Quantitative Analyst Intern Resume

Objective : As a Quantitative Analyst Intern, interact with various trading groups and gain valuable work experience while demonstrating their skills on a variety of real-world projects.

Skills : Data analysis, Statistics.

Description :

- Worked closely with the Quantitative Analysts / Portfolio Managers of the Quant team to enhance the risk / return profile of the Global Flex fund.

- Developed quantitative investment strategies.

- Undertook explorative quantitative analysis to support fund performance.

- Contributed to research meetings presentations and reports.

- Developed and maintained systems/tools to support ongoing research and portfolio management.

- Undertook day-to-day portfolio management activities.

- Involved in multiple areas of portfolio management and quantitative research, academic research, strategy conception from idea generation to implementation, conception/enhancement of portfolio management and research tools, marketing.

Experience

0-2 Years

Level

Entry Level

Education

BE

Quantitative Analyst Intern Resume

Objective : As a Quantitative Analyst Intern, working closely with quant, developers, and senior staff as mentors, interns can expect an inclusive environment conducive to learning. In addition, numerous social events allow interns to interact with colleagues and gain insight into the firm as a whole.

Skills : Python, Risk management.

Description :

- Responsible for contributing to the development of our in-house built pricing models and risk management systems.

- Responsible for creating and optimizing data-driven decision-making tools.

- Responsible for building data solutions in which you are responsible for every building block.

- Responsible for creating the database structure, the front end for the user, and all the intermediate code.

- Responsible for supporting equity and derivates traders using quantitative analyses.

- Able to translate human response into data we can use.

- Organized and conducted the validation study with the internship supervisor.

Experience

0-2 Years

Level

Fresher

Education

BSc CS

Quantitative Analyst Intern Resume

Objective : As a Quantitative Analyst Intern, conduct a thorough analysis of large datasets containing historical and real-time equity market data. Identify key opportunities and trends to aid in strategic decision-making.

Skills : Machine learning, Quantitative analysis.

Description :

- Conducted ad hoc analysis for Risk methodologies and provided technical support to RM teams.

- Contributed to the team’s internal library for pricing and XVA models/methods.

- Complied with all applicable legal, regulatory, and internal compliance requirements, including, but not limited to, the London Compliance manual and compliance policies and procedures as issued from time to time, financial security requirements, including, but not limited to, the prevention of financial crime and fraud including reporting obligations to the Money Laundering Reporting Officer.

- Conducted back-tests of trading models and strategies using historical data to evaluate their performance.

- Completed all mandatory training as required to attain and maintain competence.

- Analyzed large sets of data and developed statistical models.

- Validated the information gained through statistical models.

Experience

2-5 Years

Level

Junior

Education

BCS

Quantitative Analyst Intern Resume

Objective : As a Quantitative Analyst Intern, works closely with the RM team and provides them with technical support on all model/methodology-related issues, in particular, on the various risk reports.

Skills : SAS, Attention to detail.

Description :

- Utilized data analytics to assist with risk management.

- Collected and organized alternative asset fund financial data from various confidential and public sources, such as portfolio documents, financial statements, reports, websites, online data services, and more.

- Oversaw performance of market-making programs, and provide assistance in improving current service.

- Diligently performed accurate and detailed financial analysis of the data collected.

- Distilled, collated, recorded, and validated the measures of your analysis on specialized software platforms.

- Built your expertise in private market fund accounting and analysis for solid career advancement.

- Combined risk management, research, and technology disciplines to operate trading strategies across cryptocurrency markets.

Experience

0-2 Years

Level

Fresher

Education

BE

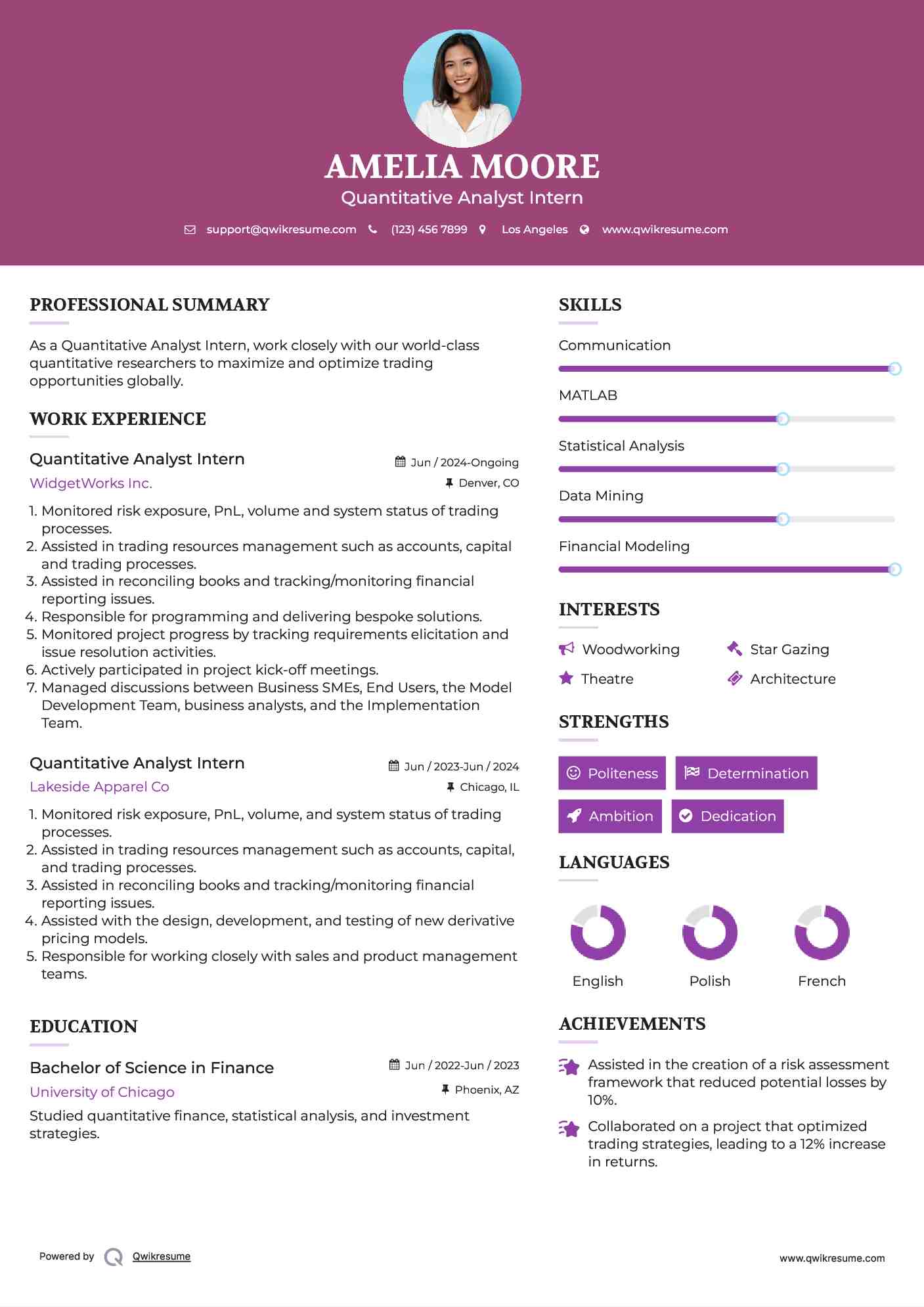

Quantitative Analyst Intern Resume

Objective : As a Quantitative Analyst Intern, work closely with our world-class quantitative researchers to maximize and optimize trading opportunities globally.

Skills : Communication, MATLAB.

Description :

- Monitored risk exposure, PnL, volume and system status of trading processes.

- Assisted in trading resources management such as accounts, capital and trading processes.

- Assisted in reconciling books and tracking/monitoring financial reporting issues.

- Responsible for programming and delivering bespoke solutions.

- Monitored project progress by tracking requirements elicitation and issue resolution activities.

- Actively participated in project kick-off meetings.

- Managed discussions between Business SMEs, End Users, the Model Development Team, business analysts, and the Implementation Team.

Experience

0-2 Years

Level

Entry Level

Education

BE

Quantitative Analyst Intern Resume

Objective : As a Quantitative Analyst Intern, will analyze algorithmic behavior, right down to order placement levels. This will provide real-world context to tackle a project with actual implications on algorithmic decision-making.

Skills : Problem-solving, Programming.

Description :

- Created detailed business requirements documents reflecting the data, quantitative and analytical needs of key business and technology initiatives.

- Responsible for helping develop new algorithms and extend/improve existing ones.

- Responsible for working directly with technologists/traders/quant’s to maintain an industry leading position in an ever more electronic environment.

- Responsible for daily quality control of derived data objects (implied dividends and implied volatility surface, which are used for overnight instrument pricing), supported by our Senior Quantitative Analysts and IT Project Management /DevOps.

- Responsible for periodical client pricing-challenges (detailed analysis of pricing models and data upon client request).

- Coordinated with the data center to ensure completeness of nightly required dataset of input data for pricing (underlying spot and history data, interest rate data, option data).

- Coordinated with IT Project Management to improve operative tools.

Experience

0-2 Years

Level

Fresher

Education

BE

Quantitative Analyst Intern Resume

Objective : As a Quantitative Analyst Intern, Responsible for the quality of our daily data deliveries of independent priced derivative instruments to clients supported by our Senior Quantitative Analysts and IT Project Management /DevOps.

Skills : Critical thinking, Data collection.

Description :

- Developed and improved strategies alongside industry leading Market analysts.

- Responsible for handling big data, execution and optimizing strategies to maximize PnL.

- Tackled execution and operational challenges to ensure efficiency and accuracy of the models developed.

- Designed and implemented marketing plans in the CRE and Data Space

- Able to efficiently sift through large datasets and find a conclusion.

- Assisted with creating digital analytics reports.

- Provided models that give investment team levers to implement in portfolio either by directly delivering tradable actions or by providing quantitative grounding to trade thesis.

Experience

0-2 Years

Level

Entry Level

Education

BCS

Quantitative Analyst Intern Resume

Objective : As a Quantitative Analyst Intern, responsible for the derivatives pricing library and all its related tools. It is the entry point for all trading desks, whether they are physical or paper, regarding risk management or new digital tools.

Skills : Finance, R, Regression.

Description :

- Supported Portfolio Managers by building portfolio management toolboxes around profit and loss, risk attribution and sizing.

- Built Investment Platforms around multi-asset tactical quantitative models.

- Communicated internally tactical quant view on a periodic basis.

- Produced research papers to support innovation and enhancements of models.

- Worked on very specific quantitative projects (1 - 2 maximum) over the course of internship.

- Spent roughly 60-70% of the time programming and liaising with key stakeholders to ensure the project is correctly scoped out.

- Liaised with internal teams where necessary.

Experience

0-2 Years

Level

Entry Level

Education

BCS

Quantitative Analyst Intern Resume

Objective : As a Quantitative Analyst Intern, participate in all aspects of the strategy development process, including data analysis, hypothesis testing, backtesting, and post-trade analysis.

Skills : SQL, Data and information visualization, and Analytical skills.

Description :

- Ensured the entire project was documented adequately and ideas shared within the research team.

- Responsible for researching macroeconomic and microeconomic conditions.

- Responsible for preparing accounting and other required reports and projections based on the analysis performed.

- Responsible for evaluating capital expenditures and asset depreciation.

- Responsible for establishing and evaluating records, statements, and profit plans.

- Responsible for identifying financial performance trends and financial risk, and making recommendations.

- Responsible for providing recommendations for improvement based on trends.

Experience

0-2 Years

Level

Entry Level

Education

BE

Quantitative Analyst Intern Resume

Objective : As a Quantitative Analyst Intern, assist in the development of mathematical and statistical models to predict market trends and price movements. Collaborate with senior analysts to refine and validate models.

Skills : Machine Learning, Quantitative Research.

Description :

- Responsible for ccoordinating with other members of the finance team, such as a risk analyst when required to review financial information and forecasts.

- Demonstrated proficiency in basic computer applications, such as Microsoft Office software products.

- Learned about banking, financial services, and the various divisions within the organization as assigned during the internship.

- Gained analytical, technical, and decision-making skills through formal and informal learning opportunities.

- Completed special projects or assignments that assist the department in its mission and help the intern learn more about the corporate environment.

- Completed all prescribed training satisfactorily.

- Demonstrated flexibility in managing multiple projects and deadlines simultaneously.

Experience

0-2 Years

Level

Fresher

Education

BCS