Mortgage Loan Closer Resume

Objective : Dedicated mortgage loan closer with two years of experience in managing closing processes and ensuring compliance with regulatory standards. Proven ability to collaborate with loan officers and underwriters to resolve issues efficiently and expedite funding. Committed to delivering exceptional service and maintaining high accuracy in documentation and closing packages.

Skills : Regulatory Compliance, Closing Documentation Preparation, Data Analysis And Reporting, Loan Documentation

Description :

- Review and verify loan documents for accuracy and compliance with regulations.

- Collaborated with loan officers, processors, and underwriters to resolve all closing-related investor suspense issues.

- Generated closing packages, ensuring proper execution post-close, and confirmed all conditions were met prior to funding authorization.

- Achieved the highest volume of closed loans in the department, including scheduling closings and verifying employment.

- Reviewed and verified legal descriptions and parcel numbers in closing documents.

- Approved HUD-1s for retail and wholesale loans after thorough documentation review.

- Recognized monthly for consistently exceeding funding production goals.

Experience

0-2 Years

Level

Entry Level

Education

B.S.B.A.

Mortgage Loan Closer Specialist Resume

Objective : Accomplished Mortgage Loan Closer Specialist with over 5 years of experience in managing closing processes and ensuring adherence to compliance standards. Expertise in collaborating with diverse teams to resolve issues and expedite funding, while maintaining exceptional accuracy in documentation. Passionate about delivering outstanding service and streamlining the closing experience for clients.

Skills : Microsoft Office Suite, Underwriting Support, Process Improvement, Team Collaboration, Client Relations

Description :

- Verified that loans received clear-to-close status before generating closing documents.

- Ensure timely funding of loans by coordinating with financial institutions.

- Conducted thorough file reviews prior to dispatching closing packages to attorneys.

- Ensured loan applicants met specific program qualifications with completed verifications.

- Prepared and approved HUD Settlement Statements, confirming accurate wiring instructions.

- Collaborated with loan officers, processors, underwriters, and title companies for compliant documentation.

- Managed disbursement of files to closers for preparation and management review.

Experience

2-5 Years

Level

Junior

Education

B.S. in Finance

Mortgage Loan Closer Resume

Headline : Skilled mortgage loan closer with 7 years of extensive experience in managing the closing process and ensuring compliance with industry regulations. Adept at collaborating with loan officers and underwriters to resolve discrepancies and facilitate timely funding. Focused on delivering exceptional service and maintaining meticulous accuracy in documentation throughout the closing process.

Skills : Loan Management, Closing Process Management, Legal Knowledge, Sales Skills, Market Research, Conflict Resolution

Description :

- Conducted comprehensive audits of loan files cleared for closing to ensure compliance with regulations.

- Verified that all charges from loan officers and title companies were accurate and disclosed.

- Ensured all pending deficiencies were resolved before submission to attorneys.

- Submitted supporting documents to title companies for borrower signatures efficiently.

- Coordinated with attorneys to finalize instructions and documents, forwarding the preliminary Settlement Statement for review.

- Managed fund disbursement by forwarding requests to the wire department upon closing condition fulfillment.

- Maintained organized records of closed loan packages awaiting original documentation.

Experience

5-7 Years

Level

Management

Education

B.S. in Bus. Admin.

Senior Mortgage Loan Closer Resume

Summary : Accomplished Senior Mortgage Loan Closer with 10 years of experience overseeing complex closing processes and ensuring compliance with industry regulations. Expertise in collaborating with cross-functional teams to expedite funding and resolve discrepancies, while maintaining meticulous attention to detail. Dedicated to providing exceptional client service and optimizing the closing experience.

Skills : Expertise In Fannie Mae And Freddie Mac Compliance, Attention To Detail, Problem Solving, Time Management, Mortgage Regulations, Payment Processing

Description :

- Prepared and reviewed all closing documentation ensuring compliance with regulatory standards and guidelines.

- Examined the Settlement Statement for accuracy in fees and compliance with state regulations.

- Coordinated with title companies to schedule closings and ensure timely funding.

- Resolved discrepancies by communicating effectively with attorneys, title companies, and borrowers.

- Closed mortgage loans while assisting clients with inquiries and processing requirements.

- Guided junior staff in their roles, enhancing team productivity and service delivery.

- Maintained detailed records for compliance and auditing purposes.

Experience

7-10 Years

Level

Senior

Education

B.S. Finance

Mortgage Loan Closer Resume

Objective : With two years of dedicated experience as a Mortgage Loan Closer, I excel in managing closing procedures while ensuring strict adherence to compliance regulations. My collaborative approach with loan officers and underwriters enables swift issue resolution and timely funding. I am passionate about delivering exceptional service and maintaining impeccable accuracy in all documentation.

Skills : Adaptability, Effective Communication, Analytical Thinking, Multi-tasking, Confidentiality, Technical Proficiency

Description :

- Ensured all documentation was current by reviewing loan files, title commitments, and gathering closing figures.

- Collaborate with underwriters to address any outstanding conditions.

- Manage multiple loan closings simultaneously while meeting deadlines.

- Prepare and distribute closing disclosures to all relevant parties.

- Maintained the integrity of all borrower records confidentially and accurately.

- Demonstrated teamwork by consistently providing courteous and professional service to borrowers.

- Applied comprehensive knowledge of state and federal regulations regarding the mortgage loan closing process.

Experience

0-2 Years

Level

Entry Level

Education

AAS-BM

Mortgage Loan Closer/Junior Associate Resume

Objective : Proficient Mortgage Loan Closer with 5 years of experience in executing closing processes while ensuring compliance with industry regulations. Skilled in collaborating with lenders and real estate professionals to address issues promptly and ensure timely funding. Committed to maintaining high standards of accuracy in documentation and enhancing client satisfaction throughout the closing experience.

Skills : Client Relationship Management, Financial Analysis, Closing Procedures, Title Review

Description :

- Managed relationships with clients and lenders to facilitate seamless mortgage loan closings.

- Coordinated initial meetings with clients, interacted with lenders, and scheduled closing appointments.

- Gathered and verified all necessary documents for closings, prepared settlement statements, and managed escrow deposits.

- Acted as a licensed escrow officer in Texas, representing lenders and clients in transactions.

- Conducted closing meetings with clients and realtors, guiding them through the closing documents.

- Drafted and recorded essential closing documents with county clerks, ensuring legal compliance.

- Distributed closing documents to all relevant parties and maintained organized files for the title company.

Experience

2-5 Years

Level

Junior

Education

BBA

Mortgage Loan Closer Resume

Headline : Versatile Mortgage Loan Closer with 7 years of experience specializing in the closing process and ensuring strict compliance with regulatory standards. Proven track record of collaborating with loan officers, underwriters, and title companies to resolve complex issues and expedite funding. Dedicated to delivering exceptional client service and maintaining precision in all documentation.

Skills : Document Management Software, Customer Relationship Management, Closing Document Preparation, Loan Processing, Quality Assurance, Document Preparation

Description :

- Effectively managed the closing process to mitigate risks and ensure timely and efficient closings.

- Prepared and verified all closing documents to meet regulatory compliance and lender requirements.

- Monitor and manage timelines to ensure timely loan closings.

- Ensured all underwriter conditions were satisfied and collateral documents were properly executed.

- Reviewed and reconciled HUD settlement statements for accuracy prior to closing.

- Collaborated closely with brokers to correct errors and ensure accurate funding and mortgage recording.

- Generated initial loan disclosures and final mortgage loan documents in collaboration with title companies.

Experience

5-7 Years

Level

Management

Education

B.B.A.

Mortgage Loan Closer/Assistant Resume

Objective : Results-oriented mortgage loan closer with two years of experience adept at managing closing workflows and ensuring compliance with applicable regulations. Known for effective collaboration with loan officers and underwriters to address challenges swiftly, facilitating timely funding. Focused on delivering high-quality service while maintaining precision in documentation and closing packages.

Skills : Compliance Knowledge, Loan Servicing, Financial Reporting, Customer Follow-up, Software Proficiency, Microsoft Office

Description :

- Audited file completeness and verified loan amounts, ensuring data accuracy on LPS.

- Maintain relationships with real estate professionals and referral sources.

- Coordinated transactions with closing agents and title companies, facilitating loan funding upon fulfillment of all conditions.

- Assured compliance with all underwriting conditions prior to sending out closing packages to investors.

- Prepared loan documents for title companies and balanced files for wire transfers.

- Ensured all underwriting conditions were met prior to final signatures, preparing files for the loan servicing unit after closing.

- Monitored the shipping of funded loans, ensuring they were dispatched within hours of the funding date.

Experience

0-2 Years

Level

Entry Level

Education

AABA

Mortgage Loan Closer Resume

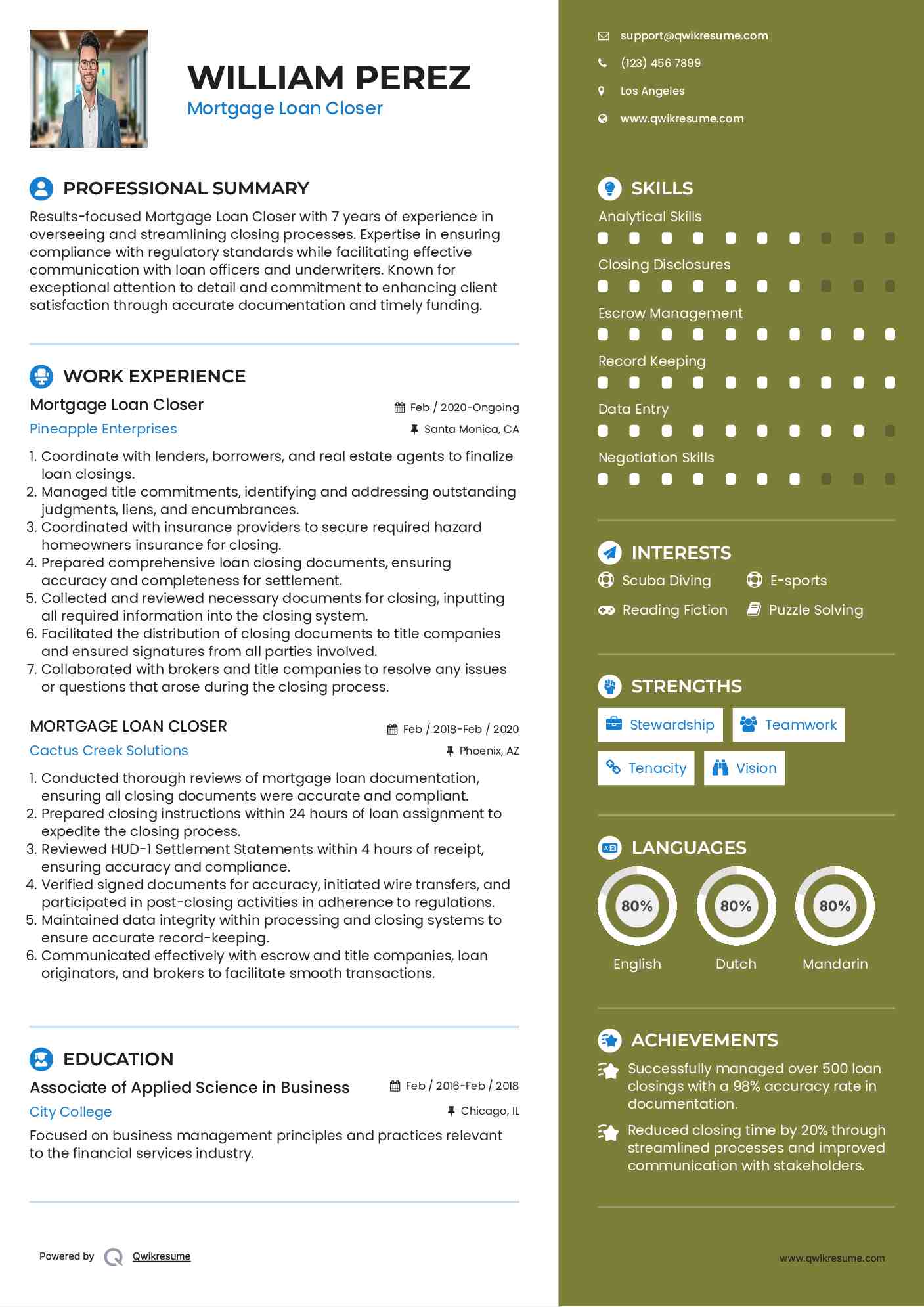

Headline : Results-focused Mortgage Loan Closer with 7 years of experience in overseeing and streamlining closing processes. Expertise in ensuring compliance with regulatory standards while facilitating effective communication with loan officers and underwriters. Known for exceptional attention to detail and commitment to enhancing client satisfaction through accurate documentation and timely funding.

Skills : Analytical Skills, Closing Disclosures, Escrow Management, Record Keeping, Data Entry, Negotiation Skills

Description :

- Coordinate with lenders, borrowers, and real estate agents to finalize loan closings.

- Managed title commitments, identifying and addressing outstanding judgments, liens, and encumbrances.

- Coordinated with insurance providers to secure required hazard homeowners insurance for closing.

- Prepared comprehensive loan closing documents, ensuring accuracy and completeness for settlement.

- Collected and reviewed necessary documents for closing, inputting all required information into the closing system.

- Facilitated the distribution of closing documents to title companies and ensured signatures from all parties involved.

- Collaborated with brokers and title companies to resolve any issues or questions that arose during the closing process.

Experience

5-7 Years

Level

Senior

Education

AAS

Mortgage Loan Closer/Financial Analyst Resume

Objective : Dynamic Mortgage Loan Closer and Financial Analyst with 5 years of experience in managing complex closing processes and ensuring compliance with industry regulations. Skilled in collaborating with diverse stakeholders to streamline operations and resolve discrepancies quickly. Committed to enhancing client satisfaction through meticulous documentation and efficient funding practices.

Skills : Mortgage Documentation Software, Client Communication Management, Financial Analysis And Reporting, Data Entry Accuracy

Description :

- Reviewed Title, Note, and Deed for Commercial and Residential Real Estate Loans, ensuring compliance with all regulatory requirements.

- Scheduled loan closings and compiled comprehensive closing documents, verifying all conditions are met.

- Communicated with borrowers, real estate brokers, and Title Companies to gather necessary documentation and resolve issues promptly.

- Coordinated with clients to arrange closing dates and times, optimizing schedules for all parties involved.

- Answered inquiries regarding closing procedures, utilizing analytical skills to clarify requirements and facilitate understanding.

- Calculated loan interest, principal payments, and closing costs, ensuring all figures were accurate and compliant.

- Maintained detailed records of all transactions and communications to ensure transparency and accountability.

Experience

2-5 Years

Level

Consultant

Education

B.S. Finance

Mortgage Loan Closer Resume

Objective : Proficient Mortgage Loan Closer with over 5 years of specialized experience in executing and finalizing closing processes while ensuring regulatory compliance. Expert in liaising with loan officers and underwriters to swiftly resolve issues, facilitating timely funding. Passionate about optimizing client experiences through meticulous documentation and exceptional service delivery.

Skills : Risk Assessment, Notary Public, Interpersonal Skills, Fha Guidelines, Va Loan Knowledge

Description :

- Managed the complete closing process, ensuring compliance with all regulatory standards.

- Input loan information into funding applications, confirming all validations are met prior to funding.

- Reviewed mortgage loan files to ensure all conditions are satisfied and requested additional conditions as needed.

- Verified accuracy and consistency of specifications on critical documents, such as Deeds of Trust.

- Assessed loan documents to confirm readiness for closing.

- Coordinated closing dates with brokers and attorneys for seamless transactions.

- Reviewed title abstracts and insurance forms for accuracy and compliance.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

Mortgage Loan Closer Resume

Objective : Motivated Mortgage Loan Closer with two years of experience in orchestrating efficient closing processes and ensuring compliance with all regulatory requirements. Skilled in collaborating with loan officers and title companies to swiftly resolve discrepancies and facilitate timely funding. Eager to leverage my attention to detail and commitment to excellence in documentation to enhance client satisfaction.

Skills : Customer Service, Interest Rate Analysis, Sales Support, Funding Procedures, Customer Education

Description :

- Ensure compliance with federal and state regulations throughout the closing process.

- Reviewed title commitments, loan approvals, and internal operating systems to facilitate smooth transactions.

- Collaborated with outside attorneys to ensure timely preparation of loan closing documents.

- Manage the scheduling of closing appointments and ensure all parties are informed.

- Ensured compliance by reviewing documentation related to fees and disclosures.

- Verified that all necessary documentation was completed to guarantee lien perfection.

- Conducted final reviews of signed closing documents, correcting discrepancies prior to fund release.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance