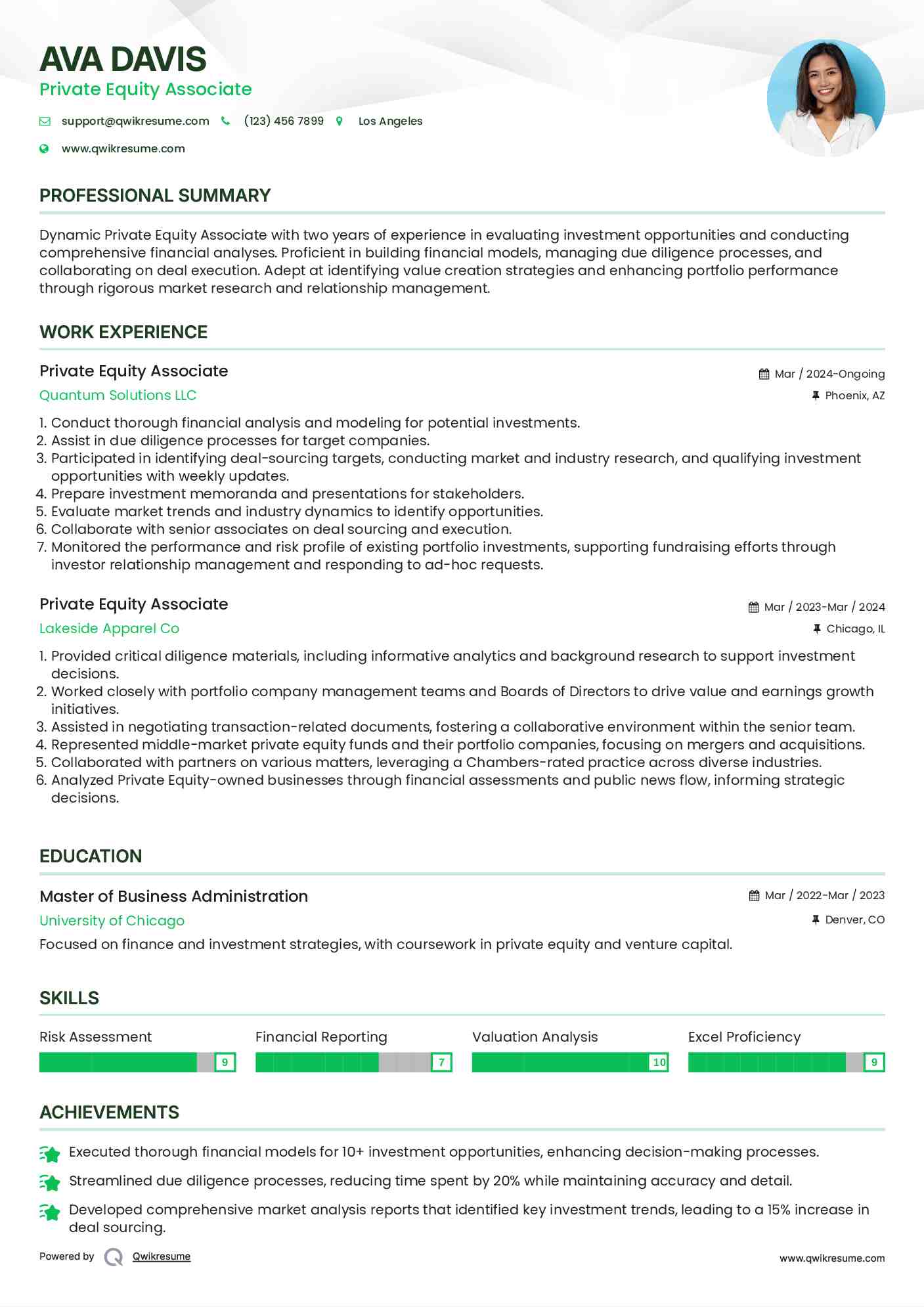

Private Equity Associate Resume

Objective : Dynamic Private Equity Associate with two years of experience in evaluating investment opportunities and conducting comprehensive financial analyses. Proficient in building financial models, managing due diligence processes, and collaborating on deal execution. Adept at identifying value creation strategies and enhancing portfolio performance through rigorous market research and relationship management.

Skills : Risk Assessment, Financial Reporting, Valuation Analysis, Excel Proficiency

Description :

- Conduct thorough financial analysis and modeling for potential investments.

- Assist in due diligence processes for target companies.

- Participated in identifying deal-sourcing targets, conducting market and industry research, and qualifying investment opportunities with weekly updates.

- Prepare investment memoranda and presentations for stakeholders.

- Evaluate market trends and industry dynamics to identify opportunities.

- Collaborate with senior associates on deal sourcing and execution.

- Monitored the performance and risk profile of existing portfolio investments, supporting fundraising efforts through investor relationship management and responding to ad-hoc requests.

Experience

0-2 Years

Level

Entry Level

Education

MBA

Junior Private Equity Associate Resume

Objective : Ambitious Junior Private Equity Associate with 5 years of experience in analyzing investment opportunities and conducting in-depth financial assessments. Skilled in financial modeling, due diligence, and transaction execution, with a focus on maximizing portfolio performance through strategic insights and robust market analysis.

Skills : Financial Visualization, Cash Flow Analysis, Equity Research, Strategic Planning, Networking Skills

Description :

- Delivered critical diligence materials, including quantitative and qualitative analytics, to support investment decisions.

- Collaborated with portfolio company management teams to implement initiatives focused on value and earnings growth.

- Assisted in negotiating transaction-related documents, fostering a collaborative team environment.

- Represented private equity funds in mergers and acquisitions, enhancing deal sourcing efforts.

- Worked alongside partners to address a diverse range of client needs across various industries.

- Conducted thorough analyses of private equity-owned businesses through financial reviews and market insights.

- Executed 1-1 interviews with industry specialists to gather valuable sector knowledge, developing comprehensive company insights.

Experience

2-5 Years

Level

Junior

Education

BSc Finance

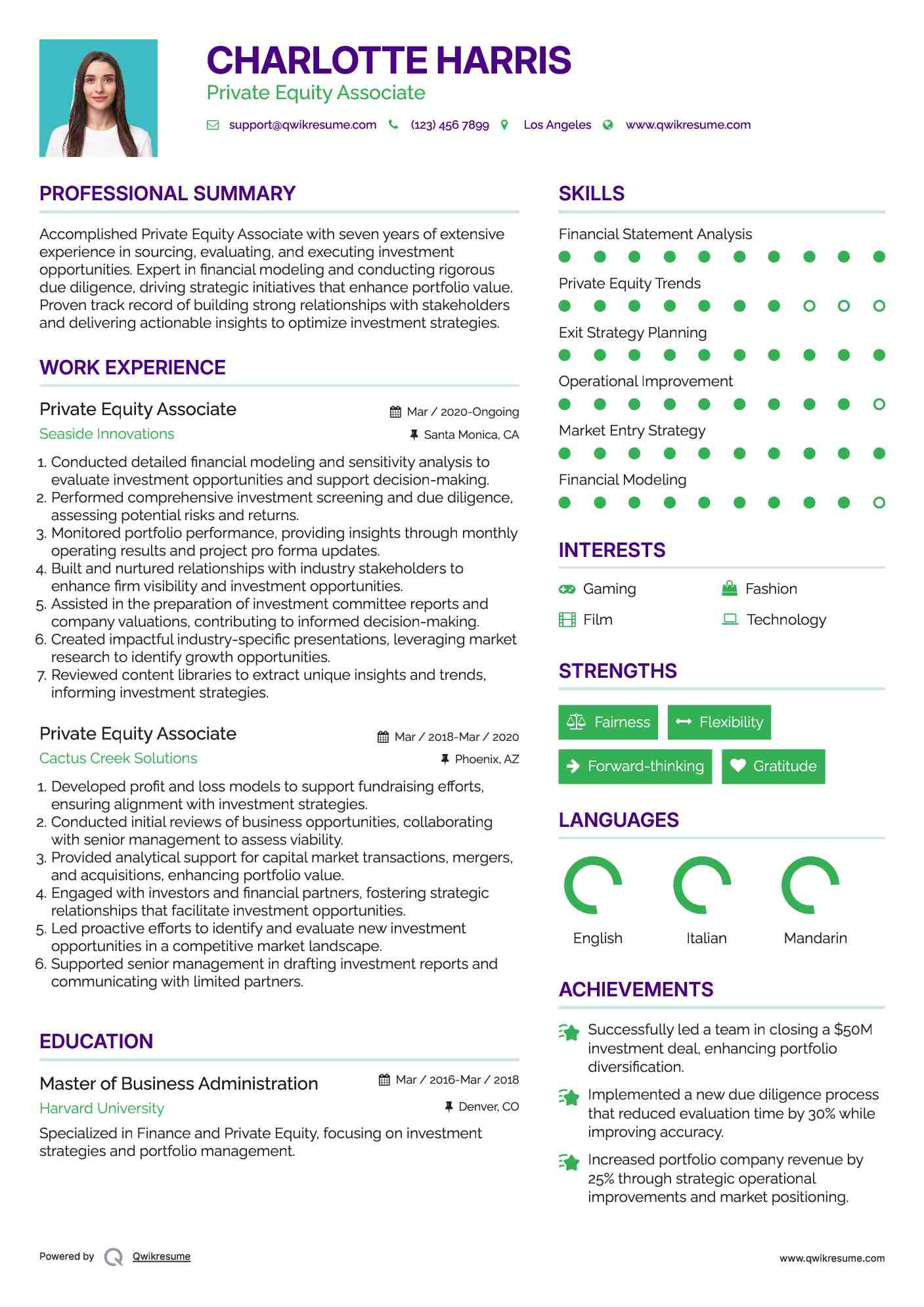

Private Equity Associate Resume

Headline : Accomplished Private Equity Associate with seven years of extensive experience in sourcing, evaluating, and executing investment opportunities. Expert in financial modeling and conducting rigorous due diligence, driving strategic initiatives that enhance portfolio value. Proven track record of building strong relationships with stakeholders and delivering actionable insights to optimize investment strategies.

Skills : Financial Statement Analysis, Private Equity Trends, Exit Strategy Planning, Operational Improvement, Market Entry Strategy, Financial Modeling

Description :

- Conducted detailed financial modeling and sensitivity analysis to evaluate investment opportunities and support decision-making.

- Performed comprehensive investment screening and due diligence, assessing potential risks and returns.

- Monitored portfolio performance, providing insights through monthly operating results and project pro forma updates.

- Built and nurtured relationships with industry stakeholders to enhance firm visibility and investment opportunities.

- Assisted in the preparation of investment committee reports and company valuations, contributing to informed decision-making.

- Created impactful industry-specific presentations, leveraging market research to identify growth opportunities.

- Reviewed content libraries to extract unique insights and trends, informing investment strategies.

Experience

5-7 Years

Level

Senior

Education

MBA

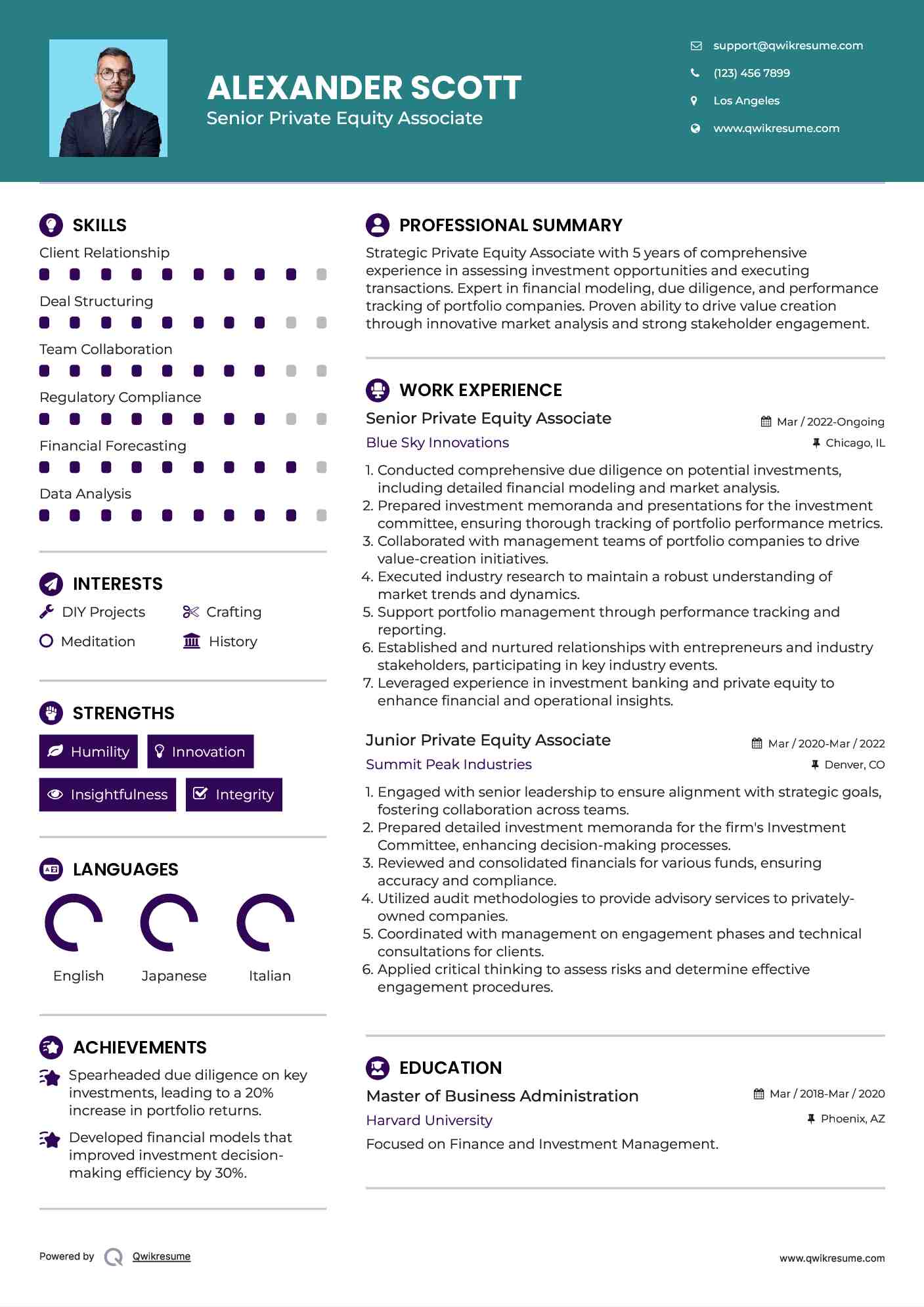

Senior Private Equity Associate Resume

Objective : Strategic Private Equity Associate with 5 years of comprehensive experience in assessing investment opportunities and executing transactions. Expert in financial modeling, due diligence, and performance tracking of portfolio companies. Proven ability to drive value creation through innovative market analysis and strong stakeholder engagement.

Skills : Client Relationship, Deal Structuring, Team Collaboration, Regulatory Compliance, Financial Forecasting, Data Analysis

Description :

- Conducted comprehensive due diligence on potential investments, including detailed financial modeling and market analysis.

- Prepared investment memoranda and presentations for the investment committee, ensuring thorough tracking of portfolio performance metrics.

- Collaborated with management teams of portfolio companies to drive value-creation initiatives.

- Executed industry research to maintain a robust understanding of market trends and dynamics.

- Support portfolio management through performance tracking and reporting.

- Established and nurtured relationships with entrepreneurs and industry stakeholders, participating in key industry events.

- Leveraged experience in investment banking and private equity to enhance financial and operational insights.

Experience

2-5 Years

Level

Senior

Education

MBA

Private Equity Associate Resume

Summary : Strategically focused Private Equity Associate with a decade of experience in investment evaluation and financial analysis. Demonstrated expertise in financial modeling, due diligence, and deal execution, driving value creation through innovative strategies. Proven ability to enhance portfolio performance and foster strong relationships with stakeholders to optimize investment outcomes.

Skills : Stakeholder Engagement, Attention To Detail, Capital Markets Knowledge, Investment Thesis Development, Time Management, Communication Skills

Description :

- Prepared comprehensive investment memoranda for the Firm's Investment Committee, driving informed decision-making on potential acquisitions.

- Conducted thorough due diligence on prospective investments, analyzing financial statements and market conditions to assess risk and opportunity.

- Collaborated with portfolio company management teams to identify growth strategies and operational efficiencies.

- Utilized advanced financial modeling techniques to evaluate investment scenarios and forecast returns.

- Engaged with senior management and stakeholders to ensure alignment on strategic initiatives and investment objectives.

- Monitored existing investments, providing insights and recommendations to optimize performance and mitigate risk.

- Participated in negotiations and deal structuring, ensuring favorable terms and compliance with regulatory requirements.

Experience

7-10 Years

Level

Senior

Education

MBA

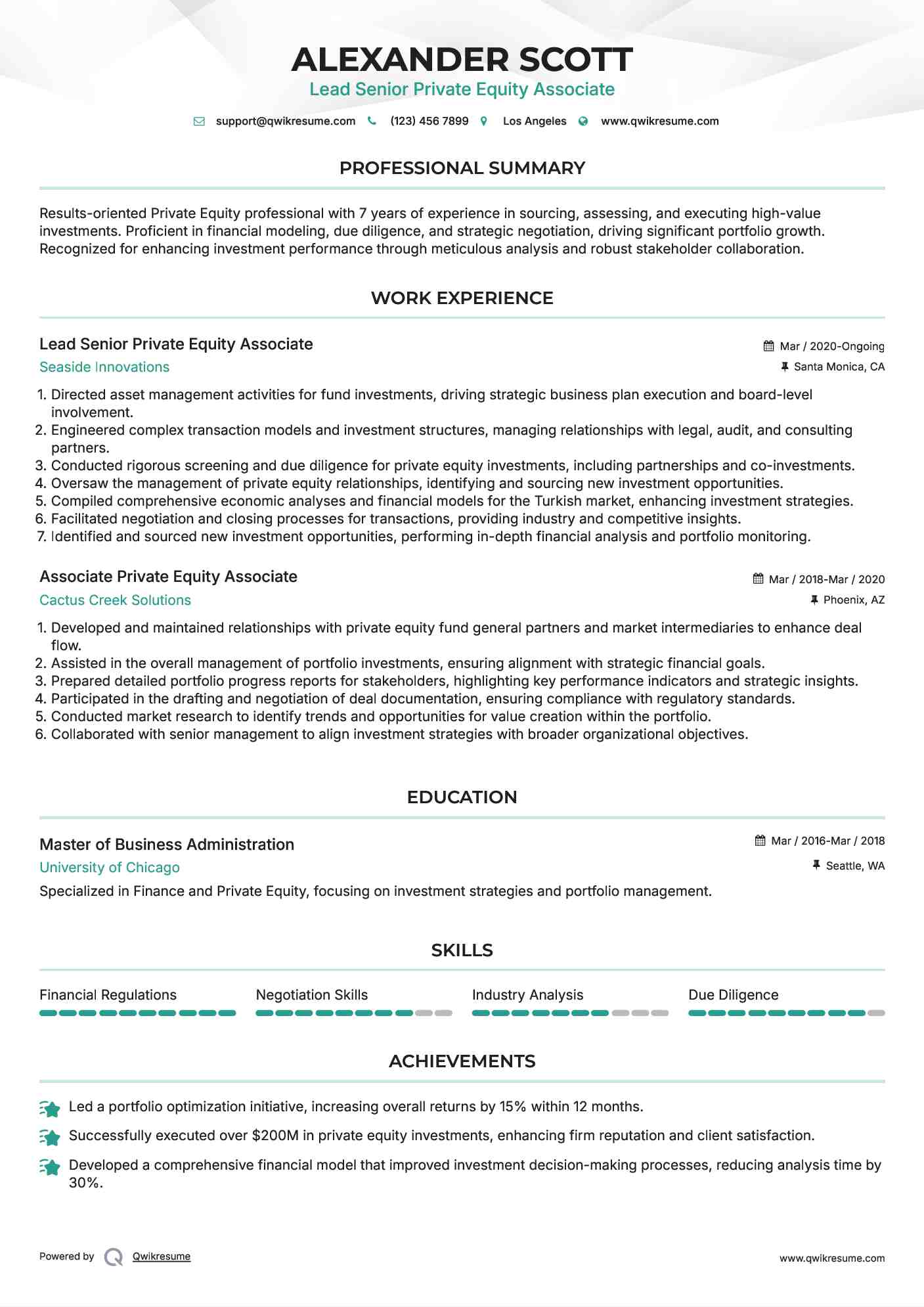

Lead Senior Private Equity Associate Resume

Headline : Results-oriented Private Equity professional with 7 years of experience in sourcing, assessing, and executing high-value investments. Proficient in financial modeling, due diligence, and strategic negotiation, driving significant portfolio growth. Recognized for enhancing investment performance through meticulous analysis and robust stakeholder collaboration.

Skills : Financial Regulations, Negotiation Skills, Industry Analysis, Due Diligence

Description :

- Directed asset management activities for fund investments, driving strategic business plan execution and board-level involvement.

- Engineered complex transaction models and investment structures, managing relationships with legal, audit, and consulting partners.

- Conducted rigorous screening and due diligence for private equity investments, including partnerships and co-investments.

- Oversaw the management of private equity relationships, identifying and sourcing new investment opportunities.

- Compiled comprehensive economic analyses and financial models for the Turkish market, enhancing investment strategies.

- Facilitated negotiation and closing processes for transactions, providing industry and competitive insights.

- Identified and sourced new investment opportunities, performing in-depth financial analysis and portfolio monitoring.

Experience

5-7 Years

Level

Management

Education

MBA

Private Equity Associate Resume

Summary : Seasoned Private Equity Associate with a decade of expertise in sourcing, analyzing, and executing high-impact investment opportunities. Specialized in financial modeling, due diligence, and strategic negotiations, consistently driving substantial portfolio growth. Recognized for delivering actionable insights and fostering strong relationships to enhance overall investment performance.

Skills : Presentation Skills, Investment Strategies, Performance Metrics, Quantitative Analysis, Business Acumen, Project Management

Description :

- Conducted comprehensive research on targeted industries to identify lucrative investment opportunities, performing detailed valuation analyses to assess financial risks.

- Executed comparative financial assessments against industry benchmarks, accurately forecasting market trends.

- Designed advanced quantitative models to evaluate the economic performance of potential investments across Asian markets.

- Prepared in-depth written analyses of investment opportunities for presentation to senior management and clients.

- Oversaw transaction execution, actively participating in client meetings, negotiating contracts, and facilitating due diligence sessions.

- Engaged in Principal Investing and Investment Banking, leveraging experience in financial consulting to drive investment success.

- Collaborated with cross-functional teams to enhance investment strategies and optimize financial outcomes.

Experience

10+ Years

Level

Executive

Education

MBA

Venture Capital Associate Resume

Objective : Accomplished Venture Capital Associate with 5 years of expertise in evaluating investment prospects and executing thorough financial assessments. Skilled in developing financial models, overseeing due diligence, and driving strategic initiatives to optimize portfolio performance. Committed to fostering strong relationships and delivering insights that generate value in diverse investment landscapes.

Skills : Problem Solving, Market Research, Sector Expertise, Financial Risk Management, Report Writing, Business Valuation

Description :

- Facilitated the organization and coordination of investment initiatives, enhancing transaction execution efficiency.

- Collaborated within a dynamic, team-oriented environment to drive strategic investment decisions.

- Developed comprehensive financial models and valuations for potential investments, analyzing capital structures and stakeholder recoveries.

- Monitored acquisitions and divestitures, ensuring accurate service history reporting for stakeholders.

- Supported the lead VC team in reviewing compliance documents and maintaining independence standards.

- Constructed and optimized corporate structures for VC firms and their portfolio companies using diverse data sources.

- Executed investment transactions in venture capital, identifying opportunities for performance enhancement.

Experience

2-5 Years

Level

Consultant

Education

MBA

Private Equity Associate Resume

Headline : Accomplished Private Equity Associate with 7 years of experience in sourcing, analyzing, and executing investment strategies. Expertise in financial modeling, comprehensive due diligence, and portfolio management, driving growth and value creation. Proven ability to leverage market insights to identify opportunities and enhance investment performance effectively.

Skills : Market Trends, Private Equity Knowledge, Capital Markets, Analytical Thinking, Presentation Development, Research Methodologies

Description :

- Supported the preparation of client presentations and pitch books, collaborating closely with teams on comprehensive due diligence throughout the investment lifecycle.

- Conducted both qualitative and quantitative analyses to assess potential investment opportunities.

- Evaluated performance metrics of potential investments, focusing on financial analysis of sponsors and underlying portfolio companies.

- Produced internal memoranda and materials supporting investment strategies and recommendations.

- Analyzed current market conditions to identify alternative investment opportunities.

- Generated detailed reports and analyses to inform asset allocation decisions.

- Assisted senior associates in identifying promising sectors and companies for investment by reviewing industry reports and attending relevant trade shows.

Experience

5-7 Years

Level

Senior

Education

MBA

Private Equity Associate Resume

Objective : Dedicated Private Equity Associate with two years of experience in financial modeling, due diligence, and investment analysis. Skilled in identifying growth opportunities and enhancing portfolio performance through detailed market assessments. Committed to driving value creation and fostering strong relationships with stakeholders to optimize investment outcomes.

Skills : Portfolio Management, Investment Valuation, Client Relationship Management, Market Trends Analysis, Critical Thinking

Description :

- Prepared detailed profit and loss models to support fundraising initiatives and enhance investor relations.

- Conducted thorough reviews of potential investments, collaborating closely with senior management to evaluate key factors.

- Provided analytical support for transactions, mergers, and acquisitions, contributing to informed decision-making.

- Engaged with investors and financial institutions to foster strong professional relationships.

- Identified and sourced investment opportunities through proactive market research and analysis.

- Supported senior management in crafting investment committee reports and presentations for stakeholders.

- Assisted in preparing company valuations and financial models to guide investment strategies.

Experience

0-2 Years

Level

Fresher

Education

B.S. Finance