Tax Accountant Resume

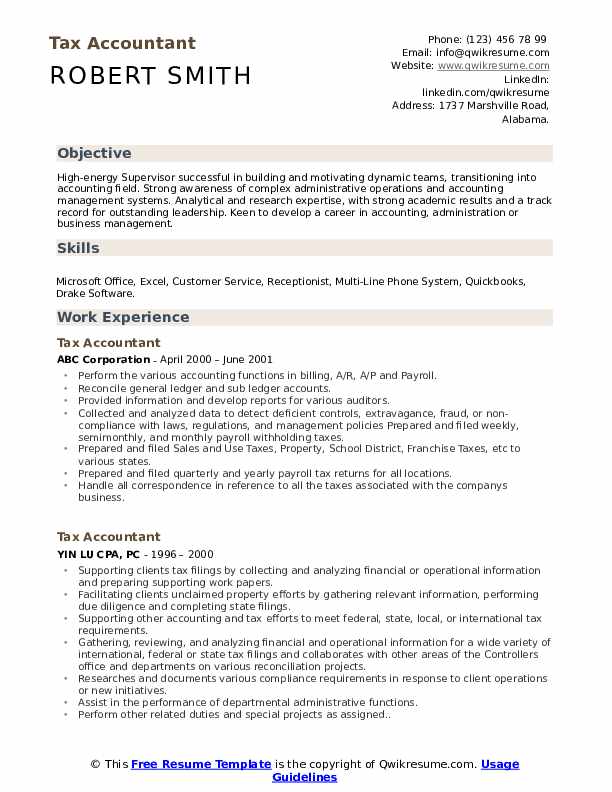

Objective : Dedicated Tax Accountant with 2 years of hands-on experience in tax preparation and compliance. Adept at analyzing financial data and ensuring adherence to tax regulations. Proven ability to streamline processes and enhance reporting accuracy. Committed to providing exceptional client service and fostering strong relationships to facilitate efficient tax filing and compliance.

Skills : Tax Preparation Software, Client Relationship Management, Accounting Software Proficiency, Effective Communication Skills

Description :

- Executed tax preparation functions, ensuring accurate and timely filing of federal and state taxes.

- Analyzed financial data to identify discrepancies and implement corrective actions.

- Prepared and submitted various tax returns including Sales and Use Taxes, Property Taxes, and Payroll Taxes.

- Communicated with auditors and provided detailed reports to support tax compliance.

- Managed correspondence related to tax inquiries and compliance issues.

- Conducted data analysis to assess operational compliance with tax regulations.

- Collaborated with cross-functional teams to enhance tax reporting accuracy.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Accounting

Lead Tax Accountant Resume

Headline : Tax Accountant with over 7 years of comprehensive experience in tax compliance, preparation, and strategic planning. Expertise in analyzing financial data for accurate reporting and regulatory adherence. Adept at optimizing processes to enhance efficiency and client satisfaction. Passionate about fostering relationships and delivering tailored tax solutions to meet diverse client needs.

Skills : Tax Software Proficiency, Advanced Excel Skills, Time Management, Accounting Principles, Data Analysis

Description :

- Supported clients' tax filings by gathering and analyzing financial data, ensuring compliance with federal and state regulations.

- Streamlined unclaimed property processes by conducting due diligence and filing state reports accurately.

- Facilitated tax compliance efforts for various jurisdictions, ensuring timely submissions and adherence to legal requirements.

- Reviewed financial information for multiple tax filings, collaborating with the Controller's office on reconciliation projects.

- Researched compliance requirements to align client operations with evolving tax regulations.

- Assisted in departmental administrative functions, enhancing overall operational efficiency.

- Led special projects aimed at improving tax preparation workflows and client service delivery.

Experience

5-7 Years

Level

Management

Education

B.S. Accounting

Tax Accountant Resume

Summary : Accomplished Tax Accountant with a decade of expertise in tax compliance, preparation, and strategic planning. Skilled in analyzing complex financial data to ensure accurate reporting and adherence to regulations. Proven success in enhancing operational efficiency and delivering exceptional client service. Eager to leverage extensive knowledge to drive tax strategy and compliance improvements.

Skills : Adaptability, Cash Flow Management, Payroll Processing, Tax Return Review, Strategic Planning, Critical Thinking

Description :

- Managed the preparation and filing of sales and use tax returns, ensuring compliance with state regulations.

- Maintained accurate records of certified mail receipts to substantiate tax filings.

- Communicated with state tax agencies to resolve inquiries regarding tax return submissions.

- Monitored changes in tax legislation and provided updates to stakeholders.

- Conducted thorough research on tax laws to address client notices and disputes effectively.

- Filed objections for discrepancies in state tax assessments, advocating for client interests.

- Responded promptly to information requests from state authorities regarding tax filings.

Experience

7-10 Years

Level

Management

Education

B.S. in Accounting

International Tax Accountant Resume

Summary : International Tax Accountant with a decade of expertise in global tax compliance and strategic planning. Proficient in navigating complex international tax regulations and optimizing tax strategies for multinational corporations. Demonstrated success in enhancing tax reporting accuracy and ensuring compliance across jurisdictions. Committed to delivering innovative solutions that align with business objectives.

Skills : Tax Planning, Tax Compliance, Audit Support, Tax Research, Irs Regulations, Accounting Software

Description :

- Assisted in the planning and implementation of effective international tax strategies to minimize liabilities.

- Conducted audits of foreign subsidiaries to ensure compliance with local tax regulations.

- Managed the preparation and filing of international tax returns for various entities.

- Maintained up-to-date knowledge of changes in international tax laws and regulations.

- Collaborated with cross-functional teams to align tax strategies with overall business objectives.

- Developed training materials and conducted workshops for staff on international tax compliance.

- Monitored and analyzed tax risks associated with global operations and advised management accordingly.

Experience

10+ Years

Level

Management

Education

MST

Tax Accountant Resume

Objective : Tax Accountant with 2 years of experience in tax preparation and compliance. Expertise in analyzing financial statements to ensure regulatory adherence and optimize tax strategies. Proven track record of enhancing process efficiency and accuracy in reporting. Passionate about delivering exceptional client service while building strong relationships to facilitate streamlined tax filing.

Skills : Tax Return Filing, Analytical Thinking, Regulatory Knowledge, Risk Assessment, Budgeting Skills, Project Management

Description :

- Prepared income tax returns for 150 agricultural and non-profit clients, ensuring compliance.

- Managed payroll tax filings, including monthly and quarterly returns, for multiple clients.

- Analyzed financial statements to identify discrepancies and recommend corrective actions.

- Collaborated with management to compile financial data for reporting at various organizational levels.

- Utilized advanced bookkeeping software to streamline accounting processes and enhance accuracy.

- Researched and implemented new tax preparation technologies to improve efficiency.

- Provided training and support for clients on tax software and compliance procedures.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Accounting

Junior Tax Accountant Resume

Objective : Motivated Junior Tax Accountant with 5 years of experience in tax compliance and preparation. Skilled in managing multi-state tax filings and ensuring adherence to regulations. Proven ability to enhance financial reporting accuracy and streamline tax processes. Eager to contribute analytical skills and a commitment to client service for effective tax solutions.

Skills : Microsoft Office Suite, Statistical Analysis, Financial Software Proficiency, Client Management

Description :

- Applied federal and state tax regulations to various tax projects, ensuring accurate decision-making.

- Managed calculations for multi-state sales, use, and excise taxes, ensuring compliance.

- Executed tax preparation for sales and usage, property, and franchise taxes.

- Coordinated the completion of registration forms for the Certificate of Authority across multiple states.

- Collaborated with accounting teams to analyze tax information requests and prepare necessary documentation.

- Conducted domestic tax planning to optimize tax positions for clients.

- Assisted in federal and state audits, preparing required documentation and supporting materials.

Experience

2-5 Years

Level

Junior

Education

B.S. Accounting

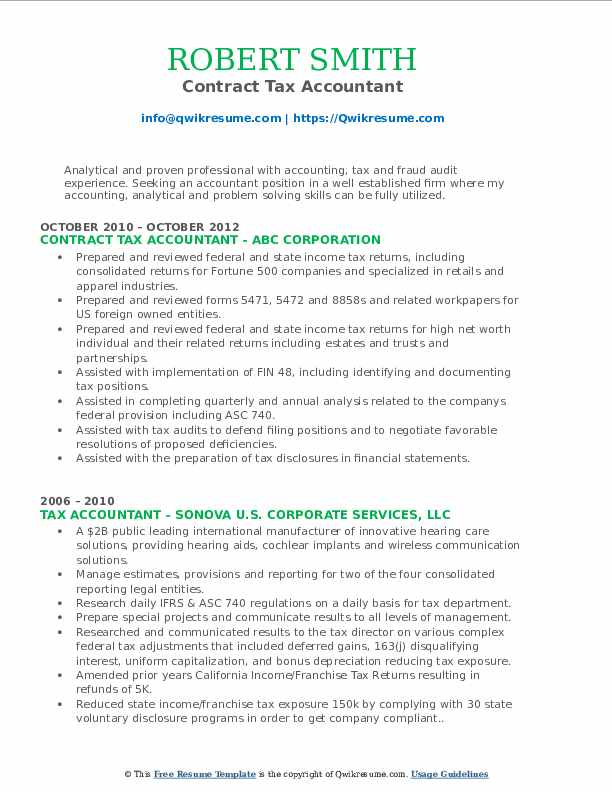

Tax Accountant Resume

Objective : Tax Accountant with 5 years of dedicated experience in tax compliance and preparation. Proficient in analyzing complex financial data to ensure accurate reporting and adherence to regulations. Demonstrated success in optimizing tax processes and enhancing client satisfaction. Eager to leverage expertise in delivering innovative tax solutions that align with organizational goals.

Skills : Tax Compliance Research, Tax Law Knowledge, Data Analysis And Reporting, Record Keeping, Communication Skills, Analytical Skills

Description :

- Prepared and filed federal and state tax returns for individuals and businesses.

- Developed comprehensive workpapers for forms 5471, 5472, and 8858 for U.S. foreign-owned entities.

- Managed tax returns for high net worth individuals, estates, trusts, and partnerships.

- Implemented FIN 48, successfully documenting and defending tax positions.

- Conducted quarterly and annual analyses for federal tax provisions, ensuring compliance with ASC 740.

- Supported tax audits, negotiating favorable resolutions and defending filing positions.

- Prepared tax disclosures for financial statements, enhancing transparency and compliance.

Experience

2-5 Years

Level

Freelancer

Education

B.S. Accounting

Assistant Tax Accountant Resume

Headline : Proficient Assistant Tax Accountant with 7 years of extensive experience in tax compliance and preparation. Expert in analyzing financial data to ensure regulatory adherence and optimize tax strategies. Skilled in enhancing workflow efficiency and providing exceptional client support. Eager to leverage my analytical skills to contribute to innovative tax solutions and drive compliance success.

Skills : Organizational Skills, Client Communication, Income Tax Returns, Sales Tax Compliance, Payroll Tax Management, Estate Tax Planning

Description :

- Represented clients in IRS hearings and conferences, ensuring compliance and favorable outcomes.

- Developed and implemented policies to meet new tax regulations effectively.

- Collected and managed fees exceeding $500,000, ensuring accurate financial reporting.

- Prepared a diverse range of tax returns, including individual, corporate, and partnership filings.

- Conducted thorough research to support audit processes and client inquiries.

- Responded promptly to client and governmental inquiries, enhancing communication and trust.

- Analyzed financial data to identify tax-saving opportunities for clients.

Experience

5-7 Years

Level

Executive

Education

B.S. Accounting

Tax Accountant Resume

Objective : Passionate Tax Accountant with 2 years of experience in tax preparation and compliance. Demonstrated expertise in analyzing financial data and ensuring compliance with tax regulations. Skilled in enhancing reporting accuracy and streamlining processes to improve efficiency. Eager to leverage analytical strengths and client-focused approach to deliver effective tax solutions.

Skills : Microsoft Excel, Tax Preparation, Financial Analysis, Compliance Reporting, Client Relations, Tax Research, Data Management, Cost Accounting, Internal Controls, Variance Analysis, Financial Forecasting, Negotiation Skills

Description :

- Maintained tax records and prepared individual, charitable, and trust tax returns, ensuring accuracy and compliance.

- Customized taxable income projections and developed financial statements to support tax strategy.

- Provided assistance during tax return audits, ensuring compliance with regulatory requirements.

- Compiled and presented reports for management and regulatory authorities, enhancing decision-making.

- Addressed inquiries regarding tax policies, ensuring clarity and compliance for bank management and auditors.

- Conducted thorough reviews of tax returns to identify areas for improvement and efficiency.

- Implemented process improvements that increased the accuracy and efficiency of tax preparation workflows.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Accounting

Associate Tax Accountant Resume

Objective : Dynamic and detail-oriented Associate Tax Accountant with 5 years of experience in tax compliance and preparation. Proficient in analyzing financial data to ensure regulatory adherence and optimize tax strategies. Committed to enhancing operational efficiency and client satisfaction through innovative solutions and exceptional service.

Skills : Financial Statements, Bookkeeping, Attention To Detail, Problem Solving

Description :

- Analyzed and reviewed sales and use tax, property tax, and compliance matters to ensure accuracy.

- Created financial projections and advised clients on tax planning strategies.

- Collaborated with clients to gather necessary financial information.

- Researched and maintained up-to-date knowledge of tax compliance, including sales/use taxes and income tax.

- Performed research related to tax laws, procedures, and compliance disclosures.

- Prepared comprehensive tax work papers, account reconciliations, and maintained records for income tax returns.

- Developed a fundamental understanding of tax laws and regulations affecting corporations.

Experience

2-5 Years

Level

Executive

Education

B.S. Accounting

Tax Accountant Resume

Objective : Detail-oriented Tax Accountant with over 5 years of experience in preparing and filing federal and state tax returns. Proficient in tax compliance, planning, and research, ensuring accuracy and adherence to regulations. Strong analytical skills with a proven track record of identifying tax-saving opportunities for clients. Excellent communication skills, fostering positive relationships with clients and stakeholders.

Skills : Tax Compliance Specialist, Client Consultation, Investment Taxation, Payroll Management, Tax Credits

Description :

- Conducted thorough tax audits and provided expert consultation to clients across various sectors.

- Acted as a liaison between clients and tax authorities to resolve tax-related queries.

- Prepared supporting documentation for tax credits and deductions.

- Collaborated with legal teams to navigate complex tax regulations and compliance issues.

- Trained and mentored junior tax staff on best practices in tax preparation and compliance.

- Supervised a diverse team of tax professionals, ensuring adherence to best practices.

- Utilized advanced software for data analysis to enhance reporting accuracy and efficiency.

Experience

2-5 Years

Level

Consultant

Education

B.S. Accounting

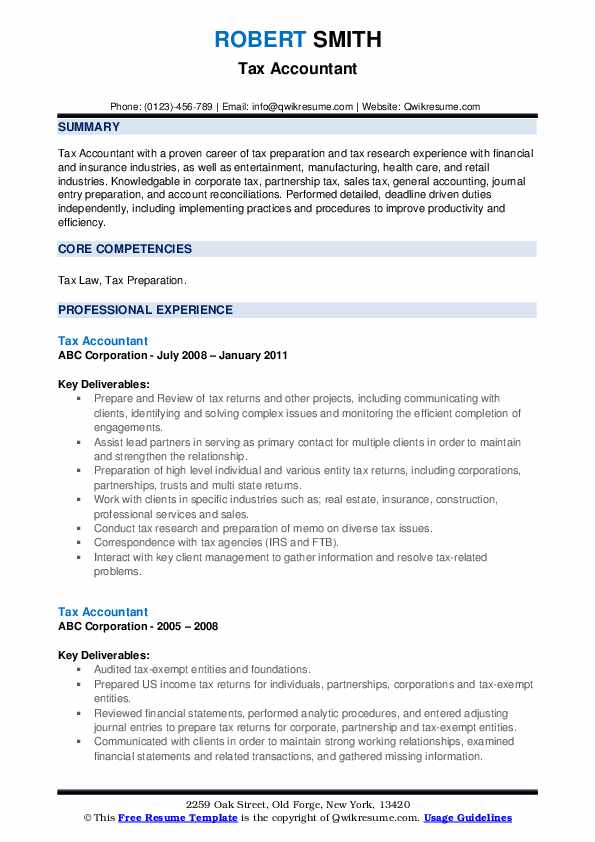

Tax Accountant Resume

Objective : Tax Accountant with 2 years of experience specializing in tax compliance, preparation, and research across various industries. Proficient in analyzing financial data to ensure regulatory adherence and optimize tax strategies. Eager to leverage strong analytical skills and commitment to client service to enhance tax efficiency and accuracy.

Skills : Team Collaboration, Ethical Standards, Tax Credit Analysis, Multi-state Taxation, Corporate Taxation

Description :

- Prepare and review tax returns and related projects, ensuring compliance and efficient completion.

- Serve as the primary contact for multiple clients, strengthening relationships and understanding their needs.

- Prepare high-level individual and entity tax returns, including corporations and multi-state filings.

- Collaborate with clients across various sectors, such as real estate and insurance, to address their tax concerns.

- Conduct tax research and draft memos on complex tax issues.

- Communicate effectively with tax agencies, including IRS and FTB, to resolve client inquiries.

- Maintain and grow client relationships with a focus on satisfaction and service delivery.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Accounting

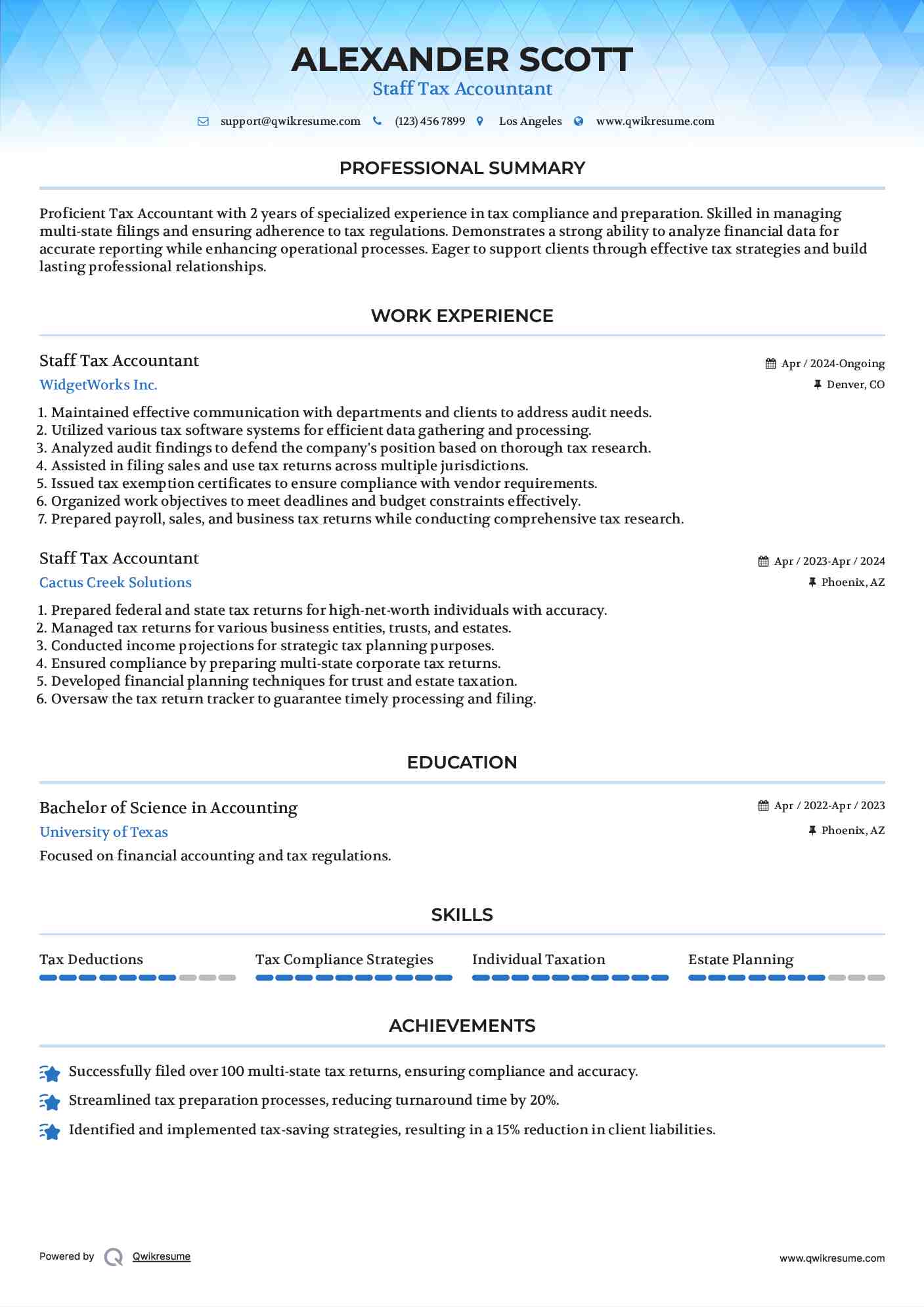

Staff Tax Accountant Resume

Objective : Detail-oriented tax professional with 2 years of experience in tax compliance and preparation. Proficient in analyzing financial data to ensure regulatory adherence and optimize tax strategies. Focused on enhancing reporting accuracy and streamlining processes to achieve efficiency. Eager to contribute to a dynamic team and deliver effective tax solutions that meet client needs.

Skills : Technical Skills, Data Entry, Presentation Skills, Research Skills, Multitasking, Confidentiality

Description :

- Reviewed and analyzed tax returns for accuracy and completeness.

- Collaborated with auditors to respond to inquiries during sales and use tax audits.

- Ensured compliance by preparing accurate non-income tax related returns.

- Participated in tax planning meetings with clients and stakeholders.

- Documented and recorded tax-related journal entries efficiently.

- Maintained organized records of client tax documents and filings.

- Conducted data analysis to ensure tax compliance across various jurisdictions.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Accounting

Staff Tax Accountant Resume

Objective : Results-driven Tax Accountant with a solid background in tax preparation and advisory services. Expertise in individual and corporate tax returns, with a focus on maximizing deductions and minimizing liabilities. Adept at utilizing tax software and staying updated on tax law changes. Committed to delivering timely and accurate financial information while fostering strong client relationships.

Skills : Corporate Tax Strategy, Tax Compliance Expertise, International Taxation, Tax Credits Knowledge, Tax Audit Preparation, Tax Liability Analysis

Description :

- Prepared year-end trial balances and financial statements for tax returns, ensuring accuracy in reporting.

- Analyzed financial statements to monitor cash flow, AR turnover, and profitability for loan agreements.

- Assisted in the implementation of tax software solutions.

- Maintained and updated Depreciation Schedules using Profix Depreciation Software.

- Trained staff on tax software applications to enhance operational efficiency.

- Validated customer certificates to ensure compliance with tax regulations.

- Compiled financial statements and provided basic accounting services for small businesses.

Experience

0-2 Years

Level

Junior

Education

B.S. Accounting

Staff Tax Accountant Resume

Objective : Proficient Tax Accountant with 2 years of specialized experience in tax compliance and preparation. Skilled in managing multi-state filings and ensuring adherence to tax regulations. Demonstrates a strong ability to analyze financial data for accurate reporting while enhancing operational processes. Eager to support clients through effective tax strategies and build lasting professional relationships.

Skills : Tax Deductions, Tax Compliance Strategies, Individual Taxation, Estate Planning

Description :

- Maintained effective communication with departments and clients to address audit needs.

- Utilized various tax software systems for efficient data gathering and processing.

- Analyzed audit findings to defend the company's position based on thorough tax research.

- Assisted in filing sales and use tax returns across multiple jurisdictions.

- Issued tax exemption certificates to ensure compliance with vendor requirements.

- Organized work objectives to meet deadlines and budget constraints effectively.

- Prepared payroll, sales, and business tax returns while conducting comprehensive tax research.

Experience

0-2 Years

Level

Junior

Education

B.S. Accounting

Staff Tax Accountant Resume

Objective : Results-driven Tax Accountant with a solid background in individual and corporate tax preparation. Skilled in utilizing tax software and tools to streamline processes and enhance accuracy. Strong communicator with the ability to explain complex tax concepts to clients. Proven track record of identifying tax-saving opportunities and ensuring compliance with all regulations.

Skills : Technical Writing, Data Entry Accuracy, Tax Compliance Analysis, Interpersonal Skills, Tax Liability Assessment, Financial Modeling

Description :

- Prepared and filed sales tax returns for clients.

- Contributed to the comprehensive reporting process for the new Form 990.

- Conducted due diligence for tax-related transactions.

- Maintained strong communication with tax manager, tax director, and external consulting firms.

- Assisted clients in establishing tax-efficient business structures.

- Advocated for changes in sales and use tax preparation providers, achieving significant cost savings.

- Prepared basic and amended Federal & Multi-State tax returns for various entities, including C & S-Corporations and LLCs.

Experience

0-2 Years

Level

Junior

Education

B.S. Accounting