Quant Developer Resume

Objective : Dynamic Quant Developer with 2 years of experience in quantitative analysis and model optimization. Proficient in developing and implementing innovative trading strategies and tools that enhance market efficiency. Adept at collaborating with cross-functional teams to improve data integration and performance. Committed to leveraging mathematical expertise and programming skills to drive impactful financial solutions.

Skills : Quantitative Programming, C++ Programming, Python Scripting, R Programming

Description :

- Develop trading algorithms and quantitative models to enhance investment strategies.

- Collaborate with quantitative analysts and traders to refine data-driven decision-making processes.

- Conduct statistical analyses to assess the performance of trading strategies and identify improvement areas.

- Integrate advanced analytics and data visualization tools into trading platforms.

- Support the deployment of quantitative models into production environments.

- Conduct backtesting and optimization of trading strategies to ensure robustness.

- Assist in the development and maintenance of high-performance computing solutions for quantitative research.

Experience

0-2 Years

Level

Entry Level

Education

BSc CS

Junior Quant Developer Resume

Objective : Quantitative professional with 5 years of experience in developing algorithms and tools that enhance trading strategies. Proficient in Python and C++, driving innovative solutions through advanced data analysis and model optimization. Collaborative team player, focused on delivering precise insights and improving financial systems. Eager to leverage analytical skills to contribute to impactful trading operations.

Skills : Statistical Analysis In R, C++ Programming For Financial Applications, Numerical Methods, Data Visualization, Api Development

Description :

- Developed and maintained quantitative models to support trading strategies across various asset classes.

- Utilized Python and C++ to enhance performance of financial applications and analytics tools.

- Collaborated with cross-functional teams to ensure data integrity and optimize trading operations.

- Conducted rapid prototyping of analytical solutions while maintaining high data accuracy.

- Supported risk management initiatives by developing predictive analytics and reporting tools.

- Authored efficient code for investment applications used by portfolio managers and analysts.

- Engaged with stakeholders to implement new trading strategies based on quantitative research.

Experience

2-5 Years

Level

Junior

Education

B.Sc. CS

Quant Developer Resume

Headline : Accomplished Quant Developer with 7 years of experience in quantitative modeling and financial analytics. Specializes in designing high-performance algorithms and optimizing trading systems. Proven ability to collaborate with multidisciplinary teams to enhance financial models and drive innovation. Passionate about leveraging data-driven insights to deliver effective trading solutions.

Skills : Quantitative Modeling, Signal Processing, Statistical Software, Financial Econometrics, Cross-validation Techniques, Feature Engineering

Description :

- Contribute to developing and maintaining best practices and workflows for quantitative and financial engineering products.

- Design and implement high-performance algorithms to enhance trading strategies and market efficiency.

- Collaborate with quantitative analysts and traders to optimize financial models and systems.

- Utilize statistical analysis to drive insights and improve model accuracy.

- Participate in all phases of the software development lifecycle, ensuring high-quality deliverables.

- Mentor junior developers in best coding practices and quantitative methods.

- Stay updated on industry trends to integrate advanced technologies into existing frameworks.

Experience

5-7 Years

Level

Senior

Education

M.S. in Fin. Eng.

Quantitative Analyst Developer Resume

Summary : Accomplished Quantitative Analyst Developer with a decade of experience in designing and implementing robust quantitative models. Expert in leveraging statistical analysis, programming, and data visualization to enhance trading strategies. Proven success in optimizing financial systems and collaborating with diverse teams to drive data-driven decision-making in fast-paced environments.

Skills : Backtesting Strategies, Data Structures, Algorithms Design, Portfolio Management, Market Microstructure, Financial Modeling

Description :

- Developed and maintained quantitative models to inform trading strategies and risk assessments.

- Applied advanced statistical techniques to analyze market data and optimize algorithms.

- Collaborated with traders and analysts to refine trading strategies based on quantitative insights.

- Conducted rigorous backtesting of trading algorithms to ensure performance and reliability.

- Designed and implemented tools for data visualization to enhance decision-making processes.

- Managed large datasets to ensure data integrity and quality for analysis.

- Provided ongoing support for model validation and performance evaluation.

Experience

7-10 Years

Level

Management

Education

M.S. Finance

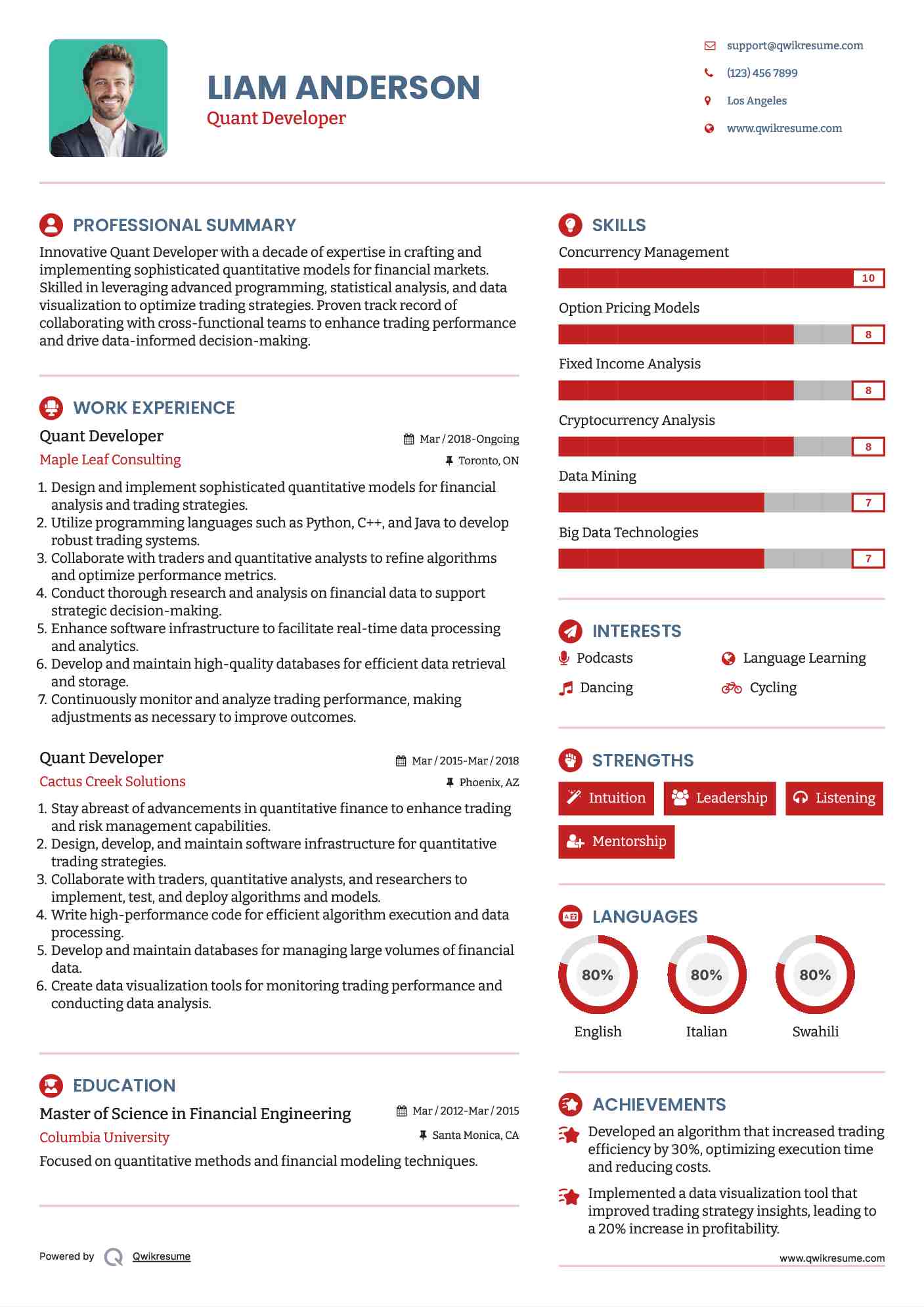

Quant Developer Resume

Summary : Innovative Quant Developer with a decade of expertise in crafting and implementing sophisticated quantitative models for financial markets. Skilled in leveraging advanced programming, statistical analysis, and data visualization to optimize trading strategies. Proven track record of collaborating with cross-functional teams to enhance trading performance and drive data-informed decision-making.

Skills : Concurrency Management, Option Pricing Models, Fixed Income Analysis, Cryptocurrency Analysis, Data Mining, Big Data Technologies

Description :

- Design and implement sophisticated quantitative models for financial analysis and trading strategies.

- Utilize programming languages such as Python, C++, and Java to develop robust trading systems.

- Collaborate with traders and quantitative analysts to refine algorithms and optimize performance metrics.

- Conduct thorough research and analysis on financial data to support strategic decision-making.

- Enhance software infrastructure to facilitate real-time data processing and analytics.

- Develop and maintain high-quality databases for efficient data retrieval and storage.

- Continuously monitor and analyze trading performance, making adjustments as necessary to improve outcomes.

Experience

10+ Years

Level

Executive

Education

M.S. Fin. Eng.

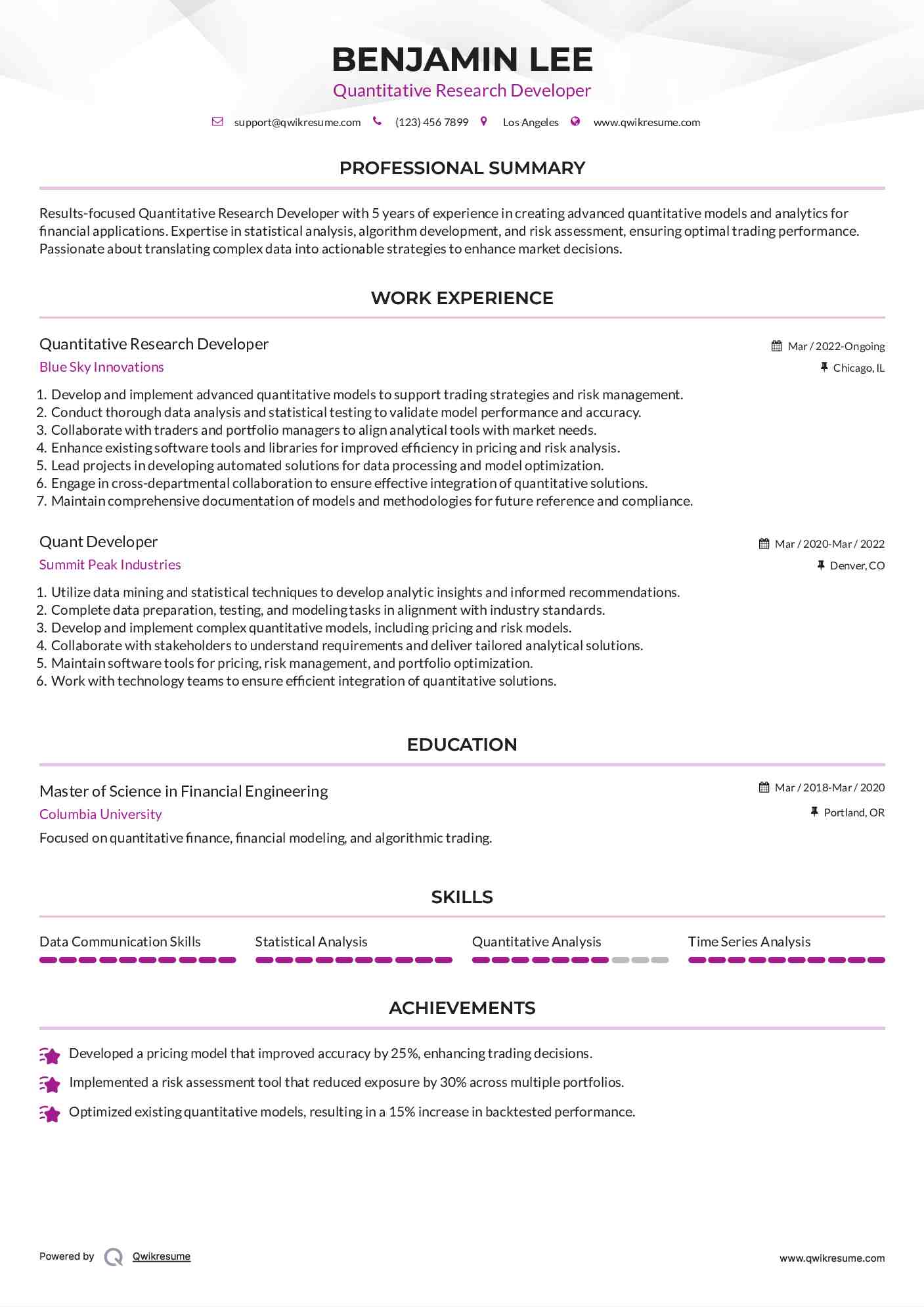

Quantitative Research Developer Resume

Objective : Results-focused Quantitative Research Developer with 5 years of experience in creating advanced quantitative models and analytics for financial applications. Expertise in statistical analysis, algorithm development, and risk assessment, ensuring optimal trading performance. Passionate about translating complex data into actionable strategies to enhance market decisions.

Skills : Data Communication Skills, Statistical Analysis, Quantitative Analysis, Time Series Analysis

Description :

- Develop and implement advanced quantitative models to support trading strategies and risk management.

- Conduct thorough data analysis and statistical testing to validate model performance and accuracy.

- Collaborate with traders and portfolio managers to align analytical tools with market needs.

- Enhance existing software tools and libraries for improved efficiency in pricing and risk analysis.

- Lead projects in developing automated solutions for data processing and model optimization.

- Engage in cross-departmental collaboration to ensure effective integration of quantitative solutions.

- Maintain comprehensive documentation of models and methodologies for future reference and compliance.

Experience

2-5 Years

Level

Consultant

Education

M.S. Fin. Eng.

Quant Developer Resume

Objective : Quant Developer with 2 years of experience in algorithm design and quantitative analysis. Skilled in translating complex mathematical models into robust trading systems and optimizing performance. Passionate about utilizing programming expertise to deliver innovative solutions in a fast-paced financial environment.

Skills : Unit Testing, Debugging Skills, Performance Tuning, Quantitative Research, Statistical Modeling, Regression Analysis

Description :

- Designed and implemented high-performance trading algorithms to maximize market opportunities.

- Developed quantitative models to predict market movements and improve trading strategies.

- Collaborated with cross-functional teams to enhance data integration and algorithm efficiency.

- Conducted rigorous backtesting and analysis to validate algorithm performance.

- Utilized programming skills in Python and C++ for algorithm development and optimization.

- Engaged in continuous learning of financial technologies and market trends.

- Provided insights and recommendations based on quantitative research and analysis.

Experience

0-2 Years

Level

Fresher

Education

M.S. Finance

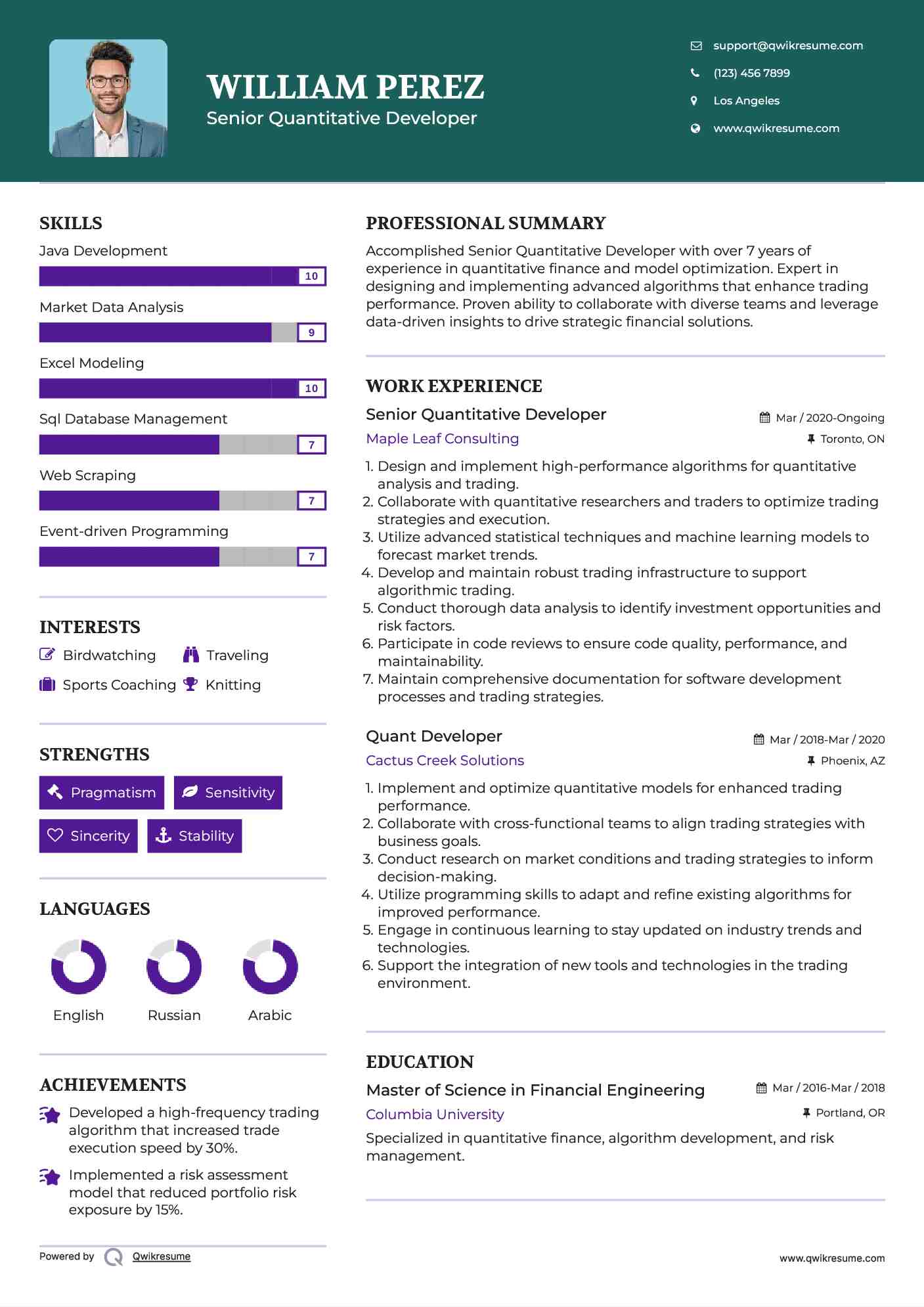

Senior Quantitative Developer Resume

Headline : Accomplished Senior Quantitative Developer with over 7 years of experience in quantitative finance and model optimization. Expert in designing and implementing advanced algorithms that enhance trading performance. Proven ability to collaborate with diverse teams and leverage data-driven insights to drive strategic financial solutions.

Skills : Java Development, Market Data Analysis, Excel Modeling, Sql Database Management, Web Scraping, Event-driven Programming

Description :

- Design and implement high-performance algorithms for quantitative analysis and trading.

- Collaborate with quantitative researchers and traders to optimize trading strategies and execution.

- Utilize advanced statistical techniques and machine learning models to forecast market trends.

- Develop and maintain robust trading infrastructure to support algorithmic trading.

- Conduct thorough data analysis to identify investment opportunities and risk factors.

- Participate in code reviews to ensure code quality, performance, and maintainability.

- Maintain comprehensive documentation for software development processes and trading strategies.

Experience

5-7 Years

Level

Senior

Education

M.S. FE

Quant Developer Resume

Objective : Quant Developer with 5 years of expertise in algorithm development and quantitative modeling. Skilled in optimizing trading systems through advanced statistical analysis and programming in Python and C++. Proven ability to enhance trading strategies and deliver high-impact financial solutions in collaborative environments.

Skills : Expertise In Trading Systems, Cloud Computing, Version Control (git), Software Development Life Cycle, Agile Methodologies, Communication Skills

Description :

- Developed and optimized quantitative models for trading strategies, enhancing performance metrics.

- Collaborated with cross-functional teams to integrate advanced data analytics into trading operations.

- Implemented robust APIs in Python for efficient data processing and strategy simulation.

- Conducted thorough backtesting of algorithms, ensuring reliability and accuracy.

- Managed data pipelines and infrastructure, ensuring high-quality data availability for analysis.

- Designed machine learning algorithms for improved market predictions and risk assessment.

- Continuously monitored and improved existing systems for optimal performance and efficiency.

Experience

2-5 Years

Level

Junior

Education

M.S. Fin. Eng.

Quant Developer Resume

Summary : Quant Developer with a decade of experience in building and refining quantitative models for trading optimization. Expert in statistical analysis and algorithm development, utilizing advanced programming skills to drive market performance. Proven ability to collaborate with cross-functional teams, delivering impactful financial solutions through innovative technology and data-driven insights.

Skills : Algorithm Development, Machine Learning, Monte Carlo Simulation, Optimization Techniques, Hedge Fund Strategies

Description :

- Develop and optimize quantitative models for trading strategies, enhancing market performance.

- Collaborate with quantitative researchers to deliver custom software solutions tailored to trading needs.

- Implement robust risk management frameworks to mitigate financial exposure.

- Conduct comprehensive reviews of trading algorithms, ensuring compliance with regulatory standards.

- Utilize advanced statistical techniques to analyze market trends and data patterns.

- Design and deploy automated trading systems that improve execution speed and efficiency.

- Engage in ongoing model validation and performance assessment to refine trading strategies.

Experience

7-10 Years

Level

Management

Education

MSc QF