Tax Associate Resume

Objective : Over 10 years of providing excellent customer service and client retention. Recognized by management for accuracy, efficiency, and commitment to excellence. Implemented efficient use of time saving skills to help save the company both time and money while increasing customer satisfaction.

Skills : Attention to detail, analytical, written and spoken communication, leadership, teamwork.

Description :

- Answer questions and provide future tax planning to clients.

- Calculate form preparation fees according to return complexity and processing time required.

- Check data input or verify totals on forms prepared by others to detect errors in arithmetic, data entry, or procedures.

- Compute taxes owed or overpaid, using adding machines or personal computers, and complete entries on forms, following tax form instructions and tax tables.

- Consult tax law handbooks or bulletins to determine procedures for preparation of atypical returns.

- Explain federal and state tax laws to individuals and companies.

- Interview clients to obtain additional information on taxable income and deductible expenses and allowances.

- Review financial records such as income statements and documentation of expenditures to determine forms needed to prepare tax returns.

Experience

0-2 Years

Level

Entry Level

Education

BS In Accounting

Tax Associate Resume

Objective : Responsible for Working with the tax team to ensure the various components of the tax process are performed - including tax planning, client interaction and performing special tax projects, and also Gathering relevant tax-related information from the client so an accurate tax return can be prepared.

Skills : Strong customer service skills, Ability to perform.

Description :

- Build customer relations by interviewing clients and preparing tax returns to determine whether the client had correctly reported all income and paid all the necessary tax, thus ensuring that they receive the highest possible tax refund.

- Provided information to assist clients, about measures to take, in making better financial decisions.

- Achievement of 100% of personal tax season goal.

- Achievement of 100% in client experience survey.

- Assist the branch in achieving all tax season goals.

- Skills Used Ability to learn and adapt easily.

- Relationship building Time management Ability to work under stress People oriented Motivation.

Experience

2-5 Years

Level

Executive

Education

Social Sciences

Senior Tax Associate Resume

Objective : Over 14 years of experience, including as a Cashier, a Tax Associate, a Certified Nurse Aide, and as an Assembler in Automotive Industries.

Skills : Microsoft Office, 10-Key, Typing, Peachtree Accounting, Project Management, Quality Assurance, Customer Service.

Description :

- Prepared tax returns for individuals and small businesses.

- Prepared tax forms such as federal, state, local, property and sales/use.

- Used tax form instructions and tables to complete tax forms.

- Interviewed clients to obtain information such as taxable income, deductible expenses and allowances.

- Reviewed financial records such as prior tax returns, income statements, expenditure documents and receipts.

- Selected appropriate tax forms based on financial record review.

- Used data management and accounting software.

Experience

2-5 Years

Level

Executive

Education

Accounting

Lead Tax Associate Resume

Summary : Detail oriented, discerning professional with ten years of multi-national payroll, HR and accounting expertise. Demonstrated ability to prioritize and manages multiple projects simultaneously, meet and anticipate tight timelines and manage situations from start to finish. Proficient with a variety of software applications, including ADP Workforcenow, Paychex & Quick books, banking software and cloud based collaboration tools.

Skills : Microsoft Office, Quickbooks, Lacerte, Lacerte.

Description :

- Conducts interviews with clients to obtain pertinent tax information and prepares tax returns for individuals and small businesses.

- Reviews client income statements and related documentation.

- Calculates taxes owed or overpaid, following tax form instructions and tax tables.

- Uses appropriate adjustments, deductions, and credits to keep client taxes to a minimum.

- Performs administrative duties, including filing, answering phone calls, and providing customer service.

- Assembles individual state and federal income tax returns; calculates client estimated income tax payments.

- Maintains tax records and related documentation; helps clients in tax planning.

- Interacts with clients on tax return information, due dates, deadlines, and other compliance matters.

Experience

10+ Years

Level

Senior

Education

Diploma

Tax Associate Resume

Objective : As a Tax Associate, responsible for Looking at tax situations from various angles to ensure the maximum tax benefit is applied, Preparing accounting-related reports through a paperless office environment, and alsoAttending professional development and training seminars on a regular basis.

Skills : Tax laws, Sales, Customer service.

Description :

- Prepared tax returns for individuals and small businesses.

- Prepared tax forms such as federal, state, local, property, sales/use, franchise receipts and gross receipts.

- Used tax form instructions and tables to complete tax forms.

- Interviewed clients to obtain information taxable income, deductible expenses and allowances.

- Reviewed financial records such as prior tax returns, income statements, expenditure documents and receipts.

- Selected appropriate tax forms based on financial record review.

- Calculated depreciation/amortization taxes.

Experience

2-5 Years

Level

Executive

Education

BA In Business

Tax Associate (Seasonal) Resume

Objective : Tax Associate is responsible for the overall tax process of the company and its clients. They are responsible for assisting clients in preparation, filing and verification of tax returns, audits and other related services.

Skills : Basic Computer Skills, Planning Skills.

Description :

- Coordinated with a team in preparing and filing federal form 1065 partnership tax returns and all necessary schedules.

- Built tax work paper files to calculate book income, taxable income, and tax allocation amounts for every partner in a hedge fund or private equity client.

- Generated and reviewed K-1 packages for all partners including statements and footnotes.

- Verified client information files and cleared any issues to ensure all client and IRS deadlines were met.

- Prepared various state tax returns for clients such as JP Morgan, Court Square Investors, Emigrant with multiple funds nationally.

- Worked with a team to properly create and file federal and state extensions.

- Implemented RPM+ to prepare K-1, tax allocation and other workpapers.

- Used Gosystem to prepare federal, state and local tax return extensions.

Experience

2-5 Years

Level

Executive

Education

Accounting

Tax Associate II Resume

Headline : Sociable, punctual, diligent and responsible student with a strong work ethic and professional attitude. Ability to work in a team, handle multiple assignments, meet deadlines and maintain confidentiality.

Skills : Microsoft Office, Accounting.

Description :

- Prepared tax returns for individuals, small businesses.

- Prepared tax forms such as federal, state.

- Interviewed clients to obtain information taxable income, deductible expenses and allowances.

- Reviewed financial records such as prior tax returns, income statements, expenditure documents, receipts.

- Selected appropriate tax forms based on financial record review.

- Calculated depreciation/amortization taxes.

- Used data management and accounting software.

Experience

5-7 Years

Level

Executive

Education

Vocational In Business

Experienced Tax Associate Resume

Summary : Self-motivated professional with a passion for providing great customer service with steadfast leadership and exceptional communication skills. Highly adept at supervising and managing various workgroups as well as training and developing staff to carry out a wide range of duties.

Skills : Microsoft Office; CCH ProSystem Tax; CFS Tax Tool, BNA Income Tax Planner, Visual Account Mate For LAN, QuickBooks, Creative Solution Accounting, Academic Search Premier, SAP, Paradox.

Description :

- Conducted federal & multi-state tax return preparation for C-corporation, S-corporation, partnership, high net-worth individual, fiduciary and private foundation.

- Performed research on tax issues using Internal Revenue Code or other treasury regulations to comply with filing requirements.

- Compiled working papers to substantiate tax provisions on non-audited financial statements.

- Identified and communicated tax matters to Managers and Partners Assisted to provide comprehensive tax advisory and compliance service to high net worth individual clients in order to maximize tax advantage.

- Collected Tax Provision and generated work paper to facilitate IRS Audit purpose.

- Prepared quarterly estimates and year-end projections for clients.

- Filed Form 1099-Misc for clients Assisted to prepare gift tax return and payroll tax return Managed multitask to meet filing deadlines.

Experience

7-10 Years

Level

Management

Education

M.S. In Accountancy Option

Federal Tax Associate Resume

Objective : Responsible for Representing the Intuit TurboTax brand and spirit by demonstrating empathy for the customer, empowering and partnering with the customer, personalizing the experience, and providing them the confidence that they can do their own taxes.

Skills : Experience with Windows XP, Microsoft Excel, Word and Works Proficient in Military CHCS, CHCS II, Misys Health Care Systems and office management.

Description :

- Hired initially for the season but was offered to work in the year round office.

- Performed various clerical duties including scheduling appointments, providing information on programs, typing, filing, faxing, reviewed daily correspondence, and answering phones making outbound follow-up calls.

- Performed data entry, report preparation, telephone reception.

- Acted as a primary information resource providing referrals, direction, information, and general assistance.

- Performed tasks with pleasant and friendly personality.

- Worked in fast-paced, high-pressured positions demonstrating the ability to prioritize multiple tasks, meet deadlines, and provide quality customer service.

- Reviewed, processed, and resolved taxpayer and internal processing errors detected in income tax returns.

- Used bilingual skills to greet clients and assist them in completing their tax forms.

Experience

0-2 Years

Level

Entry Level

Education

GED

Junior Tax Associate Resume

Objective : Positive and out-going attitude with willingness to learn great phone etiquette. Hands on work, something that I can learn that's different and that is satisfying in the since that is shows the results in the end.

Skills : Microsoft Word, Excel, PowerPoint, Outlook, Access, Amadeus, BPCS, TPS, QuickBooks, Bluescreen, Efficient Typist 72-80 Wpm, Fluent In Spanish, Inventory And Cycle Counting Training, Microsoft Access Training, And Quality Management Training.

Description :

- Completed tax forms in accordance with policies, and in compliance with legislation and regulations.

- Reviewed financial records such as income statements and documentation of expenditures to determine forms needed to prepare tax returns.

- Identified potential tax credits and liabilities and ensured accurate and complete returns were filed in a timely manner.

- Handled routine client tax questions, and worked with clients to collect necessary information for tax return completion and compliance.

- Worked with the tax team to prepare and learn to review tax returns.

- Managed a diverse portfolio for tax and advisory assignments.

- Built relationship with our clients by ensuring high service standards.

Experience

2-5 Years

Level

Junior

Education

MS In Accountancy

Tax Associate Resume

Headline : Motivated Tax Associate with oner 20 years retail experience in a fast-paced, team-based enviroment. Customer Service Rep driven to exceed sales goals and build long term relationships with customers. Delivers positive experiences through high-quality customer care. Friendly Sales Associate adept at working in diverse retail and customer service enviroments.

Skills : Microsoft, Training Skills.

Description :

- Answered an average of 50+ calls per day by addressing customer inquiries, solving problems and providing new product information.

- Greeted customers entering the store to ascertain what each customer wanted or needed.

- Earned management trust by serving as key holder, responsibly opening and closing store.

- Politely assisting customers in person and via telephone.

- Provided an elevated customer experience to generate a loyal clientele.

- Maintained cleanliness and presentation of stock room and production floor.

- Built Long-term customer relationships and advised customers on purchases and promotions.

Experience

5-7 Years

Level

Executive

Education

Accounting

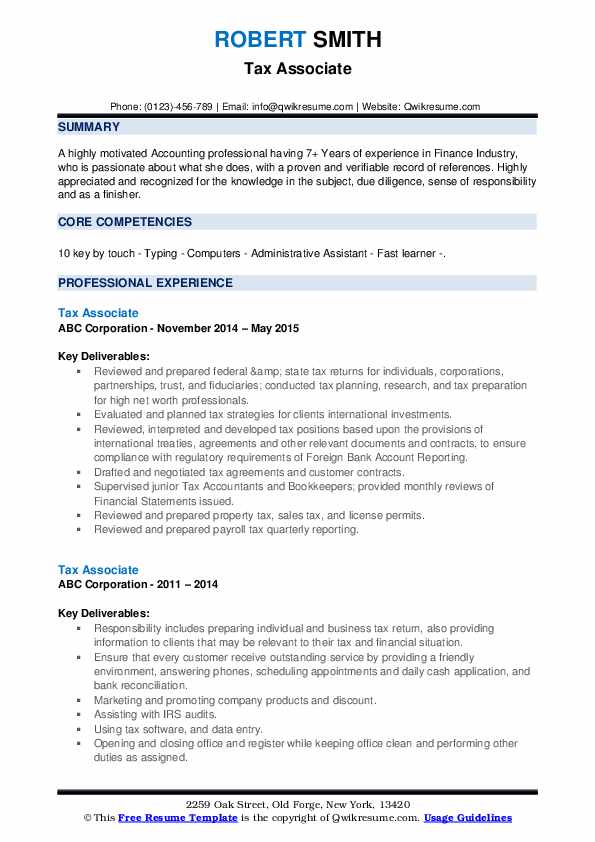

Tax Associate Resume

Summary : A highly motivated Tax Associate professional having 7+ Years of experience in the Finance Industry, who is passionate about what she does, with a proven and verifiable record of references. Highly appreciated and recognized for the knowledge in the subject, due diligence, sense of responsibility, and as a finisher.

Skills : Computer Skills, Typing Skills.

Description :

- Reviewed and prepared federal & state tax returns for individuals, corporations, partnerships, trust, and fiduciaries; conducted tax planning, research, and tax preparation for high net worth professionals.

- Evaluated and planned tax strategies for clients' international investments.

- Reviewed, interpreted and developed tax positions based upon the provisions of international treaties, agreements and other relevant documents and contracts, to ensure compliance with regulatory requirements of Foreign Bank Account Reporting.

- Drafted and negotiated tax agreements and customer contracts.

- Supervised junior Tax Accountants and Bookkeepers; provided monthly reviews of Financial Statements issued.

- Reviewed and prepared property tax, sales tax, and license permits.

- Reviewed and prepared payroll tax quarterly reporting.

- Researched, analyzed and communicated impact of current and proposed tax legislations to clients and team members.

Experience

7-10 Years

Level

Consultant

Education

Master Of Science