly secure the collateral used to qualify for the loan, and approve the loan.

- Provided information to the client concerning the different types of loans offered, the terms and interest rates, and the documentation needed to be considered for a loan.

- Made loan decisions in a timely fashion to meet other client needs.

- Referred all borrower requests for loan extensions, refinances, or any changes to original loan terms as designated in code of ethics.

- Assisted manager in evaluating other loan officers lending performance and compare it to past periods by reviewing a breakdown of the number and dollar amount of loans outstanding.

- Participated in training and seminars, workshops to improve loan processing and techniques.

- Trained new officers on loan processing and techniques.

Experience

7-10 Years

Level

Management

Education

Business Administration

Senior Loan Officer Resume

Headline : Accomplished, solutions-oriented Finance Process Manager with a solid 10+ years record of accomplishments within the finance, real estate and insurance industries, encompassing relationship management, credit analysis, document management with 100% compliance, organizational agility, and strategic forecasting. Expert utilization of applicant tracking software such as Calyx and Encompass, and agency management software such as Insight AS 400 and Applied EPIC.

Skills : Business Development, Relationship Management, Credit Analysis, Account Management, Policy, Program Management, Instructional Design, Document Management, Administration, Presentation.

Description :

- Approved loans within specified limits, and refer loan applications outside those limits to management for approval.

- Met with applicants to obtain information for loan applications and to answer questions about the process.

- Analyzed applicants' financial status, credit, and property evaluations to determine feasibility of granting loans.

- Explained to customers the different types of loans and credit options that are available, as well as the terms of those services.

- Obtained and compiled loan applicants' credit histories, corporate financial statements, and other financial information.

- Reviewed loan agreements to ensure that they are complete and accurate according to policy.

- Stayed abreast of new types of loans and other financial services and products in order to better meet customers' needs.

Experience

5-7 Years

Level

Executive

Education

MBA In Management

Junior Loan Officer Resume

Objective : A talented Customer Service and Sales Representative with experience in performing a variety of support duties requiring a range of skills and knowledge of policies and procedures. Acquiring a position to assist and direct customers, resolving problems and inquiries while working in a fast-paced and dynamic organization.

Skills : Microsoft Office, Customer Service, Team Player.

Description :

- Performed daily maintenance of the loan applicant database.

- Determined appropriate rate locks, issuance of disclosures, overage and underage waivers, and fee waivers.

- Educated customers on the variety of loan products and available credit options.

- Executed the loan origination process, including ordering credit reports, appraisals, and preliminary title reports.

- Researched insurance information and flood certificates.

- Assisted senior-level credit officers with complex loan applications.

- Adhered to all federal and state compliance guidelines relative to retail mortgage lending.

- Interviewed an average of 8 mortgage loan applicants per month.

Experience

2-5 Years

Level

Junior

Education

HS Diploma

Junior Loan Officer Resume

Objective : Currently responsible for promoting and producing 7 weekly comedy shows around the country. Experienced as a commercial real estate professional with success in the leasing and marketing of retail shopping centers. A proven track record as a top producer in a variety of sales positions with the ability to adapt to varying products and constantly changing markets.

Skills : Microsoft Office, C++, Customer Service, Teamwork, HTML, Typing, Networking, Research.

Description :

- Assisted in helping close 12 mortgage loans on average loans a month.

- Assisted Loan Officers on loan type pre-approvals & inputting all information into Calyx Point & Dropbox using Adobe Acrobat.

- Followed up with updates to each borrower as the loan transaction was in processing, prior to docs & also funding as well as filling UW Conditions.

- Funded $1.2 million on average in residential mortgage loans a month.

- Specialized in file flow process for FHA Streamline & HARP loans.

- Collected all necessary documents for various loan types such as Conventional, VA, & FHA to submit to Underwriting by guidelines.

- Performed brokerage services on behalf of clients by sourcing banks to refinance mortgages.

- Assisted customers in refinance process by addressing their needs and concerns.

Experience

2-5 Years

Level

Junior

Education

HS Diploma

Junior Loan Officer Resume

Headline : Worked in customer-service-oriented jobs that have goals that need to be completed throughout each day. Hard work is on the path to success. Interested in goal-oriented, success-driven work that motivates you and gets you excited for each day.

Skills : Microsoft Office, Google Docs, ActiveNet.

Description :

- Developed and maintained banking relationships with potential clients, existing customers,s and community organizations.

- Ensured compliance with banking policies, lending practices, and regulatory process statute.

- Maintained knowledge of banking products and services, as well as knowledge of the industry.

- Kept abreast of current developments and market trends, to further identify and service the customers' needs.

- Supported the mortgage manager and clients during the loan application process.

- Delivered mortgage application checklist items to client/borrower, analyzed applicants' financial status, credit, and property evaluation to determine the feasibility of granting loans.

- Contacted numerous cold and warm leads.

- Obtained information about customers' mortgage status, credit score, loan to value ratio, and competitor mortgage quotes.

- Ascertained and evaluated customers' particular mortgage goals and requirements.

Experience

5-7 Years

Level

Executive

Education

Associates of Science in Mechanical Engineering

Junior Loan Officer Resume

Objective : Seeks to obtain a Junior Loan Officer position as an Administrative Office Professional with a reputable organization that will allow fully utilizing reading and writing, communication, and organization skills.

Skills : Computer Proficiency in Microsoft Word, Excel, Outlook, And PowerPoint, Strong Interpersonal And Organization. Excellent Knowledge Of Office Etiquette And Phone Manners, Accomplished Ability To Multi-task.

Description :

- Set Appointments regarding home refinancing.

- Negotiated to get affordable house payments for customers.

- Matched appropriate payment plans.

- Consulted and reviewed loan programs and requirements to prospective borrowers.

- Work with assigned loan officers to get solicited company and self-generated applicants approved for various bank loans and products.

- Approve loans within specified limits, and refer loan applications outside those limits to management for approvals.

- Took thorough and complete loan applications by analyzing and prequalifying the applicant information to determine the viability of the customers.

- Cold calls for new clients, and set appointments for loan officers.

- Assisted with applications and paperwork.

Experience

0-2 Years

Level

Entry Level

Education

BBA

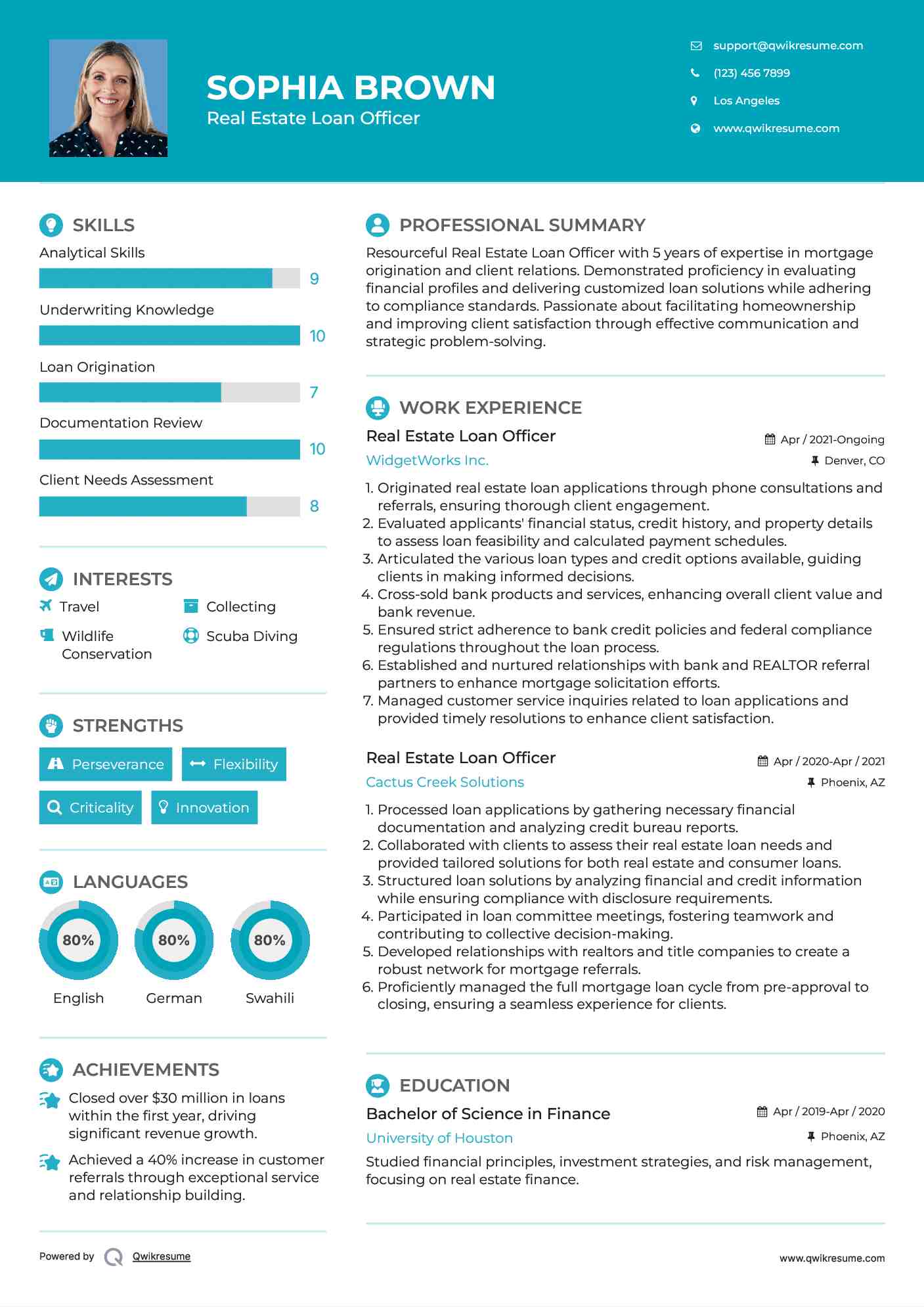

Real Estate Loan Officer Resume

Objective : Real Estate Loan Officer offering over ten years of experience in mortgage and home equity loan originations, seeking employment for continual growth and satisfaction while meeting company's goals. Licensed Mortgage Loan Originator Bilingual English & Spanish Home Equity Loan Officer Strong Work Ethic Retail Banker Multi-Task MS Word, Excel, Windows Detailed and Service-Oriented Effective Interpersonal Skills Adaptability/Quick Learner.

Skills : Mortgages, Planning Skills.

Description :

- Originated real estate loan applications via the telephone and referrals.

- Analyzed applicant's financial status, credit, and property evaluation to determine the feasibility of granting loan and computed payment schedules.

- Explained various loan types and credit options available.

- Cross sold other bank products and services I.e. credit cards, deposit accounts.

- Responsible for adherence to bank's credit policies and federal compliance regulations.

- Solicited mortgages from bank and REALTOR referral partners.

- Reviewed, filtered and replyed to MLO emails that are customer service in nature (insurance, account or post-closing related questions).

Experience

2-5 Years

Level

Executive

Education

MS

Real Estate Loan Officer Resume

Headline : Organizing and ensuring that closing packages are signed and correctly completed after loan closing to be sent to the post-closing team, Assisting with post-closing items and documentation needed, and also Demonstrating teamwork in all interactions with coworkers and in the completion of all duties and responsibilities.

Skills : Event Coordination, Negotiation Skills, Problem Solving.

Description :

- Closed volume in the third month of production, achieving 2nd place top of the leaderboard.

- Honored with multiple awards during tenure, including repeated Top Producer distinctions (four months in a row of $ 1.7+ M funded volume with proceeding months $900 +K funded volume, consistently meet or exceed $600k - 750k min requirement.

- Presented different loan options based on buyer needs assessment and/or financial goals.

- Pre-qualified and pre-approved applications.

- Analyzed financials including credit reports.

- Calculated income using tax returns for self-employed borrowers (sole proprietor, Partnership, and corporate tax returns).

- Originated and help facilitate both in-house and secondary market real estate loans.

Experience

5-7 Years

Level

Executive

Education

Associate In A.A.