Repo Trader Resume

Objective : As a Repo Trader, responsible for executing repurchase agreements (repos) and reverse repos in the financial markets. Managing transactions to provide short-term funding or to obtain securities for trading. This involves monitoring market conditions, assessing counterparty risk, and ensuring compliance with trading policies.

Skills : Market Analysis, Risk Management, Repo trading strategies, Repo Market Knowledge

Description :

- Executed repos to manage liquidity and optimize cash flows efficiently.

- Analyzed market trends to make informed trading decisions daily.

- Managed collateral requirements and ensured proper documentation for transactions.

- Monitored and evaluated counterparty risks to mitigate financial exposure effectively.

- Facilitated repo transactions between institutions to maintain market stability.

- Assessed market conditions and adjusted strategies for optimal returns.

- Implemented risk management strategies to safeguard against market fluctuations.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Finance

Repo Trader Resume

Summary : As a Repo Trader, oversaw the daily operations of the repo trading desk. This includes managing a team of traders, developing trading strategies, and ensuring efficient execution of repo transactions. This involves liaising with other departments and optimizing repo desk performance.

Skills : Quantitative Analysis, Financial Modeling, Repo trading strategies, Market analysis, Trade Execution

Description :

- Developed and maintained relationships with financial institutions and counterparties.

- Performed regular audits to ensure compliance with internal policies.

- Managed margin calls and resolved discrepancies in collateral valuations.

- Implemented technological solutions to streamline trading and reporting processes.

- Provided market insights and recommendations for strategic trading decisions.

- Reviewed and adjusted trading strategies based on market volatility and trends.

- Coordinated with back-office teams to ensure accurate trade reconciliation.

Experience

10+ Years

Level

Senior

Education

M.S. Finance

Repo Trader Resume

Summary : As a Repo Trader, responsible for managing complex repo transactions and large portfolios. Developing and implementing advanced trading strategies, analyze market trends, and provide insights on market movements. Also mentor junior traders and ensure adherence to risk management protocols.

Skills : Trading Strategies, Collateral Management, Market analysis, Risk management, Negotiation Skills

Description :

- Supported senior traders in strategic planning and decision-making processes.

- Reviewed and negotiated counterparty agreements to minimize risk exposure.

- Maintained up-to-date knowledge of market regulations and compliance requirements.

- Identified and addressed potential issues in repo transactions proactively.

- Managed proprietary trading portfolios to maximize returns and minimize risks.

- Coordinated with legal teams to address contractual and regulatory issues.

- Implemented contingency plans to handle unexpected market disruptions effectively.

Experience

7-10 Years

Level

Management

Education

M.S. Finance

Repo Trader Resume

Summary : Repo Trader specializes in assessing and mitigating risks associated with repo transactions. Analyzing counterparty risk, collateral quality, and market volatility to ensure that repo trades are executed with minimal risk exposure.

Skills : Counterparty Risk Assessment, Liquidity Management, Market analysis, Risk management, Economic Indicators

Description :

- Implemented risk assessment tools to monitor and manage exposure levels.

- Coordinated with auditors to ensure compliance with financial regulations.

- Developed reports and presentations for senior management and stakeholders.

- Analyzed market liquidity to optimize trade execution and minimize costs.

- Monitored changes in monetary policy and their impact on repo markets.

- Ensured proper documentation and reporting for regulatory compliance.

- Reviewed trading systems and platforms for performance and accuracy.

Experience

7-10 Years

Level

Management

Education

MFin

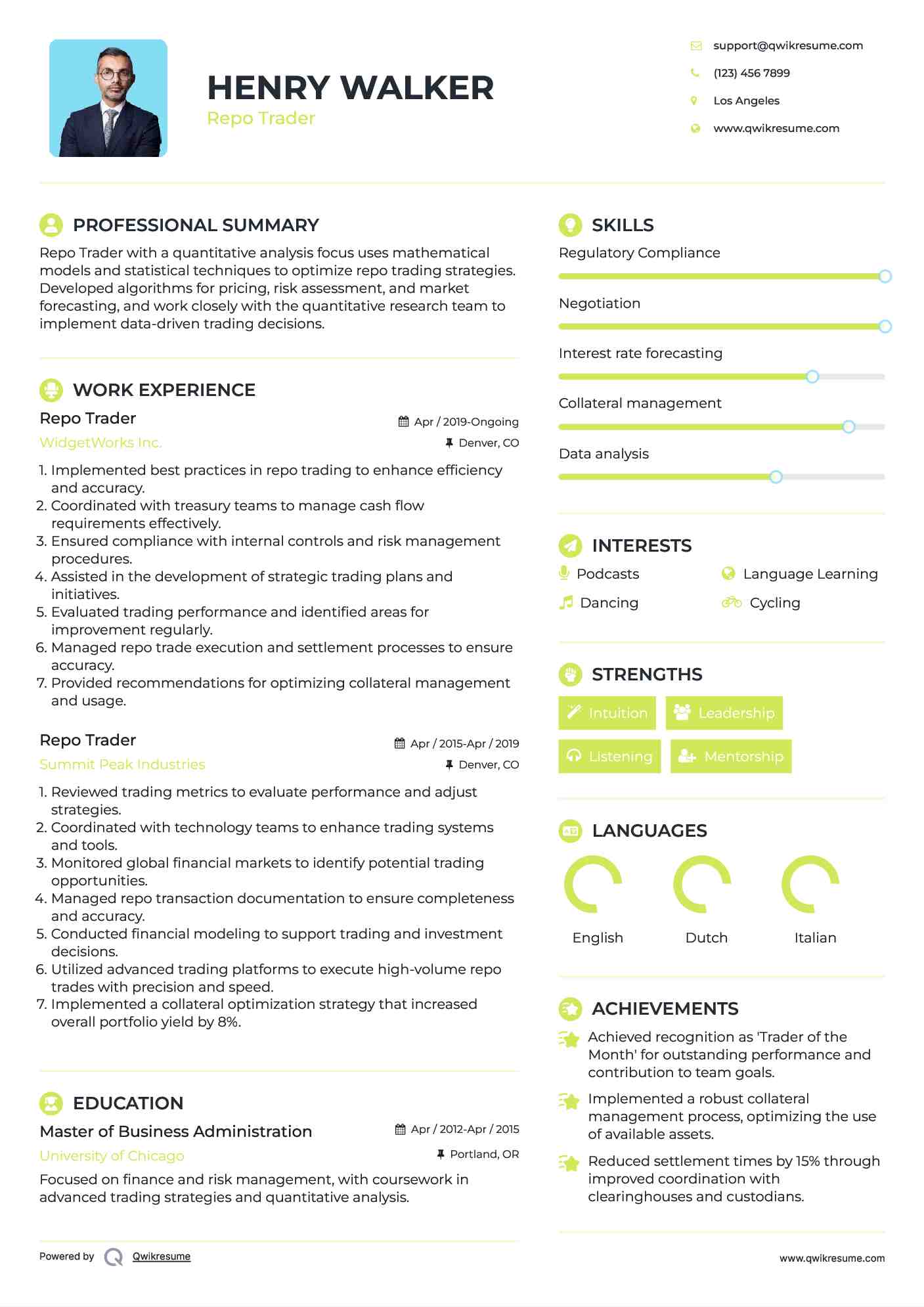

Repo Trader Resume

Summary : Repo Trader with a quantitative analysis focus uses mathematical models and statistical techniques to optimize repo trading strategies. Developed algorithms for pricing, risk assessment, and market forecasting, and work closely with the quantitative research team to implement data-driven trading decisions.

Skills : Regulatory Compliance, Negotiation, Interest rate forecasting, Collateral management, Data analysis

Description :

- Implemented best practices in repo trading to enhance efficiency and accuracy.

- Coordinated with treasury teams to manage cash flow requirements effectively.

- Ensured compliance with internal controls and risk management procedures.

- Assisted in the development of strategic trading plans and initiatives.

- Evaluated trading performance and identified areas for improvement regularly.

- Managed repo trade execution and settlement processes to ensure accuracy.

- Provided recommendations for optimizing collateral management and usage.

Experience

10+ Years

Level

Senior

Education

MBA

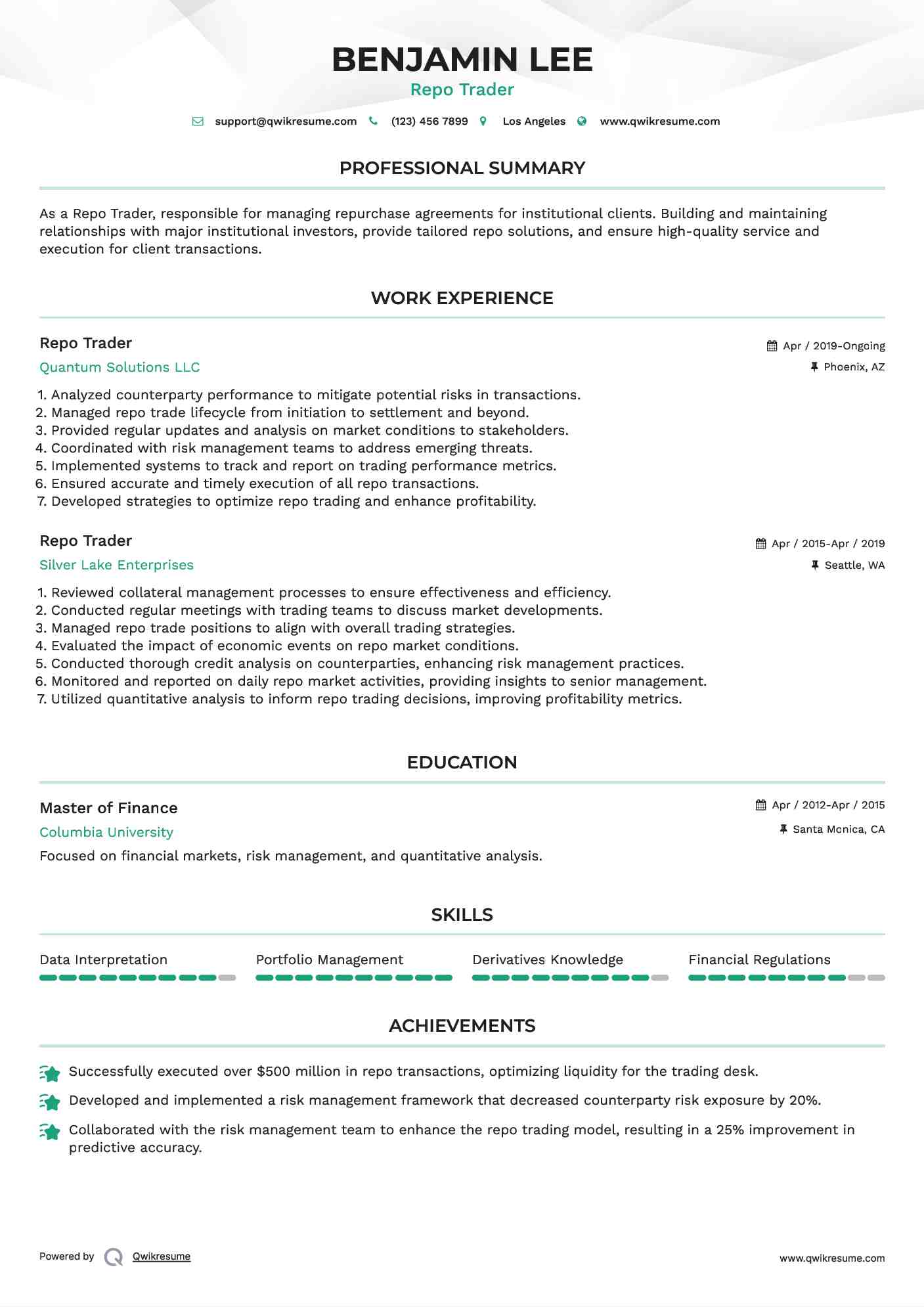

Repo Trader Resume

Summary : As a Repo Trader, responsible for managing repurchase agreements for institutional clients. Building and maintaining relationships with major institutional investors, provide tailored repo solutions, and ensure high-quality service and execution for client transactions.

Skills : Data Interpretation, Portfolio Management, Derivatives Knowledge, Financial Regulations

Description :

- Analyzed counterparty performance to mitigate potential risks in transactions.

- Managed repo trade lifecycle from initiation to settlement and beyond.

- Provided regular updates and analysis on market conditions to stakeholders.

- Coordinated with risk management teams to address emerging threats.

- Implemented systems to track and report on trading performance metrics.

- Ensured accurate and timely execution of all repo transactions.

- Developed strategies to optimize repo trading and enhance profitability.

Experience

7-10 Years

Level

Management

Education

M.Fin.

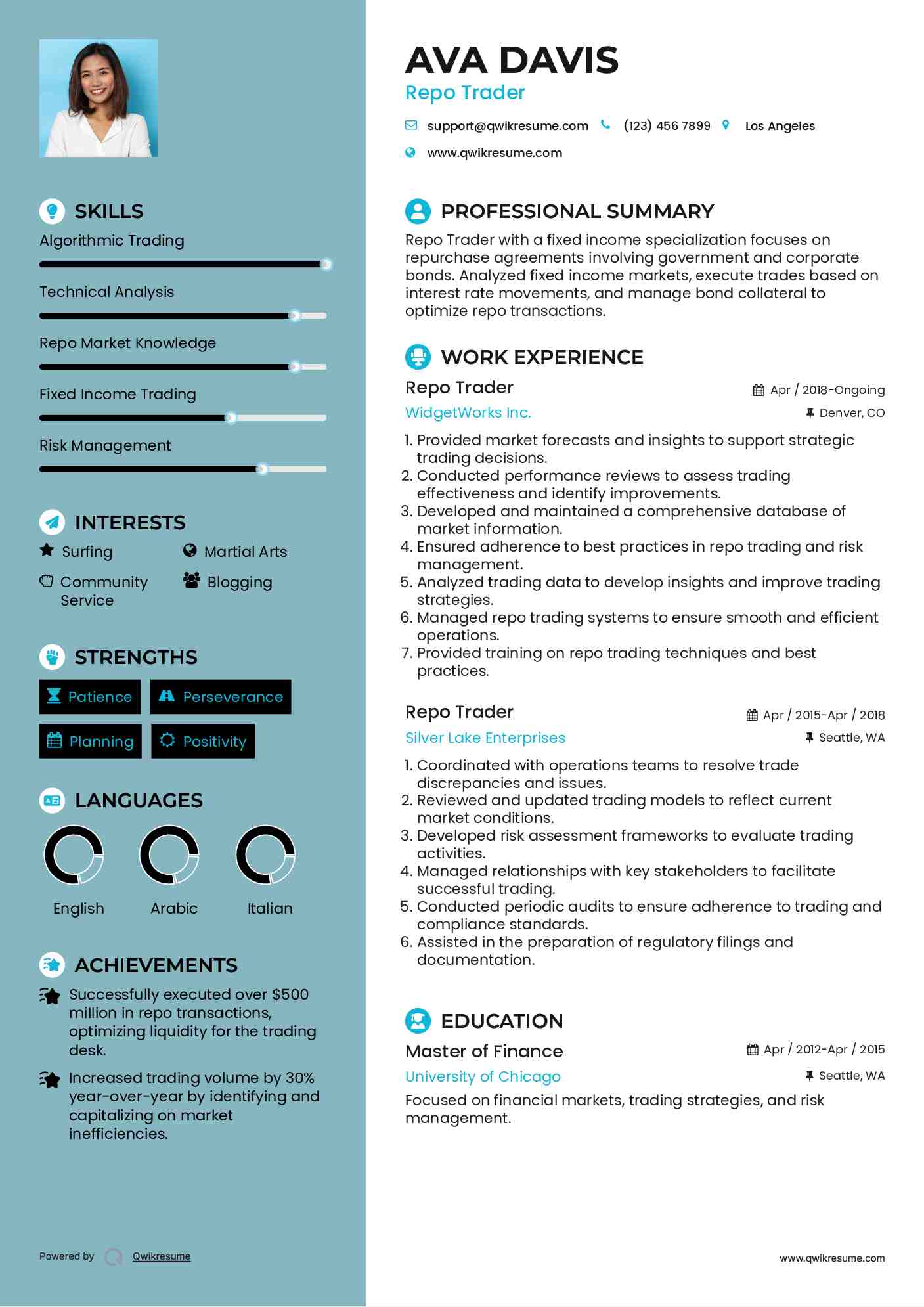

Repo Trader Resume

Summary : Repo Trader with a fixed income specialization focuses on repurchase agreements involving government and corporate bonds. Analyzed fixed income markets, execute trades based on interest rate movements, and manage bond collateral to optimize repo transactions.

Skills : Algorithmic Trading, Technical Analysis, Repo Market Knowledge, Fixed Income Trading, Risk Management

Description :

- Provided market forecasts and insights to support strategic trading decisions.

- Conducted performance reviews to assess trading effectiveness and identify improvements.

- Developed and maintained a comprehensive database of market information.

- Ensured adherence to best practices in repo trading and risk management.

- Analyzed trading data to develop insights and improve trading strategies.

- Managed repo trading systems to ensure smooth and efficient operations.

- Provided training on repo trading techniques and best practices.

Experience

10+ Years

Level

Senior

Education

MFin

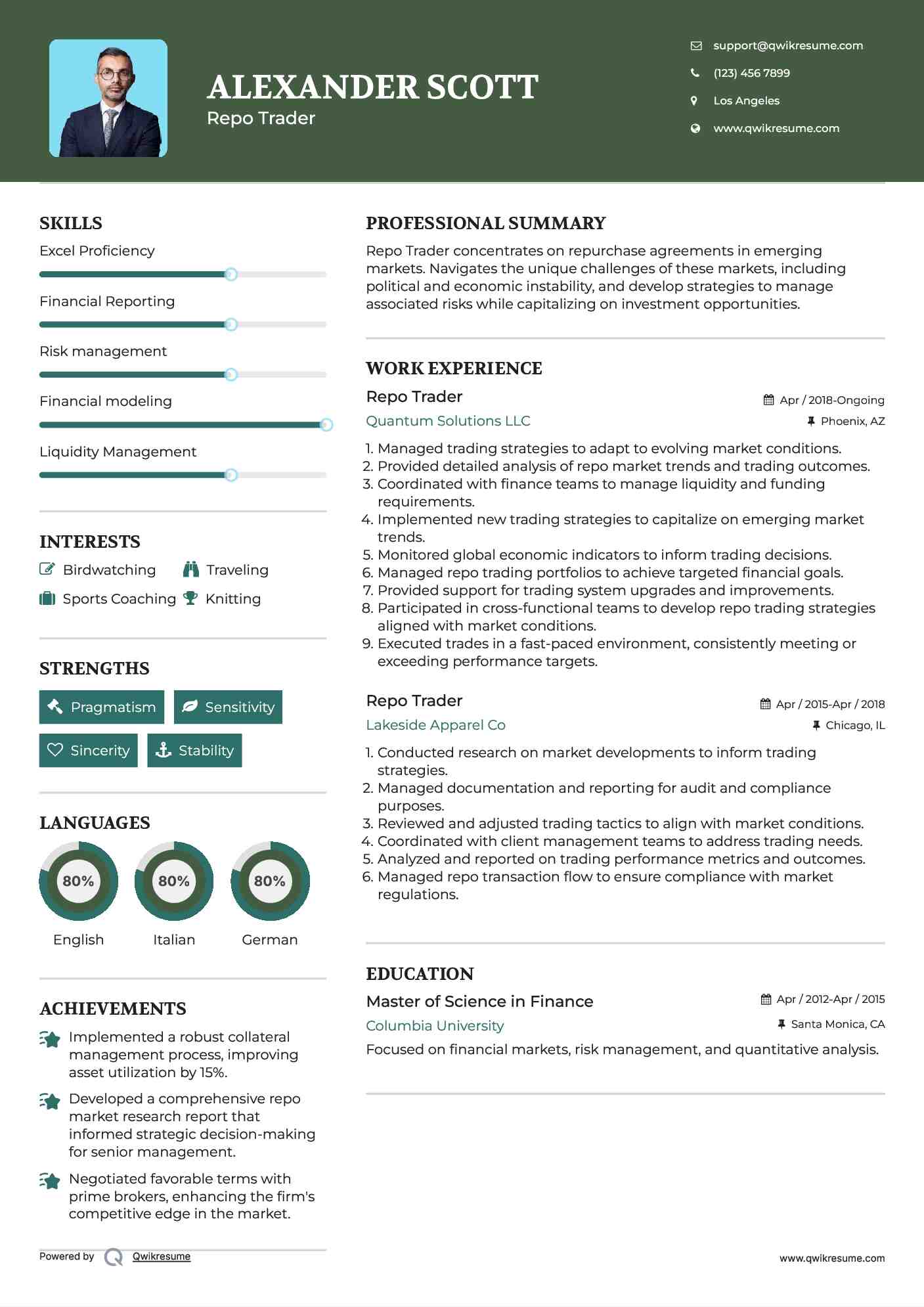

Repo Trader Resume

Summary : Repo Trader concentrates on repurchase agreements in emerging markets. Navigates the unique challenges of these markets, including political and economic instability, and develop strategies to manage associated risks while capitalizing on investment opportunities.

Skills : Excel Proficiency, Financial Reporting, Risk management, Financial modeling, Liquidity Management

Description :

- Managed trading strategies to adapt to evolving market conditions.

- Provided detailed analysis of repo market trends and trading outcomes.

- Coordinated with finance teams to manage liquidity and funding requirements.

- Implemented new trading strategies to capitalize on emerging market trends.

- Monitored global economic indicators to inform trading decisions.

- Managed repo trading portfolios to achieve targeted financial goals.

- Provided support for trading system upgrades and improvements.

- Participated in cross-functional teams to develop repo trading strategies aligned with market conditions.

- Executed trades in a fast-paced environment, consistently meeting or exceeding performance targets.

Experience

7-10 Years

Level

Management

Education

M.S. Finance

Repo Trader Resume

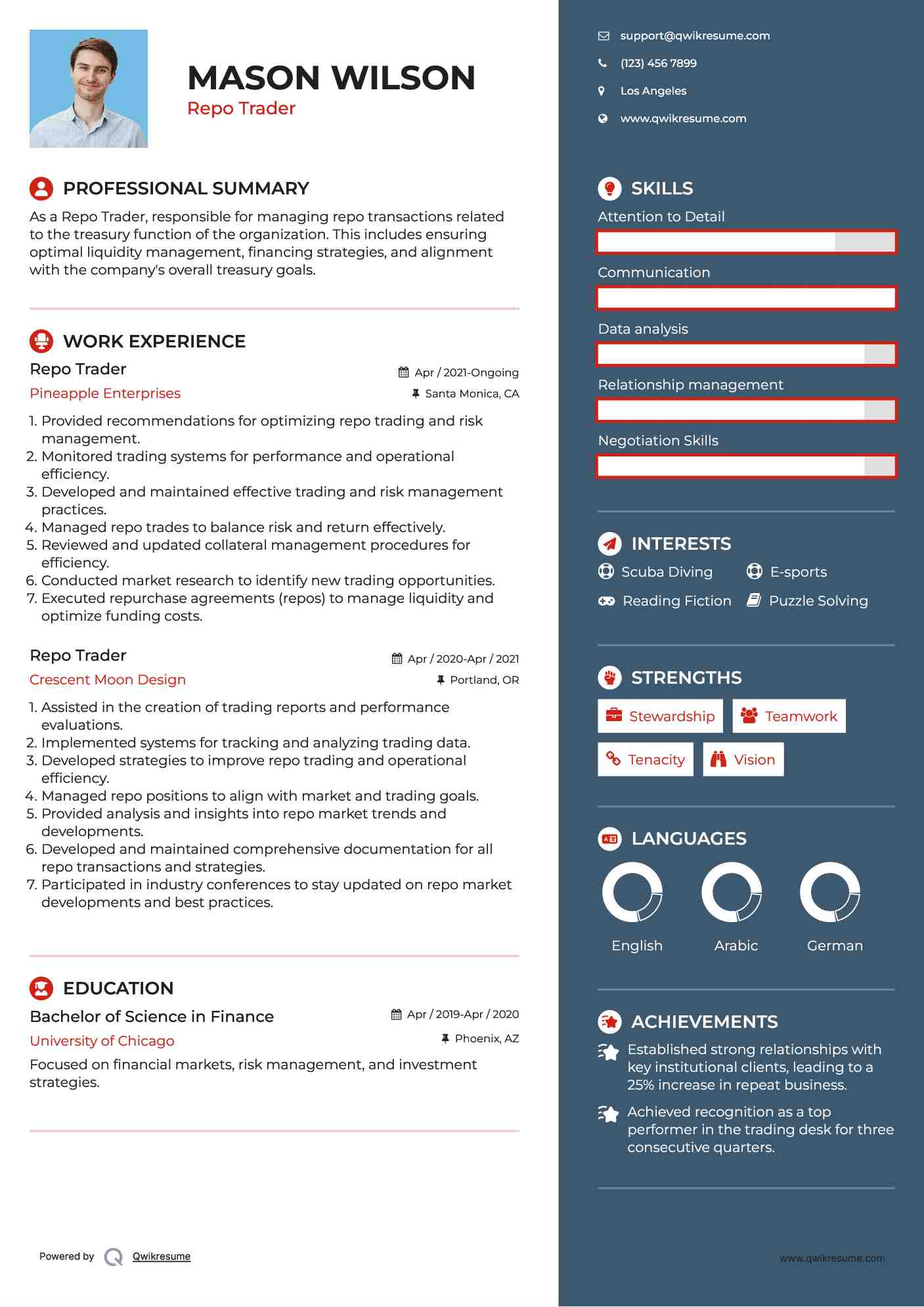

Objective : As a Repo Trader, responsible for managing repo transactions related to the treasury function of the organization. This includes ensuring optimal liquidity management, financing strategies, and alignment with the company's overall treasury goals.

Skills : Attention to Detail, Communication, Data analysis, Relationship management, Negotiation Skills

Description :

- Provided recommendations for optimizing repo trading and risk management.

- Monitored trading systems for performance and operational efficiency.

- Developed and maintained effective trading and risk management practices.

- Managed repo trades to balance risk and return effectively.

- Reviewed and updated collateral management procedures for efficiency.

- Conducted market research to identify new trading opportunities.

- Executed repurchase agreements (repos) to manage liquidity and optimize funding costs.

Experience

2-5 Years

Level

Executive

Education

BSc Finance

Repo Trader Resume

Summary : Repo Trader with a focus on technology and innovation leverages advanced trading platforms and fintech solutions to enhance repo trading efficiency. Collaborating with IT and development teams to integrate new technologies, automate processes, and stay ahead of technological trends in the repo market.

Skills : Strategic Planning, Stress Testing, Risk management, Financial reporting, Relationship management

Description :

- Developed and implemented new processes to enhance trading operations.

- Managed repo transactions to optimize returns and manage liquidity.

- Provided regular updates on trading performance to senior management.

- Reviewed and refined trading strategies based on market feedback.

- Managed documentation and compliance for repo transactions effectively.

- Coordinated with trading teams to address operational and strategic issues.

- Analyzed market conditions to forecast and manage repo rates.

Experience

10+ Years

Level

Senior

Education

MFin