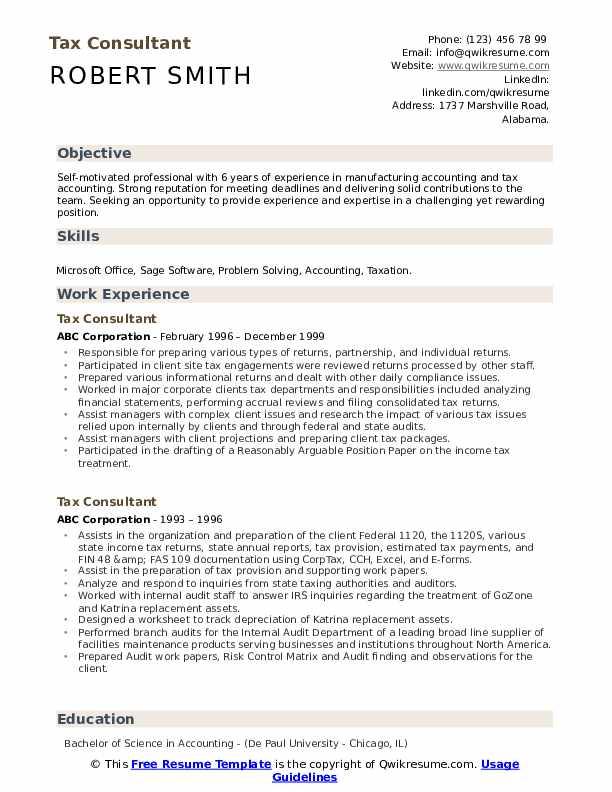

Tax Consultant Resume

Headline : Self-motivated professional with 6 years of experience in manufacturing accounting and tax accounting. Strong reputation for meeting deadlines and delivering solid contributions to the team. Seeking an opportunity to provide experience and expertise in a challenging yet rewarding position.

Skills : Microsoft Office, Sage Software, Problem Solving, Accounting, Taxation.

Description :

- Responsible for preparing various types of returns, partnership, and individual returns.

- Participated in client site tax engagements were reviewed returns processed by other staff.

- Prepared various informational returns and dealt with other daily compliance issues.

- Worked in major corporate clients' tax departments and responsibilities included analyzing financial statements, performing accrual reviews and filing consolidated tax returns.

- Assist managers with complex client issues and research the impact of various tax issues relied upon internally by clients and through federal and state audits.

- Assist managers with client projections and preparing client tax packages.

- Participated in the drafting of a Reasonably Arguable Position Paper on the income tax treatment.

Experience

5-7 Years

Level

Executive

Education

BS

Financial Tax Consultant Resume

Summary : Tax Consultant with expert knowledge in areas such as corporate personal international and inheritance tax National Insurance VAT and trusts and estates. Seeking for a challenging as well as a rewarding job.

Skills : MS Word, MS Excel, MS Access, Peoplesoft, Hyperion, Copying, Mailing, and Documenting Tax Returns.

Description :

- Responsible for updating software and troubleshooting user issues.

- Gathering information necessary to prepare annual federal & state income tax returns.

- Prepared the Federal 5471's and tied out the foreign trial balances.

- Responsible for timely and accurate preparation and filing of all required state and local tax returns and payments.

- Reviewed state and local returns, prepared reviewer points and assisted associates as needed.

- Analyze and respond to inquiries from state taxing authorities using Checkpoint and E-forms.

- Assist managers with client projections and preparing client tax packages.

- Prepare federal and state tax returns for individuals and sole proprietors.

Experience

10+ Years

Level

Senior

Education

BS

Tax Consultant-Accounting Resume

Objective : Motivated, personable business professional and detail-oriented individual, accustomed to handling sensitive and confidential information, whether under a time constraint or in day to day operations. Flexible and versatile as it relates to deadline-driven environments.

Skills : Microsoft Office, Time Management,

Commercial Awareness, Problem-Solving Skills.

Description :

- Prepared simple to moderately complex tax returns for federal and state filings.

- Preparation of supporting work papers, maintenance for deferred tax assets and liabilities, comparison of accounts, and analysis of return to provision differences.

- Analyzed account balances and account detail to determine the proper treatment of transactions on tax returns.

- Researched discrepancies in deferred tax assets and liabilities.

- Reconciled simple to moderately complex issues to ensure proper financial reporting.

- Prepared quarterly estimated state tax payments in excel and CorpTax, apportionment amounts, and current year payments.

- Responded to state taxing authorities regarding notices or gathering of return support for state audit purposes.

- Analyzed state tax issues and research relevant tax law, and recommends a course of action to the appropriate manager.

- Prepared one or more commonly utilized book to tax adjustments on a quarterly basis.

Experience

2-5 Years

Level

Junior

Education

MBA

Heavy Staff Tax Consultant Resume

Summary : Over-all 14 years of work experience in preparing Individual Income Tax Returns. Highly focused and dependable professional with excellent customer service and cash management record. Competent in working in fast-paced environments following strict timelines & schedules.

Skills : Microsoft Office, Drake Tax Software, Quickbooks.

Description :

- Prepared simple to complex tax returns for individuals and self-employed Clients.

- Worked with new as well as returning clients, explaining the new IRS tax laws for the year.

- Analyzing their tax documents and understanding their tax situation for the current year.

- Interviewed clients to obtain additional information on any possible life-events which may have an effect on their tax returns.

- Explained all the tax deductions they are eligible for in case the clients choose to itemize along with all the Schedules and work-sheets.

- Ascertained all the Refundable and Non-Refundable Credits which the Client is eligible in order to determine the maximum refund or minimum tax liability for the year.

- Helped the Client electronically file both their Federal and State Income taxes.

- Efficient in Cash handling and maintaining daily Accounts.

Experience

10+ Years

Level

Senior

Education

Certification

Contract Tax Consultant Resume

Summary : Tax Consultant with 8 years of experience, a dedicated professional with excellent communications skills and strong creative problem resolution skills; always ensures positive internal and external customer relations

Skills : Customer Service, Insurance Verification, Hospitality, Cash Handling.

Description :

- Seasonal Compute taxes owed or overpaid, using adding machines or personal computers, and complete entries on forms, following form instructions and tax tables.

- Prepare or assist in preparing simple to complex tax returns for individuals or small business.

- Use all appropriate adjustments, deductions, and credits to keep client's taxes to a minimum.

- Interview clients to obtain additional information on taxable income and deductible expenses and allowances.

- Review financial records such as income statements and documentation of expenditures to determine forms needed to prepare the tax return.

- Furnish taxpayers with sufficient information and advice to ensure correct tax form completion.

- Calculate form preparation fees according to return complexity and processing time required.

- Check data input or verify totals on forms prepared by others to detect errors in arithmetic, data entry, or procedures.

Experience

7-10 Years

Level

Management

Education

MBA

Tax Consultant I Resume

Objective : Enrolled Agent offering more than 5+ years, working for a firm providing tax, audit and other financial services. Detailed-oriented bookkeeping professional, applying financial and managerial accounting practices.

Skills : Social Media, Analytical Skills, Clerical, Maths, Verbal, and Written Communication, Cash and account handling, Accounting Skills, IT skills, Troubleshooting, Data Entry, Sales, Receptionist.

Description :

- Assist and prepare business license, licensing contracts and property taxes, annual reports documents for electronic files for implementation of paper file transition.

- Prepare leasing tax records documentation and researched local tax entities for accuracy for organizational electronic tax filings and paperless applications.

- Assist management, junior analysts in creating better documentation trials to internal auditors to prepare for upcoming agencies audits.

- Researched tax notices and consults with tax authorities for resolutions.

- Assist mailing quarterly tax reports to tax agencies and update customer accounts with activity results of letters, tax mailings and payment information mailed.

- Prepared and sent payment forms to accounts payable for payment to state and local agencies.

- Calculate form preparation fees according to return complexity and processing time required.

Experience

2-5 Years

Level

Junior

Education

MBA

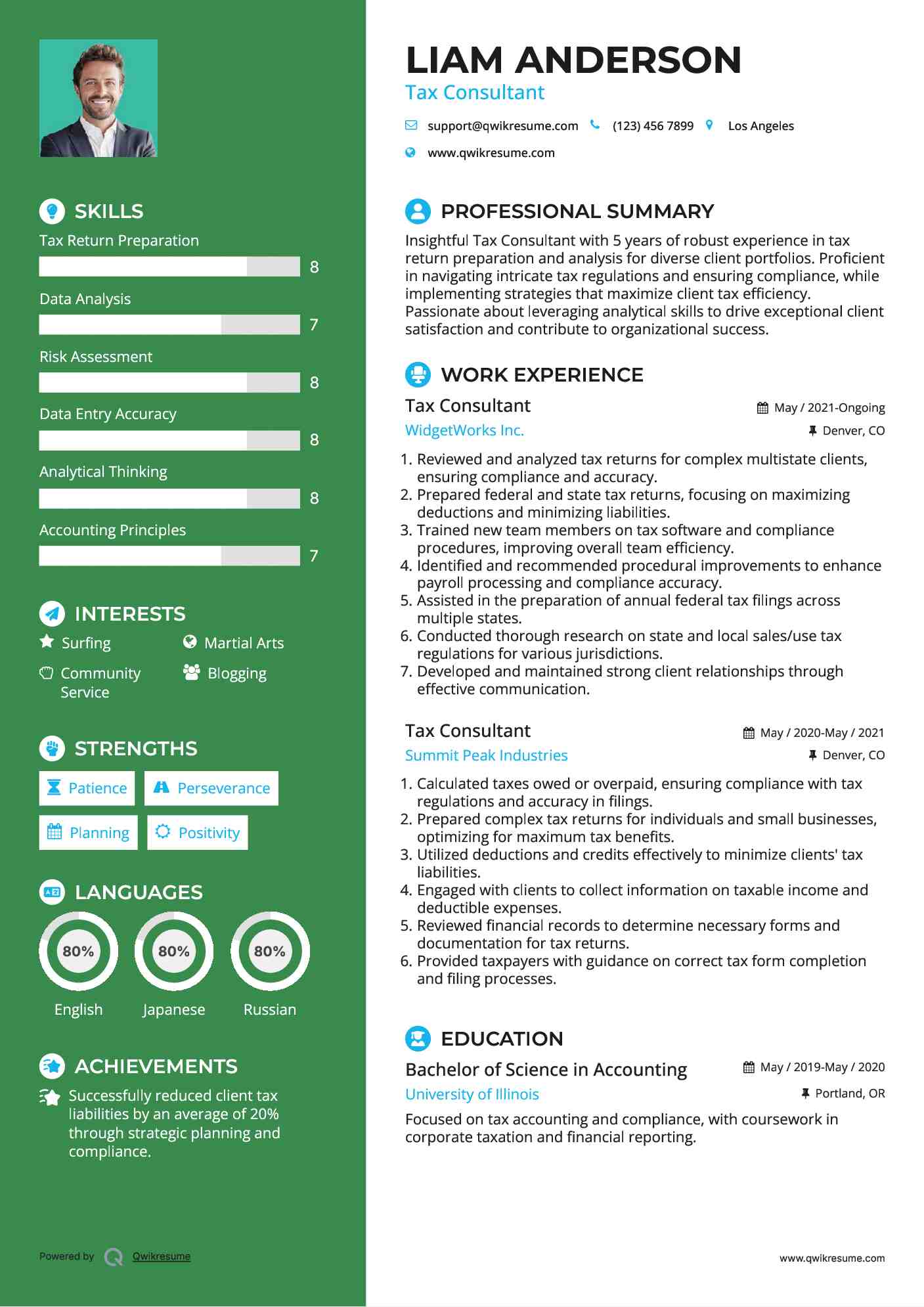

Tax Consultant-Preparer Resume

Summary : Seeking an administrative, or a similar occupation. Desire to maximize as well as build and strengthen new skills in order to bring about positive contributions.

Skills : Customer Service, Microsoft Office, Bookkeeping, Typing, Self-Motivated, Time Management.

Description :

- Review the work of the tax director and senior manager.

- Prepare and review the returns for the CPA firm's complex multistate clients.

- Trained payroll accountants preparing account reconciliations, reviewed and noted areas of improvements in the SOX control document.

- Reviewed work and recommended changes to procedures for both the payroll processing and compliance departments.

- Assisted with the preparation of the annual federal tax return, summarized in fifty states for future filings.

- Trained the tax manager on the new investment tracking software.

- Performed nationwide state and local sales/use tax research and registration for over fifty jurisdictions.

Experience

10+ Years

Level

Senior

Education

BBA

Tax Consultant II Resume

Summary : An experienced Tax Consultant with 13+ years of experience, Team player seeking a role in managing the financial planning of a company ready for continued growth on a global scale.

Skills : MS Office Suite, Quality Focus, Professionalism, Productivity, Documentation Skills, Written Communication, Data Entry.

Description :

- Compute taxes owed or overpaid, using adding machines or personal computers, and complete entries on forms, following tax form instructions and tax tables.

- Prepare or assist in preparing simple to complex tax returns for individuals or small businesses.

- Use all appropriate adjustments, deductions, and credits to keep clients' taxes to a minimum.

- Interview clients to obtain additional information on taxable income and deductible expenses and allowances.

- Review financial records such as income statements and documentation of expenditures in order to determine forms needed to prepare tax returns.

- Furnish taxpayers with sufficient information and advice in order to ensure correct tax form completion.

- Calculate form preparation fees according to return complexity and processing time required.

Experience

10+ Years

Level

Senior

Education

MS

Jr. Tax Consultant Resume

Objective : Looking for a role that will provide an opportunity to work in various areas of accounts and finance, using knowledge of employee relations, employee benefits, and employment laws.

Skills : Microsoft Office, Time Management, Organization, Attention To Detail, Quality Focus, Professionalism, Productivity.

Description :

- Transfer Pricing Familiarized clients to the concept and laws of Transfer Pricing.

- Helped clients comply with Transfer Pricing regulations through research and documentation.

- Offered clients advice and compliance assistance for domestic and cross border tax-related services.

- Employment Law was part of a team that assisted the client with advice on local Labor and Employment laws.

- Gave them an HR legal framework on which they could formulate their HR strategies.

- Corporate Compliance Provided full-cycle corporate compliance services for setting up Project or Liaison offices.

- Assisted in day to day advice to companies of all forms, on all commercial legal aspects.

Experience

2-5 Years

Level

Junior

Education

Certification

Tax Consultant III Resume

Objective : Tax Consultant consistently recognized for a strong work ethic and exceeding expectations. Seeking to bring the expertise of work to the firm. Proficient at using software's to improve efficiency and transform data into useable information.

Skills : Microsoft Office, Customer Service, Data Entry.

Description :

- Prepare or assist in preparing simple to complex tax returns for individuals or small businesses.

- Use all appropriate adjustments, deductions, and credits to keep clients' taxes to a minimum.

- Interview clients to obtain additional information on taxable income and deductible expenses and allowances.

- Review financial records such as income statements and documentation of expenditures to determine forms needed to prepare tax returns.

- Furnish taxpayers with sufficient information and advice to ensure correct tax form completion.

- Calculate form preparation fees according to return complexity and processing time required.

- Check data input or verify totals on forms prepared by others to detect errors in arithmetic, data entry, or procedures.

Experience

0-2 Years

Level

Entry Level

Education

Diploma

Property Tax Consultant Resume

Objective : Tax Consultant with expert knowledge in areas such as corporate personal international and inheritance tax National Insurance VAT and trusts and estates.

Skills : Tax Research, Computing Platforms, Microsoft Suite.

Description :

- Supervised and managed interns and other consultants, which included training, delegating, and reviewing their work.

- Created business proposals and walked through the Research and Development Credit process to help acquire new business.

- Worked with client's in-house counsel to help decipher which types of contracts may qualify for the Research and Development Credit.

- Gathered and compiled client data through client interviews, client correspondence, and tax research.

- Reviewed client data to find qualifying Research and Development Credit information.

- Completed the calculation for the tax return along with additional supporting documentation for clients to provide in the case of an audit.

- Calculate form preparation fees according to return complexity and processing time required.

Experience

2-5 Years

Level

Junior

Education

JD

Tax Consultant-Office Manager Resume

Objective : A professional individual offering a solid background in supervision and operations management with extensive experience within the transportation industry supporting the team efforts with expert advice, strategic planning, and evaluation of the need for any training required.

Skills : Accounting, Customer Service, MS Office Suite, Data Entry.

Description :

- Annually prepared over four-hundred personal income tax returns.

- Preformed record keeping and filing functions for various businesses.

- Oversaw and consulted with clients to prepare plans best suited to their individual requirements.

- Communicate and analyze customer inquiries and determine the correct course of action.

- Always completed tax returns on-time without ever compromising on quality.

- Spearheaded one-of-a-kind action team to control outside cost: resulted in a 17% cost reduction in logistics spending and 26% reduction in travel expenses during a twelve-month period.

- Possess excellent knowledge of direct and indirect tax concepts.

- Created Numerous Excel templates needed to properly analyze the state and local tax returns.

Experience

2-5 Years

Level

Junior

Education

BA

Tax Consultant-Advisor Resume

Headline : Outgoing and enthusiastic professional looking to obtain a position in the accounting field focusing on contributing skills, ethics, and motivation within an organization. Excellent team member, skilled in problem solving and communication.

Skills : Time Management, Organization, Attention To Detail, Quality Focus, Professionalism, Productivity.

Description :

- Assisted with quarterly and annual FAS 109 tax provision for domestic and international companies.

- Worked in accordance with internal control for Sarbanes Testing.

- Manage the Tax Status Reporting for 13 international and 4 domestic companies in accordance with Fin 48.

- Reconcile sales and use tax general ledger accounts for all companies.

- Created sales tax matrix for compliance statewide based upon software maintenance and license contracts.

- Managed numerous state sales and use tax audits.

- Reconcile patent litigation general ledger accounts for book and tax purposes.

- Organized Purchase Accounting Goodwill entries for most recent acquisitions domestically and internationally.

Experience

5-7 Years

Level

Executive

Education

Certification

Principal Tax Consultant Resume

Headline : CPA with extensive experience in Finance, Accounting, and Income Tax. Expertise in preparing financial statements, monitoring daily cash transactions and recording all financial activity for small to medium-sized businesses.

Skills : Microsoft Word, Excel, Access, Outlook, And PowerPoint. Knowledge Of Sales And Use Tax Laws And Regulations In the Multiple States, Tax, Consulting, Excel.

Description :

- Perform reverse audit and provide audit protection for clients.

- Prepare and manage documentation regarding taxability of client's products and services.

- Research state and local tax laws and regulations to support taxability determinations.

- Prepare sales and use tax filings, client reports of findings, and refund claims to be submitted to the taxing jurisdiction.

- Correspond with state and local tax authorities to resolve any questions or inquiries.

- Provide timely responses to client questions and concerns.

- Involved in tax consulting projects and assisted in the administration of company tax programs.

- Reviewed tax documentation and interviewed clients to determine filing status and to assist clients in tax planning.

Experience

5-7 Years

Level

Executive

Education

MBA

Tax Consultant Resume

Objective : Dedicated professional with excellent communications skills and strong creative problem resolution skills; always ensures positive internal and external customer relations. Team player seeking a role in managing the financial planning of a company ready for continued growth on a global scale.

Skills : Documentation Skills, Written Communication, Data Entry Management Equipment Maintenance, MS Office Suite.

Description :

- Maintain office responsibilities including cleaning desks, vacuuming, and dusting.

- Prepare customer Federal and State taxes and explain tax forms such as the 1040 using LibTax2013 Familiar with QuickBooks.

- Calculate receipts and separate them for tax purposes.

- Exhibit friendly professional demeanor at all times.

- Communicate effectively with customers at Liberty Tax Service in person and on the phone.

- Assisted clients to develop tax-aligned compensation and benefits programs that address their global needs.

- Researched on foreign credits and international tax issues for international assignees.

- Prepared individual income tax returns for expatriates and international assignees for multi-national clients.

Experience

0-2 Years

Level

Entry Level

Education

Certification