Payroll Tax Manager Resume

Headline : As a Payroll Tax Manager, oversaw and tracked all US payroll tax filings prepared and submitted by ADP, ensured all payroll taxes are being deposited to the tax authority by the statutory due date to prevent assessment of penalties and interest.

Skills : Payroll Processing, Tax Compliance, Financial Reporting, Collaboration

Description :

- Ensured the appropriate federal, state, and local tax accounts are set up for new hires.

- Obtained new tax accounts as required, close down dormant tax accounts, and ensure final filings are submitted by ADP.

- Assisted with the set-up of new earnings and deduction codes within ADP, work with local payroll teams to eliminate redundant codes to build a master list across Legal entities.

- Maintained online portal access to all payroll tax accounts for all legal entities.

- Reviewed, tracked, and responded to payroll tax notices, ensuring satisfactory outcomes.

- Performed regular audits and reviews of payroll tax calculations, ensuring accuracy and completeness in tax withholdings, including income taxes, Social Security, Medicare, and other applicable taxes.

- Assisted the finance team in payroll tax-related queries and provide proposed Journal Entries related to tax assessments.

Experience

5-7 Years

Level

Management

Education

B.S. Accounting

Payroll Tax Manager Resume

Summary : As a Payroll Tax Manager, oversaw and maintained accurate, timely tax processing across multiple states at a scale, managed day to day payroll tax-related activities; periodic, quarterly, annual tax payments and filings, timely amendment processing, audits, approvals, and adjustments.

Skills : Federal and State Tax Regulations, Payroll Tax Reporting, Strategic Planning, Change Management, Payroll Processing

Description :

- Developed and maintained strong relationships with internal business teams and manage the state tax account setup,SUTA experience rate maintenance, and statelocal filing requirements.

- Managed quarterly tax filings on behalf of customer employer accounts and their employees.

- Managed and oversee federal, state and local filings, including 941, 940, W2, state, and local taxes, and reconciliations.

- Brought subject matter expertise to help shape strategic initiatives leading to business process improvements.

- Ensured audit files are organized, updated timely, and provided to leadership with high-level performance metrics.

- Analyzed data provided by Clients and payroll tax collectors.

- Prepared efficient and practical approaches to situations and arrive at appropriate conclusions.

Experience

7-10 Years

Level

Management

Education

B.S. Accounting

Payroll Tax Manager Resume

Headline : As a Payroll Tax Manager, researched/Developed recommendations and make reasonable decisions in judgment areas, including the preparation of payroll tax amended returns.

Skills : Data Analysis, Attention to Detail, Confidentiality, Technical Writing, Tax Audits

Description :

- Ensured accurate and timely filings and deposits.

- Reviewed MasterTax data on a daily, weekly, monthly, and quarterly basis, performing reconciliations of client data and coordinating resolutions for any discrepancies.

- Coordinated responses and resolution of federal andor state payroll notices received by clients.

- Served as an expert in MasterTax software, setting up client tax accounts, and ensuring completeness of data.

- Demonstrated an understanding of payroll concepts and effectively apply knowledge to payroll tax filing requirements.

- Communicated with the IRS, State, and Local tax jurisdictions regarding payroll taxes.

- Managed payroll tax compliance for over 5,000 employees across multiple states, ensuring 100% accuracy.

Experience

5-7 Years

Level

Management

Education

B.S. Accounting

Payroll Tax Manager Resume

Summary : As a Payroll Tax Manager, taxated and transacted for all relocation, expatriates, inpatriates, non-qualified stock options, stock transactions, hypo tax, taxable fringe benefits, and functions as liaison with the HR/Benefits Gerdau.

Skills : Problem Solving, Communication Skills, Analytical Thinking, Training and Development, Customer Service Orientation

Description :

- Reviewed various payroll GL reports for accuracy, adjustmentscorrections, reconciliation.

- Worked with General Accounting on reconciliation of bankgeneral ledger entries for taxes and stock transactions.

- Researched and responded to all incoming government agency tax notices and work with Ceridian ior the Agency to have them resolved in a timely manner to minimizemitigate the risk of potential liabilities, penalties, and interest.

- Reviewed and reconciled total tax liabilities by entity and tax debits with Ceridian Tax Services or Canada Revenue Agency.

- Reported processes for both domestic U.S. and Canada, which includes but is not limited to year-end adjustments, balancing to payroll tax returns, and all adjusted tax forms as required.

- Worked closely with I.T for scheduling updates to the BSI systems as needed for Cyclic and Regulatory Tax Bulletin updates.

- Researched discrepancies and consult with client and payroll tax agencies to determine the best course of action.

Experience

7-10 Years

Level

Management

Education

B.S. Accounting

Payroll Tax Manager Resume

Summary : As a Payroll Tax Manager, resolved discrepancies in payroll accounting and reporting promptly, provided customer service via phone and email to address payroll issues.

Skills : Time Management, Team Leadership, Tax Compliance, Financial Reporting, Problem Solving

Description :

- Coached and developed payroll team members, ensuring cross-training within the department.

- Ensured compliance with SOX and internal controls.

- Managed the preparation and filing of Canada tax liabilities and returns, filed internally.

- Addressed new accounts or tax issues associated with mergers, acquisitions, divestitures, company name changes, FEIN changes, and all other related processes.

- Identified potential payroll tax exposure and related financial risks, communicate these risks to management, and direct the final disposition of related payroll tax items.

- Served as liaison with other departments in the determination of payroll tax impact about human resources, payroll, or executive compensation policies or programs, and resolution of related payroll tax issues.

- Drove changes in the payroll tax function to improve the accuracy and efficiency of the payroll tax function.

Experience

7-10 Years

Level

Management

Education

B.S. Accounting

Payroll Tax Manager Resume

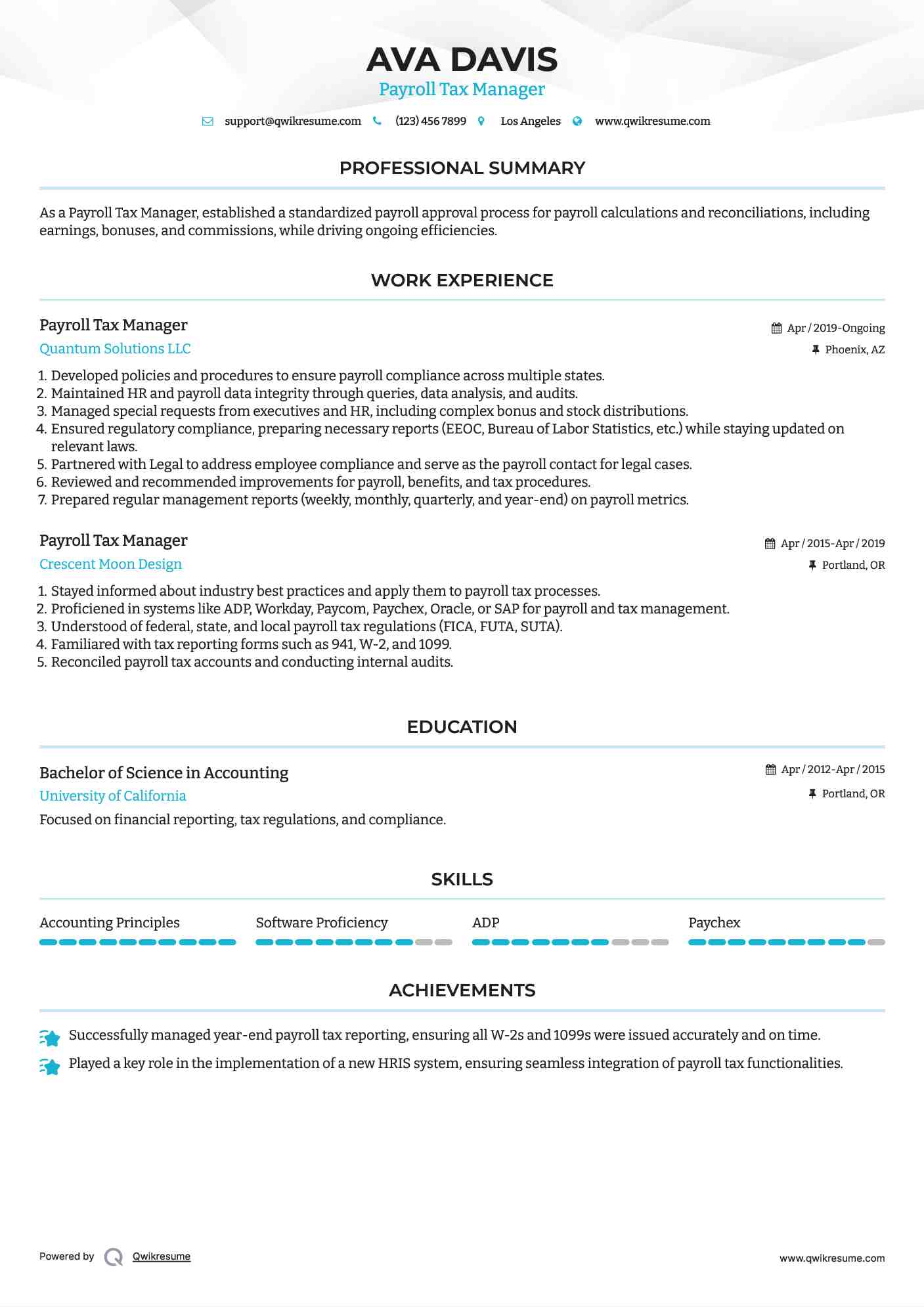

Summary : As a Payroll Tax Manager, established a standardized payroll approval process for payroll calculations and reconciliations, including earnings, bonuses, and commissions, while driving ongoing efficiencies.

Skills : Accounting Principles, Software Proficiency, ADP, Paychex

Description :

- Developed policies and procedures to ensure payroll compliance across multiple states.

- Maintained HR and payroll data integrity through queries, data analysis, and audits.

- Managed special requests from executives and HR, including complex bonus and stock distributions.

- Ensured regulatory compliance, preparing necessary reports (EEOC, Bureau of Labor Statistics, etc.) while staying updated on relevant laws.

- Partnered with Legal to address employee compliance and serve as the payroll contact for legal cases.

- Reviewed and recommended improvements for payroll, benefits, and tax procedures.

- Prepared regular management reports (weekly, monthly, quarterly, and year-end) on payroll metrics.

Experience

10+ Years

Level

Senior

Education

B.S. in Acc.

Payroll Tax Manager Resume

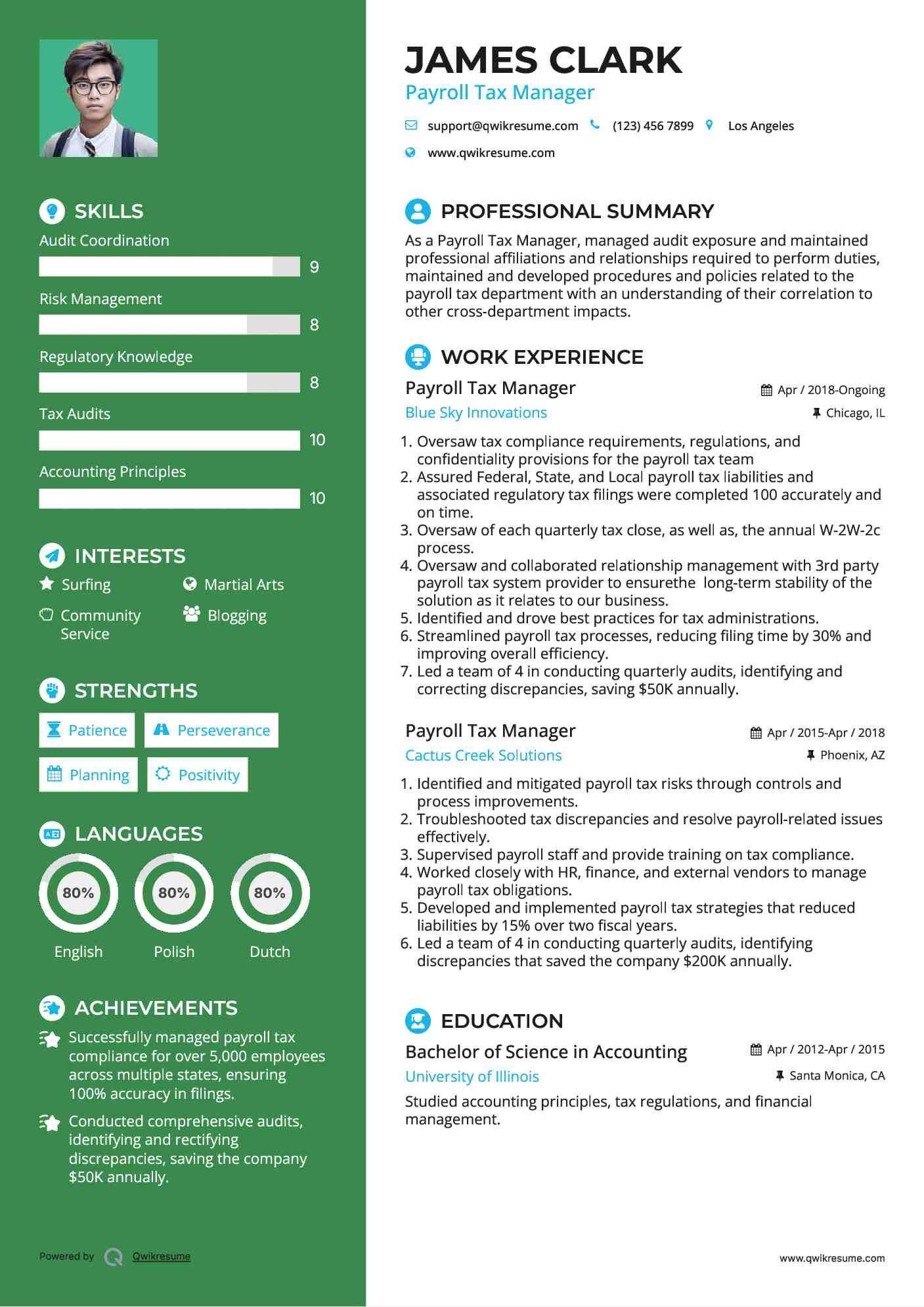

Summary : As a Payroll Tax Manager, managed audit exposure and maintained professional affiliations and relationships required to perform duties, maintained and developed procedures and policies related to the payroll tax department with an understanding of their correlation to other cross-department impacts.

Skills : Audit Coordination, Risk Management, Regulatory Knowledge, Tax Audits, Accounting Principles

Description :

- Oversaw tax compliance requirements, regulations, and confidentiality provisions for the payroll tax team

- Assured Federal, State, and Local payroll tax liabilities and associated regulatory tax filings were completed 100 accurately and on time.

- Oversaw of each quarterly tax close, as well as, the annual W-2W-2c process.

- Oversaw and collaborated relationship management with 3rd party payroll tax system provider to ensurethe long-term stability of the solution as it relates to our business.

- Identified and drove best practices for tax administrations.

- Streamlined payroll tax processes, reducing filing time by 30% and improving overall efficiency.

- Led a team of 4 in conducting quarterly audits, identifying and correcting discrepancies, saving $50K annually.

Experience

7-10 Years

Level

Management

Education

B.S.

Payroll Tax Manager Resume

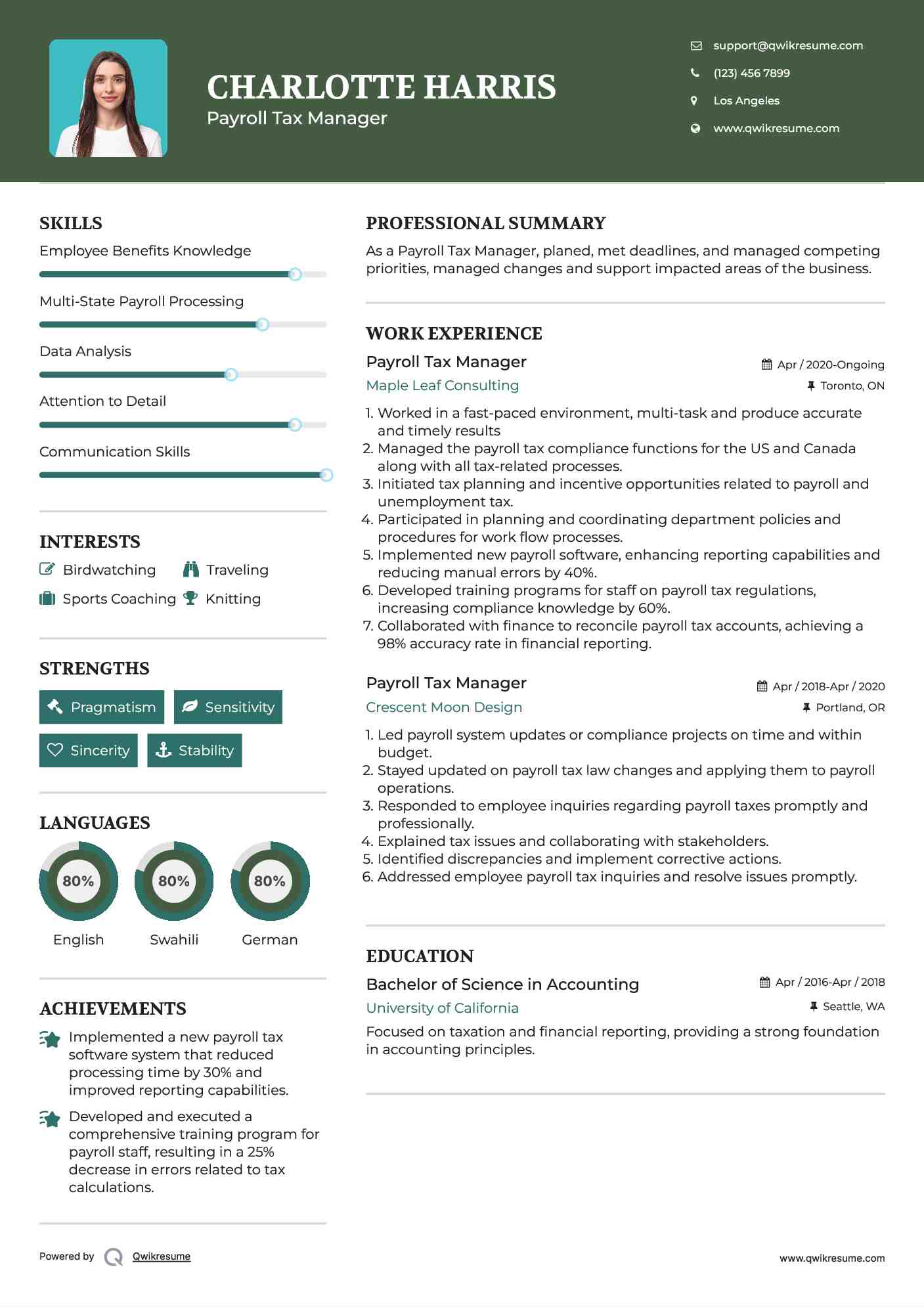

Headline : As a Payroll Tax Manager, planed, met deadlines, and managed competing priorities, managed changes and support impacted areas of the business.

Skills : Employee Benefits Knowledge, Multi-State Payroll Processing, Data Analysis, Attention to Detail, Communication Skills

Description :

- Worked in a fast-paced environment, multi-task and produce accurate and timely results

- Managed the payroll tax compliance functions for the US and Canada along with all tax-related processes.

- Initiated tax planning and incentive opportunities related to payroll and unemployment tax.

- Participated in planning and coordinating department policies and procedures for work flow processes.

- Implemented new payroll software, enhancing reporting capabilities and reducing manual errors by 40%.

- Developed training programs for staff on payroll tax regulations, increasing compliance knowledge by 60%.

- Collaborated with finance to reconcile payroll tax accounts, achieving a 98% accuracy rate in financial reporting.

Experience

5-7 Years

Level

Management

Education

B.S. in Acc.

Payroll Tax Manager Resume

Objective : As a Payroll Tax Manager, performed regular audits and reviews of payroll tax calculations, ensuring accuracy and completeness in tax withholdings, including income taxes, Social Security, Medicare, and other applicable taxes.

Skills : Tax Reconciliation, Regulatory Updates, Time Management, Software Proficiency, Tax Research

Description :

- Reconciled and prepared all periodic payroll-related journal entries and other required reports within specified deadlines.

- Monitored changes in tax laws, regulations, and rates and implement necessary adjustments to payroll tax procedures and systems.

- Collaborated with cross-functional teams to ensure accurate and timely communication and reporting of tax-related information.

- Managed relationships with external tax agencies, auditors, and consultants, ensuring timely and accurate responses to inquiries, requests, and audits.

- Provided training and guidance to HR, Payroll Operations, and other relevant teams on payroll tax-related matters, ensuring compliance with tax regulations.

- Stayed updated on industry best practices, trends, and technological advancements in payroll tax management, recommending and implementing process improvements where applicable.

- Developed strong working relationships throughout the organization at all levels.

Experience

2-5 Years

Level

Executive

Education

B.S. Accounting

Payroll Tax Manager Resume

Objective : As a Payroll Tax Manager, monitored changes in tax laws, regulations, and rates and implement necessary adjustments to payroll tax procedures and systems.

Skills : Process Improvement, Project Management, Team Leadership, Employee Relations, Record Keeping

Description :

- Reviewed the taxation of deferred compensation and stock compensation.

- Researched and documented the taxation of new earnings and benefits.

- Oversaw and managed all payroll tax operations, ensuring compliance with federal, state, and local tax laws and regulations.

- Ensured adherence to tax reconciliation and deposit controls.

- Client-faced role requiring frequent communication with customers regarding tax setups, TPA assignments, and POAs, throughout the life of the client.

- Troubleshooted issues and answered questions to assist clients in a timely manner.

- Worked independently on a variety of projects.

Experience

2-5 Years

Level

Executive

Education

B.S. Accounting