Tax Auditor Resume

Summary : Accomplished Tax Auditor with a decade of experience in conducting comprehensive audits for diverse entities. Proven ability to analyze complex financial data, ensuring compliance with federal and state regulations. Adept at developing audit strategies and fostering client relations to enhance understanding of tax obligations. Committed to delivering accurate assessments and recommendations for improved financial practices.

Skills : Tax Compliance Analysis, Tax Compliance, Financial Analysis, Audit Planning

Description :

- Conducted detailed audits of financial records for large multinational corporations and non-profit organizations.

- Calculated tax liabilities across various areas, including sales, payroll, and unemployment taxes.

- Employed statistical sampling methods to ensure thorough and fair audit processes.

- Developed and implemented audit plans and procedures, ensuring adherence to compliance standards.

- Analyzed taxpayer accounting systems through both electronic and physical audits.

- Compiled comprehensive audit reports, providing actionable recommendations for clients.

- Managed workload scheduling to maximize efficiency and ensure timely audit completion.

Experience

10+ Years

Level

Senior

Education

B.S. Accounting

Tax Auditor/Representative Resume

Summary : Dynamic Tax Auditor with over 10 years of experience in executing detailed audits across various sectors. Expertise in interpreting tax regulations, enhancing compliance, and identifying financial discrepancies. Recognized for strategic audit planning and cultivating client partnerships to optimize tax outcomes. Passionate about delivering precise evaluations that drive financial integrity.

Skills : Tax Compliance Specialist, Data Analysis, Attention to Detail, Report Writing, Tax Law Knowledge

Description :

- Managed tax administration and collection processes for sales, property, and special taxes.

- Advised taxpayers, attorneys, and accountants on complex tax law applications across multiple industries.

- Utilized indirect auditing techniques to reconstruct financial statements for businesses with incomplete records.

- Conducted audits related to tax fraud, providing substantial defense documentation to audit staff.

- Enhanced taxpayer compliance by analyzing internal controls and recommending financial improvements.

- Employed statistical sampling and analytical techniques to convert data into actionable audit insights.

- Recognized for exceeding performance targets in audit completion and budget adherence.

Experience

7-10 Years

Level

Management

Education

B.S. Accounting

Tax Auditor II Resume

Headline : Tax Auditor with 7 years of specialized experience in executing thorough financial audits for diverse clients. Skilled in interpreting tax codes and ensuring compliance with state and federal regulations. Proven track record in developing audit methodologies and fostering strong client relationships to enhance tax understanding. Dedicated to providing insightful recommendations that promote fiscal responsibility.

Skills : QuickBooks, Microsoft Excel, Internal Controls, Problem Solving, Communication Skills

Description :

- Conducted comprehensive audits in accordance with Generally Accepted Auditing Standards, ensuring adherence to regulatory requirements.

- Compiled detailed reports and analyses that exceeded established policy standards and improved audit outcomes.

- Reviewed financial records to assess compliance with local and federal tax laws, identifying potential areas of risk.

- Collaborated with business representatives to clarify audit findings and address compliance issues effectively.

- Maintained meticulous documentation throughout the audit process, ensuring a clear audit trail for all transactions.

- Utilized data analytics to detect anomalies and discrepancies critical to determining tax liabilities.

- Provided expert advice on tax obligations and best practices, enhancing client understanding of fiscal responsibilities.

Experience

5-7 Years

Level

Executive

Education

B.S. Accounting

Tax Auditor/Co-ordinator Resume

Summary : Tax Auditor with a decade of experience specializing in comprehensive financial audits and compliance assessments. Skilled at analyzing intricate financial data and interpreting tax regulations to ensure accuracy and adherence to laws. Committed to enhancing client understanding of tax obligations through effective communication and strategic recommendations.

Skills : Advanced Microsoft Office Suite, Effective Communication Skills, Client Relations, Critical Thinking, Financial Reporting

Description :

- Conducted comprehensive audits for C-corporations, partnerships, S-corporations, and individual taxpayers, ensuring compliance with tax regulations.

- Managed complex audits involving residency, income, expenses, and shareholder basis for various entities.

- Responded to inquiries from taxpayers and their representatives concerning tax liabilities and compliance issues.

- Researched intricate tax issues, providing accurate guidance to taxpayers, attorneys, and accountants.

- Initiated and led successful audit projects that enhanced compliance and identified areas for improvement.

- Identified noncompliance issues within large datasets, recommending corrective actions to mitigate risks.

- Communicated effectively with clients to clarify audit findings and foster understanding of tax obligations.

Experience

7-10 Years

Level

Management

Education

B.S. Accounting

Tax Auditor/Analyst Resume

Summary : Seasoned Tax Auditor with 10 years of extensive experience in performing in-depth audits across various industries. Expert in scrutinizing financial statements and ensuring adherence to complex tax regulations. Proven track record in optimizing audit processes and enhancing client comprehension of tax requirements. Dedicated to providing actionable insights that promote compliance and financial accuracy.

Skills : Advanced Microsoft Office Suite, Excel Skills, Research Skills, Ethical Judgment, Negotiation Skills

Description :

- Conducted thorough audits of taxpayer records to ensure compliance with state and federal tax regulations.

- Analyzed taxpayer history and previous audits to develop a strategic audit approach for each client.

- Examined tax returns and supporting documentation to identify potential issues for review.

- Executed audits in accordance with established procedures, ensuring accuracy and compliance.

- Facilitated effective communication with taxpayers and representatives regarding compliance and audit findings.

- Documented all communications and audit findings using standardized formats to maintain clarity and consistency.

- Collaborated with audit supervisors to clarify complex audit issues and ensure adherence to the audit program plan.

Experience

7-10 Years

Level

Management

Education

B.S. Accounting

Tax Auditor/Technician Resume

Summary : Dedicated Tax Auditor with 10 years of expertise in conducting thorough audits and ensuring compliance with tax regulations. Skilled in analyzing financial documents, identifying discrepancies, and developing strategic audit plans. Committed to enhancing taxpayer understanding and delivering actionable insights that drive compliance and fiscal responsibility.

Skills : Advanced Excel Proficiency, Project Management, Process Improvement, Budgeting Skills

Description :

- Interpreted and implemented the Guyana Revenue Authority's audit policies and standards for self-employed individuals.

- Conducted thorough investigations to ensure taxpayer compliance with legal tax requirements.

- Maintained and organized taxpayer files for efficient audit processes.

- Examined financial records and liaised with banks to verify accuracy.

- Verified claims for capital allowances and reviewed import/export histories.

- Prepared detailed audit reports and customized audit plans for each case.

- Facilitated taxpayer interviews to resolve disputes based on thorough analyses and evidence.

Experience

7-10 Years

Level

Management

Education

B.S. Accounting

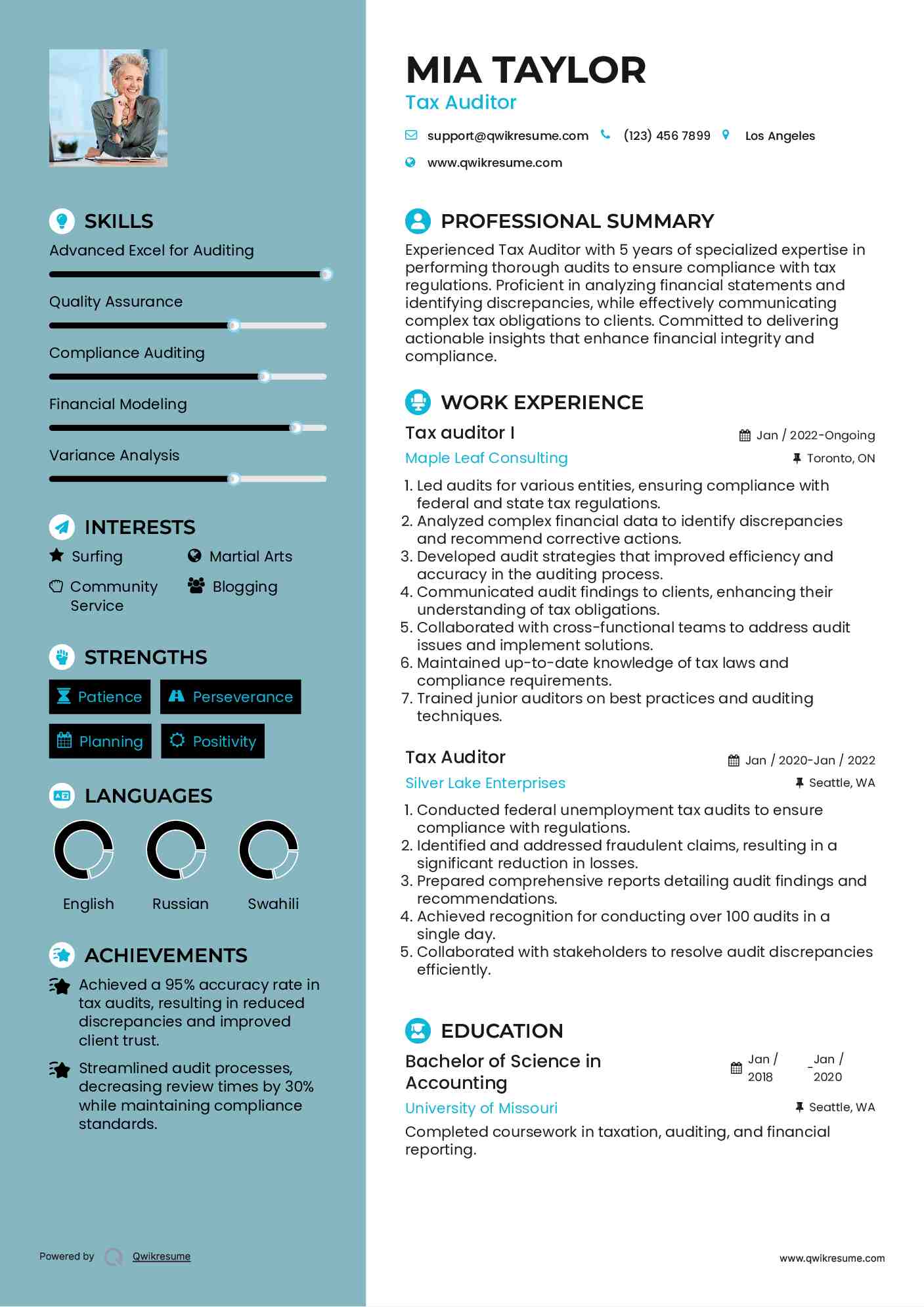

Tax auditor I Resume

Objective : Experienced Tax Auditor with 5 years of specialized expertise in performing thorough audits to ensure compliance with tax regulations. Proficient in analyzing financial statements and identifying discrepancies, while effectively communicating complex tax obligations to clients. Committed to delivering actionable insights that enhance financial integrity and compliance.

Skills : Advanced Excel for Auditing, Quality Assurance, Compliance Auditing, Financial Modeling, Variance Analysis

Description :

- Led audits for various entities, ensuring compliance with federal and state tax regulations.

- Analyzed complex financial data to identify discrepancies and recommend corrective actions.

- Developed audit strategies that improved efficiency and accuracy in the auditing process.

- Communicated audit findings to clients, enhancing their understanding of tax obligations.

- Collaborated with cross-functional teams to address audit issues and implement solutions.

- Maintained up-to-date knowledge of tax laws and compliance requirements.

- Trained junior auditors on best practices and auditing techniques.

Experience

2-5 Years

Level

Junior

Education

B.S. Accounting

Jr. Tax Auditor Resume

Objective : Tax Auditor with 5 years of experience specializing in conducting thorough audits and ensuring compliance with tax laws. Proficient in analyzing complex financial documents and identifying discrepancies to enhance fiscal accuracy. Committed to implementing effective audit strategies and fostering clear communication with clients to improve understanding of tax obligations.

Skills : Data Analysis Software, Tax Compliance, Data Interpretation, Regulatory Compliance, Tax Strategy Development

Description :

- Executed comprehensive tax audits for various tax types, ensuring compliance with regulations.

- Utilized advanced data analytics to select taxpayer accounts for audits, enhancing accuracy.

- Collaborated with supervisors to formulate audit plans and strategies tailored to specific clients.

- Prepared detailed audit reports and conducted initial conferences to discuss findings with taxpayers.

- Reviewed and analyzed financial records to verify compliance and accuracy in tax reporting.

- Developed tax work papers to support audit conclusions and recommendations.

- Monitored taxpayer accounts for compliance and advised on necessary corrections to returns.

Experience

2-5 Years

Level

Junior

Education

B.S. Accounting

Tax Auditor III Resume

Summary : Tax Auditor with 10 years of in-depth experience in executing complex audits and ensuring compliance with tax laws. Proficient in analyzing financial records, identifying discrepancies, and implementing effective audit strategies. Committed to enhancing taxpayer understanding and delivering precise recommendations that strengthen financial practices.

Skills : Advanced Microsoft Office Suite, Confidentiality, Client Service Orientation, Technical Writing, Industry Knowledge

Description :

- Approved and denied claims based on comprehensive evaluations, providing clear explanations to taxpayers.

- Prepared detailed protest cases for submission to Technical Assistance and Dispute Resolution.

- Conducted thorough research on account discrepancies, ensuring accurate postings in SAP.

- Triaged incoming Applications for Refund, identifying valid DR-26 requests efficiently.

- Collaborated on cross-functional teams to improve audit forms and modernize processes.

- Ensured compliance with Florida Statute 443 by auditing Unemployment Tax refund batches.

- Identified and rectified errors in financial data, enhancing overall accuracy of tax assessments.

Experience

10+ Years

Level

Senior

Education

B.S. Accounting

Lead Tax Auditor Resume

Summary : Tax Auditor with a robust 10-year track record in conducting meticulous audits to ensure compliance with tax laws. Expert in evaluating financial records, identifying discrepancies, and formulating effective audit strategies. Known for enhancing client relations and delivering actionable insights that drive compliance and promote fiscal responsibility.

Skills : Tax Compliance Software, Financial Analysis, Interpersonal Skills, Organizational Skills

Description :

- Conducted comprehensive audits of payroll taxes to ensure compliance with federal and state regulations.

- Reviewed financial statements, tax returns, and general ledger reports to validate accuracy.

- Investigated unreported wage claims and assessed their validity for tax purposes.

- Provided expert guidance on tax regulations to clients, including attorneys and CPA firms.

- Assisted in administrative hearings during the tax appeal process, presenting findings and recommendations.

- Gathered and analyzed data for fraud investigations, contributing to quality control improvements.

- Delivered exceptional customer service to clients, effectively addressing concerns and clarifying processes.

Experience

7-10 Years

Level

Management

Education

B.S. Accounting

Associate Tax Auditor Resume

Summary : A strategic Tax Auditor with 10 years of extensive experience in executing precise audits for various organizations. Demonstrated expertise in interpreting complex tax legislation and ensuring adherence to regulatory requirements. Passionate about delivering comprehensive insights that enhance taxpayer compliance and promote fiscal responsibility.

Skills : Tax Accounting Systems, Tax Preparation Software, Tax Compliance, Financial Analysis, Audit Planning

Description :

- Conducted tax account audits for small to moderate-sized businesses and individual taxpayers, both independently and collaboratively.

- Examined ledgers, journals, and source documents including invoices and bank statements to verify financial accuracy.

- Reviewed contracts to assess tax liabilities and resolve tax-related issues.

- Verified taxpayer reporting accuracy by cross-referencing source documents.

- Applied relevant tax laws and regulations to situations encountered during audits.

- Conducted research and fieldwork utilizing internal and external data sources for thorough audits.

- Evaluated accounting systems and internal controls for adequacy and compliance.

Experience

7-10 Years

Level

Management

Education

B.S. Accounting

Tax Auditor Resume

Summary : Tax Auditor with a decade of experience in performing detailed financial audits and ensuring compliance with tax regulations. Proficient in analyzing complex tax data and implementing effective audit strategies. Known for enhancing taxpayer relations and delivering precise recommendations that promote fiscal responsibility and accuracy.

Skills : Tax Software Proficiency, Data Analysis, Attention to Detail, Report Writing, Tax Law Expertise

Description :

- Conducted comprehensive field audits focusing on State Sales and Use Taxes, ensuring compliance with applicable laws.

- Engaged with taxpayers to address inquiries and provide guidance on tax-related matters.

- Reviewed and analyzed audit reports, collaborating with legal and financial advisors to resolve compliance issues.

- Implemented collection strategies to ensure timely filing and payment of sales and use tax liabilities.

- Achieved a consistent reduction in account receivables through effective financial oversight.

- Evaluated installment payment plans based on thorough financial assessments.

- Provided tax advisory services through various communication channels, enhancing taxpayer understanding.

Experience

7-10 Years

Level

Management

Education

B.S. Accounting