Universal Banker/Teller Resume

Objective : Dynamic banking professional with 5 years of experience in delivering exceptional customer service and financial solutions. Proven ability to build relationships, drive sales, and enhance customer satisfaction in a fast-paced environment.

Skills : Customer Relationship Management, Financial Software Proficiency, Cash Handling Expertise, Regulatory Compliance Knowledge

Description :

- Executed daily banking operations, ensuring compliance with policies and procedures.

- Processed deposits, withdrawals, and transfers while providing personalized service to clients.

- Proactively identified and pursued new account opportunities to enhance customer financial health.

- Integrated teller responsibilities with client relationship management to foster long-term partnerships.

- Safeguarded sensitive information by adhering to privacy regulations and bank policies.

- Established a welcoming environment, enhancing customer experience and satisfaction.

- Facilitated team meetings to strategize on achieving branch performance goals.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Financial Sales Consultant (Universal Banker) Resume

Summary : Dynamic banking professional with 10 years of experience in delivering exceptional customer service and financial solutions. Proven track record in sales, relationship management, and operational efficiency within a retail banking environment.

Skills : Customer Relationship Management, Financial Product Knowledge, Sales Strategy Development, Transaction Processing, Regulatory Compliance

Description :

- Delivered exceptional customer service by accurately processing financial transactions in a fast-paced retail environment.

- Educated customers on bank products, effectively promoting services to meet their financial needs.

- Supported branch goals by exceeding sales and referral targets through proactive engagement.

- Provided teller and platform support to minimize wait times and enhance customer satisfaction.

- Identified client needs through profiling, ensuring tailored financial solutions and successful sales closure.

- Communicated product benefits and requirements clearly to clients, fostering informed decision-making.

- Collaborated with bank partners to cross-sell services, strengthening client relationships and driving new business.

Experience

7-10 Years

Level

Senior

Education

BSF

Personal Universal Banker Resume

Headline : Dynamic banking professional with 7 years of experience in customer service and financial solutions. Proven ability to enhance client relationships, streamline operations, and drive sales growth while ensuring compliance with regulations.

Skills : Financial Software Proficiency, Customer Relationship Management, Cash Handling Expertise, Loan Processing Skills, Regulatory Compliance Knowledge

Description :

- Assisted clients in securing loans and establishing bank accounts tailored to their financial needs.

- Guided customers in debt consolidation, recommending suitable financial products for long-term benefits.

- Facilitated various loan types, including auto, home equity, and personal loans, ensuring informed decisions.

- Resolved customer inquiries regarding savings, checking, and credit accounts through thorough research.

- Opened and managed new customer accounts, enhancing the bank's client base and service offerings.

- Educated clients on diverse loan products and credit options, fostering financial literacy.

- Ensured adherence to federal and state compliance guidelines in all banking operations.

Experience

5-7 Years

Level

Executive

Education

B.S. Finance

Service Manager/Universal Banker Resume

Summary : Dynamic banking professional with 10 years of experience in customer service and financial solutions. Proven ability to build relationships, enhance customer satisfaction, and drive sales through effective communication and problem-solving.

Skills : Financial Software, Customer Relationship Management, Transaction Processing, Sales Techniques, Regulatory Compliance

Description :

- Welcomed and assisted bank visitors, providing information and directing them to appropriate staff.

- Managed incoming calls, taking messages and ensuring effective communication with staff.

- Maintained strong relationships with customers to enhance satisfaction and loyalty.

- Advised customers on account status and resolved disputes effectively.

- Conducted regular follow-ups to ensure customer needs were met and exceeded.

- Educated clients on banking products and services to maximize account benefits.

- Collaborated with team members to improve service delivery and operational efficiency.

Experience

7-10 Years

Level

Senior

Education

BSF

Personal Universal Banker Resume

Objective : Dynamic banking professional with 5 years of experience in customer service and financial solutions. Proven track record in building client relationships, enhancing customer satisfaction, and driving sales through effective communication and problem-solving skills.

Skills : Bilingual Communication, Exceptional Customer Service, Technological Proficiency, Sales Expertise, Financial Product Knowledge

Description :

- Assisted the Financial Center Manager in optimizing branch operations for enhanced customer experience.

- Delivered exceptional service by promoting bank products, opening accounts, and guiding clients through loan applications.

- Resolved account issues and inquiries promptly, ensuring high levels of customer satisfaction.

- Educated customers on digital banking channels, enhancing their banking experience.

- Ensured compliance with legal and regulatory standards to protect customer and bank assets.

- Participated in marketing initiatives to drive product awareness and sales growth.

- Managed cash transactions and maintained accurate records to ensure operational efficiency.

Experience

2-5 Years

Level

Junior

Education

BS Finance

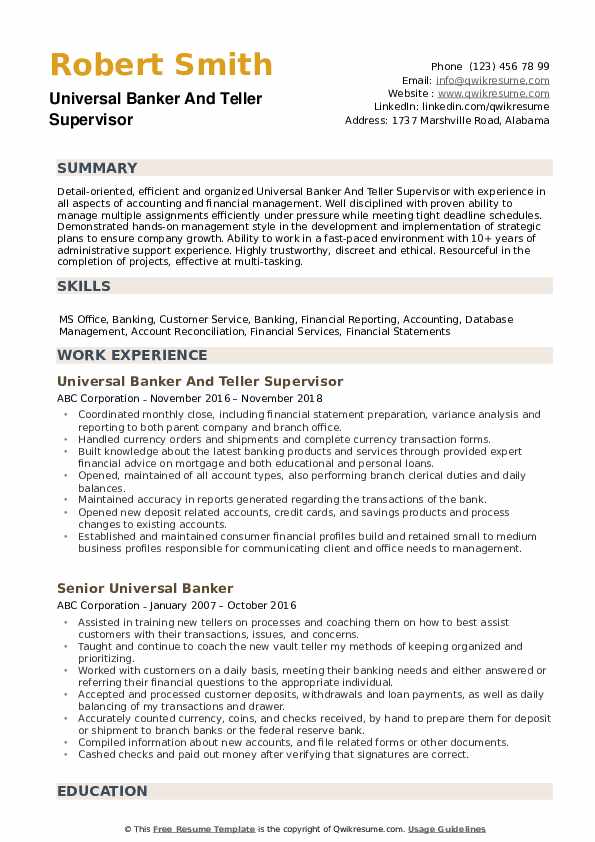

Universal Banker And Teller Supervisor Resume

Summary : Dynamic banking professional with 10 years of experience in delivering exceptional customer service and financial solutions. Proven ability to drive sales and enhance client relationships while ensuring compliance with banking regulations.

Skills : Financial Software, Team Collaboration, Sales Strategy, Customer Relationship Management

Description :

- Executed bank sales objectives by effectively demonstrating and selling products across all customer channels.

- Collaborated with branch team members to refer customers to appropriate banking services, enhancing customer satisfaction.

- Identified and sourced new lending opportunities, supporting the closing process in alignment with banking standards.

- Maintained a comprehensive understanding of banking products, benefits, and procedures to assist customers effectively.

- Processed new accounts accurately while identifying cross-sell opportunities to maximize customer engagement.

- Delivered exceptional client experiences by providing tailored service during every interaction.

- Trained staff on new banking technologies to improve service delivery and customer convenience.

Experience

7-10 Years

Level

Senior

Education

B.S. Finance

Universal Banker III Resume

Summary : Dynamic banking professional with 10 years of experience in customer service and financial solutions. Proven ability to build lasting relationships and enhance customer satisfaction through tailored banking services and proactive engagement.

Skills : Financial Software, Team Collaboration, Customer Relationship Management, Sales Strategy Development, Financial Product Knowledge

Description :

- Developed and nurtured customer relationships by conducting in-depth needs assessments to align banking products with client goals.

- Engaged with local businesses to enhance financial literacy and promote banking services, fostering community ties.

- Actively participated in local chamber of commerce events to represent the bank and strengthen community presence.

- Delivered exceptional customer service by efficiently processing transactions, including deposits, withdrawals, and loan payments.

- Promoted and sold a range of banking products to small business clients, enhancing their financial operations.

- Supported branch management in daily operations, including audit preparation and resolution of customer inquiries.

- Acted as a personal banker, identifying client needs and facilitating referrals to specialized banking services.

Experience

10+ Years

Level

Consultant

Education

B.S. Finance

Senior Universal Banker Resume

Summary : Dynamic banking professional with 10 years of experience in delivering exceptional customer service and financial solutions. Proven ability to enhance client relationships and drive sales through tailored banking products and services.

Skills : Financial Software Proficiency, Customer Relationship Management, Sales Strategy Development, Risk Management, Financial Product Knowledge

Description :

- Opened and managed deposit accounts, successfully upselling loans, credit cards, and investment products.

- Quoted competitive rates and terms, referring clients to specialists for tailored financial solutions.

- Addressed customer inquiries and maintenance requests, identifying cross-sell opportunities to enhance service.

- Managed risk by conducting thorough KYC checks and ensuring compliance with banking regulations.

- Utilized banking tools to optimize customer service, ensuring clients received appropriate product recommendations.

- Processed sales referrals and actively promoted bank services, contributing to branch revenue growth.

- Supervised branch operations, including opening and closing procedures, while leading a team to deliver exceptional service.

Experience

7-10 Years

Level

Senior

Education

BSc Finance

Universal Banker - Contract Resume

Objective : Dynamic banking professional with over 5 years of experience in customer service and financial solutions. Proven ability to enhance customer relationships and drive sales through tailored banking products and services.

Skills : Data Analysis, Transaction Processing, Financial Software, Customer Relationship Management, Sales Strategies

Description :

- Developed strong customer relationships by identifying financial needs and recommending suitable banking products.

- Proactively engaged with potential customers through outreach and in-store interactions.

- Resolved customer inquiries and issues, enhancing overall satisfaction with banking services.

- Conducted thorough verification of checks and transactions to ensure compliance and security.

- Processed deposits and withdrawals accurately, maintaining meticulous records of all transactions.

- Generated new business opportunities, contributing to branch profitability and growth.

- Collaborated with team members to achieve branch sales goals and improve service delivery.

Experience

2-5 Years

Level

Junior

Education

B.S. Finance

Universal Banker And Teller Supervisor Resume

Summary : Dynamic banking professional with 10 years of experience in customer service, financial advising, and account management. Proven ability to enhance client relationships and drive sales growth while ensuring compliance with banking regulations.

Skills : Financial Software, Data Analysis, Financial Analysis, Customer Relationship Management, Sales Strategy Development

Description :

- Managed diverse banking operations, ensuring compliance with regulations and enhancing customer satisfaction.

- Processed various transactions, including deposits, withdrawals, and loan payments, while maintaining accuracy.

- Provided expert financial advice on products, including mortgages and personal loans, to meet client needs.

- Opened and maintained accounts, ensuring all documentation was accurate and up-to-date.

- Conducted regular audits of financial transactions to ensure compliance and accuracy in reporting.

- Developed and maintained strong relationships with clients, addressing their banking needs effectively.

- Trained and mentored new staff on banking procedures and customer service best practices.

Experience

10+ Years

Level

Management

Education

BSF