Risk Manager Resume

Headline : Dynamic Risk Manager with over 7 years of experience in risk assessment and mitigation strategies across diverse sectors. Proven ability to identify vulnerabilities, develop comprehensive risk management frameworks, and implement effective compliance programs. Committed to enhancing operational efficiency and safeguarding organizational assets through proactive risk management initiatives.

Skills : Risk Assessment Proficiency, Risk Assessment, Risk Mitigation, Regulatory Compliance

Description :

- Develop and implement risk management strategies to minimize potential losses.

- Conduct risk assessments to identify vulnerabilities and threats to the organization.

- Monitor and analyze risk exposure across various business units.

- Determine clients' needs by scheduling appointments to assess current coverage and investments, aligning with long-term goals.

- Establish and monitor key risk indicators, implementing corrective action plans to mitigate identified risks.

- Deliver policy coverage and conduct follow-ups to evaluate ongoing needs and adjustments.

- Enhance agency reputation by ensuring alignment with preferred risk management practices.

Experience

5-7 Years

Level

Management

Education

B.S. Risk Mgmt.

Senior Risk Manager Resume

Summary : Accomplished Senior Risk Manager with a decade of expertise in risk assessment and management across various industries. Specializes in developing strategic risk frameworks and enhancing compliance protocols to drive operational excellence. Dedicated to fostering a culture of safety and efficiency that mitigates risks and protects organizational assets.

Skills : Risk Analysis And Reporting, Decision Making, Internal Controls, Fraud Prevention, Operational Risk

Description :

- Executed comprehensive on-site evaluations of diverse facilities to pinpoint risks and vulnerabilities.

- Ensured regulatory compliance in new construction projects through rigorous monitoring.

- Collaborated with state agency representatives to identify and mitigate loss exposures.

- Advised senior management on strategies for risk avoidance and safety enhancements.

- Authored insightful articles on risk management and facilitated training sessions.

- Reviewed compliance with federal and state laws related to risk management.

- Analyzed accident data to formulate actionable risk control recommendations.

Experience

7-10 Years

Level

Senior

Education

MBA

Risk Manager Resume

Objective : Results-focused Risk Manager with 2 years of expertise in risk assessment and compliance within healthcare environments. Skilled in developing risk mitigation strategies and enhancing operational frameworks. Eager to leverage analytical skills and proactive initiatives to protect organizational integrity and improve efficiency across various projects.

Skills : Business Impact Analysis, Root Cause Analysis, Change Management, Financial Reporting, Legal Knowledge

Description :

- Revamped the Risk and Insurance Department to enhance support for state and local risk management initiatives across multiple project sites.

- Led a corporate-wide project to centralize indemnity agreements and optimize surety bond procurement.

- Achieved a 10% reduction in insurance costs through effective negotiation and management of claims processes.

- Integrated various insurance and broker programs, improving overall risk management efficiency.

- Collaborated with legal counsel to establish compliance standards and enhance document management practices.

- Formulated guidelines for acquiring Environmental Protection Policies for high-risk assets.

- Participated in remediation projects, ensuring compliance with environmental regulations.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Risk Mgmt.

Risk Manager Assistant Resume

Objective : Detail-oriented professional specializing in risk management with 5 years of experience in identifying, assessing, and mitigating risks. Demonstrated expertise in developing and implementing risk frameworks and compliance strategies that enhance operational integrity. Passionate about contributing to a culture of safety and efficiency while safeguarding organizational assets.

Skills : Data Analysis, Presentation Development, Documentation Management, Crisis Management, Project Management

Description :

- Conduct comprehensive risk assessments to identify vulnerabilities in compliance and operational processes.

- Analyze suspicious transactions using automated fraud detection systems to ensure adherence to regulatory standards.

- Assist investigators by preparing documentation related to suspicious activities, facilitating law enforcement referrals.

- Establish and implement reporting procedures for suspicious account activities, escalating concerns as necessary.

- Review daily account activity reports, taking appropriate actions on flagged transactions.

- Collaborate with teams to develop risk management protocols, ensuring compliance with organizational policies.

- Communicate effectively with stakeholders regarding risk management initiatives and strategies.

Experience

2-5 Years

Level

Executive

Education

B.S. Risk Mgmt.

Risk Manager Resume

Objective : Experienced Risk Manager with 5 years in identifying and mitigating risks across various sectors. Adept at developing risk management frameworks and compliance strategies that enhance operational integrity. Driven to protect organizational assets through proactive assessments and strategic initiatives.

Skills : Communication Skills, Negotiation Skills, Team Leadership, Problem Solving, Ethical Judgment

Description :

- Conduct thorough risk assessments to identify potential vulnerabilities and develop mitigation strategies in collaboration with senior management.

- Implement and enhance risk-based testing and continuous monitoring processes to ensure compliance with regulatory standards.

- Revise and optimize testing procedures to encompass the entire credit lifecycle, expanding risk review coverage.

- Facilitate consumer loan reviews to identify key credit risks and deficiencies, ensuring timely corrective actions are taken.

- Design and maintain a Continuous Monitoring framework that utilizes quantitative and qualitative analysis for risk evaluation.

- Oversee remediation actions to ensure effective mitigation of identified risks.

- Engage with stakeholders and executive management to discuss emerging risks, trends, and strategic initiatives.

Experience

2-5 Years

Level

Junior

Education

MBA

Junior Risk Manager Resume

Objective : Resourceful Junior Risk Manager with 5 years of experience in risk assessment and management across financial services. Skilled in identifying potential threats, developing risk mitigation strategies, and ensuring compliance with regulatory standards. Passionate about fostering a culture of risk awareness and enhancing organizational resilience through effective risk management practices.

Skills : Risk Governance And Compliance Expertise, Stakeholder Engagement, Quantitative Analysis, Qualitative Analysis

Description :

- Facilitated the development of an Enterprise Risk Management framework to enhance risk identification and response across the organization.

- Implemented structured risk management processes, integrating strategy, technology, and personnel for improved operational performance.

- Collaborated with stakeholders to identify and assess risks related to credit, market, and operational factors.

- Analyzed complex data to solve business problems, ensuring alignment with organizational goals.

- Monitored compliance with regulatory requirements and internal policies.

- Engaged with senior management to align risk management strategies with business objectives.

- Fostered a risk-aware culture through training and awareness programs.

Experience

2-5 Years

Level

Junior

Education

BSc RM

Risk Manager Resume

Headline : Accomplished Risk Manager with 7 years of experience in identifying, analyzing, and mitigating risks across various sectors. Expertise in designing risk management frameworks and compliance strategies that enhance organizational resilience. Passionate about fostering a proactive culture of risk awareness to safeguard assets and drive operational success.

Skills : Analytical Thinking, Attention To Detail, Time Management, Credit Risk, Market Risk

Description :

- Develop and implement comprehensive risk management initiatives, processes, and procedures for campus and research foundation.

- Prepare and present budget proposals for insurance programs, conducting cost analysis and premium allocation.

- Manage campus insurance programs covering property, liability, and workers' compensation.

- Act as project liaison for significant projects, ensuring compliance with risk management standards.

- Facilitate risk workshops and training sessions for staff and management.

- Review and approve insurance language in contracts, ensuring adequate protection against risks.

- Conduct safety analyses and provide actionable recommendations for various campus events and activities.

Experience

5-7 Years

Level

Management

Education

MBA

Enterprise Risk Manager Resume

Objective : Strategic Enterprise Risk Manager with 5 years of experience in developing and implementing robust risk management frameworks. Proven track record in identifying potential risks and opportunities, enhancing compliance measures, and fostering a proactive risk culture. Committed to optimizing organizational resilience and ensuring sustainable growth through effective risk mitigation strategies.

Skills : Risk Analysis Software, Data Analytics Tools, Risk Assessment Frameworks, Training & Development, Regulatory Knowledge

Description :

- Provided strategic risk management leadership on major engineering projects, ensuring compliance with industry standards.

- Directed risk management initiatives for EPC contracts, enhancing project delivery timelines and cost efficiency.

- Facilitated workshops to develop risk registers, identifying critical threats and opportunities for project success.

- Instrumental in mitigating financial impacts by proactively managing risks in plant design and construction phases.

- Contributed to the establishment of corporate risk management policies and procedures, enhancing organizational resilience.

- Designed and delivered risk identification training programs, elevating stakeholder engagement in risk management practices.

- Played a key role in selecting and implementing advanced risk management software, improving data analysis and reporting capabilities.

Experience

2-5 Years

Level

Executive

Education

MBA

Risk Manager Resume

Headline : Proficient Risk Manager with 7 years of experience in identifying, analyzing, and mitigating risks across multiple industries. Expertise in developing risk management frameworks and enhancing compliance protocols to drive organizational success. Focused on fostering a culture of risk awareness that safeguards assets and promotes operational excellence.

Skills : N/a, Strategic Planning, Policy Development, Risk Reporting, Scenario Analysis

Description :

- Managed derivative strategies, including options and swaps, implementing effective hedging techniques to mitigate financial risk.

- Designed and executed a three-stage risk management program for a hedge fund, utilizing advanced analytical tools.

- Specified limits on portfolio leverage and diversification, analyzed risk metrics, and conducted stress testing.

- Enhanced internal risk management controls, resulting in a three-fold increase in investor assets within one year.

- Evaluated credit default swaps and other instruments to develop a robust credit risk management strategy.

- Established an efficient hedging approach, considering transaction costs and industry dynamics.

- Assessed pricing models for complex financial structures, ensuring accurate valuations and risk assessments.

Experience

5-7 Years

Level

Management

Education

MBA

Financial Risk Manager Resume

Headline : Results-oriented Financial Risk Manager with 7 years of specialized experience in risk analysis and mitigation across multiple sectors. Expert in developing tailored risk management strategies, enhancing compliance frameworks, and fostering an organizational culture focused on proactive risk management. Passionate about driving operational success while protecting corporate assets.

Skills : Advanced Microsoft Office Suite, Effective Stakeholder Communication, Cultural Awareness, It Risk Management

Description :

- Oversaw comprehensive risk management initiatives for a multi-billion dollar organization.

- Developed and maintained strong relationships with insurance brokers, carriers, and executive management.

- Procured and managed various insurance policies, including casualty, property, and pollution coverage.

- Conducted detailed gathering of exposure data for large deductible programs involving thousands of vehicles.

- Collaborated with executives to strategize on policy renewals and risk mitigation efforts.

- Managed the issuance of renewal documentation across numerous operational locations.

- Maintained a risk management portal that provided access to critical policies and procedures for stakeholders.

Experience

5-7 Years

Level

Management

Education

MBA

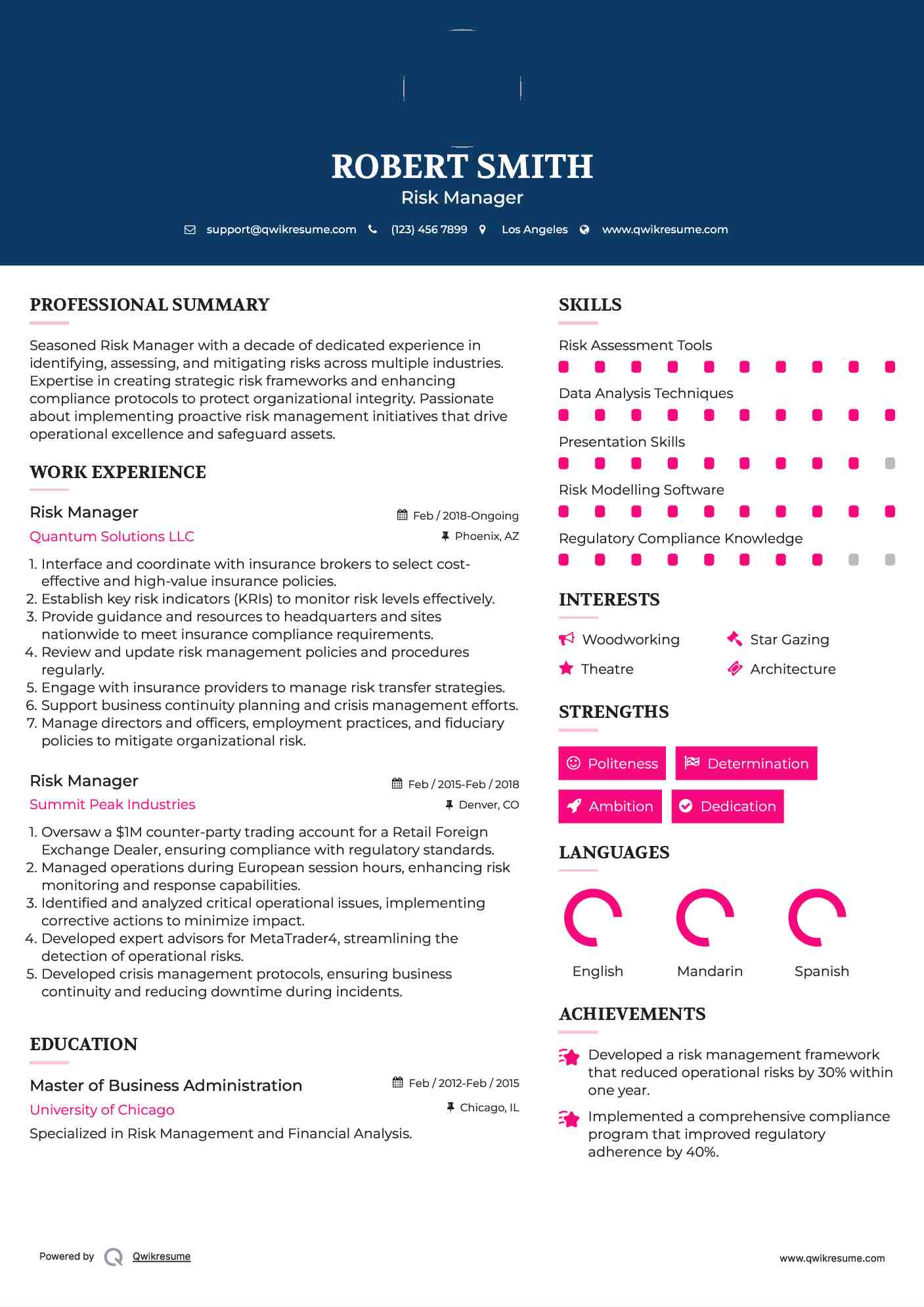

Risk Manager Resume

Summary : Seasoned Risk Manager with a decade of dedicated experience in identifying, assessing, and mitigating risks across multiple industries. Expertise in creating strategic risk frameworks and enhancing compliance protocols to protect organizational integrity. Passionate about implementing proactive risk management initiatives that drive operational excellence and safeguard assets.

Skills : Risk Assessment Tools, Data Analysis Techniques, Presentation Skills, Risk Modelling Software, Regulatory Compliance Knowledge

Description :

- Interface and coordinate with insurance brokers to select cost-effective and high-value insurance policies.

- Establish key risk indicators (KRIs) to monitor risk levels effectively.

- Provide guidance and resources to headquarters and sites nationwide to meet insurance compliance requirements.

- Review and update risk management policies and procedures regularly.

- Engage with insurance providers to manage risk transfer strategies.

- Support business continuity planning and crisis management efforts.

- Manage directors and officers, employment practices, and fiduciary policies to mitigate organizational risk.

Experience

10+ Years

Level

Executive

Education

MBA

Risk Manager Resume

Headline : Results-oriented Risk Manager with 7 years of experience in crafting and executing risk assessment strategies across various industries. Expert in identifying vulnerabilities and developing tailored frameworks to enhance compliance and operational resilience. Adept at fostering a proactive risk culture that safeguards assets and drives organizational success.

Skills : Enterprise Risk, Risk Modeling, Conflict Resolution, Critical Thinking, Adaptability

Description :

- Collaborated with management to design and implement comprehensive risk management practices across North America.

- Oversaw all aspects of commercial insurance programs, ensuring optimal coverage and compliance.

- Engaged with state workers' compensation offices to streamline self-insurance bonds.

- Partnered with various departments to create and manage customized bonding solutions.

- Analyzed insurance policies to confirm adequate coverage and mitigate potential risks.

- Directed the claims process, ensuring efficient handling and data collection for financial impact assessment.

- Achieved a 50% reduction in insurance rates through effective negotiations, enhancing competitiveness.

Experience

5-7 Years

Level

Management

Education

MBA