M And A Analyst Resume

Summary : As an M And A Analyst conducting thorough market research to evaluate potential acquisition targets and analyze industry trends. Analyzing and evaluating potential M&A targets based on business and financial performance.

Skills : Financial Modeling, Valuation Techniques, Due Diligence Process

Description :

- Developed and maintained detailed financial models to assess the underlying business performance of MA targets.

- Prepared detailed presentations summarizing the business performance of MA targets and presenting data in a manner that highlights key points.

- Summarized due diligence findings and prepared presentations and reports for executive leadership and board meetings.

- Supported data requests from executive leadership, as needed, and prepared data extracts and professional presentations for internal stakeholders.

- Analyzed application data, successfully identified filing types, and documented conclusions.

- Built working relationships with management, staff at the Board of Governors, banking institutions, and other regulatory agencies as well as within the Division.

- Prepared written correspondence (letters and emails) to applicants, their third-party representatives, and other regulatory agencies during the processing and analysis of applications and notices received.

Experience

7-10 Years

Level

Senior

Education

MBA

M And A Analyst Resume

Objective : As an M And A Analyst performing and overseeing complex financial modeling and analysis for potential transactions including bottoms-up operating models and valuations. Providing financial, and analytical modeling, detailed due diligence, and strategic support for evaluating potential M&A candidates, joint venture partners, and business development growth initiatives

Skills : M&A Strategy Development, Market Research and Analysis, Industry Trend Analysis

Description :

- Performed due diligence, prepared presentations for senior management, and coordinated with senior executives to support and execute transactions.

- Performed industry due diligence including market research of industry metrics, trends, and competitive analysis.

- Maintained an up-to-date view of market research related to the industry.

- Formulated and prepared presentations to share findings and recommendations for divisional and senior management critical to the decision-making process.

- Conducted ad-hoc analyses at the request of senior executives.

- Assisted in the identification, evaluation, and execution of strategic acquisitions and divestitures.

- Assisted MA pipeline-building processes by screeningidentifying potential targets, creatingupdating profiles, and tracking progress.

Experience

0-2 Years

Level

Entry Level

Education

BS Finance

M And A Analyst Resume

Headline : The M&A Analyst is integral to the strategic planning process within an organization, focusing on identifying and evaluating potential acquisition targets. This role involves performing rigorous financial modeling and valuation analysis to determine the feasibility and potential return on investment of proposed deals. Analysts also engage in due diligence processes, assessing risks and opportunities associated with transactions. Collaboration with legal, financial, and operational teams is essential to ensure a comprehensive understanding of each deal's implications and to facilitate smooth execution.

Skills : Financial Statement Analysis, Corporate Finance, Risk Assessment and Management

Description :

- Assisted in the construction of presentations highlighting the strategic and financial rationale, along with the associated risks, of deals for review by Executive Management and the Board of Directors.

- Facilitated acquisition and divestiture processes by working with cross-functional teams in all phases of the process, managing virtual data rooms, and organizing diligence sessions.

- Assisted in managing relationships with investment banks and other external sources of deal flow.

- Built financial models, including but not limited to, projecting a targets future financial performance.

- Deployed different valuation methodologies (DCF, precedent transactions, trading comparables, and LBO).

- Performed various return metric calculations (EPS accretiondilution analysis and IRR).

- Prepared executive-level communicationsummaries that help inform and educate UnitedHealth Group Senior Executives and Board Members regarding ongoing MA opportunities and performance.

Experience

5-7 Years

Level

Executive

Education

MS Finance

M And A Analyst Resume

Objective : As an M And A Analyst responsible for conducting financial due diligence and preliminary integration planning on potential acquisition opportunities. Leads large internal diligence teams comprised of operational and legal subject matter experts.

Skills : Negotiation Skills, Deal Structuring, Communication and Presentation Skills

Description :

- Evaluated strategic rationale for a potential acquisition and how the target may create synergies with UHGs existing capabilities.

- Provided support for special projects (new industry research, strategic financial analysis, and new business initiatives, among others).

- Demonstrated proactive initiative and drive to identify opportunities and drive impactful strategic initiatives.

- Evaluated potential acquisition targets, crafting robust business cases that serve as the cornerstone for strategic decisions.

- Facilitated seamless merger integration, planning, and execution including financial and operational revisions.

- Collaborated with senior management to evaluate potential risks and benefits of MA transactions.

- Collaborated with cross-functional teams to gather and analyze data for M&A transactions.

Experience

2-5 Years

Level

Junior

Education

MS Finance

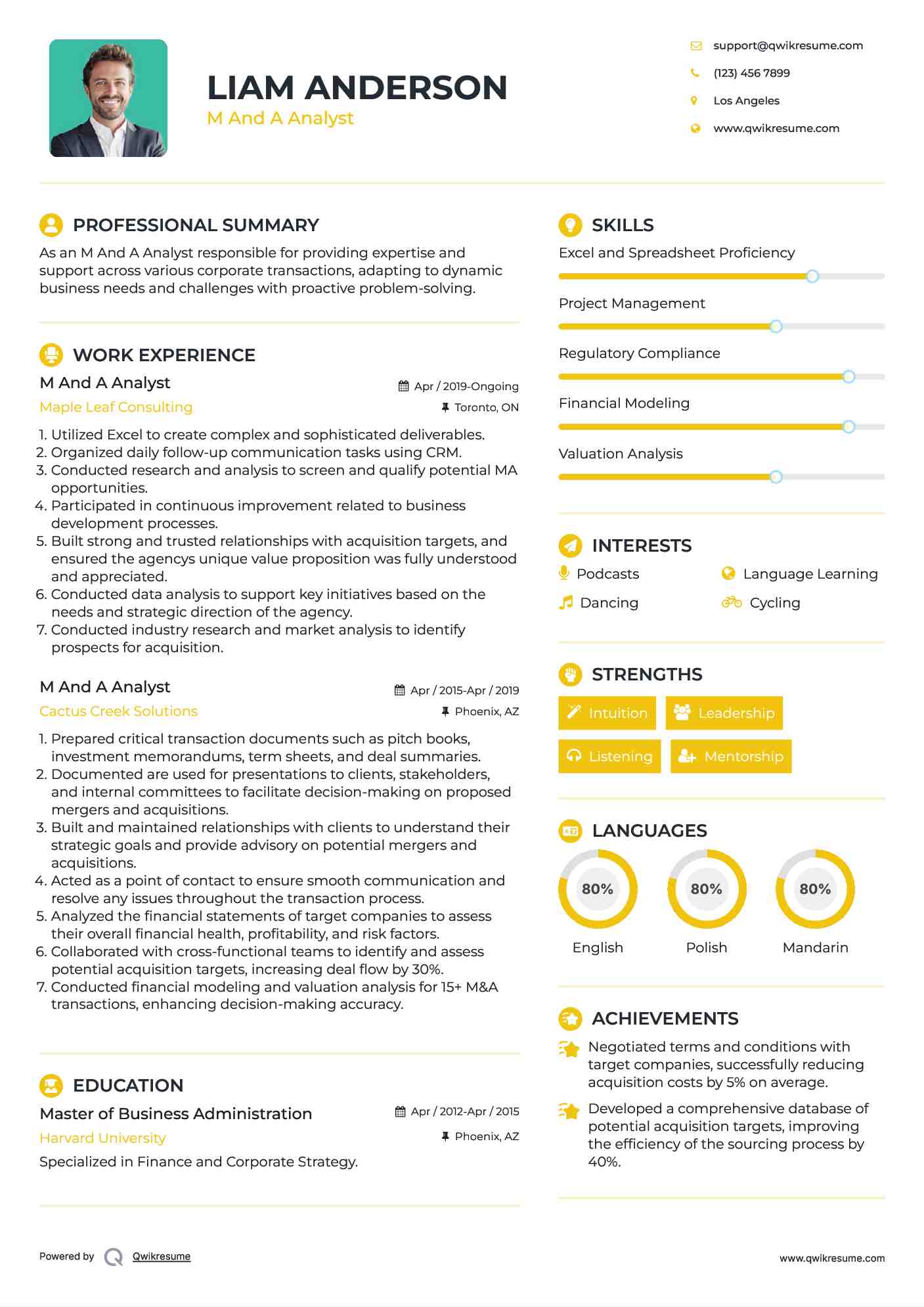

M And A Analyst Resume

Summary : As an M And A Analyst responsible for providing expertise and support across various corporate transactions, adapting to dynamic business needs and challenges with proactive problem-solving.

Skills : Excel and Spreadsheet Proficiency, Project Management, Regulatory Compliance

Description :

- Utilized Excel to create complex and sophisticated deliverables.

- Organized daily follow-up communication tasks using CRM.

- Conducted research and analysis to screen and qualify potential MA opportunities.

- Participated in continuous improvement related to business development processes.

- Built strong and trusted relationships with acquisition targets, and ensured the agencys unique value proposition was fully understood and appreciated.

- Conducted data analysis to support key initiatives based on the needs and strategic direction of the agency.

- Conducted industry research and market analysis to identify prospects for acquisition.

Experience

7-10 Years

Level

Consultant

Education

MS Accounting

M & A Analyst Resume

Objective : An M&A Analyst plays a crucial role in the evaluation and execution of mergers and acquisitions. This position involves conducting thorough financial analysis, market research, and due diligence to assess potential targets. Analysts are responsible for creating detailed financial models to project future performance and value. They collaborate with cross-functional teams to prepare presentations for stakeholders and assist in negotiations. Strong analytical skills, attention to detail, and the ability to interpret complex financial data are essential for success in this role.

Skills : Understanding of Tax Implications, Investment Analysis, Data Analysis and Interpretation, Financial Analysis

Description :

- Conducted thorough financial analysis, which encompassed financial modeling, valuation assessments, forecasts, and comparable company evaluations.

- Collaborated with both internal teams and external participants to execute due diligence, including the review of financial statements, market research, and analysis of industry trends.

- Prepared investment tear sheets, Confidential Information Memorandums, and other documentation for stakeholders, ensuring all information was clear and accurate.

- Established deal rooms and provided support across all functions to facilitate the coordination and review of due diligence materials.

- Analyzed potential deal breakers, issues, and integration challenges, actively seeking effective resolutions.

- Monitored and tracked industry and market trends to identify possible mergers and acquisitions opportunities.

- Participated in meetings, conference calls, and presentations with clients, investors, and senior professionals, fostering strong communication and collaboration.

Experience

0-2 Years

Level

Fresher

Education

BA Economics

Mergers & Acquisitions Analyst Resume

Summary : In the dynamic field of mergers and acquisitions, an M&A Analyst is tasked with identifying strategic opportunities for growth through potential acquisitions. This role requires a deep understanding of financial statements, valuation techniques, and industry trends. Analysts conduct comprehensive market assessments and competitor analyses to inform decision-making. They also prepare reports and presentations that summarize findings and recommendations for senior management. Effective communication and strong quantitative skills are vital for conveying complex information clearly and persuasively.

Skills : Report Writing, Legal Documentation Review, Team Collaboration and Leadership, Due Diligence

Description :

- Provided accurate and timely support to the MA analysts and ensured all Redefine entries and related tasks were completed with minimal errors.

- Demonstrated basic knowledge of financial analysis and developed base-level knowledge of banking laws and regulations, Board policies and guidance, and Federal Reserve System procedures.

- Worked with numerous data sources to prepare written correspondence, analysis summaries, and reports documenting analyses and recommendations.

- Developed a foundational understanding of the Competitive Analysis and Structure Source Instrument for Depository Institutions (CASSIDI) application to support the units work on competition.

- Conducted quality assurance reviews of the units work to ensure all correspondence files reflect the entire record of an application or notice.

- Supported the modernization of the units policies and procedures.

- Demonstrated strong time management and prioritization skills to meet stringent deadlines associated with applications and notices.

Experience

7-10 Years

Level

Senior

Education

BSBA

M & A Analyst Resume

Headline : An M&A Analyst is responsible for supporting the merger and acquisition process through detailed financial analysis and strategic evaluation. This role includes conducting industry research, analyzing market trends, and assessing the competitive landscape to identify potential acquisition opportunities. Analysts prepare financial models and valuation reports that guide decision-making for senior executives. Strong analytical capabilities, proficiency in financial software, and the ability to synthesize large amounts of data into actionable insights are critical skills for success in this position.

Skills : Communication, Attention to detail, Team Collaboration

Description :

- Learned the complete MA life-cycle and assisted clients through various stages in the MA process.

- Developed technical, consulting, and client service skills.

- Worked as part of a team in achieving project goals, timelines, and deliverables.

- Assisted C-Suite executives, investment bankers, and attorneys in evaluating and closing sales and acquisitions of companies.

- Executed deliverables within timelines, and consulted others as needed.

- Analyzed company financials and implemented the next steps to prepare financials for due diligence.

- Assisted in preparing and validating financial information for a sale.

Experience

5-7 Years

Level

Executive

Education

MSFE

M & A Analyst Resume

Summary : As an M & A Analyst responsible for analyzing target company financials, communicated key matters into a buy-side report to assist in evaluating and pricing the business for purchase.

Skills : Strategic Thinking, Research and Information Gathering, Cross-functional Coordination

Description :

- Worked directly with our clients to understand their goals and craft solutions to achieve them.

- Actively participated in improving the firms operations and culture, ensuring were upholding our firm values.

- Actively participated in end-to-end MA processes, from direct sourcing of acquisition targets through financial modeling, due diligence, negotiations, and closing.

- Liaised with the senior leadership team and their direct reports for strategy planning and execution.

- Prepared investment memoranda and quality of earnings reports to be presented to the senior leadership team and Board of Directors.

- Contributed to commercial analyses for non-MA opportunities, financing projects, commercial negotiations, and strategic mandates.

- Developed market research mapping, competitive business intelligence, and understanding of landscape across core markets and adjacencies.

Experience

7-10 Years

Level

Consultant

Education

BA IB

M & A Analyst Resume

Objective : In the role of M&A Analyst, the focus is on providing analytical support for mergers and acquisitions. This includes conducting financial due diligence, preparing valuation models, and analyzing the financial health of target companies. Analysts work closely with investment bankers and corporate development teams to evaluate potential deals and assess their strategic fit. The ability to communicate findings effectively and present complex financial information in a clear manner is essential for influencing key stakeholders and driving successful transactions.

Skills : Confidentiality and Data Security, Client Relationship Management, and Problem-solving

Description :

- Participated in the analysis of variances and fluctuations, explaining major changes, and identifying key value drivers.

- Conducted valuation analysis of private companies and business units including precedent transaction and comparable guideline public company methods, Discounted Cash Flow (DCF), and Leveraged Buy Out (LBO) analyses and approaches to valuation.

- Prepared, analyzed, and explained historical and projected financial information including modeling analysis.

- Researched and developed the target buyer lists utilizing various databases to create target marketing campaigns that match sell-side client buyer criteria.

- Supported principals throughout all phases of the transaction process.

- Prepared detailed financial models and comprehensive valuation analyses.

- Drafted pitch materials, client marketing materials, and PowerPoint presentations.

Experience

2-5 Years

Level

Junior

Education

BS Finance