Quantitative Trader Resume

Objective : Detail-oriented Quantitative Trader with 2 years of experience in developing and implementing high-frequency trading algorithms. Proficient in analyzing market data to identify profitable trading opportunities and optimize strategies.

Skills : Statistical Analysis, Algorithm Development, Risk Management, Data Analysis

Description :

- Developed and implemented high-frequency trading algorithms to enhance trading performance.

- Created analytical libraries for market data analysis, improving decision-making processes.

- Designed and optimized quantitative trading strategies to align with market trends.

- Collaborated with cross-functional teams to automate trading strategies, increasing efficiency.

- Managed a team of quantitative researchers, providing mentorship and task allocation.

- Conducted backtesting of trading models to ensure alignment with performance goals.

- Researched and identified new trading strategies to capitalize on market opportunities.

Experience

0-2 Years

Level

Entry Level

Education

MSc Finance

Quantitative Trader Resume

Objective : Results-driven Quantitative Trader with 2 years of experience in developing and executing data-driven trading strategies. Proficient in statistical analysis and algorithmic trading, leveraging market insights to optimize performance.

Skills : Advanced Mathematics, Quantitative Analysis, Statistical Modeling, Algorithm Development, Risk Management

Description :

- Conducted comprehensive analysis of financial markets and trading instruments to inform strategy development.

- Developed and optimized quantitative trading strategies using statistical models and historical data.

- Identified market inefficiencies and trading opportunities through systematic data analysis.

- Engineered and deployed algorithmic trading systems for rapid execution in cryptocurrency markets.

- Applied advanced statistical methods to detect trends and anomalies in financial data.

- Created and maintained trading algorithms using Python and R for enhanced performance.

- Utilized machine learning techniques and data visualization tools to refine trading strategies.

Experience

0-2 Years

Level

Fresher

Education

MSc Finance

Quantitative Trader Resume

Objective : Results-driven Quantitative Trader with 5 years of experience in developing and implementing data-driven trading strategies. Proficient in statistical analysis, risk management, and algorithmic trading to optimize portfolio performance.

Skills : Statistical Analysis, Risk Management, Algorithmic Trading, Data Mining, Financial Modeling

Description :

- Monitored and assessed risk exposure of trading strategies, implementing measures to mitigate potential losses.

- Utilized advanced statistical techniques to model and predict market movements across various asset classes.

- Analyzed extensive financial datasets to identify and capitalize on profitable trading opportunities.

- Conducted thorough research to integrate cutting-edge methodologies into automated trading systems.

- Designed and executed high-frequency trading strategies tailored for market makers.

- Managed the execution of strategies using sophisticated algorithmic trading platforms.

- Applied machine learning techniques to enhance predictive accuracy and trading performance.

Experience

2-5 Years

Level

Junior

Education

MSc Finance

Quantitative Trader Resume

Headline : Results-driven Quantitative Trader with 7 years of experience in developing predictive models and optimizing trading strategies. Proven ability to leverage data analytics for market insights and enhance trading performance.

Skills : Proficient in Python, Statistical analysis, Risk management, Data visualization, Market research

Description :

- Expanded trading strategies into new markets, enhancing portfolio diversity and risk management.

- Conducted rigorous backtesting to refine trading ideas, resulting in improved profitability.

- Collaborated with cross-functional teams to enhance the Quant Platform's capabilities and performance.

- Adapted trading strategies to align with evolving market conditions, ensuring competitive advantage.

- Led initiatives to innovate and implement new quantitative trading ideas within the core team.

- Fostered a culture of innovation and collaboration, driving team performance and growth.

- Developed and calibrated exchange simulators to enhance trading strategy testing and validation.

Experience

5-7 Years

Level

Executive

Education

MSc Finance

Quantitative Trader Resume

Summary : Results-driven Quantitative Trader with 10 years of experience in developing and optimizing trading strategies. Proven track record in leveraging statistical analysis and algorithmic models to enhance profitability while effectively managing risk.

Skills : Market Data Analysis, Algorithm Development, Statistical Analysis, Risk Management, Backtesting Strategies

Description :

- Developed and implemented quantitative trading strategies across diverse markets, enhancing profitability.

- Conducted in-depth analysis of financial data to identify lucrative trading opportunities and mitigate risks.

- Designed and coded algorithmic trading models utilizing advanced statistical methods and quantitative techniques.

- Monitored trading positions to ensure compliance with risk management protocols and optimize performance.

- Performed rigorous backtesting and performance evaluations of trading strategies to maximize returns.

- Collaborated with technology teams to refine trading systems and improve execution efficiency.

- Kept abreast of market trends and technological advancements to continuously enhance trading strategies.

Experience

7-10 Years

Level

Senior

Education

MSc Finance

Quantitative Trader Resume

Summary : Results-driven Quantitative Trader with 10 years of experience in developing and executing data-driven trading strategies. Proven track record in optimizing portfolio performance and managing risk in dynamic markets.

Skills : Analytical Decision-Making, Statistical Analysis, Algorithm Development, Risk Management

Description :

- Collaborated with analysts to analyze market data, identifying new trading opportunities in US power markets.

- Developed and executed quantitative trading strategies leveraging market analysis and risk management.

- Engaged in industry conferences to stay updated on market trends and network with peers.

- Managed systematic trading strategies, enhancing execution platforms and technology.

- Improved signal development, portfolio construction, and risk management processes.

- Led the development of trading platform infrastructure and technology enhancements.

- Utilized statistical models to refine trading strategies and improve decision-making.

Experience

7-10 Years

Level

Management

Education

MSc Finance

Quantitative Trader Resume

Headline : Results-driven Quantitative Trader with 7 years of experience in developing and optimizing trading strategies through advanced quantitative analysis and data-driven insights. Proven track record in enhancing trading performance and risk management.

Skills : Data Analysis, Algorithm Development, Risk Management, Market Research, Quantitative Analysis

Description :

- Managed and optimized systematic quantitative trading strategies, enhancing platform performance and reliability.

- Utilized advanced data analytics and statistical methods to identify new alpha sources and refine existing signals.

- Oversaw the trade execution process, ensuring effective strategy implementation while minimizing costs and slippage.

- Collaborated with the Fund Manager to integrate insights into trading decisions and strategy development.

- Designed and enhanced proprietary tools and systems to support trading operations and strategy execution.

- Contributed to strategic discussions on fund performance, risk management, and capital allocation.

- Conducted thorough market research to inform trading strategies and improve decision-making processes.

Experience

5-7 Years

Level

Freelancer

Education

MSc Finance

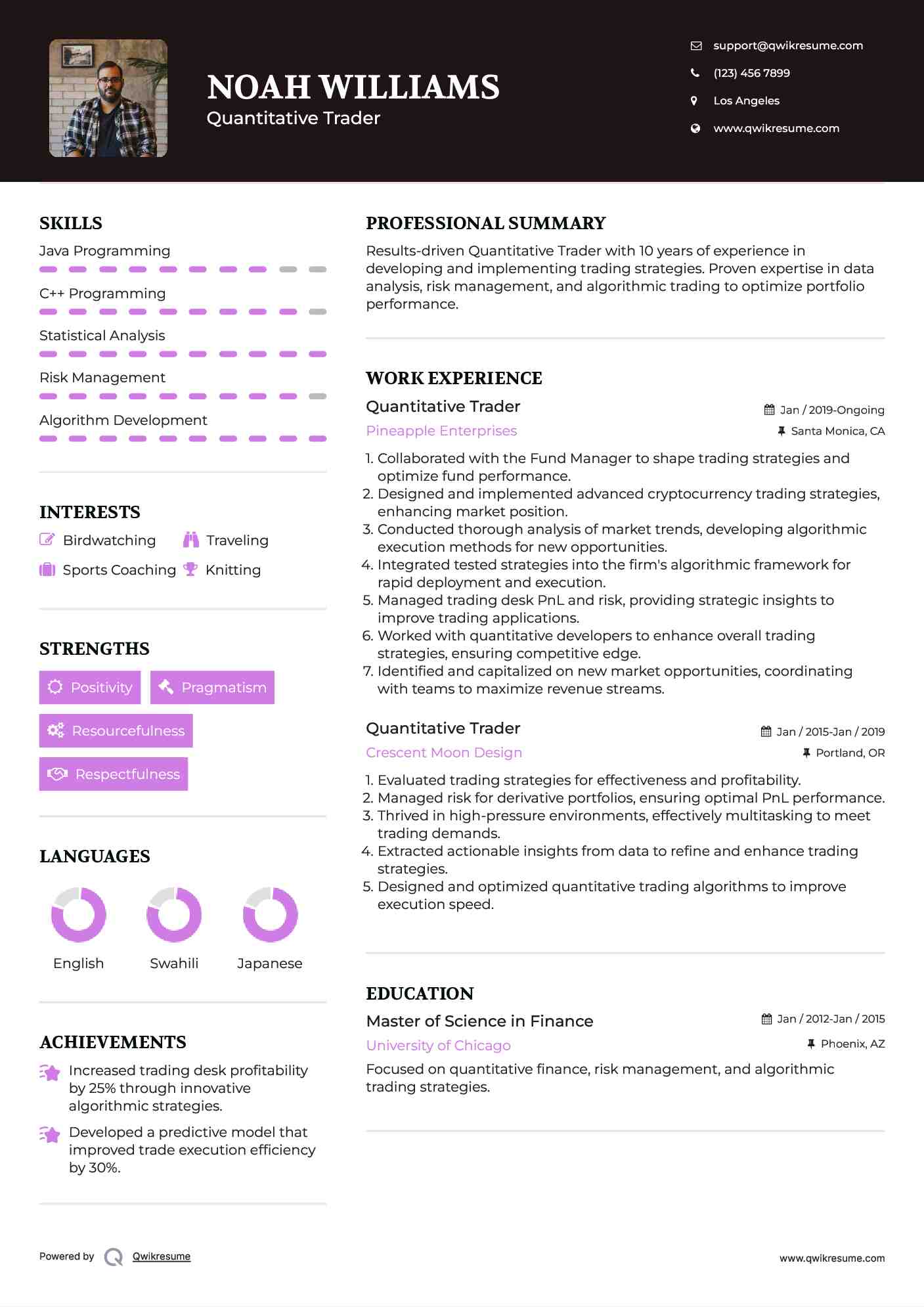

Quantitative Trader Resume

Summary : Results-driven Quantitative Trader with 10 years of experience in developing and implementing trading strategies. Proven expertise in data analysis, risk management, and algorithmic trading to optimize portfolio performance.

Skills : Java Programming, C++ Programming, Statistical Analysis, Risk Management, Algorithm Development

Description :

- Collaborated with the Fund Manager to shape trading strategies and optimize fund performance.

- Designed and implemented advanced cryptocurrency trading strategies, enhancing market position.

- Conducted thorough analysis of market trends, developing algorithmic execution methods for new opportunities.

- Integrated tested strategies into the firm's algorithmic framework for rapid deployment and execution.

- Managed trading desk PnL and risk, providing strategic insights to improve trading applications.

- Worked with quantitative developers to enhance overall trading strategies, ensuring competitive edge.

- Identified and capitalized on new market opportunities, coordinating with teams to maximize revenue streams.

Experience

10+ Years

Level

Consultant

Education

MSF

Quant Trader Resume

Headline : Results-driven Quantitative Trader with 7 years of experience in developing and optimizing trading strategies. Proven track record in leveraging data analysis and quantitative techniques to enhance trading performance and profitability.

Skills : Statistical modeling and analysis, Algorithmic trading, Risk management, Data analysis, Market research

Description :

- Designed and implemented innovative trading strategies to capitalize on market inefficiencies.

- Mentored junior traders, fostering a collaborative environment to enhance team performance.

- Executed quantitative trading strategies, achieving a 20% increase in team profitability.

- Analyzed financial markets to identify and exploit profitable trading opportunities.

- Conducted research on emerging quantitative techniques to maintain competitive edge.

- Collaborated with cross-functional teams to ensure effective strategy execution.

- Utilized advanced statistical methods to refine trading algorithms and models.

Experience

5-7 Years

Level

Senior

Education

MSc Finance

Quantitative Trader Resume

Headline : Results-driven Quantitative Trader with 7 years of experience in developing and implementing trading strategies. Proficient in data analysis, algorithm design, and risk management to optimize trading performance and maximize profitability.

Skills : Data analysis, Algorithm development, Risk management, Statistical modeling, Market analysis

Description :

- Developed and implemented quantitative trading strategies that increased profitability by 25%.

- Designed and optimized algorithms to enhance trade execution and risk management.

- Conducted in-depth market analysis to identify profitable trading opportunities.

- Collaborated with cross-functional teams to refine trading models and strategies.

- Utilized statistical modeling techniques to forecast market trends and inform trading decisions.

- Built and maintained data-driven tools to streamline trading operations and enhance performance.

- Monitored trading performance and adjusted strategies based on real-time data analysis.

Experience

5-7 Years

Level

Executive

Education

MSc Finance