Certified Senior Tax Accountant Resume

Summary : Strategically-focused Senior Tax Accountant with 10 years of experience in federal and state tax compliance and planning. Adept at developing innovative tax solutions and optimizing financial strategies to drive client success. Experienced in leveraging advanced tax technologies to enhance reporting accuracy and efficiency. Committed to fostering strong client relationships and ensuring regulatory compliance.

Skills : Process Improvement, Financial Modeling, Cost Analysis, Strategic Planning

Description :

- Implemented internal controls to ensure compliance with tax regulations and policies.

- Assisted in the development of tax policies and procedures for the organization.

- Participated in tax planning meetings to align strategies with business objectives.

- Evaluated the tax implications of international operations and cross-border transactions.

- Prepared transfer pricing documentation to comply with regulatory requirements.

- Reviewed and filed property tax returns, ensuring compliance with local regulations.

- Analyzed tax data to identify trends and provide strategic recommendations.

Experience

10+ Years

Level

Management

Education

MST

Senior Tax Accountant/Manager Resume

Headline : Dynamic Senior Tax Accountant with 7 years of specialized experience in federal and state tax compliance and strategic planning. Proficient in leveraging analytical tools and tax software to drive efficiency and ensure regulatory adherence. Passionately committed to delivering customized tax solutions that enhance client success and optimize financial outcomes.

Skills : Tax Compliance Tools, Audit And Risk Management, Payroll Tax Knowledge, Transfer Pricing, Tax Provision Calculation

Description :

- Collaborated with external auditors on tax-related matters during audits.

- Assisted in the preparation of quarterly and annual tax provisions.

- Reviewed and analyzed tax provisions for accuracy and compliance with GAAP.

- Managed tax-related projects, ensuring timely completion and adherence to budgets.

- Provided insights on the impact of tax reform on client operations and strategies.

- Assisted in the preparation of tax-related disclosures for financial statements.

- Evaluated and recommended tax-efficient structures for business operations.

Experience

5-7 Years

Level

Executive

Education

B.S. Accounting

Senior Tax Accountant - Consultant Resume

Summary : Versatile Senior Tax Accountant with 10 years of comprehensive experience in federal and state tax compliance and strategic planning. Demonstrates expertise in optimizing tax efficiencies and implementing innovative solutions. Adept at utilizing cutting-edge tax software to ensure accuracy and compliance, while maintaining strong client partnerships and navigating complex regulations.

Skills : Corporate Tax Compliance, Tax Data Analysis, Tax Document Preparation, Tax Research, Detail-oriented Tax Analysis

Description :

- Conducted detailed research and filed multi-state sales and use tax returns, ensuring adherence to all regulations.

- Executed strategic audits and negotiations to minimize personal property tax liabilities.

- Prepared and submitted annual state insurance premium tax returns, guaranteeing accuracy across jurisdictions.

- Managed the preparation of state corporate franchise, excise, and income tax returns, meeting all compliance deadlines.

- Reviewed and advised on the tax implications of employee compensation packages.

- Maintained organized work papers and documentation, significantly enhancing audit readiness.

- Acted as the key contact for state tax inquiries, building robust relationships with tax officials.

Experience

10+ Years

Level

Consultant

Education

MST

Senior Tax Accountant I Resume

Summary : Accomplished Senior Tax Accountant with 10 years of expertise in federal and state tax compliance and strategic planning. Proven ability to streamline tax processes and enhance client outcomes through innovative solutions. Skilled in utilizing advanced tax software for meticulous reporting and compliance. Dedicated to fostering strong client partnerships and ensuring adherence to evolving regulations.

Skills : Gaap Compliance, Tax Audit Management, Tax Law Expertise, Strategic Thinking, Problem Solving

Description :

- Led tax audits and liaised with tax authorities to resolve issues and disputes.

- Trained and mentored junior staff on tax compliance and accounting principles.

- Conducted tax research to identify and implement tax-saving strategies for clients.

- Collaborated with cross-functional teams to support tax planning and compliance initiatives.

- Advised clients on tax implications of business transactions and restructuring.

- Monitored changes in tax legislation and assessed their impact on client operations.

- Developed and maintained strong client relationships through effective communication and service.

Experience

10+ Years

Level

Management

Education

M.S. Accounting

Senior Tax Accountant II Resume

Summary : Accomplished Senior Tax Accountant with 10 years of extensive experience in federal and state tax compliance and strategic tax planning. Expert in analyzing complex tax issues and implementing effective solutions that enhance client financial outcomes. Proficient in utilizing advanced tax software to ensure compliance and accuracy. Dedicated to driving successful client relationships and optimizing tax strategies.

Skills : Email Communication, Ultratax Cs Software, Tax Compliance And Planning, Tax Compliance, Irs Regulations

Description :

- Oversaw complex tax compliance and reporting for corporate clients, ensuring precision and adherence to deadlines.

- Managed accounting functions for high-net-worth individuals, including reconciliations and financial reporting.

- Reviewed monthly transactions to ensure accuracy in journal entries and compliance with tax regulations.

- Prepared income statements and balance sheets utilizing advanced general ledger software.

- Supported audit engagements through detailed analytical procedures and thorough testing of transactions.

- Drafted responses to federal and state tax inquiries, ensuring compliance with current regulations.

- Implemented a transition to digital documentation, significantly improving data management and retrieval processes.

Experience

10+ Years

Level

Consultant

Education

M.S. Accounting

Certified Senior Tax Accountant Resume

Headline : Proficient Senior Tax Accountant with 7 years of experience in managing federal and state tax compliance. Expert in implementing tax strategies that minimize liabilities and enhance client profitability. Skilled in utilizing advanced tax software for accurate reporting and regulatory adherence, while maintaining strong client relationships and driving successful outcomes.

Skills : Tax Risk Management, Data Analysis And Reporting, Tax Software Proficiency, Financial Reporting And Analysis

Description :

- Participated in tax planning meetings to strategize for upcoming fiscal periods.

- Conducted training on tax software, improving team efficiency in compliance and filing.

- Provided guidance on international tax matters and cross-border transactions.

- Coordinated business license filings at state and local levels for all company entities.

- Evaluated the tax implications of mergers and acquisitions for clients.

- Conducted due diligence for tax-related aspects of potential business transactions.

- Maintained up-to-date knowledge of tax laws and regulations affecting clients.

Experience

5-7 Years

Level

Executive

Education

B.S. in Accounting

Senior Tax Accountant/Manager Resume

Summary : Accomplished Senior Tax Accountant with a decade of expertise in federal and state tax compliance and strategic planning. Proficient in devising tailored tax strategies that minimize liabilities and enhance financial outcomes. Demonstrated success in leveraging advanced tax software for precise reporting and compliance, while nurturing robust client relationships and navigating complex regulatory environments.

Skills : Attention To Detail, Cch Tax Research Software, Advanced Excel For Tax Analysis, Microsoft Word For Reporting, Database Management With Access

Description :

- Prepared and filed sales, use, and personal property tax returns, ensuring compliance through established procedures and staff supervision.

- Conducted thorough research and compiled data for preparing federal and state income tax Forms 1120 for 5 companies across 46 states.

- Maintained work papers for annual federal income tax provisions and state apportionment data, ensuring accuracy in fixed asset management.

- Oversaw corporate ownership percentages for capital contributions, facilitating accurate federal returns and investor Form K-1s.

- Initiated comprehensive reviews of 22 corporate insurance policies, generating annual savings of $500K.

- Collaborated with the legal department to address non-compliance issues across multiple jurisdictions, ensuring business continuity.

- Managed audits for franchise operations in Canada, assessing liabilities related to Provincial Sales Tax compliance.

Experience

7-10 Years

Level

Senior

Education

MST

Senior Tax Accountant - Full Time Resume

Summary : Experienced Senior Tax Accountant with expertise in corporate tax strategy and compliance. Recognized for implementing innovative tax planning strategies that saved clients over $1M in tax expenses while maintaining full regulatory compliance.

Skills : Great Plains Accounting Software, Avalara Avatax, Thomson Reuters Onesource Tax, Negotiation Skills, Tax Strategy Development

Description :

- Successfully mitigated over 90% of sales and use tax audit assessments, saving the company millions through thorough data analysis.

- Conducted extensive research on complex taxability issues, providing actionable insights that significantly reduced exposure to tax assessments.

- Developed standardized methods for documentation and information presentation to auditors, streamlining the audit process.

- Prepared, reviewed, and filed over 300 sales and use tax returns monthly for ten entities, ensuring compliance with local regulations.

- Facilitated billing migration projects, ensuring accurate taxability of items in new systems.

- Performed Balance Sheet account reconciliations, ensuring traceability of balances to source data.

- Identified opportunities for tax refunds, ensuring no potential claims were overlooked.

Experience

7-10 Years

Level

Senior

Education

B.S. Accounting

Senior Tax Accountant I Resume

Summary : Highly experienced Senior Tax Accountant with a decade of expertise in federal and state tax compliance, planning, and strategy optimization. Proven track record in delivering innovative tax solutions that enhance financial performance and ensure regulatory adherence. Committed to leveraging advanced tax technologies and fostering strong client relationships for successful outcomes.

Skills : Ms Office Suite, Sap Erp, Adobe Acrobat Dc, Hyperion Financial Management, Gaap Proficiency

Description :

- Provided support for tax-related inquiries from clients and stakeholders.

- Prepared and filed property tax returns and managed assessments.

- Analyze and forecast future tax liabilities; compile and analyze financial information for federal and state income and sales tax provisions, ensuring compliance.

- Conducted risk assessments to identify potential tax liabilities.

- Implemented tax strategies to optimize client tax positions and minimize liabilities.

- Contribute to the administrative process of tax filings, ensuring timely submissions with correct documentation.

- Reviewed and analyzed tax implications of employee compensation and benefits.

Experience

10+ Years

Level

Management

Education

B.S. Accounting

Senior Tax Accountant II Resume

Summary : Detail-oriented Senior Tax Accountant with over 8 years of experience in tax compliance, planning, and strategy. Proven track record in managing complex tax returns and audits, ensuring compliance with federal and state regulations. Strong analytical skills and expertise in tax software, coupled with excellent communication abilities to liaise with clients and stakeholders effectively.

Skills : Sap Financials, Oracle Tax Solutions, Vertex Tax Software, Sabrix Compliance Software

Description :

- Prepared and filed complex federal and state tax returns for corporations, partnerships, and individuals, ensuring compliance with all regulations.

- Developed K-1s for partnership and corporate tax returns, enhancing accuracy and efficiency.

- Represented clients in audit matters before the IRS and state agencies, preparing necessary documentation and submissions.

- Managed appeals and negotiations with tax agencies, including preparing Offers in Compromise.

- Consulted with clients on new entity setups and business strategies to minimize tax liabilities and maximize benefits.

- Oversaw general ledger management, accounts receivable, and payroll records, ensuring precise financial tracking.

- Prepared and submitted payroll tax forms and payments to federal and state agencies on time.

Experience

10+ Years

Level

Management

Education

MST

Senior Tax Accountant Resume

Headline : Results-driven Senior Tax Accountant with extensive experience in corporate tax planning and compliance. Skilled in identifying tax-saving opportunities and implementing effective strategies to minimize liabilities. Adept at managing audits and providing guidance on tax regulations. Committed to delivering high-quality service and fostering strong client relationships.

Skills : Cost Accounting, Client Relationship Management, Project Management, International Taxation, Ethical Standards

Description :

- Prepares and files sales and use tax returns for multiple states, ensuring compliance with local regulations.

- Conducts thorough reviews of tangible personal property tax returns and fixed asset reports, validating accuracy and processing payments.

- Mentors junior accountants, providing guidance and oversight to enhance team productivity and accuracy.

- Ensures precision in tax return submissions, conducting monthly account analyses to verify account balances.

- Facilitates the monthly close process by reconciling tax accrual accounts and maintaining detailed schedules.

- Acts as the primary contact during sales and use tax audits, coordinating communications and providing necessary documentation.

- Researches and interprets state sales tax regulations to assess their impact on current and future business operations.

Experience

5-7 Years

Level

Executive

Education

B.S. Accounting

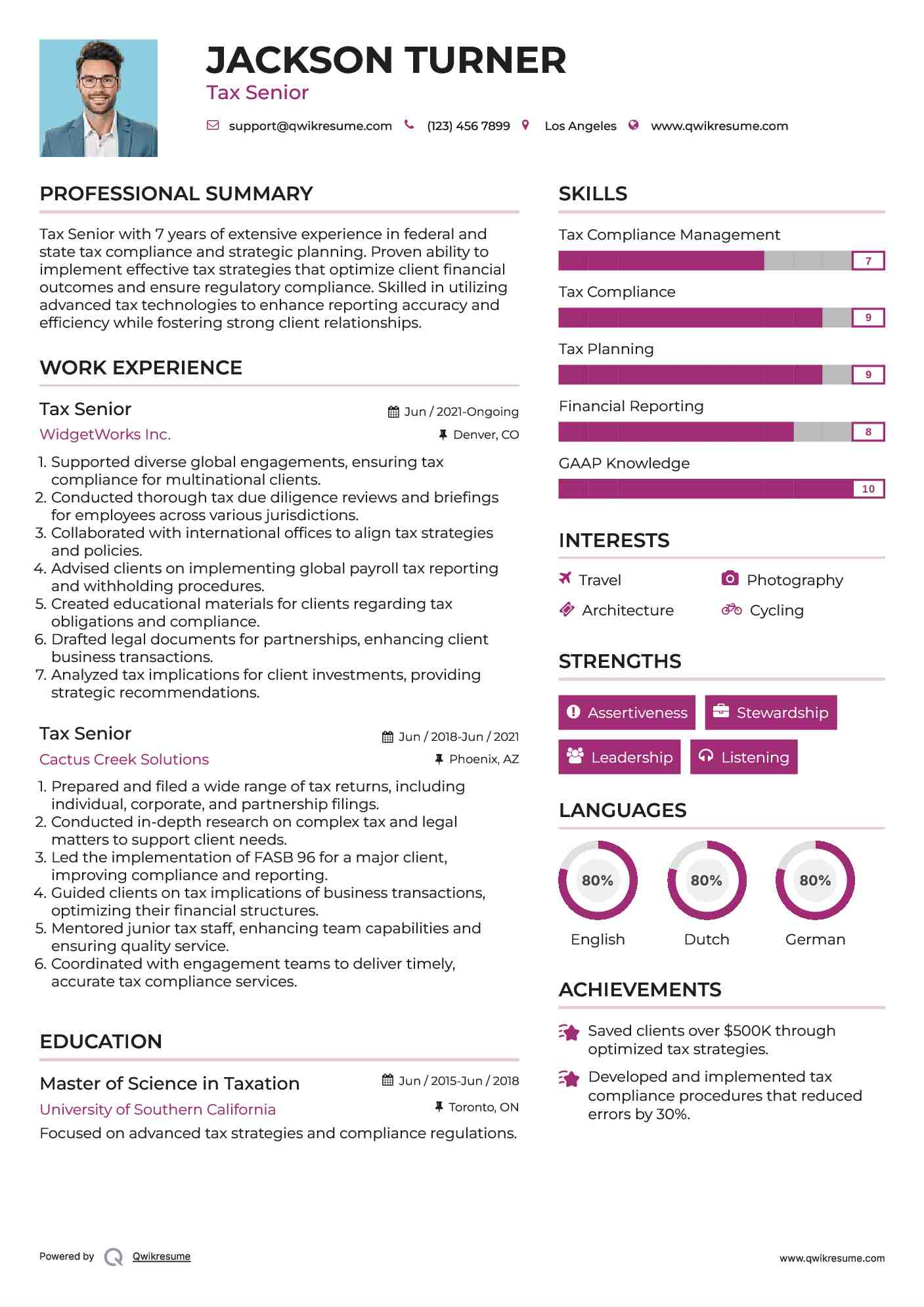

Tax Senior Resume

Headline : To obtain a Tax Senior position with a company where the application of my skillset can contribute to the achievement of the organization's goals while providing continuous learning and growth. Working effectively with confidential information. Working tactfully with employees, officials doing business with the Town, and members of the public.

Skills : Accounting, Project Management, Reporting, Requirements Management.

Description :

- Supported multiple challenging global engagements for a diverse client base.

- Conducted global tax briefings and tax due diligence reviews for local and national employees.

- Co-ordinated with EY offices in various countries.

- Assisted clients to implement global payroll reporting and tax withholding policies and procedures for local national employees and international mobile employees.

- Drafted assignee communication and education materials.

- Conducted research on tax treaty issues, U.S.

- Created letters of intent and buy/sell agreements for partnership interests.

Experience

5-7 Years

Level

Executive

Education

MBA In Finance

Tax Senior Resume

Headline : To demonstrate accountability as a professional utilizing experience in problem solving to provide accurate financial support in the accounting field. Communicating clearly in written and oral form; establishing and ability to establishing and maintain cooperative relationships with town officials and governmental representatives.

Skills : Fixed Asset, GoSystem, Excel, Word, Quickbooks, ProSystem FX, People Management, Adobe.

Description :

- Worked on an assignment directly with client for 5 months in Boston, MA and Hartford, CT, United States.

- Assisted clients with tax planning, refund analysis, nexus review.

- Reviewed tax returns and recommend tax savings opportunities.

- Reviewed of both consolidated & separate company, state & federal tax returns and work papers.

- Reviewed quarterly state estimated taxes and annual extensions calculations.

- Reviewed of amended state & federal tax returns and work papers.

- Proactively interacted with directors, senior managers, and key client management team to gather information, resolve tax-related issues, and make recommendations for business and process improvements.

Experience

5-7 Years

Level

Executive

Education

Diploma In Finance

Tax Senior Resume

Objective : To secure a challenging Tax Senior position where I can effectively contribute to the growth of the organization and grow along with organization by using my professional and technical skills. Core Qualification. Following up actively with the tax department Exhibit positive attitude, i.e., demonstrate willingness to learn, accept constructive criticism.

Skills : Analysis, SQL, Reporting.

Description :

- Use to review and prepare U.S. Federal and state personal income tax returns which includes return with multiple brokerage statement, capital gain/ (loss) transactions, Foreign Tax Credits and multiple states.

- Prepared and reviewed different variety of returns: Individuals (1040s), Foundations (990's) & Gift tax (709s).

- Know ledged on different software has been developed for different entity types such as CCH Pro-System and BNA Projections.

- Used to determine the accuracy and the completeness of the tax compliance product and perform any additional steps necessary to ensure that the product is complete ready to be delivered (Quality Checking).

- Did yearend planning for many clients (Quarterly Payments).

- Planned and performed audits.

- Contribute knowledge that can be leveraged by others.

Experience

0-2 Years

Level

Entry Level

Education

Business Management