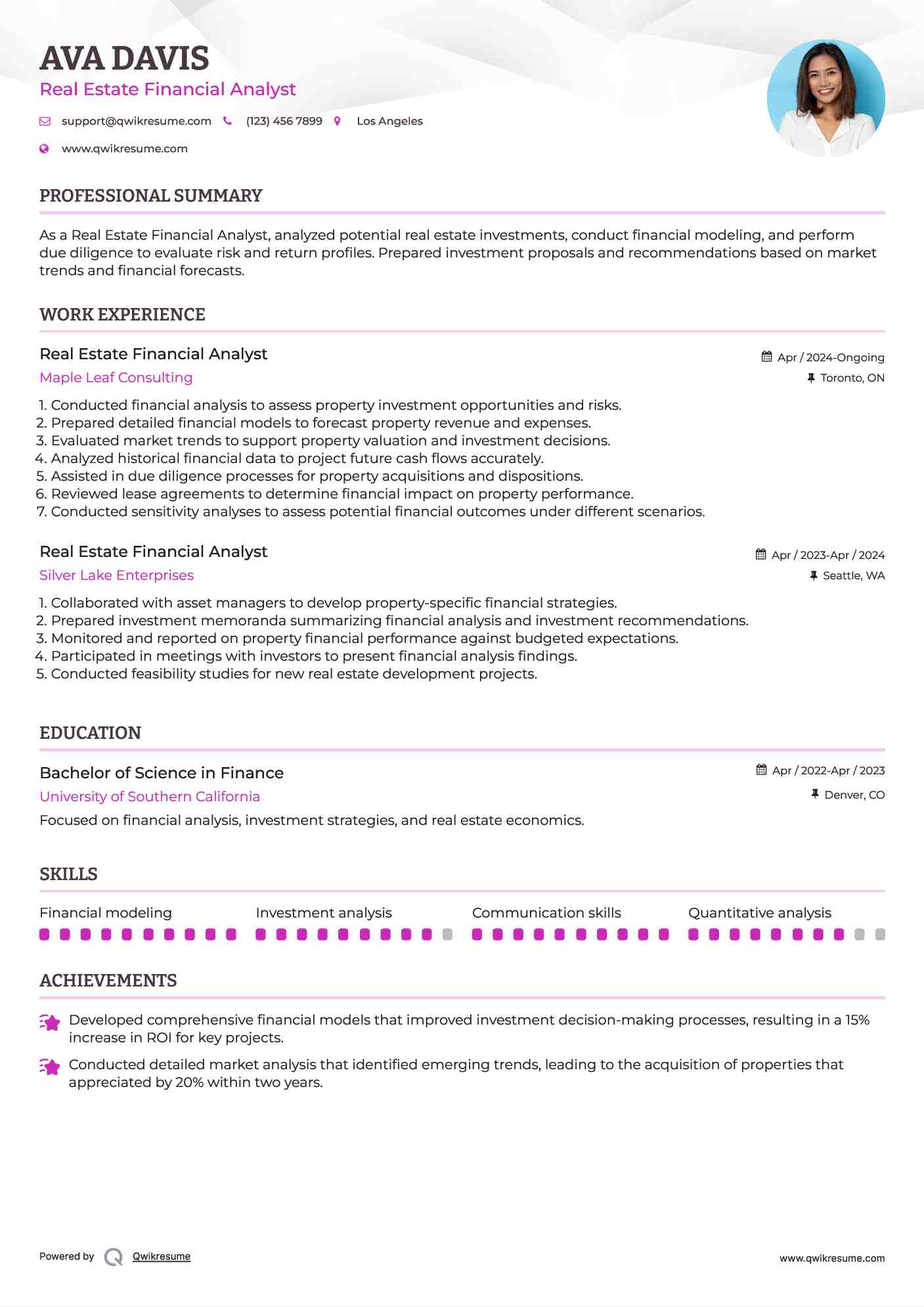

Real Estate Financial Analyst Resume

Objective : As a Real Estate Financial Analyst, analyzed potential real estate investments, conduct financial modeling, and perform due diligence to evaluate risk and return profiles. Prepared investment proposals and recommendations based on market trends and financial forecasts.

Skills : Financial modeling, Investment analysis, Communication skills, Quantitative analysis

Description :

- Conducted financial analysis to assess property investment opportunities and risks.

- Prepared detailed financial models to forecast property revenue and expenses.

- Evaluated market trends to support property valuation and investment decisions.

- Analyzed historical financial data to project future cash flows accurately.

- Assisted in due diligence processes for property acquisitions and dispositions.

- Reviewed lease agreements to determine financial impact on property performance.

- Conducted sensitivity analyses to assess potential financial outcomes under different scenarios.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

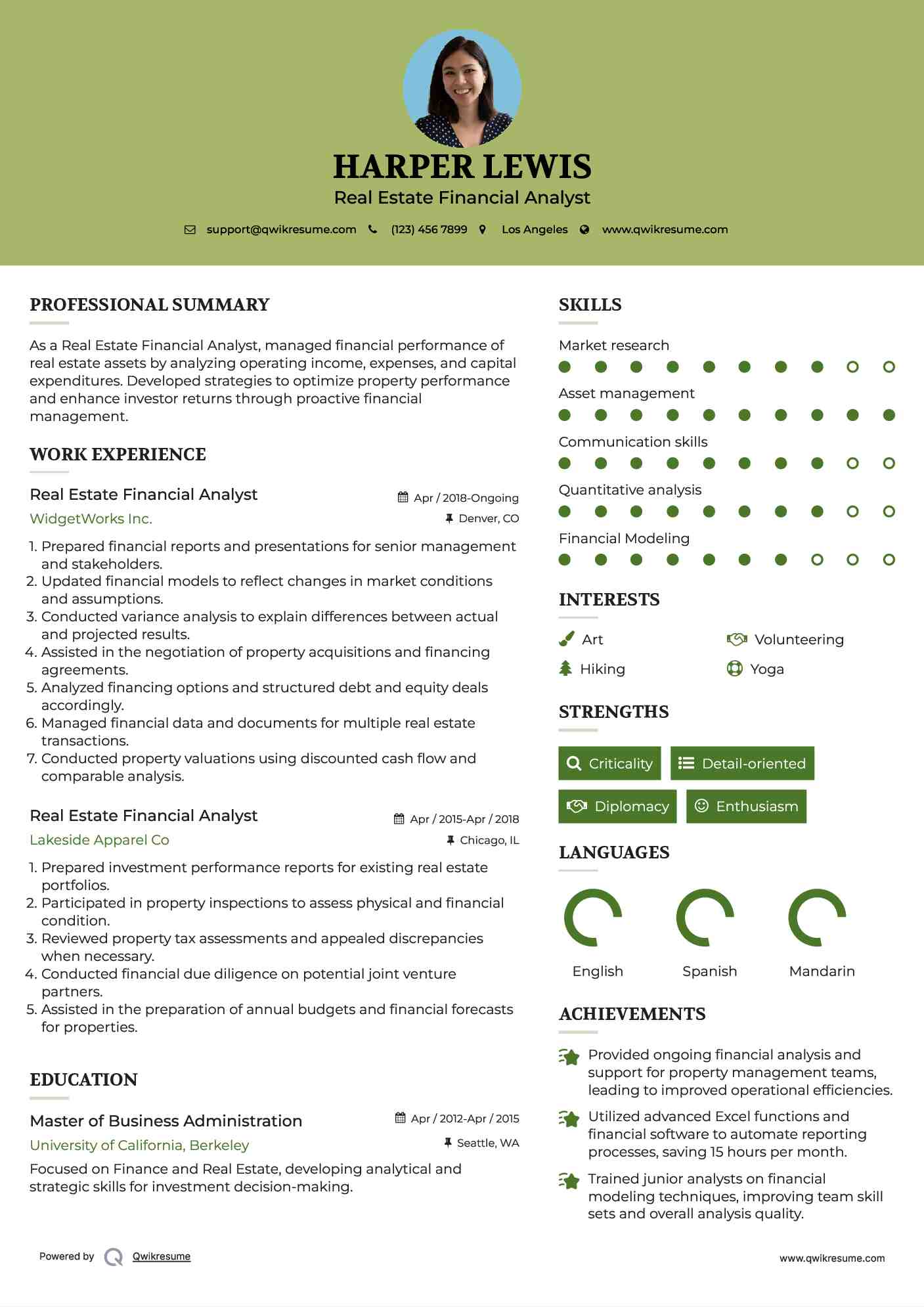

Real Estate Financial Analyst Resume

Summary : As a Real Estate Financial Analyst, managed financial performance of real estate assets by analyzing operating income, expenses, and capital expenditures. Developed strategies to optimize property performance and enhance investor returns through proactive financial management.

Skills : Market research, Asset management, Communication skills, Quantitative analysis, Financial Modeling

Description :

- Prepared financial reports and presentations for senior management and stakeholders.

- Updated financial models to reflect changes in market conditions and assumptions.

- Conducted variance analysis to explain differences between actual and projected results.

- Assisted in the negotiation of property acquisitions and financing agreements.

- Analyzed financing options and structured debt and equity deals accordingly.

- Managed financial data and documents for multiple real estate transactions.

- Conducted property valuations using discounted cash flow and comparable analysis.

Experience

10+ Years

Level

Senior

Education

MBA

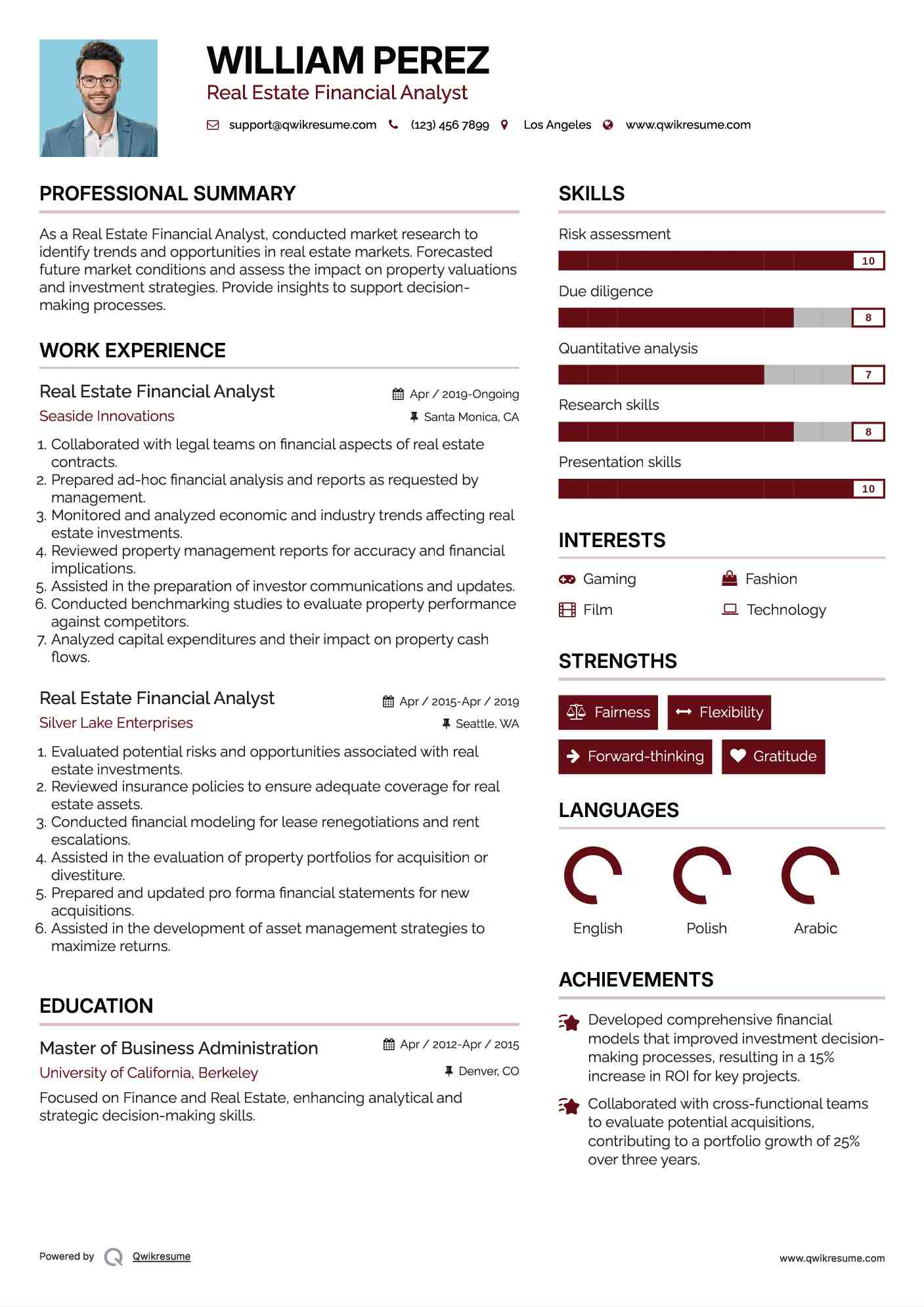

Real Estate Financial Analyst Resume

Summary : As a Real Estate Financial Analyst, conducted market research to identify trends and opportunities in real estate markets. Forecasted future market conditions and assess the impact on property valuations and investment strategies. Provide insights to support decision-making processes.

Skills : Risk assessment, Due diligence, Quantitative analysis, Research skills, Presentation skills

Description :

- Collaborated with legal teams on financial aspects of real estate contracts.

- Prepared ad-hoc financial analysis and reports as requested by management.

- Monitored and analyzed economic and industry trends affecting real estate investments.

- Reviewed property management reports for accuracy and financial implications.

- Assisted in the preparation of investor communications and updates.

- Conducted benchmarking studies to evaluate property performance against competitors.

- Analyzed capital expenditures and their impact on property cash flows.

Experience

7-10 Years

Level

Management

Education

MBA

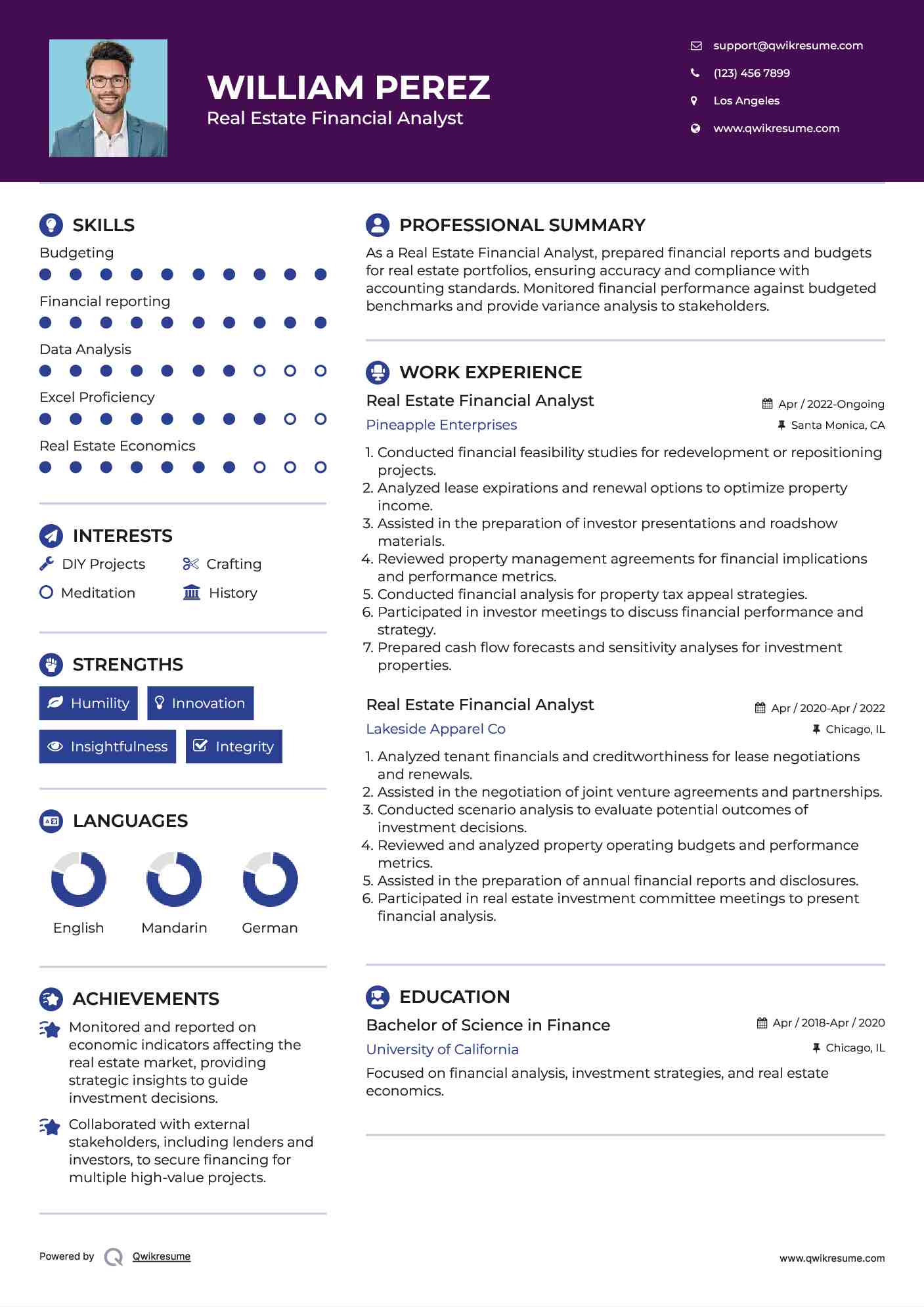

Real Estate Financial Analyst Resume

Objective : As a Real Estate Financial Analyst, prepared financial reports and budgets for real estate portfolios, ensuring accuracy and compliance with accounting standards. Monitored financial performance against budgeted benchmarks and provide variance analysis to stakeholders.

Skills : Budgeting, Financial reporting, Data Analysis, Excel Proficiency, Real Estate Economics

Description :

- Conducted financial feasibility studies for redevelopment or repositioning projects.

- Analyzed lease expirations and renewal options to optimize property income.

- Assisted in the preparation of investor presentations and roadshow materials.

- Reviewed property management agreements for financial implications and performance metrics.

- Conducted financial analysis for property tax appeal strategies.

- Participated in investor meetings to discuss financial performance and strategy.

- Prepared cash flow forecasts and sensitivity analyses for investment properties.

Experience

2-5 Years

Level

Executive

Education

B.S. Finance

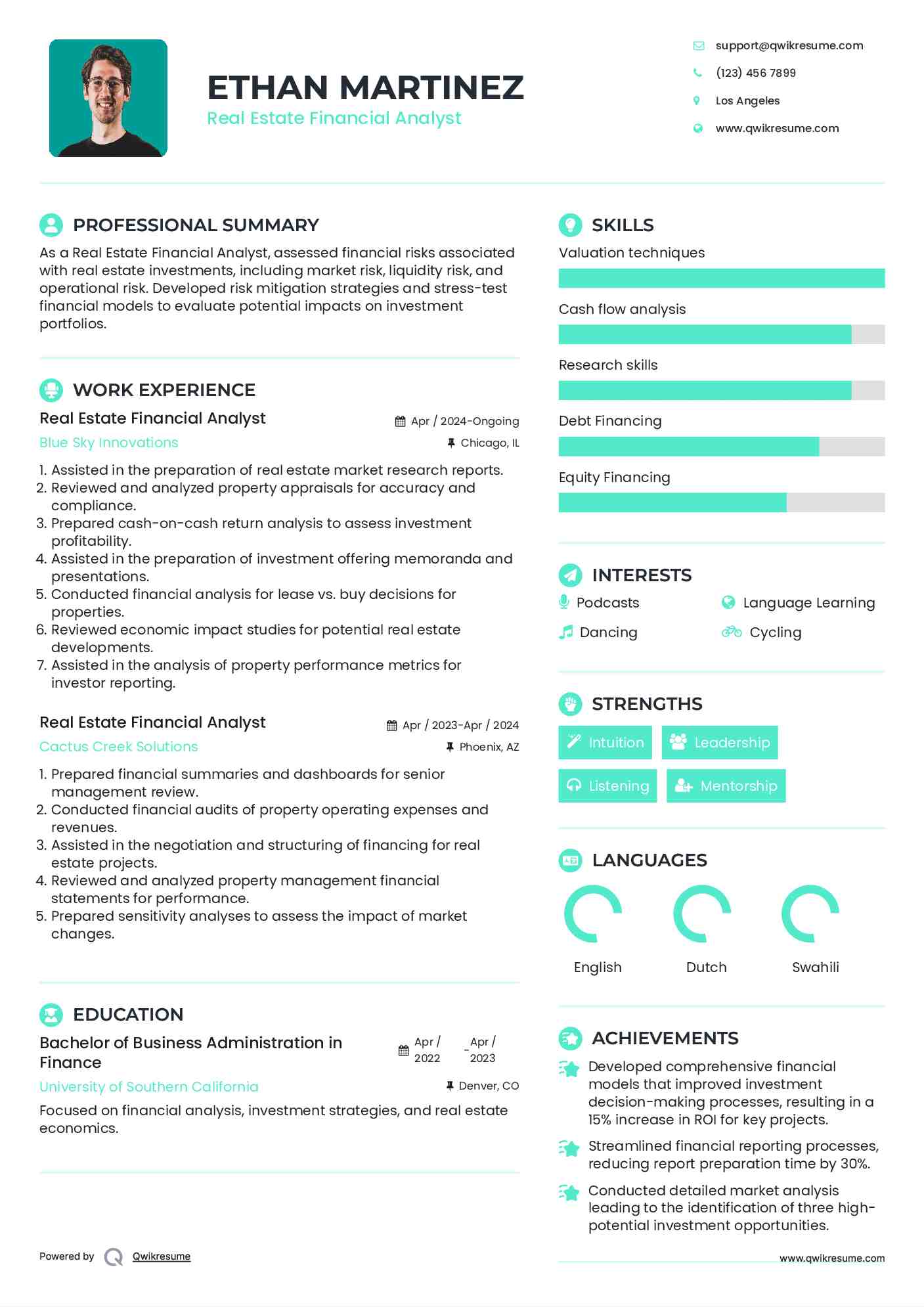

Real Estate Financial Analyst Resume

Objective : As a Real Estate Financial Analyst, assessed financial risks associated with real estate investments, including market risk, liquidity risk, and operational risk. Developed risk mitigation strategies and stress-test financial models to evaluate potential impacts on investment portfolios.

Skills : Valuation techniques, Cash flow analysis, Research skills, Debt Financing, Equity Financing

Description :

- Assisted in the preparation of real estate market research reports.

- Reviewed and analyzed property appraisals for accuracy and compliance.

- Prepared cash-on-cash return analysis to assess investment profitability.

- Assisted in the preparation of investment offering memoranda and presentations.

- Conducted financial analysis for lease vs. buy decisions for properties.

- Reviewed economic impact studies for potential real estate developments.

- Assisted in the analysis of property performance metrics for investor reporting.

Experience

0-2 Years

Level

Junior

Education

BBA-Finance

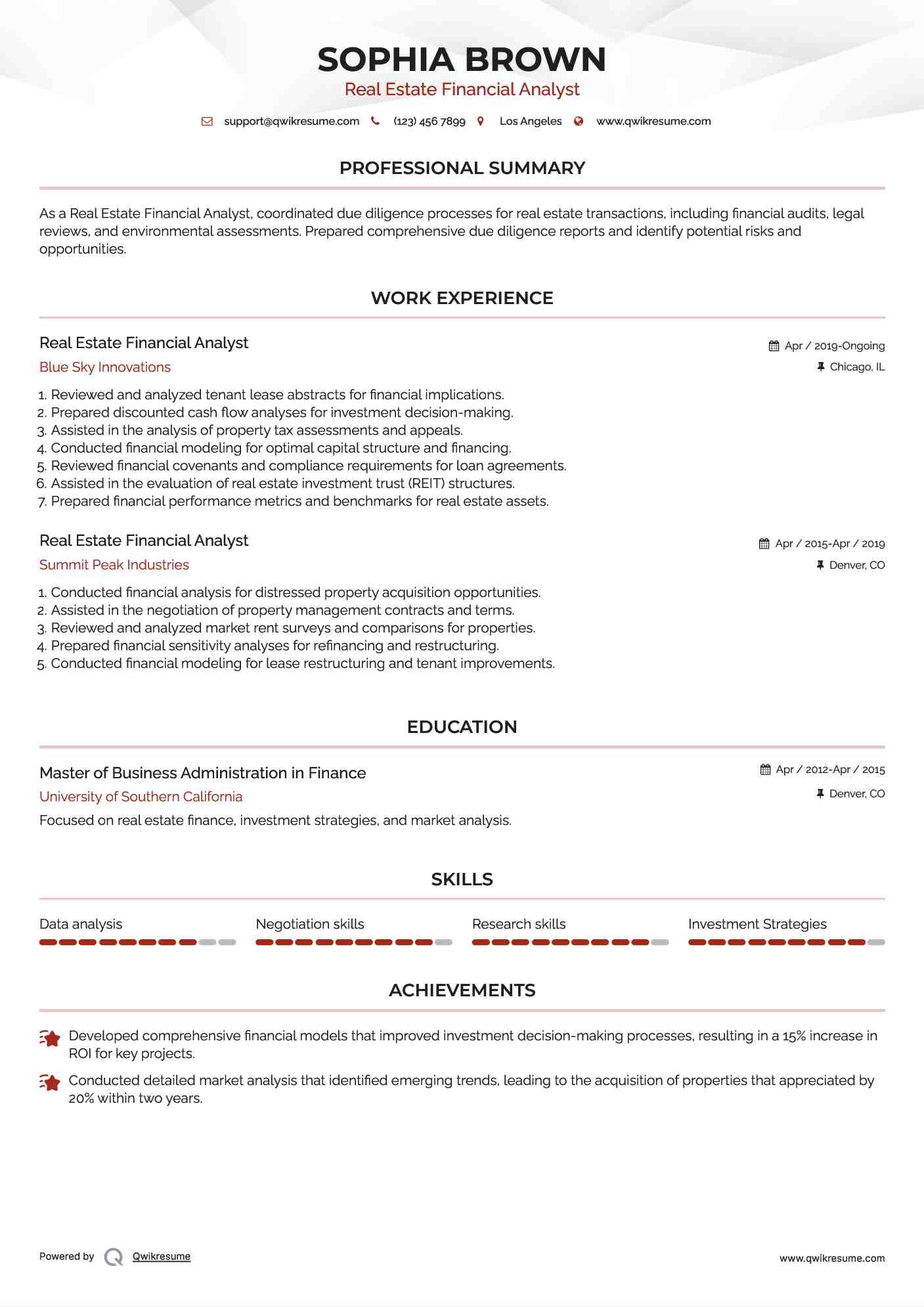

Real Estate Financial Analyst Resume

Summary : As a Real Estate Financial Analyst, coordinated due diligence processes for real estate transactions, including financial audits, legal reviews, and environmental assessments. Prepared comprehensive due diligence reports and identify potential risks and opportunities.

Skills : Data analysis, Negotiation skills, Research skills, Investment Strategies

Description :

- Reviewed and analyzed tenant lease abstracts for financial implications.

- Prepared discounted cash flow analyses for investment decision-making.

- Assisted in the analysis of property tax assessments and appeals.

- Conducted financial modeling for optimal capital structure and financing.

- Reviewed financial covenants and compliance requirements for loan agreements.

- Assisted in the evaluation of real estate investment trust (REIT) structures.

- Prepared financial performance metrics and benchmarks for real estate assets.

Experience

7-10 Years

Level

Consultant

Education

MBA

Real Estate Financial Analyst Resume

Summary : As a Real Estate Financial Analyst, assisted in capital markets transactions such as debt financing, equity placements, and refinancing activities for real estate projects. Analyzed financial implications and negotiate terms with lenders and investors.

Skills : Excel proficiency, Real estate market knowledge, Financial modeling, Market analysis, Sensitivity Analysis

Description :

- Prepared financial models for land acquisition and development projects.

- Conducted financial analysis for property feasibility studies and business plans.

- Assisted in the assessment of property insurance coverage and risks.

- Reviewed and analyzed property utility costs and consumption patterns.

- Prepared financial forecasts and projections for property performance.

- Conducted financial analysis for capital expenditure planning and budgeting.

- Conducted financial modeling and analysis for various real estate investment opportunities, including multifamily, commercial, and industrial properties.

Experience

10+ Years

Level

Senior

Education

MBA

Real Estate Financial Analyst Resume

Summary : As a Real Estate Financial Analyst, developed strategic plans for real estate portfolios based on investment objectives and market conditions. Recommended portfolio diversification strategies and asset allocation adjustments to optimize returns and manage risk.

Skills : Strategic planning, Problem-solving, Attention to detail, Financial Modeling, Market Analysis

Description :

- Assisted in the preparation of financial due diligence reports for acquisitions.

- Conducted financial analysis for portfolio diversification and risk management.

- Analyzed environmental assessments and compliance costs for property acquisitions.

- Prepared financial models for evaluating ground lease opportunities.

- Assisted in the analysis of property zoning regulations and development constraints.

- Conducted financial analysis for property disposition strategies and negotiations.

- Reviewed and analyzed economic impact studies for development projects.

Experience

7-10 Years

Level

Management

Education

MBA

Real Estate Financial Analyst Resume

Headline : As a Real Estate Financial Analyst, conducted property valuation and appraisal analysis using discounted cash flow (DCF), comparable sales, and income capitalization methods. Provided valuation reports to support investment decisions and financial reporting requirements.

Skills : Attention to detail, Communication, Presentation Skills, Regulatory Compliance, Lease Analysis

Description :

- Conducted financial analysis for lease abstraction and financial reporting.

- Assisted in the preparation of financial models for mixed-use development projects.

- Analyzed utility expense management strategies for optimizing property operating costs.

- Reviewed and analyzed lease default scenarios and financial impact assessments.

- Prepared financial sensitivity analyses for lease renewal negotiations.

- Conducted financial modeling for evaluating lease vs. sale-leaseback options.

- Assisted in the analysis of property portfolio performance against strategic objectives.

Experience

5-7 Years

Level

Executive

Education

MBA

Real Estate Financial Analyst Resume

Summary : As a Real Estate Financial Analyst, built financial models to assess the feasibility of real estate development projects and investment opportunities. Created cash flow projections, sensitivity analyses, and scenario planning to evaluate potential outcomes.

Skills : Legal and regulatory understanding, Team collaboration, Presentation skills, Communication skills, Portfolio Management

Description :

- Conducted financial modeling for evaluating property investment syndication opportunities.

- Assisted in the analysis of property market trends and forecasting for investment decisions.

- Reviewed and analyzed property inspection reports for financial impact assessments.

- Prepared financial performance summaries for investor relations communications.

- Conducted financial analysis for evaluating property leasehold interests and rights.

- Analyzed property tax assessments and valuations for appeal strategies.

- Supported the asset management team in monitoring portfolio performance and identifying value-add opportunities.

Experience

7-10 Years

Level

Consultant

Education

MBA