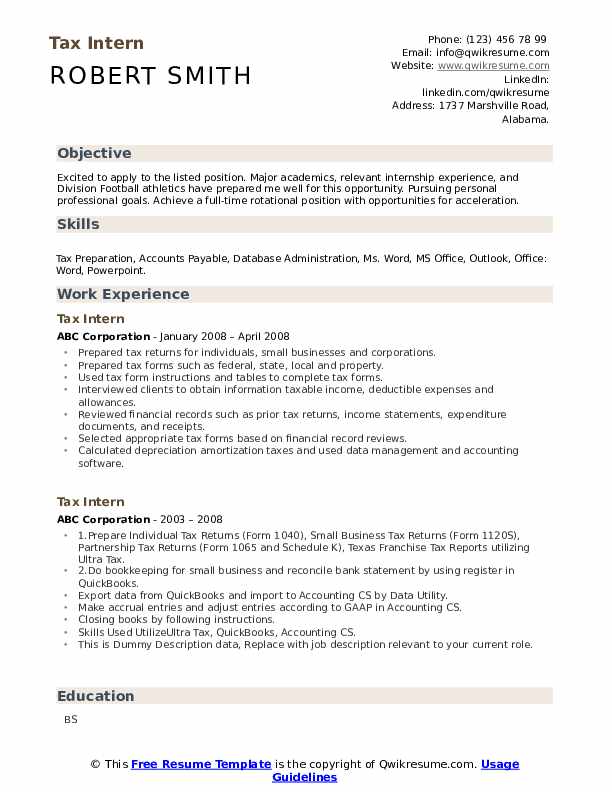

Tax Intern Resume

Objective : Aspiring Tax Intern with two years of hands-on experience in tax preparation and compliance. Proven ability to analyze complex financial data and communicate effectively with clients and team members. Eager to apply academic knowledge in accounting to support tax planning and consulting efforts in a dynamic firm. Committed to continuous learning and professional growth in the field of taxation.

Skills : Data Analysis, Tax Preparation Software, Financial Reporting, Tax Compliance

Description :

- Assisted in the preparation of federal and state tax returns for individuals and businesses, ensuring compliance with tax regulations.

- Drafted client correspondence detailing tax obligations and required documentation for timely submissions.

- Reviewed tax returns for accuracy, implementing corrections based on supervisor feedback.

- Collaborated with partners on complex tax issues, providing insights and solutions.

- Conducted research on tax regulations to support the firm’s compliance efforts.

- Participated in client meetings to discuss tax strategies and planning opportunities.

- Maintained organized records of client communications and tax filings for audit readiness.

Experience

0-2 Years

Level

Entry Level

Education

BBA

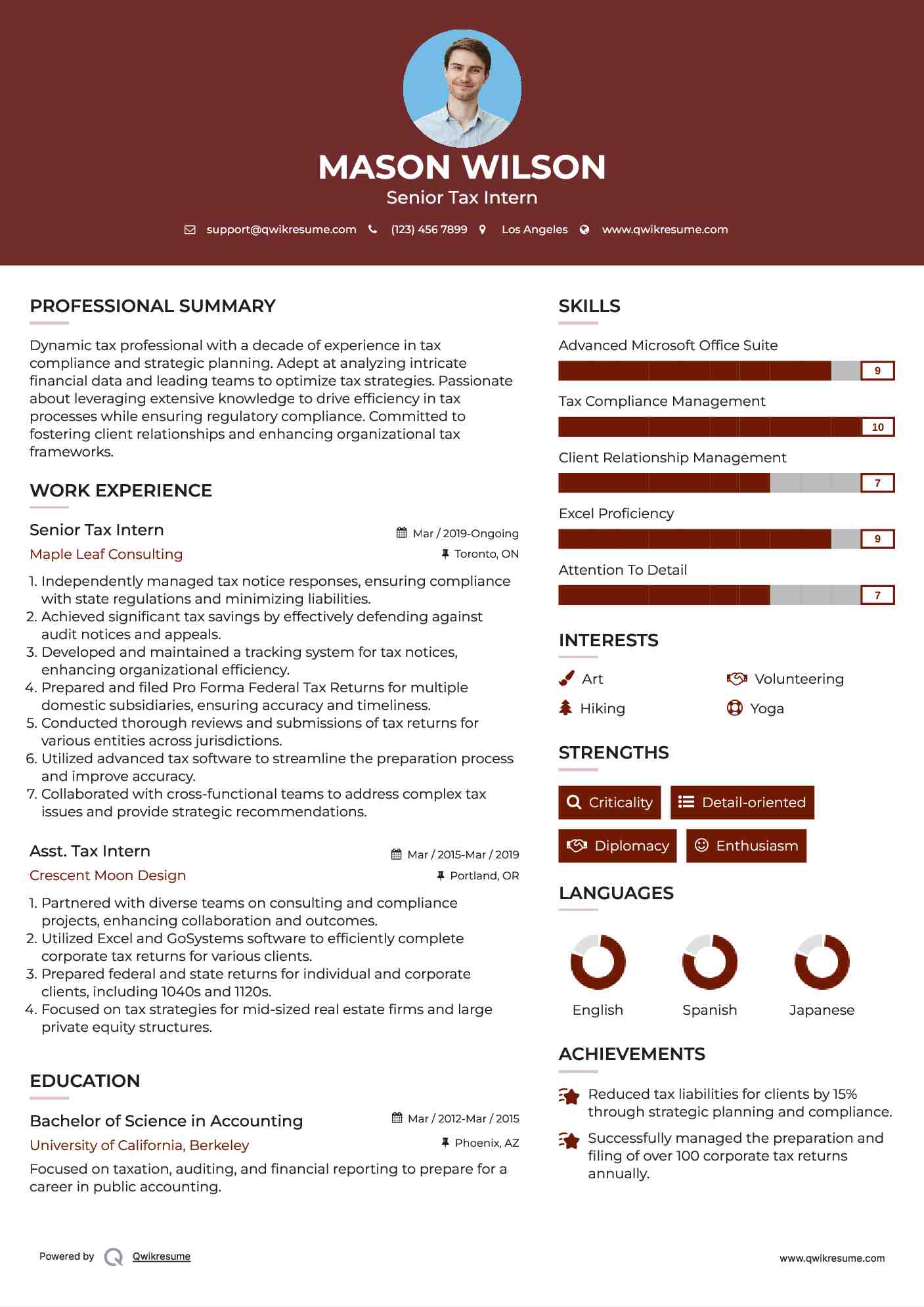

Senior Tax Intern Resume

Summary : Dynamic tax professional with a decade of experience in tax compliance and strategic planning. Adept at analyzing intricate financial data and leading teams to optimize tax strategies. Passionate about leveraging extensive knowledge to drive efficiency in tax processes while ensuring regulatory compliance. Committed to fostering client relationships and enhancing organizational tax frameworks.

Skills : Advanced Microsoft Office Suite, Tax Compliance Management, Client Relationship Management, Excel Proficiency, Attention To Detail

Description :

- Independently managed tax notice responses, ensuring compliance with state regulations and minimizing liabilities.

- Achieved significant tax savings by effectively defending against audit notices and appeals.

- Developed and maintained a tracking system for tax notices, enhancing organizational efficiency.

- Prepared and filed Pro Forma Federal Tax Returns for multiple domestic subsidiaries, ensuring accuracy and timeliness.

- Conducted thorough reviews and submissions of tax returns for various entities across jurisdictions.

- Utilized advanced tax software to streamline the preparation process and improve accuracy.

- Collaborated with cross-functional teams to address complex tax issues and provide strategic recommendations.

Experience

7-10 Years

Level

Senior

Education

B.S. Accounting

Tax Intern Resume

Objective : Dedicated Tax Intern with two years of experience in tax compliance and preparation. Skilled in analyzing financial data and collaborating with diverse teams to optimize tax strategies. Aiming to leverage academic knowledge in accounting to enhance tax planning initiatives within a forward-thinking organization. Passionate about developing expertise in taxation and contributing to client success.

Skills : Tax Software Proficiency, Financial Software Navigation, Tax Document Preparation, Data Analysis And Reporting, Client Communication Management, Technical Writing Skills

Description :

- Reviewed tax data collection packages for accuracy, identifying discrepancies and facilitating timely revisions.

- Executed calculations in tax returns, confirming trial balances and incorporating new account balances.

- Organized state tax return files to ensure proper documentation and compliance.

- Developed a dashboard for forecasting operational metrics against quarterly results and cash transfers.

- Enhanced data management practices, improving retrieval speed and accuracy.

- Participated in team meetings to discuss tax strategies and compliance updates.

- Assisted in the preparation of supporting documentation for tax audits.

Experience

0-2 Years

Level

Entry Level

Education

BBA

Assistant Tax Intern Resume

Headline : Accomplished tax professional with 7 years of diverse experience in tax compliance and financial analysis. Demonstrates expertise in preparing tax returns and optimizing tax strategies for clients. Eager to leverage in-depth knowledge of tax regulations and accounting principles to contribute effectively to a dynamic tax team. Committed to continuous improvement and delivering exceptional client service.

Skills : Tax Research, Financial Analysis, Accounting Principles, Interpersonal Skills, Negotiation Skills, Statistical Analysis

Description :

- Led efforts in supporting Income Tax, Property Tax, and Sales Tax compliance, ensuring adherence to regulatory standards.

- Analyzed complex financial data to provide actionable insights to management and enhance decision-making processes.

- Utilized strong analytical skills to prepare partnership and individual tax returns accurately and timely.

- Worked collaboratively with team members to achieve departmental goals and optimize tax strategies for clients.

- Communicated effectively with clients to develop tailored strategies for tax minimization and compliance.

- Conducted detailed research on tax regulations to support the Tax Department's initiatives.

- Managed multiple projects simultaneously, ensuring timely delivery and adherence to quality standards.

Experience

5-7 Years

Level

Executive

Education

B.S. Accounting

Tax Intern Resume

Objective : Passionate Tax Intern with 5 years of experience in tax compliance, preparation, and financial analysis. Demonstrated proficiency in utilizing advanced accounting principles to support tax planning and consulting. Adept at collaborating with diverse teams and communicating complex tax concepts clearly. Eager to contribute to a forward-thinking firm while enhancing my expertise in tax regulations.

Skills : Microsoft Excel Proficiency, Word Processing Expertise, Proficient In Ms Office Suite, Email Management Skills, Document Preparation Skills, Presentation Development

Description :

- Collaborated with diverse teams on various consulting and compliance projects, enhancing project outcomes.

- Utilized advanced Excel and tax software to efficiently complete corporate tax returns for multiple clients.

- Engaged in technical tax training, staying updated on current tax legislation and compliance requirements.

- Assisted in the preparation of tax documentation, ensuring accuracy and compliance with client needs.

- Analyzed complex financial data to identify potential tax savings and strategic opportunities for clients.

- Supported senior team members in reviewing tax returns and compliance documents for accuracy.

- Contributed to the development of tax strategies that aligned with client financial goals.

Experience

2-5 Years

Level

Consultant

Education

B.S. Accounting

Tax Intern Representative Resume

Summary : Experienced tax professional with a decade of expertise in tax compliance, preparation, and strategic planning. Skilled in analyzing complex financial data and collaborating with teams to enhance tax strategies and ensure regulatory adherence. Passionate about applying comprehensive tax knowledge to drive efficiency and support clients' financial objectives.

Skills : Expert In Tax Preparation Software, Proficient In Financial Analysis, Advanced Excel Skills, Knowledge Of Tax Regulations

Description :

- Assisted in preparing individual and corporate tax returns under supervision.

- Conducted research on tax regulations and compliance requirements.

- Analyzed financial statements to identify tax implications and opportunities.

- Supported the tax team in audits and inquiries from tax authorities.

- Maintained communication with tax staff, corporate professionals, and government officials.

- Conducted thorough reviews of tax returns to ensure accuracy and compliance.

- Assisted in developing tax strategies to optimize client financial outcomes.

Experience

7-10 Years

Level

Management

Education

B.S. in Accounting

Tax Intern Resume

Objective : Motivated Tax Intern with two years of focused experience in tax compliance and financial analysis. Proficient in preparing tax returns and ensuring adherence to regulations. Eager to leverage academic insights in accounting to enhance tax strategies and support clients effectively. Committed to professional development and contributing to a results-oriented team.

Skills : Advanced Excel For Data Analysis, Word Processing And Documentation, Strategic Planning, Email Communication Management, Document Formatting Skills, Forecasting

Description :

- Collaborated with team members to streamline tax processes and workflows.

- Assisted in the preparation of local income tax returns, ensuring timely submissions.

- Conducted detailed reviews of financial documents to ensure compliance with tax regulations.

- Collaborated with team members to optimize tax preparation processes.

- Maintained accurate tax records and documentation for audit purposes.

- Provided insights on tax implications of financial decisions to clients.

- Engaged in continuous learning to stay updated on tax law changes.

Experience

0-2 Years

Level

Entry Level

Education

BBA

Junior Tax Intern Resume

Objective : Ambitious tax professional with 5 years of comprehensive experience in tax preparation, compliance, and financial analysis. Proficient in evaluating financial data and ensuring adherence to tax regulations. Ready to apply in-depth knowledge of accounting principles to support tax strategies and enhance client service in a collaborative environment.

Skills : Tax Compliance Software, Tax Research Techniques, Presentation Skills, Time Management, Data Entry Accuracy, Problem Solving

Description :

- Conducted comparative analysis of tax liabilities for different scenarios.

- Conducted tax research and analysis, including detailed reviews of partnership agreements to ensure compliance.

- Assisted in the preparation of transfer pricing documentation.

- Assisted in the development of tax strategies to optimize client financial performance.

- Collaborated with senior tax professionals to enhance tax compliance processes.

- Participated in client meetings to discuss financial findings and tax implications.

- Maintained up-to-date knowledge of tax laws and regulations to provide informed recommendations.

Experience

2-5 Years

Level

Junior

Education

B.S. Accounting

Tax Intern Resume

Objective : Resourceful Tax Intern with 5 years of experience in tax compliance and financial analysis. Proven track record in preparing comprehensive tax returns and optimizing strategies for diverse clients. Ready to apply analytical skills and accounting knowledge to enhance tax planning initiatives in a dynamic environment. Motivated to contribute to team success while deepening expertise in taxation.

Skills : Project Management, Financial Management Software, Accounting Software Expertise, Tax Compliance Tools, Basic Bookkeeping, Document Management

Description :

- Presented updated tax regulations and developments to finance colleagues, enhancing team knowledge.

- Identified errors in prior tax returns, resulting in significant client savings.

- Supported audit evidence gathering for state sales tax compliance, ensuring accuracy in filings.

- Prepared tax returns and supporting documentation for various entities including individuals and corporations.

- Contributed to special accounting projects, including depreciation schedules for client assets.

- Collaborated with team members to streamline tax workpapers, improving overall workflow.

- Engaged in continuous education on tax laws to ensure compliance and optimization of strategies.

Experience

2-5 Years

Level

Executive

Education

B.S. Accounting

Tax Associate Intern Resume

Objective : Detail-oriented Tax Intern with a strong foundation in tax regulations and compliance. Proficient in conducting research, preparing tax returns, and assisting in audits. Eager to apply analytical skills and knowledge of tax software to support the team in delivering accurate and timely tax services. Committed to continuous learning and professional development in the field of taxation.

Skills : Financial Reporting Software, Client Service, Data Analysis Tools, Accounting Software Proficiency

Description :

- Prepared comprehensive work papers using firm software, cultivating strong client relationships to address their tax needs.

- Adhered to firm policies while applying knowledge of various accounting applications in tax preparation.

- Enhanced understanding of audit procedures and tax regulations through hands-on experience.

- Exhibited strong leadership and problem-solving skills while communicating complex information effectively.

- Successfully prioritized multiple assignments, demonstrating excellent time management and organizational skills.

- Collaborated with a team of professionals, contributing to a cohesive work environment.

- Organized and reviewed client tax documents, ensuring prompt and accurate tax return preparation.

Experience

0-2 Years

Level

Entry Level

Education

BBA

Tax Intern Resume

Objective : Detail-focused Tax Intern with two years of experience in tax compliance and preparation. Adept at analyzing financial records and effectively engaging with clients to gather necessary tax information. Seeking to leverage academic expertise in accounting and tax regulations to contribute to a dynamic team and enhance tax planning initiatives.

Skills : Regulatory Compliance, Financial Data Analysis, Client Interaction, Accounting Software Utilization, Client Communication Skills

Description :

- Prepared federal, state, and local tax forms, ensuring adherence to all regulatory requirements.

- Utilized tax form instructions and tables to accurately complete tax documentation.

- Conducted client interviews to gather information on taxable income, deductible expenses, and allowances.

- Reviewed financial records, including prior tax returns and income statements, to ensure accurate tax filings.

- Assisted in the preparation of international tax compliance documents.

- Calculated depreciation and amortization taxes using accounting software for accurate reporting.

- Maintained up-to-date knowledge of tax regulations to ensure compliance and accuracy in filings.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Accounting

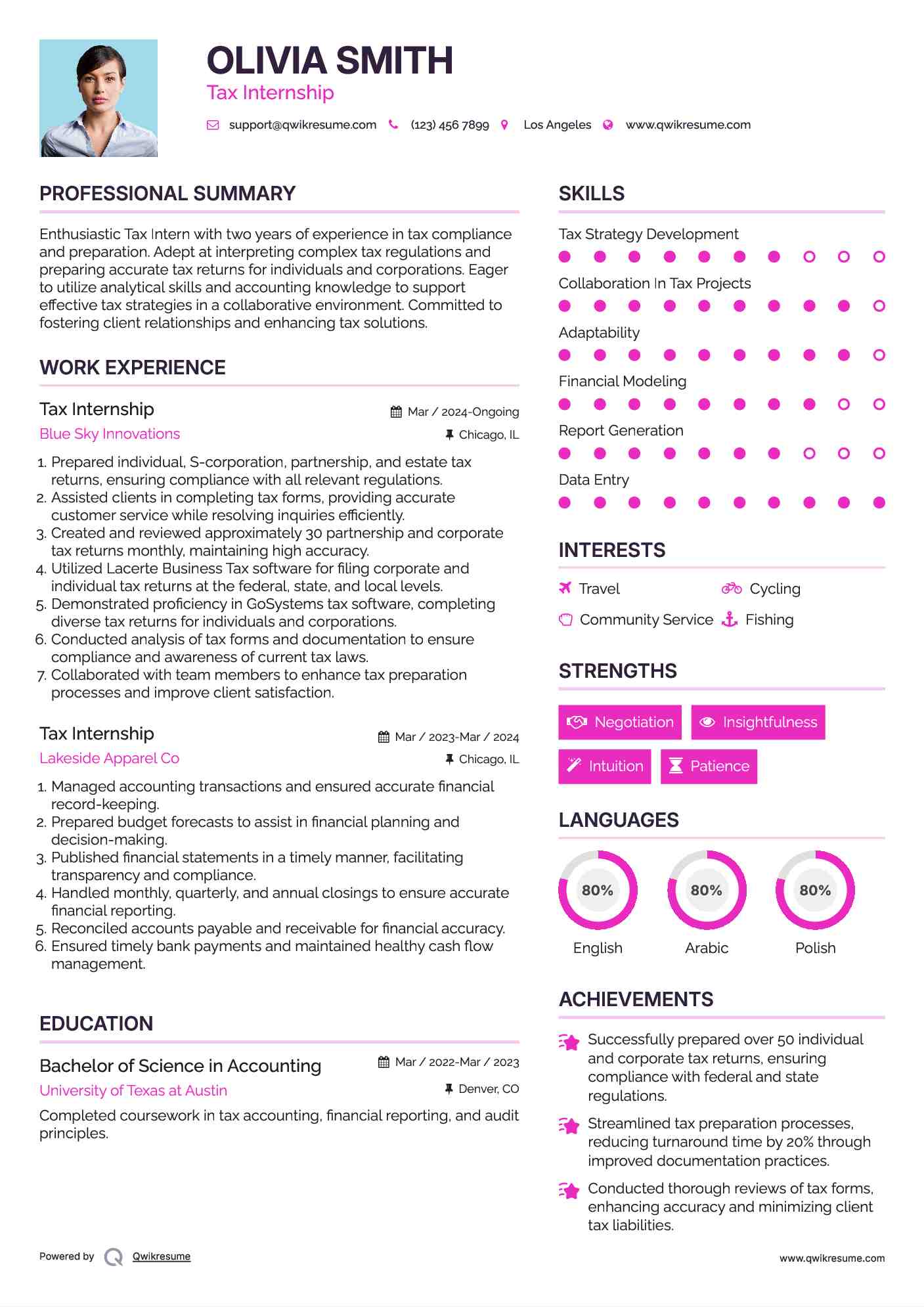

Tax Internship Resume

Objective : Enthusiastic Tax Intern with two years of experience in tax compliance and preparation. Adept at interpreting complex tax regulations and preparing accurate tax returns for individuals and corporations. Eager to utilize analytical skills and accounting knowledge to support effective tax strategies in a collaborative environment. Committed to fostering client relationships and enhancing tax solutions.

Skills : Tax Strategy Development, Collaboration In Tax Projects, Adaptability, Financial Modeling, Report Generation, Data Entry

Description :

- Prepared individual, S-corporation, partnership, and estate tax returns, ensuring compliance with all relevant regulations.

- Assisted clients in completing tax forms, providing accurate customer service while resolving inquiries efficiently.

- Created and reviewed approximately 30 partnership and corporate tax returns monthly, maintaining high accuracy.

- Utilized Lacerte Business Tax software for filing corporate and individual tax returns at the federal, state, and local levels.

- Demonstrated proficiency in GoSystems tax software, completing diverse tax returns for individuals and corporations.

- Conducted analysis of tax forms and documentation to ensure compliance and awareness of current tax laws.

- Collaborated with team members to enhance tax preparation processes and improve client satisfaction.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Accounting

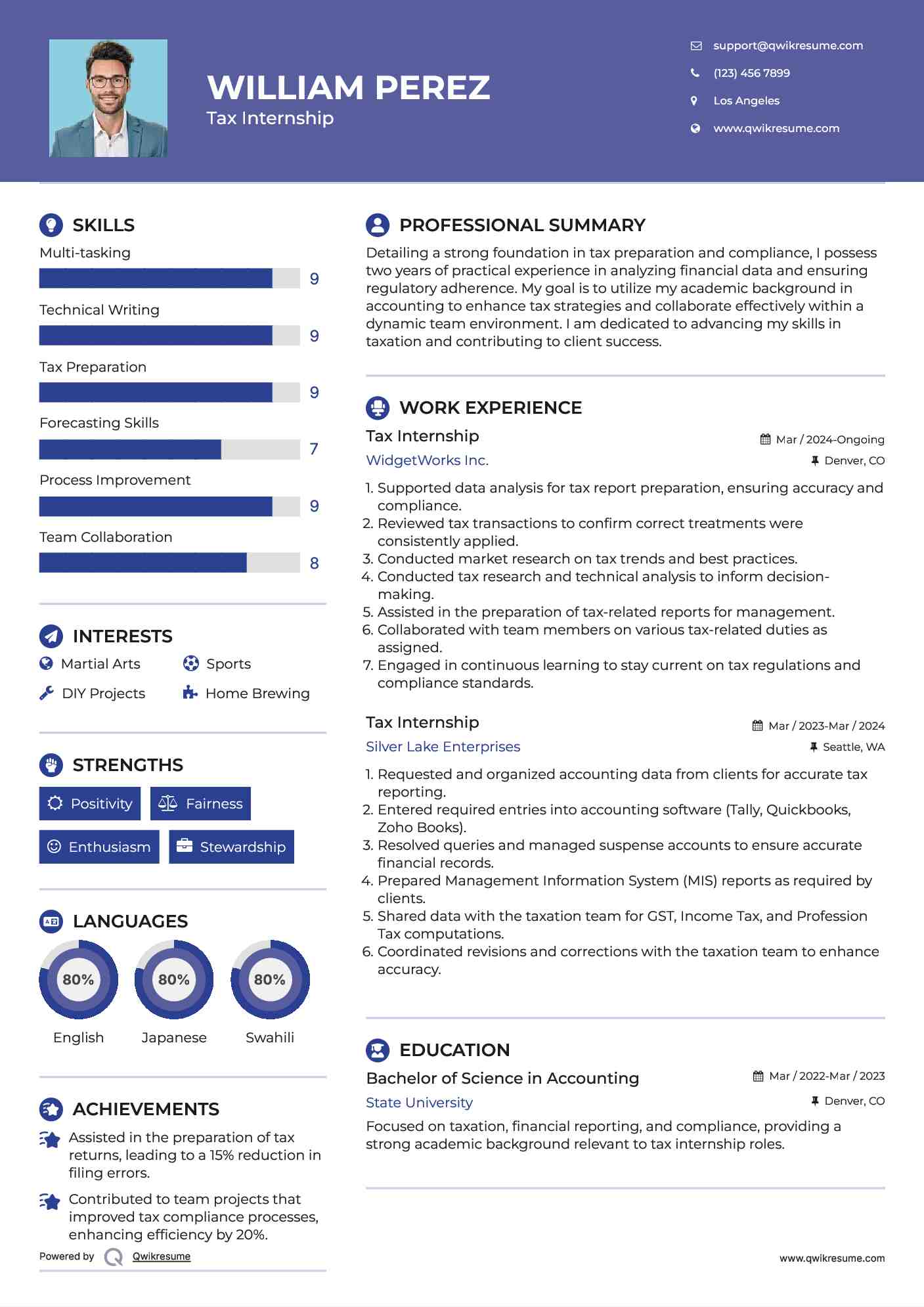

Tax Internship Resume

Objective : Detailing a strong foundation in tax preparation and compliance, I possess two years of practical experience in analyzing financial data and ensuring regulatory adherence. My goal is to utilize my academic background in accounting to enhance tax strategies and collaborate effectively within a dynamic team environment. I am dedicated to advancing my skills in taxation and contributing to client success.

Skills : Multi-tasking, Technical Writing, Tax Preparation, Forecasting Skills, Process Improvement, Team Collaboration

Description :

- Supported data analysis for tax report preparation, ensuring accuracy and compliance.

- Reviewed tax transactions to confirm correct treatments were consistently applied.

- Conducted market research on tax trends and best practices.

- Conducted tax research and technical analysis to inform decision-making.

- Assisted in the preparation of tax-related reports for management.

- Collaborated with team members on various tax-related duties as assigned.

- Engaged in continuous learning to stay current on tax regulations and compliance standards.

Experience

0-2 Years

Level

Entry Level

Education

B.Sc. Accounting

Tax Internship Resume

Objective : With two years of immersive experience in tax compliance and preparation, I excel at leveraging analytical skills to evaluate financial data and ensure regulatory adherence. My goal is to apply my accounting knowledge to support effective tax strategies and enhance client services within a collaborative team. Committed to ongoing learning, I aim to contribute significantly to a dynamic tax environment.

Skills : Proficient In Financial Analysis And Reporting, Organizational Skills, Research Skills, Quantitative Analysis, Budgeting, Record Keeping

Description :

- Supported tax audits by gathering necessary documentation.

- Participated in orientation and technical training programs, gaining essential tools for client engagements.

- Researched and drafted technical memoranda to support tax return positions and responses to IRS inquiries.

- Assisted in client representation during IRS examinations and appeals processes.

- Prepared and reviewed Income Tax Returns and Information Reports for accuracy.

- Drafted internal communications on current tax law issues to facilitate knowledge sharing.

- Negotiated voluntary disclosures for unclaimed property reports, improving compliance rates.

Experience

0-2 Years

Level

Entry Level

Education

B.S. Accounting

Tax Internship Resume

Headline : Driven tax professional with 7 years of extensive experience in tax compliance and strategic planning. Proficient in analyzing financial data and implementing effective tax solutions. Eager to apply my knowledge of tax regulations and accounting principles to support a dynamic team in optimizing tax strategies and enhancing client services. Committed to excellence and continuous professional development in the taxation field.

Skills : Effective Communication, Strong Accountability, Critical Thinking, Tax Software Knowledge

Description :

- Assisted with tax audits by gathering necessary documentation from clients and stakeholders.

- Provided exceptional customer service and administrative support to enhance team efficiency.

- Processed invoices in the approval workflow, ensuring accurate general ledger coding.

- Executed three-way matching of invoices with purchase orders and receipts.

- Investigated discrepancies and implemented solutions to resolve issues promptly.

- Managed weekly payment runs, ensuring timely booking within vendor accounts.

- Prepared tax withholding on payments, coordinating remittance with the accounting team.

Experience

5-7 Years

Level

Executive

Education

BSA